The relationship between public debt and privatisation: the moderating roles of political ideology and electoral cycles

ABSTRACT

Using a sample of 25 European countries between 1995 and 2013, this study shows a bidirectional relationship between privatisations and public debt. Firstly, our findings suggest that governments with higher levels of debt tend to privatise state-owned enterprises (SOEs) to a greater extent than less-indebted governments. Subsequently, the results show that privatisations effectively reduce indebtedness. This means that causality between privatisation and public debt should be considered in future studies. In addition, we have found that such a strategy is used more by right-wing governments, which implies the existence of partisan effects. However, our findings do not support any effect caused by electoral cycles.

Keywords: Privatisation; Public Debt; Indebtedness; Ideology; Elections; Electoral Cycles.

JEL classification: H13; H30; H63; H74.

La relación entre deuda pública y privatización: el papel moderador de la ideología política y los ciclos electorales

RESUMEN

Utilizando una muestra de 25 países europeos entre 1995 y 2013, este estudio expone una relación bidireccional entre privatizaciones y deuda pública. En primer lugar, nuestros resultados sugieren que los gobiernos con mayores niveles de deuda tienden a privatizar empresas públicas en mayor medida que los gobiernos menos endeudados. Posteriormente, los resultados revelan que las privatizaciones reducen efectivamente el endeudamiento. Esto significa que la causalidad entre privatización y deuda pública debería tenerse en cuenta en futuros estudios. Además, se ha constatado que dicha estrategia es más utilizada por los gobiernos de derechas, lo que implica la existencia de efectos partidistas. Sin embargo, nuestros resultados no apoyan ningún efecto causado por los ciclos electorales

Palabras clave: Privatización; Deuda Pública; Endeudamiento; Ideología; Elecciones; Ciclos Electorales.

Códigos JEL: H13; H30; H63; H74.

1. Introduction

Traditionally, privatisation has been defined as the partial or complete transfer of a function from the public to the private sector (Butler, 1991). This has historically occurred radically, which has resulted in different definitions of privatisation. Concretely, this paper uses the material approach of Obinger et al. (2016) to define privatisation; that is, selling the shares of a state-owned enterprise (SOE) to private investors, resulting in a transfer of ownership and control from the public to the private sector.

These transfers have spread throughout the world since their beginnings in 1979, when the first privatisations were carried out by Margaret Thatcher’s government in the United Kingdom (UK), prompted by the belief that the private sector worked more efficiently (Parker & Saal, 2003). During the 1980s, other European countries implemented privatisation programmes, but the most ambitious ones were introduced from 1993 onwards, after the Maastricht Treaty. In that moment, privatisations were used as a way of complying with the terms and conditions of the Treaty (Clifton et al., 2003). The different European directives on market liberalisation and the destruction of large state monopolies have since encouraged privatisations, particularly in the telecommunications, transport and electricity sectors.

Furthermore, the Stability and Growth Pact (SGP) adopted by the European Union (EU) member states established fiscal rules to ensure the stability of the economic and monetary union (Dasí-González, 2011). Since 1999, national deficits have not been permitted to exceed 3%, and debt cannot exceed 60% of a country’s GDP (Benito & Martínez, 2002). As a result, some countries have resorted to a wide range of measures to comply with these limits. The privatisation of SOEs has been one of the measures that governments have advocated to reduce deficits and debt (Annet, 2006).

Thus, the debt (and deficit) limits established, firstly by the Maastricht Treaty and secondly by the SGP, could account for the privatisations that have occurred in Europe since the 1990s, especially in countries with financial problems (Buti et al., 2003; Bofinger, 2003; Orban & Szapáry, 2004), such as Southern and Central Eastern European countries. Moreover, the Troika made up of the European Commission (EC), the European Central Bank and the International Monetary Fund (IMF) pushed privatisation programmes on the EU members that were facing financial difficulties during the crisis of 2008, as in Greece and Ireland (Clifton et al., 2018).

This paper focuses on the link between privatisations and levels of debt in the European context, as Cuadrado-Ballesteros & Peña-Miguel (2019) did for deficits. Some authors have demonstrated a greater predisposition towards privatisation by governments facing high levels of debt (Bortolotti et al., 2003; Bortolotti & Pinotti, 2003), who expected them to reduce public debt. However, this positive consequence has not been corroborated until now (Bortolotti & Pinotti, 2008; Schneider & Häge, 2008). Most of the previous literature has analysed the effect in one direction (i.e., the effect of privatisation on debt, or the effect of debt on privatisation). Only Ramamurti (1992) suggested the existence of a two-way link between privatisation reforms and public debt in Latin America, but that study is qualitative and does not provide any empirical evidence in that regard. This study contributes to the literature by analysing the two-way relationship between the privatisation of SOEs and indebtedness. The term “two-way” refers to an analysis in two directions; in other words, establishing whether governments with higher levels of debt privatise SOEs to a greater extent in the hope that the privatisation of those companies will reduce debt levels.

Two moderating factors are considered in this analysis, namely, political ideology and electoral cycles. Political ideology may affect both the decision to privatise and the decision to use public debt. Right-wing parties have traditionally been characterised by displaying greater fiscal discipline, resorting to public spending and debt to a lesser extent than the left (Alesina & Rosenthal, 1995; García-Sánchez et al., 2011; Rudolph and Evans, 2005). Right-wing parties believe in the superiority of the private sector in terms of performance (Biais & Perotti, 2002). However, most controversial economic measures (e.g., privatising SOEs, cutting spending, increasing taxes and reducing public debt levels) are normally carried out in the years immediately following elections so that politicians’ images are not damaged when they face voters (Baber & Sen, 1986).

This study aims to analyse the two-way relationship between the privatisation of state companies and levels of indebtedness while controlling for political ideology and electoral cycles. We use a sample of data from 25 countries between 1995 and 2013, all of which belonged to the EU at that time. The empirical results show that governments with higher levels of debt privatise SOEs to a greater extent than less-indebted governments. Furthermore, our findings suggest that privatisations effectively reduce debt levels. Although there is no evidence to support the influence of electoral cycles on privatisations, our findings show that right-wing governments tend to make greater use of privatisations, especially when they have high levels of debt.

The remainder of the paper is structured as follows. The second section reviews the existing literature on the relationship between privatisation and indebtedness. We then propose three hypotheses considering the moderating effect of political ideology and electoral cycles. The third section describes the methodology in detail and the fourth section discusses the descriptive and exploratory analyses. The last section offers conclusions and contributions for future research.

2. Literature review and hypotheses

2.1. The relationship between indebtedness and privatisation

Traditionally, the privatisation of SOEs has been included in actions to improve the efficiency of the public sector and offset unfavourable financial and economic situations. In fact, in the 1990s, the public sector in the EU adopted New Public Management (NPM) techniques to restructure administrations, and those techniques included privatisation (among other measures). Both privatisation and the other formulas were based on operational and organisational systems, processes and techniques from the private sector, which were applied to public administrations (Hood, 1995) to more efficiently allocate public resources (Diefenbach, 2009).

According to the NPM approach, companies in the private sector operate more efficiently, and their financial performance is better. So, governments may apply market techniques to public services (Stark, 2002) to improve unfavourable financial and economic situations. By privatising SOEs, governments could begin to obtain revenue from companies that were operating inefficiently, and they would have less need to resort to using debt to finance them. Privatisation reduced indebtedness and could thus be a financial restructuring instrument that injected economic resources from the private sphere into public finances (extra-budgetary resources).

Previous literature has analysed the relationship between debt levels and privatisation, but all of them consider the effect in one direction. For instance, Törok (2019) pointed out that part of the proceeds from privatisation certainly reduced Brazilian government debt. Bernardini et al. (2019) analysed 11 developed countries from 1990 to 2000 and stated that privatisation may have contributed to the reduction of the debt ratio both by reducing debt and improving economic efficiency. Katsoulakos & Likoyanni (2002) showed that privatisation reduces debt levels, using a sample of 23 OECD countries over the period 1990–2000. Bortolotti et al. (2003) found that countries with the highest levels of debt show a greater predisposition towards privatisation in a sample of 34 countries from 1977 to 1999, and Bortolotti & Pinotti (2003) showed a similar result for 21 industrialised economies.

Theoretically, there are various arguments defending a positive relationship between indebtedness and privatisation, which can be summarised as follows.

Privatisation allows for cuts in public spending, as certain activities are transferred to the private sector. A cut in public spending also reduces funding requirements, including the use of public debt (Vickers & Yarrow, 1988).

The debt of SOEs is part of the consolidated debt of the general government. Therefore, if those companies are transferred to the private sector, their debt is no longer included in the public debt (Jeronimo et al., 2000).

Traditionally, SOEs have been characterised as having high levels of debt that have accumulated over decades. Privatisation is a way of slowing down the acquisition of debt year after year, at least by the corporate, state-owned sector (Dalkalachev, 2003).

Selling off SOEs generates cash (Reinhart et al., 2015) that can be used to pay off accumulated debt (Bernardini et al., 2019; Törok, 2019) without having to cut public spending or increase taxes. Parker (1999) summarised some examples of governments that have used the revenue from privatisations to pay off public debt or reduce its use (France, Austria, Italy, Portugal and Spain).

The previous point also affects the interest payments resulting from indebtedness. If the revenue from the sale of SOEs is used to settle existing debt, the payment of the ensuing interest will also be reduced. This improves cash flow (Sheshinski & López-Calva, 2003), releasing further resources that can be used to continue to pay off debt.

Based on these arguments, the following hypothesis is proposed:

H1: Governments that face higher debt levels tend to adopt privatisation to a greater extent, expecting that this will reduce their indebtedness.

2.2. The moderating effects of political ideology and electoral cycles

The public choice theory interprets the political system as a market where agents interact to attain their aims (Downs, 1957). In this market, politicians may act ideologically or opportunistically, following “partisan” (Hibbs, 1977) and “opportunistic” models (Nordhaus, 1975).

The partisan model considers that governments are ideologically driven, as each party represents the interests of different segments of the electorate. Those segments are usually located on the ideological right or left. In general, right-wing parties favour market solutions, considering the private sector to be superior in terms of efficiency and productivity (Benito et al., 2021). They believe in minimum intervention in the public sector. Therefore, it could be expected that conservative parties are more likely to privatise than parties with other ideologies. Indeed, much of the previous literature has empirically shown a greater predisposition towards privatisation by right-wing governments (Belke et al., 2007; Bortolotti & Pinotti, 2008; Bortolotti & Siniscalco, 2004; Bortolotti et al., 2003; Obinger et al., 2014; Schmitt, 2013; Schneider & Häge, 2008). Privatisation achieved worldwide relevance in the 1980s when the Conservative governments of Margaret Thatcher in the UK and Ronald Reagan in the US privatised important SOEs (overall in the telecommunications and energy sectors) to improve the financial situations their countries were facing.

Traditionally, right-wing parties defend fiscal discipline (Alesina & Rosenthal, 1995; García-Sánchez et al., 2011; Rudolph & Evans, 2005), while left-wing parties show a greater inclination towards the use of public debt to cover public spending (García-Sánchez et al., 2011; Tellier, 2006). Thus, to carry out their policies, right-wing governments with high debt levels are subject to more partisan pressure than when their debt levels are low, taking into account the fiscal discipline they promote. If privatisations reduce public debt levels, we can expect right-wing governments with high levels of debt to use privatisations to reduce their indebtedness to a greater extent than parties with other ideologies. This is because these reforms are in line with conservative ideological convictions supporting free markets, as opposed to public sector intervention. Furthermore, right-wing followers would not accept that the resources obtained from privatisations were not used to maintain a balanced budget.

Based on the above, we propose the following hypothesis:

H2: Right-wing governments facing higher debt levels implement privatisation to a greater extent than governments with other ideologies, expecting these reforms to reduce indebtedness.

The opportunistic model posits that politicians usually act out of self-interest instead of focusing on the interests of their constituents. Politicians are generally interested in holding onto or gaining power, so they will seek to create favourable conditions (through public spending, public debt, fiscal pressure, etc.) in the run-up to elections to influence voters and create what are known as electoral cycles.

Privatisation could be considered a controversial measure (Breen & Doyle, 2013). Despite the positive effects in terms of efficiency and economic growth (Belke et al., 2007; Bortolotti & Pinotti, 2008; Bortolotti et al., 2001, 2003; Boubakri et al., 2009; Roberts & Saeed, 2012; Schmitt, 2011, 2013, 2014; Schneider & Häge, 2008), the general public has a more critical view of privatisation due to its negative outcomes in terms of working conditions, unemployment, inequality and corruption (Cuadrado-Ballesteros & Peña-Miguel, 2020; Kikeri & Nellis, 2004; Knott & Miller, 2006; Overman, 2016; Peña-Miguel & Cuadrado-Ballesteros, 2019). Therefore, it is more likely that governments will privatise SOEs right after elections to avoid damaging their image during elections.

On the other hand, Baber & Sen (1986), Clingermayer & Wood (1995), Reid (1998), Binet & Pentecote (2004), Ashworth et al. (2005) and García-Sánchez et al. (2011), among others, have empirically demonstrated that the use of debt increases in the years prior to elections, while governments tend to adopt budgetary discipline measures in the years following elections (Benito et al., 2015; Ríos et al., 2017; Baber & Sen, 1986). We could therefore expect that privatisation tends to be implemented after elections to reduce pre-election debt increases. In addition, greater resources obtained from privatisations in pre-electoral years would not be used to reduce debt. These resources would be employed to implement opportunistic policies to increase the governing party’s popularity.

According to these arguments, we propose the following hypothesis:

H3: Privatisation tends to be implemented in the years immediately following elections to reduce indebtedness.

3. Methodological approach

3.1. Sample

To answer the research questions, this study uses econometric techniques with a sample of data from 25 European countries between 1995 and 2013. All the countries represented in the sample belonged to the EU at that time. The sample selection is based on the availability of information about the main variables, which represent privatisation and indebtedness. Data on privatisation are available on the Privatisation Barometer website1, a project launched by the Fondazione Eni Enrico Mattei (FEEM). This foundation is a not-for-profit and non-partisan institution studying governance financed by KPMG Advisory. FEEM is the official supplier of privatisation data for the Organisation for Economic Cooperation and Development (OECD) and the World Bank. Data on privatisations are available until 2013, which limits the period of analysis of this study. Information on indebtedness is available from the EU AMECO database2, provided by the European Commission’s Directorate-General for Economic and Financial Affairs. This database contains macroeconomic data on the EU-28, eurozone, EU candidate countries and other OECD countries.

Specifically, the countries included in the sample are Austria, Belgium, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden and the United Kingdom. This context is appropriate for the study given the importance of privatisation in Europe. Most of the top ten countries in the OECD in terms of privatisation are European (OECD, 2009).

Other additional control variables will be used with data obtained from the databases of the OECD, Eurostat, World Bank and Comparative Political Data Set (Armingeon et al., 2018).

3.2. Variables

Here, privatisation is defined as the transfer of ownership or voting rights from the State3 to the private sector (Obinger et al., 2016) through the sale of the shares of an SOE4 to private investors. Following Bortolotti et al. (2001), Bortolotti et al. (2003) and Zohlnhöfer et al. (2008), among others, privatisations are represented by two variables, called Deals and Proceeds. The first refers to the number of privatisation transactions in absolute terms (both partial and total5) in each country in each year. The second represents the total revenue (in current US dollars) obtained from all those transactions (both partial and total), relativised by the GDP (in current US dollars). This last variable represents the willingness of governments to privatise SOEs and also how the market values the sales of SOEs. Therefore, it captures the economic relevance and financial success of the privatisation transactions in a country. It is important to include both variables because considering only the number of transactions would underestimate the economic effect of privatisations, and considering only the revenue of those reforms would overestimate their impact when just a few large SOEs are involved (Bortolotti et al., 2001).

Indebtedness is represented by the variable called Debt, which refers to the amount of the consolidated gross debt of all public administrations in relative terms to the GDP at current prices. Gross debt is defined in Article 1.5 of Council Regulation (EU) No. 3605/93, amended by Council Regulation (EC) No. 475/2000, as the nominal value outstanding at the end of the year of the general government sector (S.13), with the exception of those liabilities whose corresponding financial assets are held by that sector. Government debt comprises general government liabilities in the following categories: (i) currency and deposits; (ii) securities other than shares, excluding financial derivatives; and (iii) loans as defined in the European System of Accounts (ESA) 1995. Data were retrieved from the AMECO database, which is the annual macro-economic database of the European Commission’s Directorate-General for Economic and Financial Affairs.

Regarding the moderating political factors, the variable Right refers to the relative power of conservative or right-wing parties based on the proportion of seats they occupy in the parliament (Belke et al., 2007; Schmitt 2011, 2013, 2014; Schneider & Häge, 2008). In other words, it is the percentage of the total parliamentary seats held by all the right-wing parties in government, weighted by the number of days holding those seats in a specific year. The variable Post_Elections is a dummy that takes the value of 1 in the year immediately following elections and 0 otherwise.

Additionally, the results are controlled by control variables whose impact on privatisation and indebtedness has been shown in previous studies. The control variables for explaining privatisations are (Belke et al., 2007; Bortolotti et al., 2001, 2003; Clifton et al., 2003, 2006; Schmitt, 2013, 2014; Zohlnhöfer et al., 2008), membership in the eurozone, through a dummy variable that takes the value of 1 for member states of the Economic and Monetary Union (EMU) and 0 otherwise (Euro); the level of economic development measured by using the Gross Domestic Product per capita (GDP); the market capitalisation of listed domestic companies as a percentage of the GDP (Capitalisation); the fiscal situation of the government through net lending (+) or net borrowing (-), excluding interest as a percentage of the GDP (Balance); the openness of the economy to direct foreign investments as a percentage of the GDP (FDI); the share of sectors in which there are explicit legal limitations on the number of competitors (Barriers); and the share of activity sectors where the State controls at least one firm (Public_Ownership).

The control variables explaining indebtedness are Euro, GDP, Balance, the inflation rate (Inflation), which affects payments of nominal interest and real tax revenue, and the unemployment rate (Unemployment), which affects indebtedness through increased spending on pensions, health care, social welfare, etc. (Sinha et al., 2011).

3.3. Models of analysis

The three hypotheses are empirically tested through several econometric models that include the variables described above. Subindex i represents each country, and t refers to each year of the sample. \(\eta_{i}\) refers to the unobservable heterogeneity, i.e., the characteristics of each country, which are different from other countries but invariant over time, and \(\varepsilon_{it}\) is the classical disturbance term.

Models (1), (2), (3) and (4) test hypothesis H1 by analysing the effect of Debt on the privatisation variables, namely, Deals and Proceeds, as well as the effect of these privatisation variables on Debt.

\[\begin{equation} \label{eq1} \small \begin{split} Deals_{it}& = \beta_{0} + \beta_{1}Debt_{it - 1} + \beta_{2}Right_{it} + \beta_{3}Post\_ Elections_{it} \\ & + \beta_{4}Euro_{it} + \beta_{5}GDP_{it} + \beta_{6}Balance_{it - 1}\\ & + \beta_{7}Capitalization_{it} + \beta_{8}FDI_{it} + \beta_{9}Barriers_{it}\\ & + \beta_{10}Public\_ Ownership_{it} + \eta_{i} + \varepsilon_{it} \end{split} \ \ \ \ \ (1) \end{equation}\] \[\begin{equation} \label{eq2} \small \begin{split} Proceeds_{it}& = \beta_{0} + \beta_{1}Debt_{it - 1} + \beta_{2}Right_{it} + \beta_{3}Post\_ Elections_{it}\\ & + \beta_{4}Euro_{it} + \beta_{5}GDP_{it} + \beta_{6}Balance_{it - 1}\\ & + \beta_{7}Capitalization_{it} + \beta_{8}FDI_{it} + \beta_{9}Barriers_{it}\\ & + \beta_{10}Public\_ Ownership_{it} + \eta_{i} + \varepsilon_{it} \end{split} \ \ \ \ \ (2) \end{equation}\] \[\begin{equation} \label{eq3} \small \begin{split} Debt_{it}& = {\beta_{0} + \beta}_{1}Debt_{it - 1} + \beta_{2}Deals_{it - 1} + \beta_{3}Right_{it} \hspace{0.3cm} \\ & + \beta_{4}Post\_ Elections_{it} + \beta_{5}Euro_{it} + \beta_{6}GDP_{it}\\ & + \beta_{7}Balance_{it - 1} + \beta_{8}Unemployment_{it}\\ & + \beta_{9}Inflation_{it} + \eta_{i} + \varepsilon_{it} \end{split} \ \ \ \ \ (3) \end{equation}\] \[\begin{equation} \label{eq4} \small \begin{split} Debt_{it}& = \beta_{0} + \beta_{1}Debt_{it - 1} + \beta_{2}Proceeds_{it - 1} + \beta_{3}Right_{it}\\ & + \beta_{4}Post\_ Elections_{it} + \beta_{5}Euro_{it} + \beta_{6}GDP_{it}\\ & + \beta_{7}Balance_{it - 1} + \beta_{8}Unemployment_{it}\\ & + \beta_{9}Inflation_{it} + \eta_{i} + \varepsilon_{it} \end{split} \ \ \ \ \ (4) \end{equation}\]Models (5), (6), (7) and (8) test the moderating effect of political ideology (Hypothesis H2) through the interaction of the variable Right with Debt, Deals and Proceeds, as well as the moderating effect of electoral cycles (Hypothesis H3) through the interaction Post_Elections with Debt, Deals and Proceeds.

\[\begin{equation} \label{eq5} \small \begin{split} Deals_{it}& = \beta_{0} + \beta_{1}Debt_{it - 1} + \beta_{2}Right_{it} + \beta_{3}Post\_ Elections_{it}\\ & + \alpha_{1}Debt\_ Right_{it - 1} + \alpha_{2}Debt\_ Post\_ Elections_{it - 1}\\ & + \beta_{4}Euro_{it} + \beta_{5}GDP_{it} + \beta_{6}Balance_{it - 1}\\ & + \beta_{7}Capitalization_{it} + \beta_{8}FDI_{it} + \beta_{9}Barriers_{it}\\ & + \beta_{10}Public\_ Ownership_{it} + \eta_{i} + \varepsilon_{it} \end{split} \ \ \ \ \ (5) \end{equation}\] \[\begin{equation} \label{eq6} \small \begin{split} Proceeds_{it}& = \beta_{0} + \beta_{1}Debt_{it - 1} + \beta_{2}Right_{it} + \beta_{3}Post\_ Elections_{it}\\ & + \alpha_{1}Debt\_ Right_{it - 1} + \alpha_{2}Debt\_ Post\_ Elections_{it - 1}\\ & + \beta_{4}Euro_{it} + \beta_{5}GDP_{it} + \beta_{6}Balance_{it - 1}\\ & + \beta_{7}Capitalization_{it} + \beta_{8}FDI_{it} + \beta_{9}Barriers_{it}\\ & + \beta_{10}Public\_ Ownership_{it} + \eta_{i} + \varepsilon_{it} \end{split} \ \ \ \ \ (6) \end{equation}\] \[\begin{equation} \label{eq7} \small \begin{split} Debt_{it}& = \beta_{0} + \beta_{1}Debt_{it - 1} + \beta_{2}Deals_{it - 1} + \beta_{3}Right_{it}\\ & + \beta_{4}Post\_ Elections_{it} + \alpha_{1}Deals\_ Right_{it - 1}\\ & + \alpha_{2}Deals\_ Post\_ Elections_{it - 1} + \beta_{5}Euro_{it} + \beta_{6}GDP_{it}\\ & + \beta_{7}Balance_{it - 1} + \beta_{8}Unemployment_{it}\\ & + \beta_{9}Inflation_{it} + \eta_{i} + \varepsilon_{it} \end{split} \ \ \ \ \ (7) \end{equation}\] \[\begin{equation} \label{eq8} \small \begin{split} Debt_{it}& = \beta_{0} + \beta_{1}Debt_{it - 1} + \beta_{2}Proceeds_{it - 1} + \beta_{3}Right_{it}\\ & + \beta_{4}Post\_ Elections_{it} + \alpha_{1}Proceeds\_ Right_{it - 1}\\ & + \alpha_{2}Proceeds\_ Post\_ Elections_{it - 1} + \beta_{5}Euro_{it}\\ & + \beta_{6}GDP_{it} + \beta_{7}Balance_{it - 1} + \beta_{8}Unemployment_{it}\\ & + \beta_{9}Inflation_{it} + \eta_{i} + \varepsilon_{it} \end{split} \ \ \ \ \ (8) \end{equation}\]Even if politicians could lower debt, they might not be able to reap the benefits as quickly as contemporaneous effects suggest, given that privatisation takes time to complete (Katsoulakos & Likoyanni, 2002; Robinson, 2003). Accordingly, Models (1), (2), (5) and (6) include the first-order lag of debt because the effect of debt on privatisation could be delayed. Models (3), (4), (7) and (8) also include the first-order lag of debt because one year’s debt level is affected by the previous year’s level of debt (Anaya & Pienkowski, 2015). Furthermore, Models (3), (4), (7) and (8) include the first-order lag of privatisation variables because the effect of privatisation on debt could be delayed. All the models include the first-order lag of Balance, since Cuadrado-Ballesteros & Peña-Miguel (2019) showed that this effect might be delayed.

3.4. Technique of analysis

Endogeneity is a relevant problem because previous models show a bidirectional relationship between privatisation and indebtedness, resulting in causality problems. Endogeneity could also appear because some relevant determinants of public debt and privatisation (e.g., corruption, political stability, accountability indicators, legal origin, electoral systems, growth, etc.) have been omitted due to multicollinearity problems with other variables in the models.

Accordingly, the parameters in Models (1) to (8) have been estimated using the generalised method of moments (GMM), specifically, the two-step system estimator of Arellano and Bover (1995). This estimator allows endogeneity problems and other statistical issues like heteroscedasticity and serial correlation to be corrected (Arellano & Bond, 1991). Although there are other estimators that might correct the last two issues, the GMM estimator overcomes endogeneity by using lagged values of the right-hand-side variables included in the model as instruments. These instruments are uncorrelated with the errors, as Arellano & Bond (1991) demonstrated, and they contain information about the current value of the variable. In contrast, it is difficult to prove that external instruments traditionally selected as conventional instrumental variable estimators are uncorrelated with the error term yet also contain enough information about the variables they represent (Pindado & Requejo, 2015). The number of instruments should not be very large compared to the number of observations because the results could be biased6. However, the higher the number of instruments, the greater the efficiency (Pindado & Requejo 2015). Instrument validity is checked by two tests: (i) the Arellano-Bond test for AR(2) in first differences is the test for second-order serial correlation in the first-differenced residuals, asymptotically distributed as N(0,1) under the null hypothesis of no serial correlation between the error terms; and (ii) the Hansen test of over-identification restrictions is to test the validity of the over-identifying restrictions for the GMM estimator, asymptotically distributed as chi2, under the null hypothesis that the over-identifying restrictions are valid. The results of those tests are shown at the end of the results tables.

Furthermore, standard errors of coefficients in two-step GMM models tend to be severely skewed. Consequently, the econometric literature indicates that it is advisable to correct the errors with the Windmeijer (2005) correction.

4. Results

4.1. Descriptive analysis

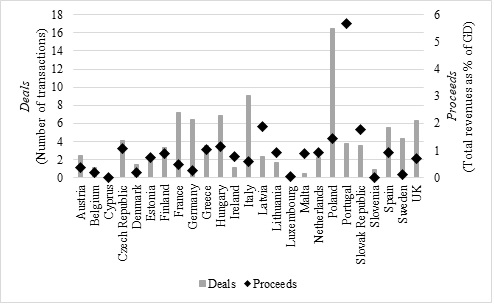

The most relevant descriptive statistics of all the variables included in the models are given in Table 1. Regarding the privatisation variables, the mean value of Deals shows that there was an average of three or four transactions during the period of analysis, while the mean value of Proceeds suggests that privatisation revenues were about 0.92% of the GDP, on average. However, there are relevant differences in the sample. The maximum value of Deals is 55 for Poland in 2010, and the maximum value of Proceeds is 16.86%, shown by Portugal in 1997 when the government sold, among other things, part of EDP Electricidade de Portugal for US$2,033.4 million.

Table 1. Descriptive statistics

| Variable | Description | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Deals | Number of privatisation transactions in absolute terms (both partial and total). Source: Privatisation Barometer | 3.8484 | 5.2565 | 0 | 55 |

| Proceeds | Total revenue (in current US dollars) obtained from privatisation transactions (both partial and total) (% GDP). Source: Privatisation Barometer | 0.9242 | 2.0641 | 0 | 16.86 |

| Debt | Consolidated gross debt of all public administrations (% GDP). Source: AMECO database | 54.5063 | 30.9232 | 3.66 | 177.41 |

| Right | Percentage of the total parliamentary seats of all the right-wing parties in government, weighted by the number of days holding that seat in a specific year. Source: Comparative Political Data Set | 38.3905 | 37.5476 | 0 | 100 |

| Post_Elections | Dummy variable that takes the value of 1 in the year immediately after elections are held and 0 otherwise. Source: Comparative Political Data Set | 0.3579 | 0.4799 | 0 | 1 |

| Euro | Dummy variable with the value of 1 for member states of the EMU. Source: Comparative Political Data Set | 0.4316 | 0.4958 | 0 | 1 |

| GDP | Gross domestic product divided by midyear population. Source: World Bank | 31,942.57 | 19,550.93 | 5,140.53 | 111,968.4 |

| Capitalisation | Market Capitalisation of listed domestic companies (% of GDP). Source: World Bank | 56.9451 | 45.6417 | 1.19 | 326.36 |

| Balance | Net lending (+) or net borrowing (-) by the general government, excluding interest (% GDP). Source: AMECO database | -0.1523 | 3.6007 | -29.19 | 9.57 |

| FDI | Foreign direct investment, net inflows (% GDP). Source: World Bank | 10.3944 | 37.3394 | -58.32 | 451.72 |

| Barriers | The share of sectors with explicit legal limitations on the number of competitors. Source: OECD Indicators of Product Market Regulation | 1.2398 | 0.6344 | 0.2 | 3.52 |

| Public_Ownership | The share of activity sectors with State control over at least one firm. Source: OECD Indicators of Product Market Regulation | 2.8342 | 1.0936 | -3.22 | 4.98 |

| Unemployment | Unemployment rate. Source: World Bank | 8.7789 | 4.2670 | 1.8 | 27.3 |

| Inflation | Rate of inflation. Source: World Bank | 3.1879 | 3.7387 | -9.68 | 27.98 |

The differences between countries can also be seen in Figure 1, where Poland stands out as the country with the highest number of transactions (Deals), while Portugal is the country with the highest level of revenues from privatisations (Proceeds). There are also differences between years. There is a general downtrend in privatisations throughout the period of analysis, as we can see in Figure 2. However, these operations become more frequent from 2008 onwards, when the Troika, made up of the European Commission (EC), the European Central Bank and the International Monetary Fund (IMF), pushed privatisation programmes on the European Union (EU) members that were facing financial difficulties during the crisis of 2008, as in Greece and Ireland (Clifton et al., 2018).

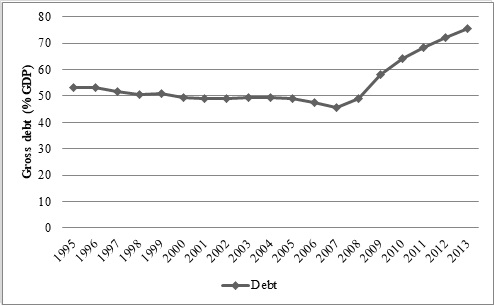

Regarding indebtedness, the Debt variable average indicates debt of roughly 54.5% of the GDP, reaching values of over 17% in Greece in the final years analysed (2011–2013). The lowest values are in Estonia (3.66% in 2007). Figure 3 shows a great rise in indebtedness from 2008 onwards, coinciding with the onset of the international financial crisis.

Figure 1. Distribution of privatisation variables by country

Figure 2. Evolution of privatisation variables (1995-2013)

Figure 3. Evolution of the debt variable (1995-2013)

Table 1 also shows the descriptive statistics of the rest of the independent and control variables. The most salient results are summarised as follows: the mean value of Right suggests that 38.39% of parliamentary seats are controlled by right-wing parties. The deficit accounted for 0.15% of the GDP in general, although it was nearly 30% of the GDP in Ireland and Greece. The average unemployment rate was 8.7% but reached 27.3% in Greece in 2013. Direct foreign investment was about 10.39% of the GDP on average, with values rising to 451.72% in Malta and dropping to -58.32% in Luxembourg in 2007. Regarding the variable Barriers, the mean value points to legal limitations on the number of competitors in about 1.24% of the activity sectors. Finally, it can be highlighted that States control at least one firm in almost 3% of the activity sectors (Public_Ownership).

4.2. Econometric analysis

Table 2 shows the results of Models (1) to (4), which test hypothesis H1. In Panel A, Debt positively impacts Deals (Model 1) and Proceeds (Model 2), with statistical relevance at different confidence levels. These findings suggest that the countries with the highest levels of debt resort to privatisations to a greater extent than less-indebted countries. We could expect that privatisations were implemented to reduce levels of debt. Therefore, this study tests the opposite effect through Models (3) and (4) in Panel B; that is, the effect of the privatisation variables on Debt. Concretely, Deals and Proceeds are statistically relevant in both models, suggesting that debt levels decrease after privatisations have been carried out. These results corroborate the first hypothesis of this study, suggesting a bidirectional relationship (causality) between privatisations and debt levels. Our findings contribute to the previous literature which showed that more indebted countries tend to privatise more than countries with lower levels of debt (Bortolotti et al., 2003; Bortolotti & Pinotti, 2003). Scholars have explained their findings on debt reduction after privatisation. However, they have failed to empirically analyse that effect. Our findings show that privatisations are effective in reducing debt levels.

In Panel A, Right and Post_Elections are only statistically relevant in explaining Proceeds. Both have positive coefficients, which means that right-wing governments tend to carry out the largest privatisations; and that governments tend to implement more significant privatisations in the year immediately following an election. These findings are in line with the previous literature on the political economy of privatisations (Belke et al., 2007; Bortolotti & Pinotti, 2008; Bortolotti & Siniscalco, 2004; Bortolotti et al., 2003; Obinger et al., 2014; Schmitt, 2013; Schneider & Häge, 2008).

In Panel B, Right and Post_Elections show negative and positive coefficients, respectively. This concurs with the academic literature demonstrating that right-wing governments are not as predisposed to use public debt as left-wing governments (García-Sánchez et al., 2011; Tellier, 2006). This follows the Right’s defence of fiscal discipline (Alesina & Rosenthal, 1995; García-Sánchez et al., 2011; Rudolph & Evans, 2005). Furthermore, these findings evidence the existence of an electoral cycle in debt, although it is contrary to the expected results (García-Sánchez et al., 2011). Our findings could be explained by the variable Post_Elections, which takes the value of 1 in the year immediately following elections. It is likely that debt reduction could not be seen only one year after elections were held.

Regarding the control variables in Panel A, Euro positively impacts both privatisation variables. This means that the EU is an explanatory factor when considering privatisations in Europe (Clifton et al., 2003). In addition, Balance negatively impacts Proceeds, indicating that governments with large deficits tend to resort to privatisations to a greater extent (Cuadrado-Ballesteros & Peña-Miguel, 2019). Furthermore, levels of capitalisation and the openness of the economy to direct foreign investment explain the privatisation of SOEs in Europe (Belke et al., 2007; Bortolotti et al., 2001; Schmitt, 2013 2014; Zohlnhöfer et al., 2008). The share of activity sectors where the State controls at least one firm (Public_Ownership) is also statistically relevant, but the effect is not conclusive. In Panel B, public debt is related to several variables that represent a deterioration in public finances, such as deficits, inflation, GDP and unemployment (Akitoby et al., 2017; Barquero Romero & Loaiza Marín, 2017; Panizza & Presbitero, 2014).

Table 2. Relationship between privatisation and debt (Hypothesis 1)

| Panel A. Effect of Debt on Privatisation | ||||

|---|---|---|---|---|

| Model 1 Dependent variable: Deals | Model 2 Dependent variable: Proceeds | |||

| Coef. | Std. Err | Coef. | Std. Err | |

| Debtt-1 | 0.0483* | 0.0207 | 1.0073*** | 0.0080 |

| Right | 0.0115 | 0.0133 | 0.1748* | 0.0739 |

| Post_Elections | 0.0042 | 0.3091 | 0.0088† | 0.0048 |

| Euro | 0.2043† | 0.1003 | 0.4438* | 0.1601 |

| GDP | 2.8086 | 1.7371 | 0.1569 | 0.3790 |

| Balancet-1 | 0.0792 | 0.0471 | -0.0297* | 0.0116 |

| Capitalisation | -0.0090 | 0.0114 | 0.3902*** | 0.0526 |

| FDI | 0.0059** | 0.0019 | 0.9923*** | 0.0580 |

| Barriers | -0.4096 | 1.2663 | -0.0149 | 0.0634 |

| Public_Ownership | 4.2316** | 1.1630 | -0.3052** | 0.0905 |

| Constant | -15.2326** | 5.0818 | 2.0080* | 0.8123 |

| Year | Yes | Yes | ||

| Country | Yes | Yes | ||

| Arellano-Bond test for AR (2) in first differences | Pr > z = 0.486 | Pr > z = 0.655 | ||

| Hansen test | Pr > chi2 = 0.211 | Pr > chi2 = 0.270 | ||

| Number of observations | 279 | 279 | ||

| Number of instruments | 19 | 23 | ||

| Panel B. Effect of Privatisation on Debt | ||||

| Model 3 Dependent variable: Debt | Model 4 Dependent variable: Debt | |||

| Coef. | Std. Err | Coef. | Std. Err | |

| Debtt-1 | 0.9944*** | 0.0083 | 1.0073*** | 0.0080 |

| Dealst-1 | -0.2013* | 0.0761 | ||

| Proceedst-1 | -0.1748* | 0.0739 | ||

| Right | -0.0123** | 0.0042 | -0.0088† | 0.0048 |

| Post_Elections | 0.4401** | 0.1294 | 0.4438* | 0.1601 |

| Euro | 0.6767† | 0.3475 | 0.1569 | 0.3790 |

| GDP | 0.0075 | 0.0148 | 0.0297* | 0.0116 |

| Balancet-1 | -0.9711*** | 0.0980 | -0.9923*** | 0.0580 |

| Unemployment | 0.0653 | 0.0721 | -0.0149 | 0.0634 |

| Inflation | 0.1205* | 0.0577 | 0.3052** | 0.0905 |

| Constant | 2.5935*** | 0.4406 | 2.0080* | 0.8123 |

| Year | Yes | Yes | ||

| Country | Yes | Yes | ||

| Arellano-Bond test for AR (2) in first differences | Pr > z = 0.486 | Pr > z = 0.655 | ||

| Hansen test | Pr > chi2 = 0.211 | Pr > chi2 = 0.270 | ||

| Number of observations | 444 | 444 | ||

| Number of instruments | 25 | 25 | ||

Notes: †, *, **, ***significant at the 10, 5, 1 and 0.1 percent levels, respectively; the maximum VIF value is 3.92 in Models (1) and (2), 3.31 in Model (3) and 3.28 in Model (4).

Table 3 shows the results of Models (5) to (8), which test hypotheses H2 and H3 regarding the moderating effect of political ideology and electoral cycles, respectively.

In Panel A, Debt again positively impacts Deals (Model 5) and Proceeds (Model 6). Once again, Right positively impacts Proceeds, indicating that privatisation is implemented by right-wing governments to a greater extent than governments with other political ideologies. Debt_Right also shows positive coefficients in both models, suggesting that right-wing governments with higher levels of debt resort to privatisation to a greater extent. Given these results, it could be concluded that faced with high debt levels, one of the measures adopted by right-wing governments is to privatise SOEs. Previous literature has shown that privatisations help reduce public spending and therefore lessen the need for financial resources (Dalkalachev, 2003; Vickers & Yarrow, 1988). This is achieved by transferring the debt of former SOEs to the private sector (Jeronimo et al., 2000) and/or securing revenue that can be used to repay debt and cover the interest arising from its use (Parker, 1999). Although we have found the relevance of political ideology as a moderator in the relationship between privatisations and debt, electoral cycles are not relevant since Post_Elections and Debt_Post_Elections are not significant in any model.

In Panel B, we can see the effect of the privatisation variables (Deals and Proceeds) on Debt and the moderating effect of ideology (Right) and electoral cycles (Post_Elections). The two privatisation variables are statistically relevant in both models, and they have negative coefficients, which suggests that indebtedness tends to decrease after privatisations are carried out. These findings are in line with those shown in the previous table. Again, Right negatively impacts Debt, which means that right-wing governments tend to have lower debt levels than governments with other ideologies. Post_Elections is also statistically relevant in both models, and it has positive coefficients, suggesting that debt levels tend to decrease in the year immediately following an election. However, the interaction terms (Deals_Right, Deals_Post_Elections, Proceeds_Right, Proceeds_Post_Elections) are not statistically relevant in any model. These results suggest that privatisation may be a good strategy to reduce public debt, regardless of the political ideology of the government that has implemented it and the electoral moment in which this measure has been implemented (although privatisation tends to be used by right-wing governments to a greater extent).

Finally, the results of the control variables in Table 3 are similar to those obtained in Table 2.

Table 3. Moderating effects of ideology and elections (Hypotheses 2 and 3)

| Panel A. Effect of Debt on Privatisation | ||||

|---|---|---|---|---|

| Model 5 Dependent variable: Deals | Model 6 Dependent variable: Proceeds | |||

| Coef. | Std. Err | Coef. | Std. Err | |

| Debtt-1 | 0.0384* | 0.0155 | 0.0205** | 0.0059 |

| Right | 0.0068 | 0.0106 | 0.0153*** | 0.0030 |

| Post_Elections | 0.0387 | 0.2733 | 0.0720 | 0.2214 |

| Debt_Rightt-1 | 0.2552* | 0.0977 | 0.3099* | 0.1408 |

| Debt_Post_Electionst-1 | -0.0008 | 0.0060 | -0.0038 | 0.0052 |

| Euro | 2.5087* | 1.0352 | 0.6033* | 0.2115 |

| GDP | 0.0809 | 0.0661 | -0.0267† | 0.0130 |

| Balancet-1 | -0.0628 | 0.0612 | -0.0065 | 0.0126 |

| Capitalisation | 0.0152 | 0.0129 | 0.0055† | 0.0031 |

| FDI | 0.0070* | 0.0026 | 0.0021† | 0.0011 |

| Barriers | 0.1516 | 0.8175 | 0.2741 | 0.2285 |

| Public_Ownership | 3.6933** | 1.0113 | 0.2869 | 0.2113 |

| Constant | -11.1410* | 4.9400 | -0.6908 | 0.9200 |

| Year | Yes | Yes | ||

| Country | Yes | Yes | ||

| Arellano-Bond test for AR (2) in first differences | Pr > z = 0.430 | Pr > z = 0.117 | ||

| Hansen test | Pr > chi2 = 0.714 | Pr > chi2 = 0.554 | ||

| Number of observations | 267 | 267 | ||

| Number of instruments | 25 | 23 | ||

| Panel B. Effect of Privatisation on Debt | ||||

| Model 7 Dependent variable: Debt | Model 8 Dependent variable: Debt | |||

| Coef. | Std. Err | Coef. | Std. Err | |

| Debtt-1 | 1.0230*** | 0.0224 | 0.8793*** | 0.0210 |

| Dealst-1 | -0.1179* | 0.0460 | ||

| Proceedst-1 | -0.1994*** | 0.0494 | ||

| Right | -0.0375† | 0.0218 | -0.0227† | 0.0125 |

| Post_Elections | 1.1911** | 0.4222 | 0.6818*** | 0.1572 |

| Deals_Rightt-1 | 0.0070 | 0.0057 | ||

| Deals_Post_Electionst-1 | -0.1332 | 0.1243 | ||

| Proceeds_Rightt-1 | 0.0046 | 0.0038 | ||

| Proceeds_Post_Electionst-1 | 0.1868 | 0.1222 | ||

| Euro | 0.3562 | 1.1946 | 4.7168*** | 1.0625 |

| GDP | -0.0122 | 0.0357 | -0.0898† | 0.0500 |

| Balancet-1 | -0.9126*** | 0.0719 | -0.9547*** | 0.0908 |

| Unemployment | -0.0053 | 0.1502 | 0.2949** | 0.1009 |

| Inflation | -0.0822 | 0.0778 | 0.2229** | 0.0586 |

| Constant | 2.3455 | 1.4806 | 7.3416*** | 1.7495 |

| Year | Yes | Yes | ||

| Country | Yes | Yes | ||

| Arellano-Bond test for AR (2) in first differences | Pr > z = 0.905 | Pr > z = 0.961 | ||

| Hansen test | Pr > chi2 = 0.884 | Pr > chi2 = 0.678 | ||

| Number of observations | 444 | 444 | ||

| Number of instruments | 32 | 31 | ||

Notes: †, *, **, ***significant at the 10, 5, 1, and 0.1 percent level, respectively; the maximum VIF value is 4.49 in Models (1) and (2), 4.63 in Model (3) and 4.52 in Model (4).

5. Conclusions and contributions

This study corroborates the causality between privatisations and indebtedness. That is, governments with higher levels of debt tend to privatise SOEs to a greater extent than less-indebted governments, expecting that privatisations will help to reduce debt levels. Most prior studies have analysed this relationship in one direction: the effect of privatisations on indebtedness (Bernardini et al., 2019; Katsoulakos & Likoyanni, 2002; Törok, 2019), or the effect of debt on privatisations (Bortolotti & Pinotti, 2003; Bortolotti et al., 2003). However, our findings suggest the existence of a bidirectional relationship, which gives rise to endogeneity that should be controlled in future studies.

In addition, this study considers the role of two political factors as moderators in this relationship: partisanship and electoral cycles. Although we have failed to find evidence to support the role of electoral cycles in privatisations, the empirical results do corroborate the relevant role of political ideology, suggesting that right-wing governments make use of privatisation to a greater extent than parties with other ideologies, especially when these conservative governments have high debt levels. Considering that right-wing governments traditionally show less willingness to use public debt to cover spending (García-Sánchez et al., 2011; Tellier 2006), they typically use different strategies to reduce indebtedness. Among these strategies, privatisation might be one of the most salient since it is in line with the Right’s ideological convictions supporting free markets.

This study furthers the evidence about privatisation and indebtedness (Bortolotti and Pinotti, 2003, 2008; Bortolotti et al., 2003; Schneider and Häge, 2008) in several aspects: (i) it uses a sample of European countries, which have not been previously analysed in the literature; (ii) it analyses the two-way relationship between privatisation and indebtedness, while previous studies were limited to establishing a one-directional effect (particularly that of debt on privatisation); (iii) it empirically shows that privatisations are effective in reducing indebtedness, adding evidence to the conclusions of previous studies that have explained privatisation as a way of improving financial situations; and (iv) it analyses the moderating effect of different political factors on the relationship between privatisation and indebtedness.

This research also contributes to the literature on the political economy in privatisation, which traditionally has shown a greater predisposition for conservative governments to privatise (Belke et al., 2007; Bortolotti & Siniscalco, 2004; Bortolotti & Pinotti, 2008; Bortolotti et al., 2003; Obinger et al., 2014; Schmitt, 2013; Schneider & Häge, 2008). Although some studies do not fully corroborate this stance (Cioffi & Höpner, 2006; Cuadrado-Ballesteros & Peña-Miguel, 2019), our results show that conservative parties tend to implement privatisations when they have high levels of debt.

Despite these contributions, the research is not free of limitations. First, privatisations have been measured by year and country, without considering the activity sector to which the privatised companies belong. Second, it could also be interesting to consider the type of privatisation undertaken, differentiating between public offers and private sales (Bortolotti et al., 2001 2003). Third, the period of analysis ends in 2013 due to the availability of data on the Privatisation Barometer website. Thus, this study does not consider the most recent privatisations in Europe. It would be interesting to include this wave of privatisation in future studies by using other sources of data that contain more recent operations. Fourth, the moderating effects of political ideology and electoral cycles could also be analysed jointly (Frey & Schneider, 1978a, 1978b, 1979), although a more sophisticated methodological approach is needed. This could be an interesting idea for future studies. Finally, we model short-term effects, while privatisation reforms have longer-term implications in terms of foregone revenues and/or expenditures that will not exist in the future.

Furthermore, if the sample is enlarged, future research could consider the multi-collateral effects of the Covid-19 pandemic and the consequences of Brexit on privatisation. These contextual factors may affect debt levels.