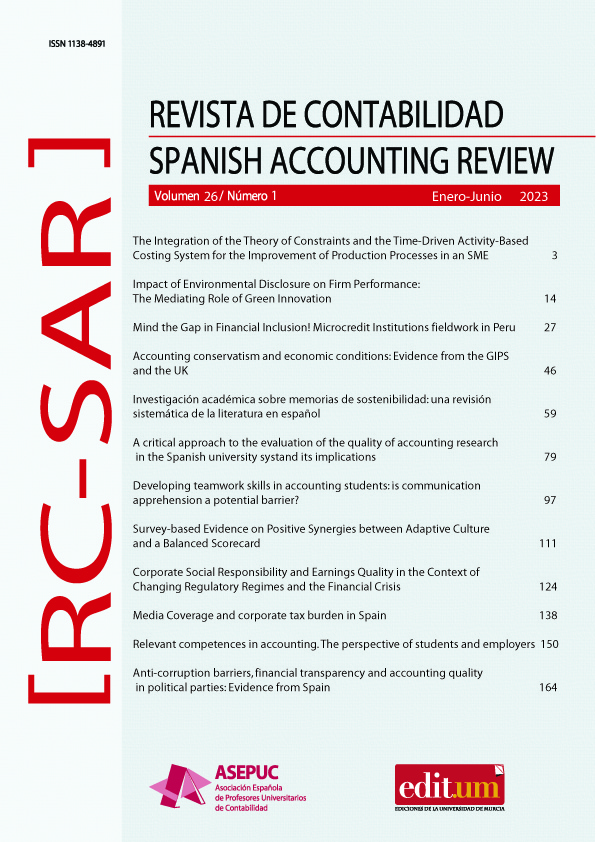

Presión mediática y estrategia fiscal en España

Media Coverage and corporate tax burden in Spain

Resumen

Esta investigación analiza la relación entre la presión mediática y la estrategia fiscal corporativa en una muestra de empresas no financieras cotizadas españolas en el periodo 2003-2016. Mostramos que la cobertura mediática reduce la carga fiscal de las empresas. Los resultados se encuentran en consonancia con el papel de la legitimación en Europa Continental, de manera que las empresas que están sujetas a una mayor presión mediática muestran menos necesidad de recurrir a la política fiscal para legitimar el comportamiento empresarial. Además, el estudio señala que las empresas sujetas a una mayor presión mediática combinada con un tono negativo de las noticias soportan una mayor carga fiscal. Así, cuando los medios de comunicación amenazan la legitimación de la actuación corporativa, las empresas muestran una mayor tendencia a utilizar la política fiscal como forma de restaurar su legitimación.

Descargas

-

Resumen622

-

PDF 597

-

HTML 230

Citas

Ahern, K. R., & Sosyura, D. (2014). Who writes the news? Corporate press releases during merger negotiations. The Journal of Finance, 69 (1), 241-291. https://doi.org/10.1111/jofi.12109

Ahmad, K., Han, J., Hutson, E., Kearney, C., & Liu, S. (2016). Media-expressed negative tone and firm-level stock returns. Journal of Corporate Finance, 37, 152-172. https://doi.org/10.1016/j.jcorpfin.2015.12.014

Allen, A., Francis, B., Wu, Q., & Zhao, Y. (2015). Analyst coverage and corporate tax avoidance. University of Nebraska-Lincoln, Rensselaer Polytechnic Institute e Kogod School Business, Working Paper.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58 (2), 277-297. https://doi.org/10.2307/2297968

Arellano, M., & Bover, O. (1995). Another look at the instrument variable estimation of error components models. Journal of Econometrics, 68(1), 29-51. https://doi.org/10.1016/0304-4076(94)01642-D

Austin, C. R., & Wilson, R. J. (2015). Are reputational costs a determinant of tax avoidance? In 2013 American Taxation Association Midyear Meeting: Tax Avoidance in an International Setting.

Ayers, B. C., Laplante, S. K., & McGuire, S. T. (2010). Credit ratings and taxes: The effect of book-tax differences on ratings changes. Contemporary Accounting Research, 27(2), 350-402. https://doi.org/10.1111/j.1911-3846.2010.01011.x

Badertscher, B. A., Katz, S. P., & Rego, S. O. (2013). The separation of ownership and control and corporate tax avoidance. Journal of Accounting and Economics, 56(2-3), 228-250. https://doi.org/10.1016/j.jacceco.2013.08.005

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The Quarterly Journal of Economics, 131(4), 1593-1636. https://doi.org/10.1093/qje/qjw024

Balakrishnan, K., Blouin, J., & Guay, B. (2012). Does tax aggressiveness reduce corporate transparency? Retrieved from http://ssrn.com/abstract=1792783

Bednar, M. K. (2012). Watchdog or lapdog? A behavioral view of the media as a corporate governance mechanism. Academy of Management Journal, 55(1), 131-150. https://doi.org/10.5465/amj.2009.0862

Bednar, M. K., Boivie, S., & Prince, N. R. (2013). Burr under the saddle: How media coverage influences strategic change. Organization Science, 24(3), 910-925. https://doi.org/10.1287/orsc.1120.0770

Bednar, M. K., Love, E. G., & Kraatz, M. (2015). Paying the price? The impact of controversial governance practices on managerial reputation. Academy of Management Journal, 58(6), 1740-1760. https://doi.org/10.5465/amj.2012.1091

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115-143. https://doi.org/10.1016/S0304-4076(98)00009-8

Bona-Sánchez, C., Pérez Alemán, J., & Santana Martín, D. J. (2011). Ultimate ownership and earnings conservatism. European Accounting Review, 20(1), 57-80. https://doi.org/10.1080/09638180903384676

Bona-Sánchez, C., Pérez-Alemán, J., & Santana-Martín, D. J. (2014). Politically connected firms and earnings informativeness in the controlling versus minority shareholders context: European evidence. Corporate Governance: An International Review, 22(4), 330-346. https://doi.org/10.1111/corg.12064

Bona-Sánchez, C., Pérez-Alemán, J., & Santana-Martín, D. J. (2019). Earnings credibility in politically connected family firms. The British Accounting Review, 51(3), 316-332. https://doi.org/10.1016/j.bar.2018.12.003

Bushee, B. J., Core, J. E., Guay, W., & Hamm, S. J. (2010). The role of the business press as an information intermediary. Journal of Accounting Research, 48(1), 1-19. https://doi.org/10.1111/j.1475-679X.2009.00357.x

Cahan, S.F. (1992). The effect of anti-trust investigations on discretionary accruals: A refined test of the political-cost hypothesis. The Accounting Review, 67(1), 77-95. https://www.jstor.org/stable/248021

Cahan, R. H., Cahan, S. F., Lee, T., & Nguyen, N. H. (2017). Media content, accounting quality, and liquidity volatility. European Accounting Review, 26(1), 1-25. https://doi.org/10.1080/09638180.2015.1087866

Calvé Pérez, J. I., Labatut Serer, G., & Llopis, R. (2005). Economic-financial variables that affect small business tax burden: Effects of the 1955 Fiscal Reform on the Valencia Community companies. Spanish Journal of Finance and Accounting, 34, 875-897. https://doi.org/10.1080/02102412.2005.10779565

Chahine, S., Mansi, S., & Mazboudi, M. (2015). Media news and earnings management prior to equity offerings. Journal of Corporate Finance, 35, 177-195. https://doi.org/10.1016/j.jcorpfin.2015.09.002

Chen, S., Chen, X., Cheng, Q., & Shevlin, T. (2010). Are family firms more aggressive than nonfamily firms? Journal of Financial Economics, 95(1), 41-61. https://doi.org/10.1016/j.jfineco.2009.02.003

Claessens, S., Djankov, S., & Lang, L. H. (2000). The separation of ownership and control in East Asian corporations. Journal of Financial Economics, 58(1-2), 81-112. https://doi.org/10.1016/S0304-405X(00)00067-2

Core, J. E., Guay, W., & Larcker, D. F. (2008). The power of the pen and executive compensation. Journal of Financial Economics, 88(1), 1-25. https://doi.org/10.1016/j.jfineco.2007.05.001

Dai, L., Parwada, J., & Zhang, B. (2014). The Governance Role of Media through New Dissemination: Evidence from Insider Trading. Working Paper. Australian National University.

Deephouse, D. L. (2000). Media reputation as a strategic resource: An integration of mass communication and resource-based theories. Journal of Management, 26(6), 1091-1112. https://doi.org/10.1177/014920630002600602

Derashid, C., & Zhang, H. (2003). Effective tax rate and the "industrial policy" hypothesis: Evidence from Malaysia. Journal of International Accounting, Auditing and Taxation, 12(1), 45-62. https://doi.org/10.1016/S1061-9518(03)00003-X

Drake, M. S., Guest, N. M., & Twedt, B. J. (2014). The media and mispricing: The role of the business press in the pricing of accounting information. The Accounting Review, 89(5), 1673-1701. https://www.jstor.org/stable/24468380

Dyck, A., & Zingales, L. (2002). The corporate governance role of the media. In The right to tell: The role of mass media in economic development (pp. 107-37). Washington, USA; World Bank. https://openknowledge.worldbank.org/handle/10986/15212

Dyck, A., Volchkova, N., & Zingales, L. (2008). The corporate governance role of the media: Evidence from Russia. The Journal of Finance, 63(3), 1093-1135. https://doi.org/10.1111/j.1540-6261.2008.01353.x

Dyreng, S. D., Hanlon, M., & Maydew, E. L. (2010). The effects of executives on corporate tax avoidance. The Accounting Review, 85(4), 1163-1189. https://doi.org/10.2308/accr.2010.85.4.1163

Dyreng, S. D., Hoopes, J. L., & Wilde, J. H. (2016). Public pressure and corporate tax behavior. Journal of Accounting Research, 54(1), 147-186. https://doi.org/10.1111/1475-679X.12101

Engelberg, J. E., & Parsons, C. A. (2011). The causal impact of media in financial markets. The Journal of Finance, 66(1), 67-97. https://doi.org/10.1111/j.1540-6261.2010.01626.x

Faccio, M., & Lang, L. H. (2002). The ultimate ownership of Western European corporations. Journal of Financial Economics, 65(3), 365-395. https://doi.org/10.1016/S0304-405X(02)00146-0

Fama, E. F. (1980). Agency problems and the theory of the firm. Journal of Political Economy, 88(2), 288-307. https://www.jstor.org/stable/1837292

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(3), 301-325. https://doi.org/10.1086/467037

Fang, L., & Peress, J. (2009). Media coverage and the cross‐section of stock returns. The Journal of Finance, 64(5), 2023-2052. https://doi.org/10.1111/j.1540-6261.2009.01493.x

Feeny, S., Gillman, M., & Harris, M. N. (2006). Econometric accounting of the Australian corporate tax rates: A firm panel example. Accounting Research Journal, 19, 64-73.

Frank, M. M., Lynch, L. J., & Rego, S. O. (2009). Tax reporting aggressiveness and its relation to aggressive financial reporting. The Accounting Review, 84(2), 467-496. https://doi.org/10.2308/accr.2009.84.2.467

Franklin, B. (2014). The Future of Journalism. Journalism Studies, 15(5), 481-499. https://doi.org/10.1080/1461670X.2014.930254.

Graham, J. R., Hanlon, M., Shevlin, T., & Shroff, N. (2014). Incentives for tax planning and avoidance: Evidence from the field. The Accounting Review, 89(3), 991-1023. https://doi.org/10.2308/accr-50678

Greene, W. H. (2000). Ecomometric analysis. Upper Saddle River, NJ: Prentice Hall.

Gurun, U. G., & Butler, A. W. (2012). Don't believe the hype: Local media slant, local advertising, and firm value. The Journal of Finance, 67(2), 561-598. https://doi.org/10.1111/j.1540-6261.2012.01725.x

Hanlon, M., & Heitzman, S. (2010). A review of tax research. Journal of accounting and Economics, 50(2-3), 127-178. https://doi.org/10.1016/j.jacceco.2010.09.002

Hanlon, M., & Slemrod, J. (2009). What does tax aggressiveness signal? Evidence from stock price reactions to news about tax shelter involvement. Journal of Public Economics, 93(1-2), 126-141. https://doi.org/10.1016/j.jpubeco.2008.09.004

Hoffman, A. J., & Ocasio, W. (2001). Not all events are attended equally: Toward a middle-range theory of industry attention to external events. Organization Science, 12(4), 414-434. https://doi.org/10.1287/orsc.12.4.414.10639

Hooghiemstra, R., Kuang, Y. F., & Qin, B. (2015). Say-on-pay votes: The role of the media. European Accounting Review, 24(4), 753-778. https://doi.org/10.1080/09638180.2015.1034152

Jansson, A. (2013). Real owners" and "common investors: Institutional logics and the media as a governance mechanism. Corporate Governance: An International Review, 21(1), 7-25. https://doi.org/10.1111/j.1467-8683.2012.00932.x

Joe, J., Louis, H., & Robinson, D. (2009). Manager's and investors' responses to media exposure of board ineffectiveness. Journal of Finance and Quantitative Analysis, 44(3), 579-605. https://doi.org/10.1017/S0022109009990044

Kanagaretnam, K., Lee, J., Lim, C. Y., & Lobo, G. J. (2018). Cross-country evidence on the role of independent media in constraining corporate tax aggressiveness. Journal of Business Ethics, 150, 879-902. https://doi.org/10.1007/s10551-016-3168-9

Kubata, A., Lietz, G., & Watrin, C. (2013). Does corporate tax avoidance impair earning informativeness? Working Paper. Consultado el 12 de noviembre de 2014. Retrieved from http://ssrn.com/abstract=2363873

Kuhnen, C. M., & Niessen, A. (2012). Public opinion and executive compensation. Management Science, 58(7), 1249-1272. https://doi.org/10.1287/mnsc.1110.1490

La Porta, R., Lopez‐de‐Silanes, F., & Shleifer, A. (1999). Corporate ownership around the world. The Journal of Finance, 54(2), 471-517. https://doi.org/10.1111/0022-1082.00115

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. (2000). Investor protection and corporate governance. Journal of Financial Economics, 58(1-2), 3-27. https://doi.org/10.1016/S0304-405X(00)00065-9

Lanis, R., & Richardson, G. (2012). Corporate social responsibility and tax aggressiveness: An empirical analysis. Journal of Accounting and Public Policy, 31(1), 86-108. https://doi.org/10.1016/j.jaccpubpol.2011.10.006

Lauterbach, B., & Pajuste, A. (2017). The media and firm reputation roles in corporate governance improvements: Lessons from European dual class share unifications. Corporate Governance. International Review, 25(1), 4-19. https://doi.org/10.1111/corg.12153

Lee, S. (2015). News media coverage of corporate tax avoidance and corporate tax reporting. WU International Taxation Research Paper Series.

Lisowsky, P. (2010). Seeking shelter: Empirically modeling tax shelters using financial statement information. The Accounting Review, 85(5), 1693-1720. https://doi.org/10.2308/accr.2010.85.5.1693

Liu, B., & McConnell, J. J. (2013). The role of the media in corporate governance: Do the media influence managers' capital allocation decisions? Journal of Financial Economics, 110(1), 1-17. https://doi.org/10.1016/j.jfineco.2013.06.003

Liu, B., McConnell, J. J., & Xu, W. (2017). The power of the pen reconsidered: The media, CEO human capital, and corporate governance. Journal of Banking and Finance, 76, 175-188. https://doi.org/10.1016/j.jbankfin.2016.12.004

López-Iturriaga, F. J., & Santana-Martín, D. J. (2015). Do shareholder coalitions modify the dominant owner´s control? The impact on dividend policy. Corporate Governance: An International Review, 23(6), 519-533. https://doi.org/10.1111/corg.12126

Loughran, T., & McDonald, B. (2011). When is a liability not liability? Textual analysis, dictionaries, and 10-Ks. Journal of Finance, 66(1), 35-65. https://doi.org/10.1111/j.1540-6261.2010.01625.x

McGuire, S. T., Wang, D., & Wilson, R. J. (2014). Dual class ownership and tax avoidance. The Accounting Review, 89(4), 1487-1516. https://doi.org/10.2308/accr-50718

McIntyre, R. S., & Nguyen C. T.D. (2000). Corporate income taxes in the 1990s. Washington, USA: Institute of Taxation and Economic Policy.

Miller, G. S. (2006). The press as a watchdog for accounting fraud. Journal of Accounting Research, 44(5), 1001-1033. https://doi.org/10.1111/j.1475-679X.2006.00224.x

Minnick, K., & Noga, T. (2010). Do corporate governance characteristics influence tax management? Journal of Corporate Finance, 16(5), 703-718. https://doi.org/10.1016/j.jcorpfin.2010.08.005

Monterrey Mayoral, J., Sánchez Segura, A., & Fernández Rodríguez, E. (2010). Diferencias en agresividad fiscal entre empresas familiares y no familiares. Spanish Journal of Finance and Accounting/Revista Española De Financiación Y Contabilidad, 39, 65-107. https://doi.org/10.1080/02102412.2010.10779679

Monterrey Mayoral, J., & Sánchez Segura, E. (2015). Planificación fiscal y gobierno corporativo en las empresas cotizadas españolas. Hacienda Pública Española, 214, 55-89.

Peña-Martel, D., Pérez-Alemán, J., & Santana-Martín, D. J. (2018). The role of the media in creating earnings informativeness: Evidence from Spain. BRQ Business Research Quarterly, 21(3), 168-179. https://doi.org/10.1016/j.brq.2018.03.004

Plesko, G. A. (2003). An evaluation of alternative measures of corporate tax rate. Journal of Accounting and Economics, 35(2), 201-226. https://doi.org/10.1016/S0165-4101(03)00019-3

Pollock, T. G., & Rindova, V. P. (2003). Media legitimation effects in the market for initial public offerings. Academy of Management Journal, 46(5), 631. https://doi.org/10.2307/30040654

Rego, S. O. (2003). Tax-avoidance activities of U.S. Multinational corporations. Contemporary Accounting Research, 20(4), 805-833. https://doi.org/10.1506/VANN-B7UB-GMFA-9E6W

Richardson, G., & Lanis, R. (2007). Determinants of the variability in corporate effective tax rates and tax reform: Evidence from Australia. Journal of Accounting and Public Policy, 26(6), 689-704. https://doi.org/10.1016/j.jaccpubpol.2007.10.003

Rodríguez, E. F., & Arias, A. M. (2006). La relación contabilidad-fiscalidad a través de la aplicación práctica del Impuesto de Sociedades. Revista Española de Financiación y Contabilidad, 130, 621-644. https://www.jstor.org/stable/42782491

Ruiz-Mallorquí, M., & Santana-Martín, D. J. (2009). Ultimate institutional owner and takeover defenses in the controlling versus minority shareholders context. Corporate Governance: An International Review, 17(2), 238-254. https://doi.org/10.1111/j.1467-8683.2009.00735.x

Sacristán-Navarro, M., & Gómez-Ansón, S. (2007). Family ownership and pyramids in the Spanish market. Family Business Review, 20(3), 247-265. https://doi.org/10.1111/j.1741-6248.2007.00100.x

Santana-Martín, D.J., & Aguiar-Díaz, I. (2006). El último propietario de las empresas cotizadas españolas. Cuadernos de Economía y Dirección de la Empresa, 26, 47-72.

Studenmund, A. H. (1997). Using econometrics: A practical approach. Reading, MA: AddisonWesley.

Tetlock, P. (2007). Giving content to investor sentiment: the role of media in the stock market. Journal of Finance, 62(3), 1139-1168. https://doi.org/10.1111/j.1540-6261.2007.01232.x

Watts, R. L., & Zimmerman, J.L. (1978). Towards a positive theory of the determination of accounting standards. The Accounting Review, 53, 112-134. https://ssrn.com/abstract=928684

Wong, J. (1988). Economic incentives for the voluntary disclosure of current cost financial statements. Journal of Accounting and Economics, 10(2), 151-167. https://doi.org/10.1016/0165-4101(88)90018-3

Wooldridge, J.M. (2002). Econometric analysis of cross section and panel data. Cambridge, MA: MIT Press.

World Economic Forum. (2017). The Global Competitiveness Report. 2016-2017.

Zimmerman, J. (1983). Taxes and firm size. Journal of Accounting and Economics, 5, 119-149. https://doi.org/10.1016/0165-4101(83)90008-3

Derechos de autor 2023 Revista de Contabilidad - Spanish Accounting Review

Esta obra está bajo una licencia internacional Creative Commons Atribución 4.0.

Las obras que se publican en esta revista están sujetas a los siguientes términos:

1. Ediciones de la Universidad de Murcia (EDITUM) y ASEPUC conservan los derechos patrimoniales (copyright) de las obras publicadas, y favorece y permite la reutilización de las mismas bajo la licencia de uso indicada en el punto 2.

2. Las obras se publican en la edición electrónica de la revista bajo una licencia de Creative Commons Reconocimiento-NoComercial-SinObraDerivada 4.0 Internacional. Permite copiar, distribuir e incluir el artículo en un trabajo colectivo (por ejemplo, una antología), siempre y cuando no exista una finalidad comercial, no se altere ni modifique el artículo y se cite apropiadamente el trabajo original. Esta revista no tiene tarifa por la publicación Open Access. ASEPUC y EDITUM financian los costes de producción y publicación de los manuscritos.

3. Condiciones de auto-archivo. Se permite y se anima a los autores a difundir electrónicamente la versión publicada de sus obras, ya que favorece su circulación y difusión y con ello un posible aumento en su citación y alcance entre la comunidad académica.