"Old" financial instruments in "new"" circular models: Applied environmental accounting in the banking sector for reporting in a circular economy

ABSTRACT

The role of commercial banks and financial institutions has been described as crucial for the circular economy since they are key actors in financing companies and projects. The facilitating potential of some financial instruments managed by the financial sector has not been studied in connection to extending the circular economy in the environmental accounting framework. Particularly, the renting contracts service, which has been associated with more sustainable performance, shows interesting circular characteristics for servitization and the sharing economy.

By studying the details of renting contracts of a financial institution over 18 years as a case study in Spain, this research demonstrates how this type of service, applied to vehicles, can render important benefits in terms of use of resources, environmental impact, energy efficiency and reduced carbon emissions. Measuring these quantitative impacts and reporting about them is important from an environmental accounting basis and in the framework of the European Union taxonomy for sustainable finance.

The results obtained from the stakeholders’ perspective highlight the pivotal role of existing financial instruments and the need for new metrics for reporting linked to the servitization of the economy as a specific circular issue. This paper contributes to the academic literature by bringing empirical results to a still recent line of research. For practitioners, we provide innovative metrics for circular economy in the financial sector, and for policymakers, this research highlights the wider role of financial institutions in promoting circular economy within the sustainability framework.

Keywords: Environmental accounting; Circular economy; Reporting; Renting; Sustainable finance taxonomy; Financial sector.

JEL classification: Q56; G28; G21.

"Viejos" instrumentos financieros en "nuevos" modelos circulares: Contabilidad medioambiental aplicada al sector financiero para el reporting de la economía circular

RESUMEN

El papel de los bancos y las instituciones financieras ha sido calificado como crucial para la economía circular, como actores clave para financiar empresas y proyectos. El potencial facilitador de algunos instrumentos financieros gestionados por el sector financiero no ha sido estudiado en relación con el fomento de la economía circular en el marco de la contabilidad medioambiental. En particular, el servicio de renting, que se ha asociado a un rendimiento más sostenible, muestra interesantes características vinculadas a la economía circular y a la servitización de la economía.

Analizando en detalle los contratos de renting de una entidad financiera durante 18 años como caso de estudio en España, este estudio demuestra cómo este tipo de servicios, aplicado a los vehículos, puede aportar importantes beneficios en cuanto al uso de recursos, impacto ambiental, eficiencia energética y reducción de emisiones de carbono. Medir cuantitativamente e informar acerca de estos impactos es relevante para la contabilidad medioambiental en el marco de la Taxonomía Europea de finanzas sostenibles.

Los resultados obtenidos desde la perspectiva de los stakeholders destacan el papel fundamental de los instrumentos financieros existentes y la necesidad de nuevas métricas para el reporting vinculado a la servitización de la economía como un tema circular específico. Este trabajo contribuye a la literatura académica proporcionando resultados empíricos a una línea de investigación aún incipiente. Para los profesionales, se aportan métricas novedosas para la economía circular en el sector financiero, mientras que, para la definición de políticas de sostenibilidad, esta investigación pone de relieve el amplio papel de las instituciones financieras en la promoción de la economía circular.

Palabras clave: Contabilidad medioambiental; Economía circular; Reporting; Renting; Taxonomía de finanzas sostenibles; Sector financiero.

Códigos JEL: Q56; G28; G21.

1. Introduction

In response to institutional demand, reducing the consumption of materials and resources within the circular economy (CE) requires a greater definition and control of the company's material loops closing (Aranda-Usón et al., 2020; Scarpellini et al., 2017). The circular model implies changes at different organization's levels, including accounting processes in the framework of sustainability accounting and accountability (Scarpellini et al., 2020). In the coming years, the CE-related activities and impacts will be part of the information reported within the framework of Directive (EU) 2022/2464 as regards to corporate sustainability reporting (Directive (EU) 2022/2464 as regards Corporate Sustainability Reporting, 2022). Consequently, sustainability reports have to contain information on the extent to which the companies have managed to introduce the CE.

These progress towards CE requires not only institutional and market forces, but also adaptation in all sectors, including the financial one. This need for adaptation in financial products is what has led the European Union (EU) to consider the financial sector as a key actor to favour the sustainable functioning of the economy and the promotion of the CE. A clear sign of this aim is reflected by its integration in sustainable finance through the so-called European Taxonomy regulated by the Regulation (EU) 2020/852 of the European Parliament and the Council, on the establishment of a framework to facilitate sustainable investment (Regulation (EU) 2020/852 on the Establishment of a Framework to Facilitate Sustainable Investment, and Amending Regulation (EU) 2019/2088, 2020). In this way, the EU seeks to reorient capital flows towards sustainable activities and investments and directly involving the financial sector.

Indeed, the financial sector has a pivotal role in facilitating the transition to a CE by providing financing to CE projects and proactive companies. Furthermore, the new standards adopted to inform about the sustainability characteristics of investment funds point out at the relevant role that the financial sector may play as ‘adviser' for investors and other stakeholders. On the other hand, this sector is also committed to adopt the CE and sustainability perspective in their own premises. As pointed out by Marco-Fondevila et al. (2021), the financial services sector reporting (mostly composed of commercial banks in the study), shows a strong commitment with sustainability, especially with regards to renewable energy, energy efficiency and low carbon emissions, as well as to low environmental impact and dematerialization. However, given the type of activity associated to the banking business, their indicators are mostly focused on energy consumption in their premises, use of paper, ink and other materials, and fostering environmental activities.

The financial sector contribution to the CE may well go beyond the initiatives adopted within their premises and the financing of CE projects (Aranda-Usón et al., 2019; Scarpellini et al., 2021). Specifically, some financial instruments offered by the sector, such as leasing and renting contracts, may be connected to indirect improvements in areas like carbon emissions, energy efficiency and renewable energy (Scarpellini et al., 2021). In 2018, Ionaşcu & Ionaşcu (2018) found that leasing and renting contracts act as a catalyst for companies' financial performance. Analysing a sample of quoted companies over a 4-year period, the authors concluded that leasing does not penalise the economic performance but allows for their sustainable development. According to Fischer et al. (2012) vision of the “leasing society”, leasing transactions are connected to circular business models since the asset is recovered by the leasing company at the end of the lease or the asset lifetime, reintegrating it into a new economic cycle with a minimal impact on the natural environment.

From that standpoint, and focusing on the leasing and renting contracts applied to vehicles, a shift from private ownership to a leasing/renting option, may bring a lower need of vehicles and a more efficient use of the latter. In this sense, the financial sector, as main actor in offering and providing leasing and renting contracts to companies, could be having a significant indirect role in facilitating the transition to a CE model. However, to the best of our knowledge, no research has been conducted to assess the actual link that leasing and renting contracts may have with the circular model and the related impacts in terms of CE. Therefore, the first research question (RQ1) of this paper aims at contributing to that gap in the literature.

Previous research on the topics of CE and the banking sector does not address the leasing and renting contracts as a lever to promote the CE. Indeed, according to Benito-Bentué et al. (2022) results, financial entities managers are not aware of the potential impact of such financial instruments, and focus solely on the CE initiatives applied within their companies and on the CE projects they do finance. However, by being aware of that impact, measuring it and reporting about it, both, financial institutions and stakeholders would be capable of acknowledging its potential and adopt it as part of their sustainability behaviour. Therefore, it becomes necessary to assess in which way does the shift to leasing and renting contracts contribute to the extension of the CE model, and which indicators could be used to report about it. Consequently, our second research question (RQ2) addresses this line of inquiry.

In order to reach a valuable and reliable answer to these questions, it is necessary to analyse a large sample of leasing and renting contracts, as well as the details and implications linked to the CE. To reach that goal, the current research is based on a case study in a banking entity, analysing its renting contracts for vehicles during an 18-year period.

From a theoretical perspective, our research provides the first comprehensive and up-to-date analysis of previous studies focused on the CE in the banking sector. We approach existing financial instruments such as renting from an unprecedented perspective, applied to the CE-related measurement. In addition, we summarise the current state of knowledge to describe the stream of research by offering structured indicators and a specific measurement procedure for environmental accounting.

In summary, the main objective of this study is to broaden the knowledge about the potential of existing financing instruments to extend the circular model in the framework of environmental accounting. It is, therefore, focused on providing the specific metrics to measure the renting contracts impact upon the CE, and allow for extended reporting from the financial sector.

2. Background

2.1. The CE in the banking sector

Financial institutions have a key role to play in reshaping economies, enabling the introduction of CE through the financing of models that incorporate circularity to generate opportunities in the financial sector (Moneva et al., 2023). The EU expects financial institutions to develop products and services that respond to the different needs of companies looking to develop circular business models that accelerate the transition. In fact, pressure from governments, institutions and other stakeholders' groups is pushing large financial sector corporations to increasingly disclose non-financial information (Elalfy & Weber, 2019; Aguado-Correa et al., 2023). Under the general framework of the stakeholders' theory, this study analyses how the sector can respond to the stakeholders' pressure about the challenges posed by the EU sustainable finance taxonomy in terms of promoting environmental change within the framework of sustainability reporting. However, the theoretical framework of analysis for the measurement and reporting of the CE is still unclear (Aranda-Usón et al., 2022). To fill this gap, the main goal of this section is to define a framework of analysis to connect the implications of the CE for financial institutions within environmental accounting and reporting.

The adaptation to the CE presents benefits for commercial banks and other financial institutions showing greater opportunities in diversification in loans, in growth of financing to new circular customers and in the improvement of social perception towards the financial sector promoting responsible and sustainable banking (Ozili, 2021). In this way, financial institutions can accelerate the financing of the low-carbon economy through project financing, prices of emissions-linked products or expanding the range of products in their portfolios.

One of the objectives to address is how the CE is financed through the financial sector. Analysing the accessibility to financing innovative business models based on circularity, Saarinen & Aarikka-Stenroos (2022) analyse the factors that can drive funding to the Circular Economy by observing that applying criteria such as profitability, valuation, and investment costs in circular business models is a viable measure for financing, and therefore they conclude that financial entities should update their financing analysis approach.

Table 1. Summarised classification of main CE-related literature considered as the basis for this study

| CE-related concept | A general approach to the CE considered for banking sector analysis is based on concepts such as reuse, recycling, eco-innovation, resource efficiency, waste elimination, and regenerative design. | (Cole, 2011; Johl & Toha, 2021; Kirchherr et al., 2017; Salesa et al., 2022; Stahel, 2016; Tisserant et al., 2017; Worldwathc Institute, 2008; Xiang et al., 2020) |

| Sectorial applied approach | Circular applied proposals are considered for adapting different sectors to the CE, such as Agriculture, Construction, Energy, Real Estate or banking sector. | (Gubeladze & Pavliashvili, 2020; Hao et al., 2020; Ikiz Kaya et al., 2021; Norouzi et al., 2021; Salesa et al., 2023) |

| Business model | The CE enables the evolution from traditional business models to circular business models, thereby overcoming barriers and taking advantage of opportunities through improved competitiveness, cost savings, or transformation to circular value chains, including in the banking sector. | (Li et al., 2010; Mentink, 2014; Ormazabal et al., 2018; Roos & Brackley, 2012; Salvioni & Brondoni, 2020) |

| Banking sector | Financial resources and financing of the CE have been analyzed in terms of public and private funds, requiring the need to adapt current financing models in the banking sector because it offers benefits such as loan diversification, promoting responsible and sustainable banking, and increasing the number of circular and sustainable customers. | (Aranda-Usón et al., 2019; Ozili, 2021; Ozili & Opene, 2021; Saarinen & Aarikka-Stenroos, 2022b; Toxopeus et al., 2018; Ziolo et al., 2020) |

| Theoretical approach | Financial institutions are including the CE-related indicators to report their environmental activities to increase their legitimacy. The theoretical approach to this specific topic is still understudied. | (Benito-Bentué et al., 2022; Llena-Macarulla et al., 2023; Moneva et al., 2023) |

Given these considerations, it is interesting to know which opportunities for the financial sector may come from financing circularity, in a way that allows for a faster transition to the CE through the allocation of capital, the servitization of the economy and the development of rules that guide financial activity to contribute for a sustainable growth model.

Indeed, the financial sector is still not identified as a financier of the CE, and banking is referred to under terms such as "Green Banking" (Chen et al., 2022), as a crucial sector to promote "Socially Responsible Investment” (da Silva Inácio & Delai, 2022), and as "Ethical Banking" (Oh et al., 2013), but without relating it to the CE or product servitization. Therefore, the importance of analysing the current products that the banking sector is offering lies on the possible adaptations that they are suffering in order to meet the expectations of integration and adaptation towards the sustainability of the sector, being able to present characteristics that enhance or can be related to the CE.

The adaptation of these financial products to sustainable finance through the use of cash flows has caused limitations when promoting circularity, restraining the analysis of the role of the sector in a CE scenario (Dewick et al., 2020; Ozili & Opene, 2021). Consequently, one of the financial products where possible characteristics related to CE could be present are the leasing and renting contracts, which purpose is to finance an asset and not the cash flow.

From a theoretical perspective, we could argue that the literature tends to associate the concept of CE with corporate environmental management in line with results obtained by Heras-Saizarbitoria et al. (2023) at micro level, being particularly relevant the reporting activity (Moneva et al., 2023). Thus, according to Moneva & Llena, (2000), the stakeholder theory is of interest in this study because it recognises that, besides the traditional users of accounting information (shareholders and creditors), several additional agents are interested in the environmental behaviour of companies through CE reporting. Consequently, financial institutions are including the CE-related indicators to report their environmental activities to increase their legitimacy. The visibility of financial products backed by socially and environmentally responsible investments through the common EU taxonomy label responds to various stakeholders' interests and is causing an increase of CE accountability in response of their stakeholders' interests (Moneva et al., 2023).

Form a different theoretical approach, other CE studies analyze accounting from perspectives inspired by the resource-based view theory (Llena-Macarulla et al., 2023) and by the evolution of dynamic capabilities (Scarpellini et al., 2020). In addition, Llena-Macarulla et al. (2023) apply the Institutional theory to study environmentThe European taxonomy of sustainable investments of the EU details the classification of activities that are considered CE to be included in the sustainable financing scheme of EU Regulation 2020/852 (Regulation (EU) 2020/852 on the Establishment of a Framework to Facilitate Sustainable Investment, and Amending Regulation (EU) 2019/2088, 2020), by promoting repair, reuse, reduction and recycling, among other priority issues for the material loops closing. Within this framework, products are called to finance new business models based on the sharing of goods that maximize their utility and the value of the product as long as possible. Thus, leasing and renting can be considered as instruments that allow for compliance with environmental and carbon emissions limits, since, given their characteristics, they may finance circular goods such as vehicles, for instance. As stated by (Rogers & Rodrigues, 2015), long-term leasing of cars benefits both the supplier and the customer from a sustainable development point of view. Focusing on carbon emissions, the authors associate the leasing and renting contracts to a longer life of the asset, thus to lower emissions linked to the primary production and manufacturing of vehicles.

On the other hand, leasing and renting contracts relate to circularity through services such as maintenance or repair, cost savings compared to private property or access to different vehicles, encouraging the use of increasingly lesser polluting technologies. In summary, it can be argued that this type of financial instrument facilitates the paradigm shift to decouple the use of property including in the change of consumer-object behavior and relations between consumers (Bardhi & Eckhardt, 2012).

In general terms, servitization allows the manufacturer to retain ownership of the product (Windahl & Lakemond, 2010) or dispose of it to a financial institution, allowing the customer to use it through leasing and renting contracts. Therefore, the analysis of vehicle leasing and renting as a lever for behaviors linked to circular models is of interest since it encourages a greater intensity of use with respect to owned vehicles (Ellen MacArthur Foundation, 2015) while it improves efficiency (Korhonen, Honkasalo, et al., 2018; Korhonen, Nuur, et al., 2018). Renting being an alternative to the ownership of private vehicles when another type of transport is not possible or convenient (Katzev, 2003), it allows the manufacturer to retain ownership of the product (Windahl & Lakemond, 2010), and it favors a reduction in number of cars being able to replace one car-sharing vehicle by 6.5 owned vehicles (Millard-Ball et al., 2005). Regardless of its greater or lesser use, the reuse of the vehicle in renting would enhance the circularity of the vehicle by increasing its use and therefore its longevity (Franklin-Johnson et al., 2016).

However, to the best of our knowledge, no study has been published that quantitatively studies the actual impact of renting contracts in relation to circularity, with specific indicators in terms of carbon emissions reduction, use of resources or reduction of waste for reporting in a CE-related model. Thus, the first research question of this study is the following (RQ1): Is the shift to leasing/renting contracts positively related to the CE model?

We approach these topics from the accounting and reporting perspective (Burritt & Schaltegger, 2010; Larrinaga & Bebbington, 2021; Schaltegger et al., 2006; Unerman et al., 2010) and taking into account the stakeholders' theoretical framework that is still understudied in the framework of the CE (Salesa et al., 2023). Only few studies have explicitly analyzed financial institutions' impacts on the CE and sustainability, and its reporting (Bonifácio Neto & Branco, 2019).

This study addresses this gap, by empirically analysing the effects that renting contracts may have in promoting the CE, specifically in renting of vehicles, since they represent the highest share of renting contracts, and are subject to significant environmental impacts. Through this analysis, we intend to answer the following research question (RQ2): Which indicators could be used to report on the leasing/renting impact as CE-related contracts?al accounting practices related to the CE because they consider that regulations and operations developed in a circular model could partially explain the implementation of measuring practices and the reporting in a circular scenario in line with (Marco-Fondevila et al., 2020). However, based on the few specific studies in the banking sector and the main objective of this research, we consider the general framework of the stakeholders theory as a reference for our research, still aware that it requires significant future research.

2.2. Leasing and renting contracts in a circular model

The European taxonomy of sustainable investments of the EU details the classification of activities that are considered CE to be included in the sustainable financing scheme of EU Regulation 2020/852 (Regulation (EU) 2020/852 on the Establishment of a Framework to Facilitate Sustainable Investment, and Amending Regulation (EU) 2019/2088, 2020), by promoting repair, reuse, reduction and recycling, among other priority issues for the material loops closing. Within this framework, products are called to finance new business models based on the sharing of goods that maximize their utility and the value of the product as long as possible. Thus, leasing and renting can be considered as instruments that allow for compliance with environmental and carbon emissions limits, since, given their characteristics, they may finance circular goods such as vehicles, for instance. As stated by (Rogers & Rodrigues, 2015), long-term leasing of cars benefits both the supplier and the customer from a sustainable development point of view. Focusing on carbon emissions, the authors associate the leasing and renting contracts to a longer life of the asset, thus to lower emissions linked to the primary production and manufacturing of vehicles.

On the other hand, leasing and renting contracts relate to circularity through services such as maintenance or repair, cost savings compared to private property or access to different vehicles, encouraging the use of increasingly lesser polluting technologies. In summary, it can be argued that this type of financial instrument facilitates the paradigm shift to decouple the use of property including in the change of consumer-object behavior and relations between consumers (Bardhi & Eckhardt, 2012).

In general terms, servitization allows the manufacturer to retain ownership of the product (Windahl & Lakemond, 2010) or dispose of it to a financial institution, allowing the customer to use it through leasing and renting contracts. Therefore, the analysis of vehicle leasing and renting as a lever for behaviors linked to circular models is of interest since it encourages a greater intensity of use with respect to owned vehicles (Ellen MacArthur Foundation, 2015) while it improves efficiency (Korhonen, Honkasalo, et al., 2018; Korhonen, Nuur, et al., 2018). Renting being an alternative to the ownership of private vehicles when another type of transport is not possible or convenient (Katzev, 2003), it allows the manufacturer to retain ownership of the product (Windahl & Lakemond, 2010), and it favors a reduction in number of cars being able to replace one car-sharing vehicle by 6.5 owned vehicles (Millard-Ball et al., 2005). Regardless of its greater or lesser use, the reuse of the vehicle in renting would enhance the circularity of the vehicle by increasing its use and therefore its longevity (Franklin-Johnson et al., 2016).

However, to the best of our knowledge, no study has been published that quantitatively studies the actual impact of renting contracts in relation to circularity, with specific indicators in terms of carbon emissions reduction, use of resources or reduction of waste for reporting in a CE-related model. Thus, the first research question of this study is the following (RQ1): Is the shift to leasing/renting contracts positively related to the CE model?

We approach these topics from the accounting and reporting perspective (Burritt & Schaltegger, 2010; Larrinaga & Bebbington, 2021; Schaltegger et al., 2006; Unerman et al., 2010) and taking into account the stakeholders' theoretical framework that is still understudied in the framework of the CE (Salesa et al., 2023). Only few studies have explicitly analyzed financial institutions' impacts on the CE and sustainability, and its reporting (Bonifácio Neto & Branco, 2019).

This study addresses this gap, by empirically analysing the effects that renting contracts may have in promoting the CE, specifically in renting of vehicles, since they represent the highest share of renting contracts, and are subject to significant environmental impacts. Through this analysis, we intend to answer the following research question (RQ2): Which indicators could be used to report on the leasing/renting impact as CE-related contracts?

3. Method and case study

The study of the effect that financial instruments such as renting may have in the promotion of the CE requires an in-depth analysis of those instruments' details, beneficiaries, characteristics, etc. Therefore, a case study method was chosen as the best option to extract very specific data from a particular entity representing the sector, from which conclusions may be extrapolated to the whole of the sector. The main phases of the analysis are summarised as follows:

Literature review and selection of financial instruments to analyse

Case study selection and empirical data collection

Preparation of the multi-annual data bank

Data analysis and main results

The entity selected is a Spanish banking group with more than 5,000 employees in which one of the financial instruments offered is renting. In fact, it is a product which turnover has been increasing through the years, evidencing a growing demand for this type of products by the market. The renting contracts offered are mostly oriented to vehicles. Within the company strategy, sustainable and circular products, as well as their financing, are not key elements, so the data extracted for the sample do not have any type of sustainable characteristic a priori, thus being representative of the standard practice in the sector.

The choice of this particular entity was determined by the possibility to access the necessary data to carry out the research, which allowed us to draw conclusions based on real events. To this end, the necessary variables were extracted from the renting contracts, grouping them by type of vehicle, mileage and contracted time horizon. Information and data limitations were then assessed. Once these limitations were solved, the data were brought to a quantitative analysis through arithmetic calculations, means and weightings that would allow us to know the evolution of these instruments through the historical series, and their impact in CE.

3.1. Renting data analysis

In order to know if renting contracts are a financial product impacting the CE, a quantitative methodology has been used, so that real data was obtained, allowing us to measure the potential impact on CE of such financial instruments. To that end, the scope of the research was defined as all renting contracts for an 18-years period, from 2004 to 2021. The variables extracted from the contracts are those shown in Table 2.

Table 2. Renting contract variables analysed

| Variable | Data |

|---|---|

| Total mileage in contract | Total mileage contracted per time horizon |

| Time horizon | Contract length in time |

| Client type | Company or individual |

| Vehicle model | Classification per model |

| Plate | Environmental classification |

| Investment | Amount paid in acquisition |

| Discount | Discount given by supplier |

| Residual value | Final value of the vehicle at the end of its life |

For each contract, the annual mileage of the vehicle was calculated, taking into account the number of kilometres contracted and the time horizon, thus obtaining the average number of kilometres per vehicle and per type of contract.

\[\frac{{Total \ Kilometres}_{\ n}\ }{Nbr.\ of \ vehicles_{\ n}}\]

Secondly, through their registration data, the environmental labels of vehicles in the fleet were noted so that the energy rating of the vehicle was determined, that is, the quality in terms of CO2 emissions. The classification of the label, from highest to lowest number of emissions made by vehicles, was obtained from the database of the General Directorate of Traffic. Then, for each year of the historical series, the vehicles that existed for each environmental label were quantified calculating the average on the total number of vehicles per year. In this way, for each year of the historical series, the composition in terms of environmental quality contracted, out of the total contracts for each year, was available.

3.2. Impact on CE

Firstly, we analysed renting contracts from a socioeconomic perspective, by carrying out several analyses, starting with the historical evolution of mileage contracted through the years, to assess if more mileage is demanded by consumers and therefore a more intense use of the vehicle is made through renting compared to the use of private ownership vehicles. On the other hand, a longer time horizon of renting, implies a greater number of kilometres contracted for the vehicle and therefore a longer use. The classification obtained for number of kilometres and time horizon per vehicle in renting contracts is then compared to the average kilometres per year in the whole country, as disclosed by the Traffic General Directorate in Spain1.

Secondly, from the investment point of view, another of the renting contracts characteristics is that it gives access to newer vehicles, thus counting on more efficient technologies with lower CO2 emissions rates. However, these vehicles tend to have higher prices which may discourage private users to choose them as the preferred option. In renting contracts, it is the financial entity who assumes the cost of the vehicle, with access to discounted prices, on the one hand, and distributing the extra cost through several years of renting contract, on the other. In this sense, the information about the vehicle price, the discount given to the entity and its residual value have been extracted from the renting contracts, so that the investment assumed by the company can be compared to that of a private owner. In order to discriminate among renting contract users being individuals or companies, the taxation effect was included in the analysis.

Thirdly, from the environmental point of view, the fact that renting contracts give access to newer and less polluting vehicles does also have an effect on the carbon emissions of the fleet. Therefore, the renting contracts of the entity were grouped according to their environmental label and carbon emissions rate, so that they can be compared to the corresponding averages of the whole country fleet of vehicles. To that end, the research used the data provided by the Spanish Institute for Energy Saving and Diversification (IDAE)2, where the average carbon emissions for renting vehicles and the whole fleet can be extracted. In order to establish a comparable data set, the length of renting contracts was homogenised to fit the period presented by the study. Therefore, we used the total number of monthly kilometres contracted for each year by time horizon, so that the emissions for each year were applied to each vehicle, showing the evolution of emissions as of entries and exits of vehicles from the fleet. The annual mileage of the fleet was multiplied by the average grams of CO2/km generated by the vehicle according to the study.

\[ Emissions_{t} = \sum_{t}^{}{m*\left( g\ {CO}_{2_{t}}*\ Km_{t} \right)} \]

With m = months of CO2 emissions in year t and t = every one of the analysed years in the study.

4. Main results

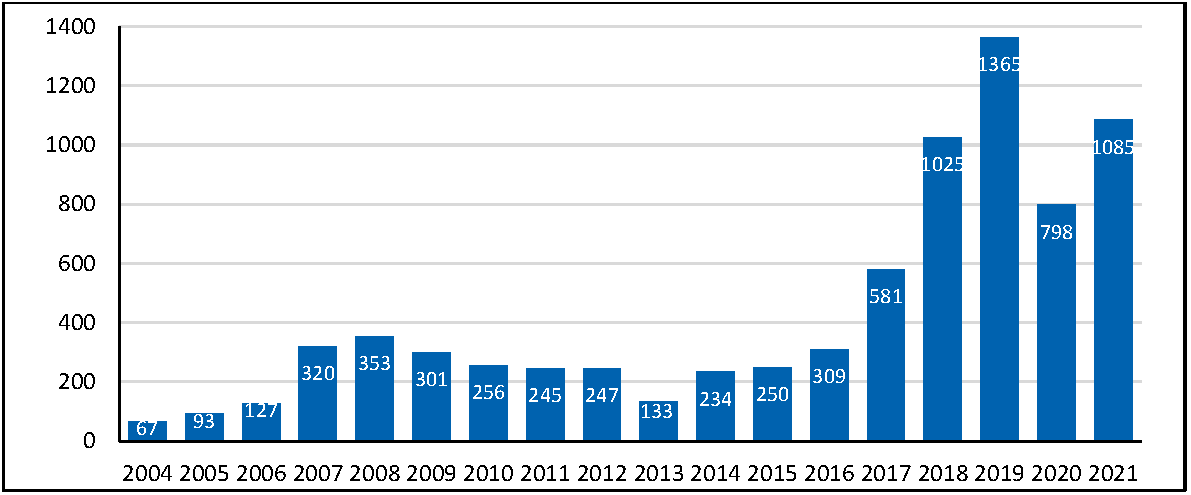

The first approach to the renting contracts evolution in the entity over the period studied showed a significant increase in number of contracts and mileage, with a sudden change of trend in 2020 that bounds back in 2021, likely due to the COVID-19 pandemics impact in the economy (Figure 1). This first observation suggests that the potential impact of renting contracts on CE is growing as a result of its scale and the number of kilometres contracted.

Figure 1. Number of renting contracts per year

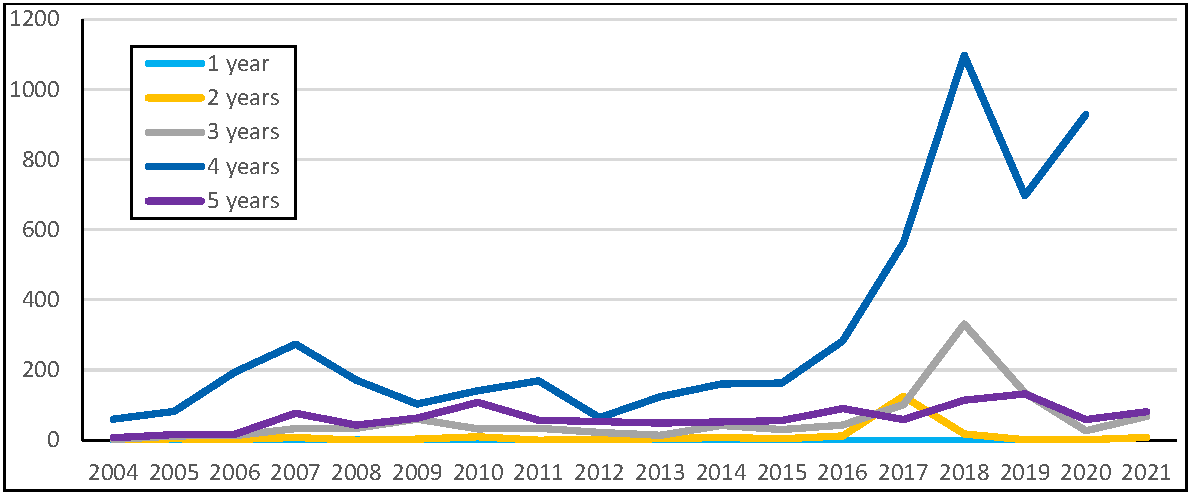

Secondly, the data show that over the years, and specially from 2015 onwards, the preferred time horizon for renting contracts becomes longer than before, meaning more years of use and more kilometres per renting contract and vehicle (Figure 2).

Figure 2. Number of vehicles contracted per time horizon and year

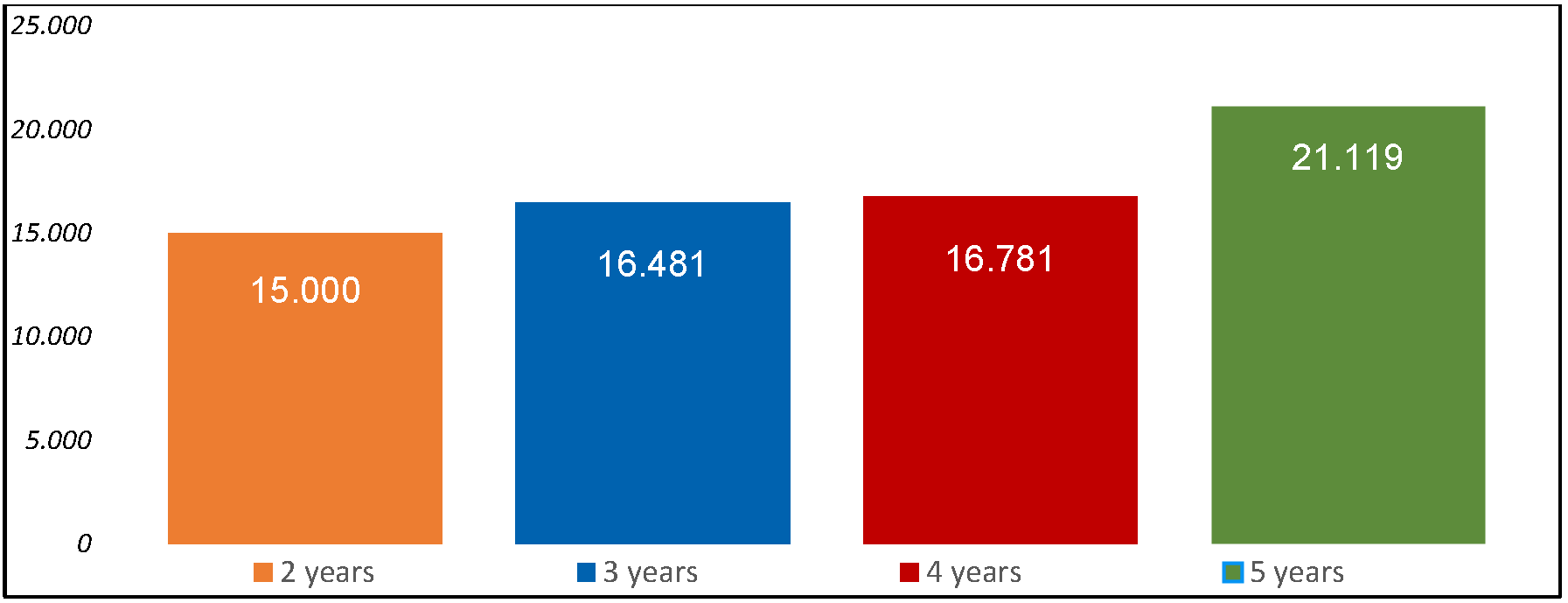

Indeed, as shown in Figure 3, the average use of vehicles in kilometres per year increases as the contracting period grows, with 5-year time horizon contracts as those with higher average mileage per year.

Figure 3. Average use of vehicles per renting time horizon (kms.)

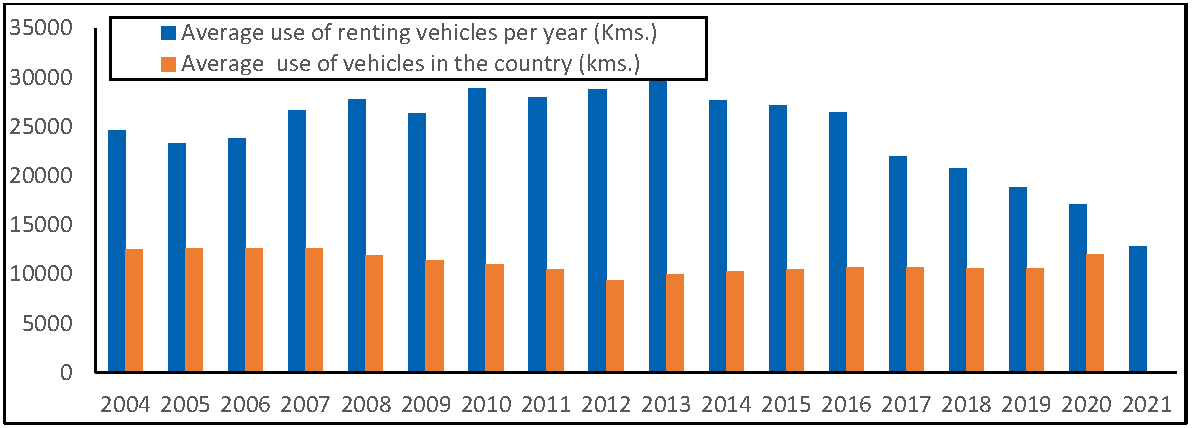

If compared to the national average of kilometres per vehicle in Spain, it can be seen how the average number of kilometres for renting contracts is typically higher than the national average, even though the difference has decreased over the last few years (Figure 4).

Figure 4. Average use of vehicles (kms.)

The second part of the renting contracts analysis was driven to its potential to foster the access to newer and less polluting vehicles. As previously explained, renting contracts may allow to better financial conditions and significant discounts on price, which facilitate the access to new technologies at more affordable costs. In this respect, we focused the analysis in ‘zero emissions' vehicles, which represent the more sustainable kind in terms of carbon emissions.

The analysis was carried out in gross for legal entities, and in net for individuals. First, the main difference between the two analyses lays in the investment made by the client (Table 3). We can observe that the investment assumed is lower in legal entities because taxes can be deducted, whereas individuals cannot. On the other hand, the bank obtained almost a 15% discount on vehicles with a ‘zero emissions' label, which meant that, while a private individual (not a client) had to acquire a vehicle at 100% of its cost, the bank was able to acquire it at 87.27%. Considering that the residual value of the vehicle was calculated by the bank to be 40.73% of the vehicle initial value, the investment that the clients had to make was 46.54% of the vehicle cost if they were legal entities and 56.32% if individuals.

Table 3. Blue label vehicles financing access

| Legal entities | Individuals | |

|---|---|---|

| Discount | 14,79% | |

| Company investment | 87,27% | |

| Residual value | 40,73% | |

| Client investment | 46,54% | 56,32% |

| Difference between ownership and renting | 114,86% | 77,56% |

If the client acquired the vehicle in ownership instead of accessing to its use through renting, the price to pay for it becomes more than double for legal entities and around 77% higher for individuals. On top of this, expenses such as insurance or repairs, which were not taken into account in the analysis, are higher with ownership since in renting contracts the insurance deal negotiated between supplier and company is typically better than for private owners, and repairs are assumed by the company and not by the client (unlike with private owners).

According to the reports of the European Automobile Manufacturers Association3, cars in Spain have an average age of 12.9 years. If the difference between ownership and access to the vehicle in legal entities and individuals was of 114.86% and 77.56% respectively, with an investment of 46.54% and 56.32%, and considering an average time horizon for renting contracts of 4 years, we could envisage that in 12.9 years, renting would foster three ‘zero emissions' vehicles compared to just one in private ownership.

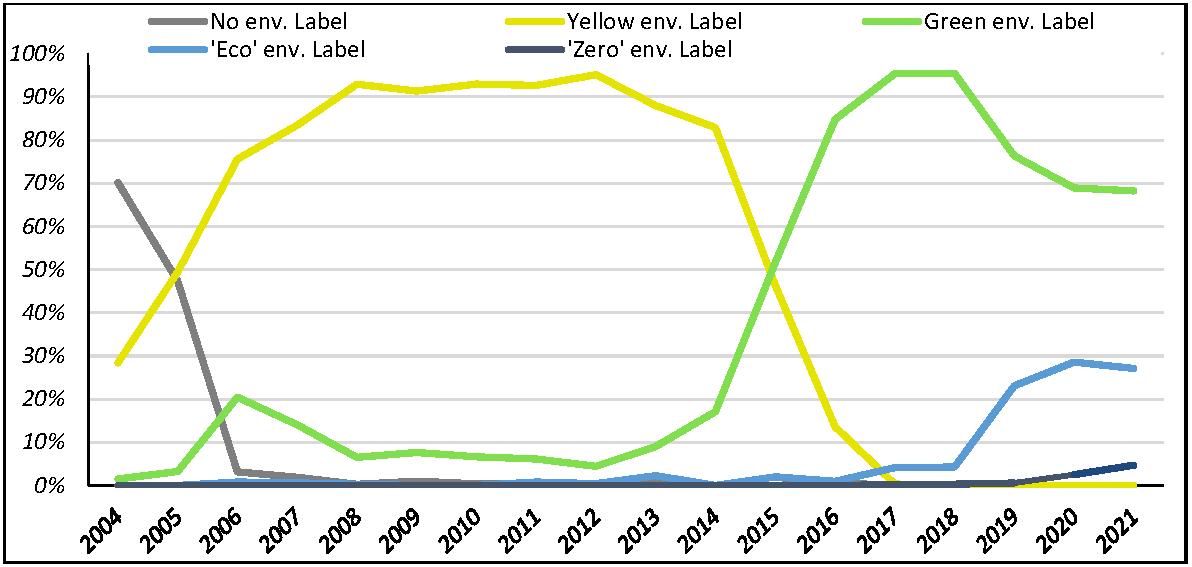

The third step of the analysis addresses the environmental perspective by assessing the evolution of the environmental characteristics of the renting fleet vehicles through the analysis of its energy efficiency according to the different labels given by the authorities (Figure 5).

Figure 5. Environmental label of the renting fleet

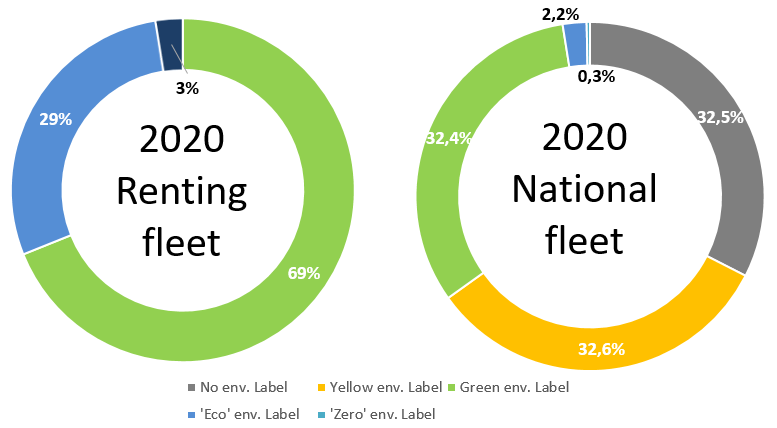

Firstly, it can be observed how in 2004 more than 70% of the total renting fleet was composed of vehicles without label, that is, the fleet was mostly composed of vehicles of the worst environmental quality. From 2004 onwards, most of the fleet improved from ‘no label' to ‘yellow label', the second worse, while the most environmentally wise types remained below 10% of the total fleet. Again, a sudden change of trend is visible from 2012 onwards, substituting the ‘Yellow label' by the more efficient ‘Green label', while from 2016, a significant surge of the ‘Eco label' type can be also noted. By 2020, the energy efficiency of the vehicles in the renting fleet was composed of almost one third of ‘Eco' or ‘Zero' emissions vehicles and a bit more than two thirds of ‘Green label' vehicles. In contrast, the whole fleet in the country is still composed of one third of vehicles with ‘Yellow label', another third with no label at all, and just one third for ‘Green Label' vehicles (Figure 6).

Figure 6. Energy efficiency in the renting and national fleets

Even though since 2020 the trend presents a slight deceleration, possibly due to the effect of COVID-19 in households and companies' availability of funds together with the current crisis in the vehicles manufacturing sector, it is clear that the renting fleet is far more efficient than the national one, contributing to less polluting cars and lower carbon emissions.

Indeed, looking specifically to carbon emissions, beyond the significant gap in volume of emissions derived from the different environmental structure of the renting fleet and the national one, it has to be noted that the trend continues and gets wider, when comparing the new vehicles registered every year. As shown in Table 4, the difference in average carbon emissions from newly registered cars for renting and for private owners, grows since 2012, being of almost 4% less emissions in year 2021.

Table 4. Trend in carbon emissions for new registered vehicles

| Year | Renting contracts | Private Ownership | Difference |

|---|---|---|---|

| 2012 | 133,94 | 136,08 | -1,57% |

| 2013 | 125,87 | 127,95 | -1,59% |

| 2014 | 121,46 | 123,98 | -1,75% |

| 2015 | 117,69 | 120,8 | -2,00% |

| 2016 | 114,56 | 118,93 | -2,63% |

| 2017 | 114,46 | 119,09 | -3,27% |

| 2018 | 117,36 | 122,25 | -3,74% |

| 2019 | 120,21 | 125,07 | -3,89% |

| 2020 | 112,29 | 115,95 | -3,79% |

| 2021 | 128,89 | 133,67 | -3,71% |

The results reflect an increase in absolute emissions from renting contracts due to the significant increase in the number of vehicles in the fleet. However, when looking at emissions per vehicle, the average emissions from vehicles in the renting fleet has steadily become smaller, at a higher pace than private ownership vehicles.

4.1. Reporting issues and discussion from an accounting perspective

The analyses performed in the chosen entity for an 18-year period, breaking down the renting contracts information to get relevant details about its potential indirect impact in promoting the CE, has rendered relevant results. As an alternative to private ownership, the renting contracts for vehicles have proven to have a positive effect in reducing the total number of cars needed. Thus, these financial instruments are related to various CE's principles, like dematerialization, emission saving, sharing goods and servitization.

As detailed in the previous section, the renting fleet of vehicles accumulate a higher number of kilometers per year, namely a higher mileage, than those of private ownership. If we assume the number of kilometers to undergo by users does not depend on the ownership option, but on labor or domestic conditions, it becomes clear than for a given number of kilometers, the renting option requires a lower number of vehicles and, thus, a lower use of resources. Consequently, it implies higher intensity levels in the using phase.

The discounts and special conditions that renting entities such as the studied can get from suppliers, have also an impact in easing the access to more environmentally wise vehicles. Indeed, newer technologies such as the ‘zero emissions' vehicles, imply higher selling prices which may limit the companies and private users' potential to choose this option. Our results show how the intermediary role of renting entities may allow to a much lower investment from legal entities and individuals, thus favoring the expansion of less polluting vehicles.

On the other hand, and specially in countries such as Spain, which vehicles fleet is rather old and energy inefficient, the renting contracts favor the substitution of obsolete cars for new ones with better environmental characteristics. Indeed, our results highlight the fact that the distribution of the different environmental labels is much cleaner among the renting fleet of cars than among the national fleet. Even when new registered vehicles are compared in terms of carbon emissions, those to serve renting contracts have better ratios than those of private ownership, stressing the higher obligation of renting entities towards environmentally clean vehicles.

As a consequence, we may answer the first research question (RQ1) by acknowledging the positive impact that renting contracts have in fostering the CE in key areas such as reducing the need for resources, improving the energy efficiency and reducing the carbon emissions.

It is important to note, however, that our study has not reached a clear understanding of what the end of live cycle is for renting vehicles. Once discarded for renting service, we have managed to find out the residual value of the vehicles, as calculated by the entity, but we are not certain about the destination or use of those vehicles from then on, all of which could have relevant implications in terms of its positive or negative contribution to circularity.

The important role of commercial banks and financial institutions to foster the CE has been widely described by scholars and institutions such as the EU, mostly as intermediaries that provide financing to circular companies and projects. Furthermore, commercial banks are increasingly interested in adopting sustainability and CE initiatives (Benito-Bentué et al., 2022). However, managers and decision makers in these entities are not aware of the inherent potential that some financial services they provide to their clients may have to extend the circular model. Just by acknowledging and envisaging this potential, financial entities could develop metrics and indicators to measure and disclose their indirect impact in CE.

Our results show that renting contracts have a significant impact in terms of use of resources (both for number of vehicles and energy consumption), in environmental impact and in carbon emissions avoided. This information is definitely relevant for the entities, since it brings a new perspective to the renting business, with non-financial benefits and sustainability related goals. Indeed, this new understanding of the renting business impact in CE may change the financial entities' approach to it, making it a corporate strategic service, built upon both, the financial and the non-financial goals of the entity. Therefore, it is of the entities' interest to understand, measure and report their renting contracts impact in CE as an environmental accounting procedure, and as part of the environmental related disclosure (Blanco-Zaitegi et al., 2022; Llena et al., 2007; Schaltegger et al., 2017).

On the other side, a number of reasons suggest that reporting on the mentioned impacts, both qualitatively and quantitatively, may be also beneficial for the entities' customers, their stakeholders and society as a whole. For a company contracting renting services from financial entities, it is clearly interesting to know the environmental benefits attached to the service since they contribute to its own commitment to the CE. Furthermore, such information becomes another positive point towards shifting to the renting model, thus contributing to more business for the financial entity, and a more sustainable fleet of vehicles. Beyond the focus on the entity and its clients, as well as on its reputation and corporate image, reporting on the positive impacts of renting does also help extend CE initiatives such as car-sharing, car-pooling and similar ideas in the framework of servitization of the economy. Indeed, the financial entities' stakeholders are very diverse and numerous, and most of them could be interested in knowing about the particular contribution of the financial sector through renting contracts to the CE.

Therefore, besides developing specific metrics and internal systems to measure the renting contract impact, financial institutions should consider including this information in their reports in response to the increasing stakeholders' interest in the CE. To that end, together with the qualitative information, some specific quantitative indicators could be included in the corporate reports. Answering the second research question (RQ2) and based in our results, the following table presents some of the indicators that the entity could use to report on their impact on CE linked to their renting contracts (Table 5).

Table 5. CE indicators from renting contracts

| Sustainable use of resources | Average mileage of renting cars compared to national fleet |

|

| Environmental impact | Energy efficiency label distribution compared to national fleet |

|

| Percentage of ‘zero emissions’ vehicles in the fleet |

| |

| Fight against Climate Change | Carbon emissions avoided per Km. compared to national fleet |

|

| Evolution of carbon emissions within the renting fleet |

|

The indicators presented in Table 5 are examples (among other) derived from the results obtained in our study, which could be adapted to the entities' strategy, policies and needs. Besides, these indicators are connected to existing standards and initiatives such as the GRI, for energy intensity and efficiency, or the Green House Gas protocol (GHG), with its three scopes for carbon emissions.

Specifically, the GRI 305 series of indicators for emissions, includes three indicators for energy use (one per scope as of GHG protocol), and one for energy intensity. Although the indicators we propose in this paper would not make part of GRI 305 Emissions indicators due to the different focus, the entities could present specific indicators as suggested in Table 5 following the same scheme of GRI 305, thus associating the volume of carbon emissions saved through more mileage per car, more efficiency in use and more carbon free vehicles, to the standard scheme. The indicators proposed could then serve as complementary information to GRI 305.

Despite some voices questioning the CE relevance in the accounting field at the moment (Larrinaga & Garcia-Torea, 2022), this study highlights the pivotal role of existing financial instruments, as renting and leasing, for new measurements of car-sharing and car-pooling impacts linked to the servitization of the economy as specific issues in the framework of the so-called circular sustainability accounting (Aranda-Usón et al., 2022; Scarpellini, 2022).

5. Conclusions

The CE has become a main objective for institutions and companies willing to fight critical issues such as global warming, environmental degradation and scarcity of resources. The role of commercial banks and financial institutions has been described as crucial, since they are a key actor to finance companies and projects. However, the current involvement of the financial sector is apparently limited to financing others and implementing small actions within their premises.

By studying the details of renting contracts over an 18-year period, this study enhances the knowledge about how existing financial instruments such as renting and leasing may offer a link to extending the CE-related actions reported by commercial banks and financial institutions. Particularly, the renting contracts service, which has been associated to more sustainable performance, shows interesting characteristics linked to the CE principles. Indeed, the quantitative results obtained prove the facilitating role that the financial sector has to extend the CE model through the renting business.

In this respect, measuring the quantitative impacts and reporting about them is equally important on an environmental accounting basis and in the framework of the new EU taxonomy for ‘green' products and services. Understanding and acknowledging the potential of renting contracts to extend the CE, becomes important not only for financial entities, but also for their stakeholders, who may decide to shift from ownership to renting if they know about its impact on CE. The inclusion of specific indicators for renting contracts impact on CE serves both, the instrumental perspective of reporting (by improving commercial banks and clients' business and corporate image), and the normative one, by extending relevant information on sustainability among stakeholders.

In this regard, and despite the existing debate over the theoretical framework for the CE (Aranda-Usón et al., 2022), the role and involvement of the banking sector could be seen from three different theoretical perspectives. Looking at the improvement of reputation derived from reporting on CE contributions, the legitimacy approach could be guiding the entities. On the other side, the savings in use of resources, carbon emissions and environmental impact could also be associated to the Resources Based View theory. However, the fact that these improvements serve society as a whole, and that reporting over it may have an impact on stakeholders' behavior, suggests a normative approach that would fall under the stakeholders' theory framework.

This paper contributes to the literature on CE by bringing empirical results to a still recent line of research such as the actual role of the banking sector. Our results do also help practitioners, mostly within the banking sector, understand the potential to foster the CE and align to sustainability goals. Finally, by highlighting the wider role of financial institutions in promoting the CE, our work may be of use for policymakers who can consider to make them part of future strategies and policies on the matter, as well to society as a whole, since it gains a possibility to engage in a more sustainable behavior by shifting to renting based schemes such as sharing economy, servitization or a more rational and efficient use of vehicles.

Even though the research was based in a rather long period, the fact that only one entity was studied can be considered as a limitation. The selected entity is representative of the Spanish sector, and has an average volume of business in what regards renting contracts. However, extending the study to other entities, especially in other countries, could improve and extend the use of results. On the technical side, more information would be relevant to close the loop, especially regarding the end of life of vehicles. To that end, this line of research could be extended by applying the Life Cycle Analysis and Life Cycle Costing methods to the renting contracts analysis.