The impact of socioemotional wealth on corporate reporting readability in a multinational family-controlled firm

ABSTRACT

Extant research suggests that the most significant elements of a family firm's socioemotional wealth (SEW) can drive financial reporting decisions. This paper explores this empirically by analyzing corporate disclosures of a case organization -- Guinness, a multinational family brewing firm -- over an extended period. We identify the presence of the SEW dimensions in the firm's corporate disclosures and explore the relationship between the most salient SEW dimension (family identity) and readability, measured by the Bog index. The analysis finds a positive association between family identity and readability in the period when the firm under study can be defined as a family firm. Other SEW dimensions do not appear to have an influence on readability. In addition, at the end of the period of study, when the firm under study ceased to be a family firm, the SEW dimensions failed to have an effect on readability.

Keywords: Corporate reporting; Family business; Readability; Socioemotional wealth.

JEL classification: G41; L21; M21; M41.

La influencia de la riqueza socioemocional en la legibilidad de la información financiera de una empresa familiar multinacional

RESUMEN

La investigación previa sugiere que los elementos más destacados de la riqueza socioemocional de las empresas familiares pueden influir en la información financiera divulgada por parte de las mismas. Este trabajo intenta analizar la proposición previa de forma empírica mediante el estudio de la información divulgada por parte de una empresa familiar multinacional, Guinness, durante un largo período de tiempo. En el estudio se identifica la presencia de las dimensiones de la riqueza socioemocional en la información corporativa de la empresa y se explora la relación entre la dimensión más destacada (identidad familiar) y la legibilidad. Los resultados muestran una relación positiva entre la identidad familiar y la legibilidad en el período en el que la empresa estudiada se considera una empresa familiar. El resto de las dimensiones de la riqueza socioemocional no parecen influir en la legibilidad. Además, al final del período de estudio, cuando la empresa estudiada dejó de ser una empresa familiar, las dimensiones de la riqueza socioemocional dejaron de tener un impacto en la legibilidad.

Palabras clave: Información corporativa; Empresa familiar; Legibilidad; Riqueza socioemocional.

Códigos JEL: G41; L21; M21; M41.

1. Introduction

Research on corporate reporting issues in family firms tends to draw upon theories dominating the accounting arena, e.g., agency theory, and little such research is primarily based on alternative theories, where prevalence is given to non-economic constituents of family firms (Prencipe et al., 2014). An alternative theory where the focus is on non-economic constituents of family firms is socioemotional wealth (SEW). This theory, developed by Gómez-Mejía et al. (2007), suggests that decisions made by dominant family owners will be driven by an attempt to preserve socioemotional endowment, even over the financial utilities of those decisions. SEW examples include the ability to exercise authority, perpetuation of family values, preservation of family dynasty, conservation of the firm's social capital, succession based on family membership rather competence and altruism to family members. In recent years, increasing research has adopted assumptions of SEW to complement traditional theories (Borralho et al., 2020a; Paiva et al., 2019).

Gomez-Mejia et al. (2014) developed a theoretical framework of financial reporting in family business, suggesting it may be driven by the emphasis on different SEW dimensions. They focused on two dimensions of SEW "family control and influence" and "family identity", by hypothesizing that companies prioritizing control and influence would decrease reporting quality and companies prioritizing family identity would increase reporting quality. They called for empirical testing of their hypothetical propositions. In an initial attempt to answer this call, Drago et al. (2018), using proxies to assess the priority given to those two dimensions, analyzed the relationship between them and readability. Readability is related to the capability to read a text (Schroeder & Gibson, 1990). Drago et al. (2018) found mixed results in the case of the "family identity" dimension and called for further research. This paper is an empirical response to both calls.

After empirically identifying the SEW dimensions over a long timeframe (1950-1996) in the corporate disclosures of a multinational family firm, Guinness, the objective of this paper is to explore the relationship between the most salient SEW dimension and reporting quality, proxied by readability. To identify the SEW dimensions, we draw on Cleary et al. (2019), who identified the presence of SEW in Guinness (and another brewery) from 1950 to 1972. By using their coding scheme, we also extend the identification of the SEW dimensions in Guinness from 1973 to 1996. Cleary et al. (2019) did not analyze reporting quality or any of its attributes, such as readability. To measure readability, we use the Bog index, a multi-faceted measure that captures almost all of the Securities and Exchange Commission's (SEC) plain English guidelines for corporate reporting and is validated and recommended for studying readability in corporate financial disclosures (Bonsall et al., 2017). Our results show a positive association between family identity and readability in the period when Guinness can be defined as a family firm. This was the case until 1986, by means of control of the board of directors. In 1997 Guinness as a company dissolved.

Our paper builds on Gomez-Mejia et al. (2014), Drago et al. (2018) and Cleary et al. (2019) and contributes to financial reporting literature in family firms in several aspects. First, although we recognize Drago et al. (2018) primacy in analyzing the relationship between readability and two SEW dimensions, this is the first study to analyze the relationship between readability and the identified most salient SEW dimension. Second, by assuming that family control is through majority share ownership or control of board (Anderson & Reeb, 2003), we also offer an interesting insight with the transition of the company studied from being a family to a non-family firm in the later years of study. This insight departs from the main approach in financial reporting in family business which has focused on analyzing family vs. non-family firms (Terrón Ibáñez et al., 2019), or alternatively differences among family firms (Prencipe et al., 2014). Our results imply that in family firms SEW may be more influential than economic determinants used by traditional perspectives.

The remainder of this paper is presented as follows. The next section explores some extant literature on SEW and corporate reporting quality. Then, the methods include details about the data sources, the identification of the SEW dimensions, the measure of readability and statistical issues. The findings are next presented, including a sensitivity analysis. Later, the results are discussed and finally some concluding comments are offered.

2. Socioemotional wealth and corporate reporting quality

Except for some works that consider non-economic factors in conjunction with traditional theories (Borralho et al., 2020a; Paiva et al., 2019) or that focus primarily on non-economic factors (Cleary et al., 2019; Drago et al., 2018), accounting and reporting studies in family firms mainly rely on economic factors to explain corporate behavior. The mainstream literature in financial accounting research in family firms has been dominated by earnings management studies (Borralho et al., 2020a; Borralho et al., 2020b; Jaggi et al., 2009; López-González et al., 2019; Paiva et al., 2019; Prencipe & Bar-Yosef, 2011; Prencipe et al., 2008), with a lesser number of studies focused on different reporting quality issues, such as narratives (Drago et al., 2018) or voluntary disclosures (Engel et al., 2019). Marett et al. (2018) also studied SEW importance in family firm communication. However, they focused on internal communication using an experimental design.

Gómez-Mejía et al. (2007) termed the non-economic utility derived by family business owners as SEW. The concept attempts to capture how emotions, social capital and altruism affect business management, e.g. management processes, strategic choices, governance, stakeholder relationships and business ventures (Gómez-Mejía et al., 2011). Berrone et al. (2012) presented five dimensions of SEW, labeled FIBER. "Family control and influence" refers to the control and influence of family members. "Family members' Identification with the firm" ("family identity" in short) addresses the close identification of the family with the firm. "Binding social ties" refers to family firms' social relationships. "Emotional attachment" deals with the affective content of SEW and refers to the role of emotions in the family business context. "Renewal of family bonds to the firm through dynastic succession" refers to the intention of handing the business down to future generations -- see the Appendix also. These five dimensions have been adopted by several studies (e.g., Hauck et al., 2016; Smith, 2016). The concept of SEW has also been subject to some debate (e.g. Cruz & Arredondo, 2016; Hasenzagl et al., 2018; Nason et al., 2019), which are beyond the scope of the present study. Here, we accept SEW as defined by Gómez-Mejía et al. (2007) and take the FIBER dimensions as being representative of its components.

Family firms may stress different FIBER dimensions. Thus, how a firm responds or fails to respond to institutional demands is mainly driven by the main interests (or prevalent FIBER dimensions) of the firm (Berrone et al., 2010). "Firm choices depend on the reference point of key decision makers, who aim to preserve their accumulated endowment in the firm." (Cennamo et al., 2012, p. 1158). Linking SEW to accounting, Gomez-Mejia et al. (2014) developed a framework on financial reporting decisions in family-controlled firms. They argue that financial reporting decisions -- such as earnings management and voluntary disclosure -- are driven by different aspects of SEW. They focus on two dimensions of SEW "family control and influence" (the F of FIBER) and "family identity" (the I of FIBER) as these are considered the most exposed to external pressures in the case of corporate reporting, as being the most sensitive to stakeholder's claims (Cennamo et al., 2012; Cruz et al., 2014). Our empirically based analysis shows that the most salient SEW dimension over time within the Guinness corporate disclosures is the "family identity" dimension.

To maintain good reputation and positive image is desirable for any organization. However, reputation is closely linked to the concern for SEW preservation, being especially crucial for family businesses (Martin et al., 2016) and particularly for those family firms where the identification of the family with the firm is salient to the SEW endowment. In these companies, family and the firm become closely and inextricably tied (Berrone et al., 2012), and maintaining firm reputation is the main objective, as the firm becomes a projection of the family's values (Berrone et al., 2010; Gomez-Mejia et al., 2014). As for the association between the firm and the family, loss of reputation in the firm may lead to a loss of reputation for the family, as family's identity and reputation is considered to be tied to the identity and reputation of the business (Berrone et al., 2010; Pazzaglia et al., 2013).

A variable to measure the association between the family and the firm is through the "family identity" dimension. When this dimension is dominant, family principals will be rather cautious about the image they project outside. Those families will be particularly concerned about avoiding practices that may harm corporate reputation (Borralho et al., 2020a; Borralho et al., 2020b; Paiva et al., 2019) because any threat to the reputation of the firm will appear as a hazard to individual reputation and to the existence of the family itself. Then, corporate actions will be driven by the fear that the firm, and then family as well, may be stigmatized as negligent corporate citizens (Cennamo et al., 2012). Stakeholders will generally see the firm as an extension of the family itself and any potential public criticism may be harmful to family members because it sullies the family's name (Berrone et al., 2010; Cennamo et al., 2012). Greater public recognition of the identification of the family with the firm "can lead to more affective benefits (or harm) to family members from the family firm's increased (or diminished) reputation [...] enjoying family firm successes and suffering family firm defeats, including those associated with corporate reputation" (Deephouse & Jaskiewicz, 2013, pp. 343-344).

Corporate reputation is affected by information disclosure. Inappropriate corporate disclosure, including lower reporting quality, may damage corporate reputation (Borralho et al., 2020a; Deephouse & Jaskiewicz, 2013; Martin et al., 2016). Negative image associated with low reporting quality could blacken a firm's reputation and therefore lead to socioemotional wealth loss for the family (Dyer & Whetten, 2006; Martin et al., 2016). For this reason, family firm principals will give stronger consideration to the potential loss of reputation that may result from low financial reporting quality. Due to strong firm-family identity, reputational losses to the firm as a result of low reporting quality could damage family members at a deep personal level, as they view themselves as psychologically intertwined with the image of the firm (Ashforth & Mael, 1989; Martin et al., 2016). When this association is higher, i.e. when the "family identity" is dominant, family firms may be more sensitive to potential image and reputation problems and they may be probably interested in proving quality financial reporting to help stakeholders to assess the situation of the firm in order to build an environment of trust and transparency for stakeholders (Borralho et al., 2020b; Martin et al., 2016; Pazzaglia et al., 2013). This building of a reliable relationship with stakeholders will support the firm's reputation (Cennamo et al., 2009). Therefore, when the "family identity" dimension is emphasized, family companies will be particularly careful of information quality, and "ensuring the quality of financial reporting becomes crucial for family owners to satisfy their desire of preserving the family's image and reputation" (Gomez-Mejia et al., 2014, p. 393).

For companies prioritizing family identity, the objective of conveying a transparent and reliable image will particularly decrease the family's incentives to adopt opportunistic strategies as it could harm the image and reputation of the company, and therefore family reputation. These firms will therefore increase reporting quality by disclosing accurate and quality information to protect and enhance family reputation (Gomez-Mejia et al., 2014; Hirst et al., 2008). Alternatively, Gomez-Mejia et al. (2014) predict that when the "family control and influence" dimension is prioritized, family firms have incentives to decrease reporting quality. The main goal of family members, in this latter case, would be to maintain control over strategic decisions.

As Gomez-Mejia et al. (2014) conclude, their propositions are hypothetical and require empirical testing. They hypothesize that when family principals prioritize the "family identity" dimension, they will increase reporting quality to improve legitimacy and reputation. Apart from earnings management, a common reporting quality characteristic analyzed in general corporate literature is readability, mainly by attempting to relate it to economic factors (Li, 2008; Rutherford, 2003; Suárez Fernández, 2016). However, in a family business context, it may be reasonable that the influence of SEW aspects would be greater than the influence of economic factors. Following the logic of Gomez-Mejia et al. (2014), we expect that when family firms increase emphasis on "family identity", they will communicate more clearly and accurately, and then producing more readable reports. It may be used to enhance firm and family reputation. Therefore, a direct relationship between the emphasis on "family identity" and readability is expected. We will therefore test if:

Hypothesis: When the "family identity " dimension of SEW is prioritized, the emphasis on this dimension is directly related to reporting quality, measured by readability.

3. Methodology

Our research is based on a single longitudinal case (Yin, 1984). Single cases allow researchers to achieve an in-depth understanding of the internal processes in the organizations and its context over time (Fletcher et al., 2016). The extended time period of our case favors these insights. Case studies are appropriate to explore theories (Barratt et al., 2011; Payne, 2018).

3.1. Data sources

In 1759, Arthur Guinness founded St. James's Gate brewery in Dublin, trading locally at first. Guinness was incorporated in 1886 as Arthur Guinness & Son Ltd. According to the first published accounts in 1887, profit before tax was 544,985. By 1920, profits exceeded 3 million, declined somewhat in the 1930s (Dennison & MacDonagh, 1998), but rose again. The 1950s-1970s was an expansionary period and by 1980, profits had risen to around 50 million (Guinness Annual Report, 1980). A decade later, in 1990, turnover was in excess of 3.5 billion, profits 847 million (Guinness Annual Report, 1990). In 1997, the Guinness company merged into Diageo plc with Grand Metropolitan (Moreno & Quinn, 2020). Prior research has established Guinness as a family firm (Cleary et al., 2019; Dennison & MacDonagh, 1998) (see more detail later). As highlighted by Moreno et al. (2019), the company is also a large multi-national operation, particularly from the 1960s. They also note that by "1991, based on market capitalization, it was the largest British consumer goods company and the second largest in the European Community" (p. 1721). Its growth as a company from the 1950s to the 1990s through diversification and acquisition is typical of other brewing firms (Gourvish & Wilson, 1994). Thus, Guinness is deemed as sufficiently representative as a family business and of its sector and suited to the research objectives here.

While new corporate media have emerged, the annual report is traditionally considered as the dominant form of corporate reporting (Amernic et al., 2010). The Chairman's Statement is one of the most read sections within the annual report (Fanelli & Grasselli, 2006; González et al., 2021). It consists of non-standard narrative content, allowing companies discretion on content to include (Moreno & Quinn, 2020). It offers an overview of the situation of a company, including typically unaudited information on operations, strategies, values and results (Balata & Breton, 2005). In addition, its periodic character makes it an optimal source to analyze the presence of attributes over time. It does not usually have a legal basis as regards content, even today. This is the case in most countries, as Spain, where while this document is unregulated, it tends to be part of the annual report of large/listed companies. In the UK, such a report is recommended (not mandated) by corporate governance rules, the first of which emerged in 1992. Thus, for the most part of the period covered by this study, there were no regulatory factors influencing its format or content. This is important as we can rule out regulatory factors in the analysis. We have ascertained from Guinness family members that the Chairman's Statement was written by the Chairman himself up to 1985. Thus, this reinforces the fact that it is expected to reflect the values of the family. We obtained the Chairman's Statement of Guinness from the company archive. Each statement was converted to an electronic format suitable for analysis.

3.2. SEW in Guinness reports

The presence of SEW in Guinness corporate disclosures from 1950 to 1972 has been assessed by Cleary et al. (2019). They develop a coding scheme and manually coded for the presence of the FIBER dimensions of SEW (Berrone et al., 2012) in the corporate disclosures in two Irish family breweries, Guinness and Murphy's. Their observation period was limited by the availability of sources and by the time which both companies could be termed a family firm -- the Murphy family lost control in 1972. Guinness, however, remained controlled by the Guinness family until 1986. Cleary et al. (2019) noted there are many interpretations as to what constitutes family control, referring to definitions by Anderson & Reeb (2003), Astrachan et al. (2002) and Howorth et al. (2010). To be consistent with Cleary et al. (2019), we use the definition of a family business offered by Anderson & Reeb (2003) -- that family control is through majority share ownership or control of board. From 1986, the Chairman was no longer a family member (from incorporation, the Chairman had always been a family member), and the board was not dominated by family members. The family still held some shares (but not a majority) and the Earl of Iveagh (Arthur Francis Benjamin Guinness) remained a board member until 1991. Thus, the Guinness data includes eleven years (1986-1996)1 when the company is not defined as a family company.

In this paper, we utilize the Cleary et al. (2019) dataset on the FIBER dimensions from 1950 to 1972 and extend their work to identify and codify the FIBER dimensions in Guinness from 1973 to 1996. We consistently apply Cleary et al. (2019) coding scheme and codification methods to ensure the extended dataset is in line with their work. The coding scheme is shown in the Appendix. It is based on the FIBER dimensions proposed by Berrone et al. (2012). Cleary et al. (2019) coded the paragraphs as the units of analysis, which is more appropriate to identify the FIBER dimensions than words. Similarly, we coded each paragraph in the Chairman's Statements according to the coding scheme with F, I, B, E or R if referring to any of the FIBER dimensions, 0 otherwise. If a paragraph referred to more than one FIBER dimension, it was assigned multiple codes (of equal weight) reflecting each dimension. Photographs and graphics are not codified, and relative frequency is the counting unit. Similar to Cleary et al. (2019), we ensured consistency of coding. After an initial pilot coding between the authors and subsequent discussion of the results, the 24 Chairman's Statements from 1973 to 1996 were coded by one author. To assess the reliability of the coding, four reports were chosen randomly and independently coded by the second author. The results were highly correlated (90%), indicating an acceptable degree of reliability of the coding process. The coding of the second author was only used for reliability purposes. For consistency, only the codes of the first author were retained for the subsequent analysis.

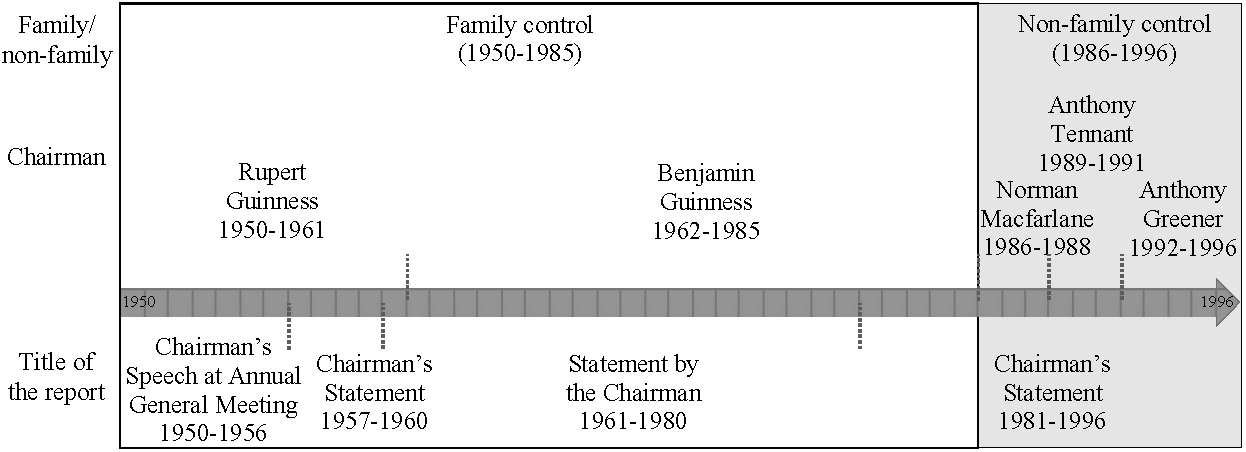

As our data includes a period when the company is not considered as a family firm, we primarily analyze the period in which Guinness is considered as a family firm (1950-1985). However, to provide further insights, we also compare the results with the period when Guinness is not considered a family firm (1986-1996) -- see also Figure 1. Despite not being a family company in this latter period, we have also codified it using the same methodology to allow comparisons of the results between family and non-family controlled periods.

Figure 1. Timeline of the period of Guinness under study

3.3. Readability: Bog index

To improve readability in corporate reports, the SEC published "A Plain English Handbook" (SEC, 1998) with the objective of guiding corporate managers to write in plain English, avoiding common structures which worsen readability.2 It specifically recommends avoiding long sentences, passive voice, weak verbs, superfluous words, legal and financial jargon, numerous defined terms, abstract words, unnecessary details and unreadable design and layout. Traditional readability indices (such as Fog and Flesch) only capture a limited number of attributes of plain English and are not comprehensive (Bonsall et al., 2017) and are associated with face validity concerns particularly in the case of financial reports (Jones & Shoemaker, 1994; Loughran & McDonald, 2014). For these reasons, Bonsall et al. (2017) validate and recommend the Bog index for use in studying readability in corporate financial disclosures. The Bog index is a multi-faceted measure of disclosure clarity. It captures most of the SEC's plain English guidelines for corporate reporting, including sentence length, passive voice, weak verbs, overused words, complex words and jargon. One of the features of this measure is that, unlike other indices, word complexity is determined by word familiarity based on a proprietary list of over 200,000 words, rather than multisyllabic counts -- overcoming major criticisms of the Fog and Flesch indices. The Bog index can be calculated using the Stylewriter software and has three distinct components:

\[ \text{Bog Index = Sentence Bog + Word Bog - Pep}\]

Sentence Bog relates to sentence length. It is the average sentence length for the document, squared, and divided by a standard long sentence limit of 35 words per sentence. Word Bog relates to word difficulty and style issues. It takes the sum of word difficulty (using the proprietary list of over 200,000 words, assesses from 0 to 4 based on familiarity and precision) and style problems (based on passive verbs, hidden verbs, overwriting, legal terms, clichés, abstract words and wordy phrases), multiplied by 250 and divided by the number of words. Pep relates to attributes that facilitate reading, such as names, interesting words and conversational expressions. It takes the sum of these features multiplied by 25 (one tenth of the effect relative to Word Bog) and divides by the number of words plus sentence variety (standard deviation of sentence length multiplied by 10 and divided by the average sentence length). Taking the sum of the three elements, a higher Bog index implies a less readable document (Bonsall et al., 2017). Recent research has used the Bog index to measure readability in financial reporting (Bakarich et al., 2019; Bonsall & Miller, 2017; Chychyla et al., 2019; Hasan, 2020).

3.4. Statistical methodology

To test our hypothesis, and control for potential simultaneous effects caused by other variables on readability, we construct an ordinary least squares (OLS) regression model to analyze the determinants of readability. The Bog index, as indicative of readability, constitutes the dependent variable. The I dimension, "family identity" is the (dependent) variable of interest (I). We include control variables used in previous literature which explores the Guinness company over a similar period of time (see Moreno et al., 2019). We use profitability, as measured by the increase or decrease in earnings before interest and tax from the previous year (IDEB). Profitability is expected to be positively related to readability, as poor profitability may be poorly disclosed, in an attempt to hide bad results (Li, 2008). We also include risk, as proxied by the debt ratio (DEBR). Risk is expected to be negatively associated with readability, in an attempt to obscure a higher risky position (Rutherford, 2003). Other qualitative variables, such as changes in chairpersons and changes in document titles can also influence readability (Moreno & Casasola, 2016). Different chairpersons may involve different writing styles and changes in title may involve major changes in the preparation, structure and content of the narratives. Therefore, we also control for different chairpersons, as proxied by dummy variables (CHAIi); and different titles of the Chairman's Statement in the period of study, also proxied by dummy variables, (TITLi). Table 1 summarizes the variables included in the model.

Table 1. Description of variables

| Variable | Name | Definition | Source |

|---|---|---|---|

| Dependent variable | |||

| Bog index | BOG | Readability measure | Stylewriter software |

| Interest variable | |||

| Family Identity | I | I dimension (of FIBER) identified in the Chairman’s Statement (%) | Cleary et al. (2019) and manual coding |

| Control variables | |||

| △/▽ EBIT | IDEB | 0=decreasing; 1=increasing (compared to prev. year) | Financial statements of Guinness |

| Debt ratio | DEBR | Total liabilities divided by total assets × 100 | Idem |

| Chairpersons | CHAIi | Defined as one dummy for each different chairperson | Chairman’s statements of Guinness |

| Titles | TITLi | Defined as one dummy for each different title | Idem |

△/▽ EBIT = increasing/decreasing earnings before interest and tax

To analyze the determinants of readability in the Guinness Chairman's Statements, we first include only control variables in Model 1:

\[\begin{equation} \label{eq1} \small \text{BOG} = \beta_{0} + \beta_{1}\text{IDEB} + \beta_{2}\text{DEBR} + \beta_{3}\text{CHAI}_{i} + \beta_{4}\text{TITL}_{i} \ \ \ \text{(Model 1)} \end{equation}\]Next, the variable of interest, the I dimension, is added to Model 1, to analyze the influence of this salient FIBER dimension on readability, resulting in Model 2:

\[\begin{equation} \label{eq2} \small \text{BOG} = \beta_{0} + \beta_{1}\text{I} + \beta_{2}\text{IDEB} + \beta_{3}\text{DEBR} + \beta_{4}\text{CHAI}_{i} + \beta_{5}\text{TITL}_{i} \ \ \ \text{(Model 2)} \end{equation}\]4. Results

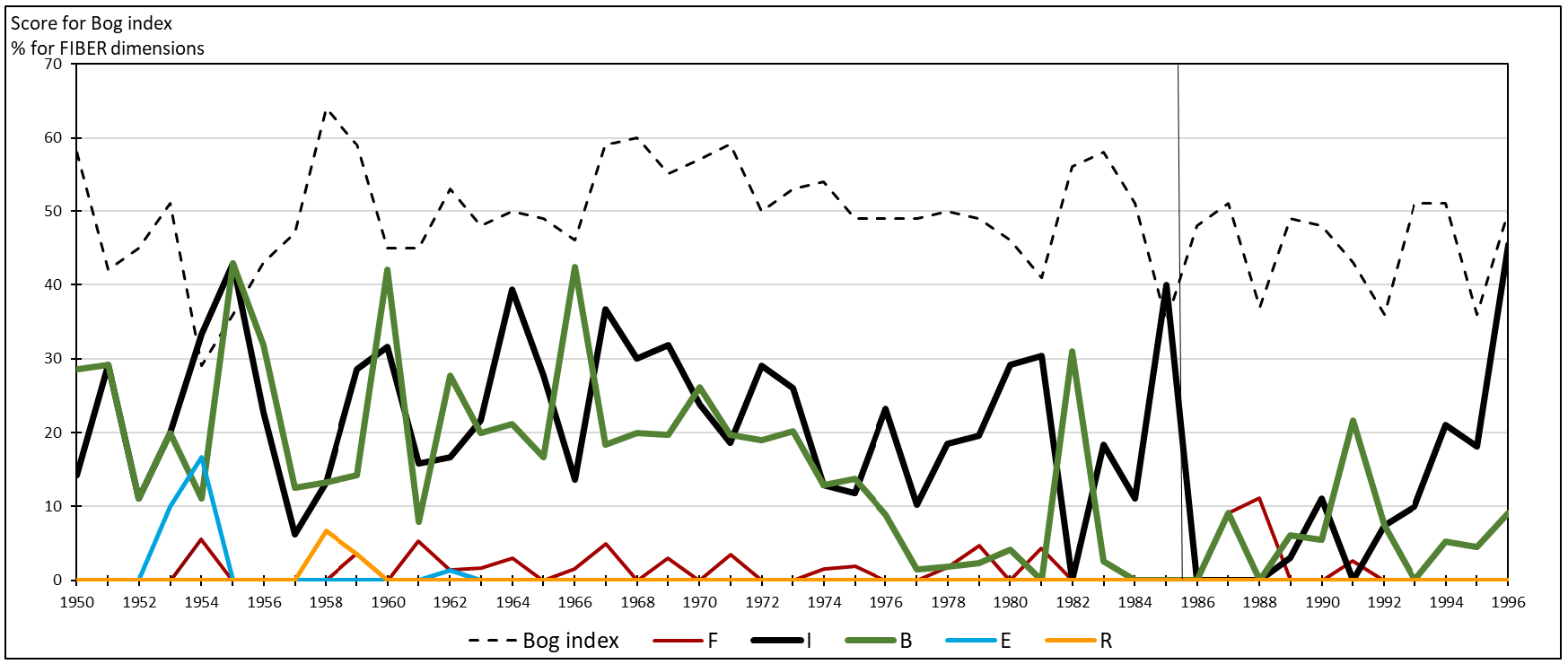

Figure 2 shows the evolution of each FIBER dimension (over the total document) and Bog index from 1950 to 1996 (the vertical line represents the transition from family to non-family). Table 2 shows the mean of the relative presence of each FIBER dimension over the Chairman's Statement, as measured by the paragraphs identified with a dimension over the total number of paragraphs in the statement. Focusing on the period of Guinness as a family company (1950-1985) and taking Figure 2 and Table 2 together, the I dimension of FIBER is clearly the most salient over time. This is consistent with Cleary et al. (2019), who analyzed the period 1950-1972.3

Figure 2. Evolution of FIBER dimensions (over the total document) and Bog index

Table 2. Mean of each FIBER dimension over total document (%)

| 1950-1985 | 1986-1996 | |

|---|---|---|

| F | 1.33 | 2.08 |

| I | 22.48 | 10.57 |

| B | 17.08 | 6.24 |

| E | 0.78 | 0.00 |

| R | 0.28 | 0.00 |

| N | 36 | 11 |

Table 3 shows descriptive statistics. Focusing on the period of Guinness as a family company (1950-1985), the Bog index mean is calculated as 49.72. This implies the readability of Guinness Chairman's Statements is considered for general writing as Fair. The I dimension has an average presence of 22.48% over the total number of paragraphs analyzed. The earnings before interest and tax increase in 78% of the years of the period and decrease in 22%. The mean of the debt ratio is 42%. Two different chairpersons -- both family members -- signed the statements from 1950 to 1985 (from 1986 to 1996 three different chairpersons -- non family members -- signed the statements) and four different titles featured (see Figure 1).

Table 3. Descriptive statistics

| 1950-1985 | 1986-1996 | |||||||

|---|---|---|---|---|---|---|---|---|

| Variable | Mean | St. Dev. | Min | Max | Mean | St. Dev. | Min | Max |

| Dependent variables | ||||||||

| BOG | 49.72 | 7.54 | 29.00 | 64.00 | 45.45 | 6.28 | 36.00 | 51.00 |

| Interest variables | ||||||||

| I | 22.48 | 10.12 | 0.00 | 42.86 | 10.57 | 13.78 | 0.00 | 45.45 |

| Control variables | ||||||||

| IDEB | 0.78 | 0.42 | 0.00 | 1.00 | 0.82 | 0.40 | 0.00 | 1.00 |

| DEBR | 41.98 | 14.56 | 22.57 | 71.05 | 51.72 | 10.10 | 39.56 | 70.91 |

| CHAI1 | 0.33 | 0.48 | 0.00 | 1.00 | ||||

| CHAI2 | 0.67 | 0.48 | 0.00 | 1.00 | ||||

| CHAI3 | 0.27 | 0.47 | 0.00 | 1.00 | ||||

| CHAI4 | 0.27 | 0.47 | 0.00 | 1.00 | ||||

| CHAI5 | 0.45 | 0.52 | 0.00 | 1.00 | ||||

| TITL1 | 0.19 | 0.40 | 0.00 | 1.00 | ||||

| TITL2 | 0.11 | 0.32 | 0.00 | 1.00 | ||||

| TITL3 | 0.56 | 0.50 | 0.00 | 1.00 | ||||

| TITL4 | 0.14 | 0.35 | 0.00 | 1.00 | 1.00 | 0.00 | 1.00 | 1.00 |

| N | 36 | 11 | ||||||

Tabe 4 depicts the Pearson correlation matrix. In line with the hypothesis, BOG is negatively associated with the I dimension. This means that when the I dimension increases, readability increases (lower Bog index = higher readability). One title is also associated with readability. The I dimension is not associated with any of the control variables. IDEB also does not show any association with other variables. DEBR is associated with all chairpersons and titles. The qualitative variables (chairpersons and titles) show some mutual associations. A multicollinearity analysis was also undertaken. When every independent variable was incorporated in the analysis, including the I variable and the control variables (Model 2), the condition index was 19 and the variance inflation factor of the variable of interest, I, was 1.06. In general, in any of the analysis conducted (as shown in Table 5 and Table 6), the results reveal no condition indices exceeding the threshold of 30 (Belsley, 1991). Therefore, there are no evident multicollinearity concerns.

Table 4. Pearson correlation coefficients

| BOG | I | IDEB | DEBR | CHAI1 | CHAI2 | TITL1 | TITL2 | TITL3 | |

|---|---|---|---|---|---|---|---|---|---|

| I | -0.34* | ||||||||

| IDEB | 0.04 | 0.15 | |||||||

| DEBR | 0.04 | -0.05 | -0.03 | ||||||

| CHAI1 | -0.26 | 0.00 | 0.09 | -0.75* | |||||

| CHAI2 | 0.26 | 0.00 | -0.09 | 0.75* | -1.00 | ||||

| TITL1 | -0.42* | 0.11 | 0.26 | -0.49* | 0.69* | -0.69* | |||

| TITL2 | 0.19 | -0.09 | -0.02 | -0.42* | 0.50* | -0.50* | -0.17 | ||

| TITL3 | 0.27 | 0.04 | -0.21 | 0.42* | -0.67* | 0.67* | -0.55* | -0.40* | |

| TITL4 | -0.08 | -0.10 | 0.02 | 0.34* | -0.28 | 0.28 | -0.20 | -0.14 | -0.45* |

N=36 (1950-1985). * p < 0.05

Table 5 shows the regression model results. In Model 1, none of the control variables are found significant, except for one title -- thus disclosures were less readable in the period of the second title. In Model 2, when we include the variable of interest, the I dimension (negatively related to BOG) is found significant, in line with expectations. Then, an increase in the I dimension corresponds to a decrease in the Bog index, this implying a higher readability. None of the remaining control variables are found significant. The inclusion of the I dimension also constitutes an evident improvement in terms of the adjusted R2 from 0.13 to 0.26.

Table 5. Regression models

| Model 1 BOG 1950-1985 | Model 2 BOG 1950-1985 | Model 2’ BOG 1986-1996 | ||||

|---|---|---|---|---|---|---|

| Coef. | Sth.Err. | Coef. | Sth.Err. | Coef. | Sth.Err. | |

| I | -0.28* | 0.11 | 0.09 | 0.16 | ||

| IDEB | 2.73 | 3.08 | 3.51 | 2.86 | 14.34* | 3.18 |

| DEBR | -0.14 | 0.13 | -0.17 | 0.12 | 0.35* | 0.12 |

| CHAI2 | 7.68 | 7.92 | 9.61 | 7.35 | ||

| CHAI4 | 5.38 | 2.96 | ||||

| CHAI5 | 6.89 | 3.86 | ||||

| TITL2 | 10.60* | 4.48 | 9.39* | 4.16 | ||

| TITL3 | 4.45 | 8.13 | 2.78 | 7.52 | ||

| TITL4 | 1.46 | 8.85 | -1.00 | 8.22 | ||

| Constant | 44.67* | 5.24 | 51.38* | 5.54 | 10.16 | 8.00 |

| Adjusted R2 | 0.13 | 0.26* | 0.75* | |||

| Condition index | 17.11 | 19.06 | 21.52 | |||

| No. of observations | 36 | 36 | 11 | |||

See Table 1 for description of the variables. In Model 1, only control variables (and not the variable of interest, I) are included. In Model 2, not only control variables of Model 1, but also the variable of interest (I) is included. Models 1 and 2 compute the observations from 1950 to 1985. Model 2’ is similar to Model 2, with only observations from 1986 to 1996 computed. For the categorical variables CHAIi and TITLi, in Models 1 and 2 CHAI1 and TITL1 are considered as the reference levels, respectively, and in Model 2’ CHAI3 is considered as the reference level for CHAIi (there is no change in title in Model 2’).

* p < 0.05

From 1950 to 1985 Guinness is considered as a family firm. The last family member with the Chair role remained on the board until 1991. This represents a decrease in familiness of the firm, and the firm can no longer be defined as a family firm from 1986 (Figure 1). For this reason, we also tested the potential influence that the I dimension may still have in those years in which Guinness cannot be defined as a family firm. The I dimension is still the most emphasized FIBER dimension in the period 1986-1996 (Figure 2 and Table 2). However, it is also noticeable, as could be expected, that there was a very significant decrease in the presence of every FIBER dimension in this period (Figure 2 and Table 2), with the exception of the F dimension (in any case, the presence of this dimension was much reduced). Overall, the aggregated average presence of the FIBER dimensions in the Chairman's Statement fell from 42% in the period 1950-1985 to 19% in the period 1986-1996. This decrease is reasonable as SEW is a construct associated with family businesses (Gómez-Mejía et al., 2007).

Thus, Model 2' includes the same variables as Model 2, but only with the observations from 1986 to 1996. The results of Model 2' do not show the I dimension as significant in this period. However, profitability and risk now become significant. These two variables are pointed out as influential by traditional perspectives such as agency theory. Different chairpersons and titles are not significant. Thus, the association between the I dimension and readability is not significant when Guinness cannot be defined as a family firm.

4.1. Sensitivity analysis

Although only the I dimension is expected to influence reporting quality, we also analyzed the potential influence on readability of some of the other FIBER dimensions revealed in the Chairman's Statement from 1950-1985. These were the F and B dimensions, the next most salient as per Table 2. The other two dimensions (E and R) did not have a regular presence (Figure 2 and Table 2) in the Chairman's Statement (the E and R dimensions are only present in three and two years, respectively) and are thus not further analyzed. The F dimension is tested in Model 3 and the B dimension in Model 4, both shown in Table 6. These two Models (3 and 4) follow a similar structure to Model 2, but the different FIBER dimension is included in place of the I dimension.

Table 6. Regression models for sensitivity analyses

| Model 3 BOG 1950-1985 | Model 4 BOG 1950-1985 | |||

|---|---|---|---|---|

| Coef. | Std.Err. | Coef. | Std.Err. | |

| F | -0.69 | 0.72 | ||

| B | -0.00 | 0.13 | ||

| IDEB | 2.38 | 3.10 | 2.74 | 3.15 |

| DEBR | -0.16 | 0.13 | -0.15 | 0.15 |

| CHAI2 | 5.77 | 8.17 | 7.73 | 8.37 |

| TITL2 | 10.52* | 4.49 | 10.59* | 4.61 |

| TITL3 | 7.22 | 8.62 | 4.41 | 8.47 |

| TITL4 | 3.91 | 9.22 | 1.41 | 9.41 |

| Constant | 46.15* | 5.46 | 44.77* | 7.14 |

| Adjusted R2 | 0.13 | 0.10 | ||

| Condition index | 18.20 | 20.68 | ||

| No. of observations | 36 | 36 | ||

See Table 1 for description of the variables. Models 3 and 4 follow the same structure as Model 2. However, a different FIBER dimension is included instead of the I dimension. In Model 3, the F dimension and in Model 4 the B dimension. For the categorical variables CHAIi and TITLi, in the two models, CHAI1 and TITL1 are considered as the reference levels, respectively.

* p < 0.05

The results do not show a significant impact of the F or B dimensions on readability. Thus, FIBER dimensions other than the I dimension do not seem to have an impact on readability. This finding supports the notion that only the most salient dimension has a significant influence on readability as suggested by Gomez-Mejia et al. (2014). Similar to Model 2, the period related to the second title of the document is also associated with a lower readability, both in Models 3 and 4. We also tested the potential influence of the rest of FIBER dimensions in the period 1986-1996. None were found to have a significant effect on readability.

5. Discussion of results

Corporate reporting quality may be instrumental to manage family reputation, particularly when there is a strong association between the family and the firm. It may prevent any potential damage coming from negative image associated with lower reporting quality, to ultimately avoid socioemotional wealth loss for the family (Dyer & Whetten, 2006; Martin et al., 2016). A higher readability, representative of higher reporting quality, may be used as an attempt to increase family reputation. When the firm-family association is stronger, firms will be particularly aware not to damage family image reputation, and will disclose clearer and more transparent information. Due to strong firm-family identity, the face of the family mirrors the face of the firm (Berrone et al., 2010; Borralho et al., 2020a; Stockmans et al., 2010). By disclosing more readable information when the firm-family association is stronger, firms will be enabling more transparent communication to help stakeholders to fairly gauge the position of the company, which will enhance the family's image and reputation (Cennamo et al., 2009; Gomez-Mejia et al., 2014).

Our results show that the most salient SEW dimension, i.e. "family identity" in this study, drives financial reporting, as captured in the Chairman's Statement, when Guinness is defined as a family firm. However, it is not significant when Guinness ceased to be a family firm. This interesting finding may shed light on the mixed results found by previous general corporate literature studies when analyzing reporting quality in general and readability in particular. Such prior research has almost neglected non-economic factors -- such as SEW -- in attempts to explain corporate reporting. Previous agency theory developments have not found agreement on the determinants of corporate readability, as a proxy for reporting quality. Some research has found a positive relationship between readability and performance (Dempsey et al., 2012; Li, 2008; Subramanian et al., 1993), while other studies have not found support for this association (Courtis, 1986; Rutherford, 2003; Smith et al., 2006). Our results support the notion that in family firms (at least some) SEW dimensions could be more influential than the economic determinants used by traditional perspectives in the general corporate literature. Therefore, beyond economic pressures, emotions, social capital and other social constituents affect corporate reporting of (at least) family firms (Gómez-Mejía et al., 2007, 2011). Specifically, the influence of the I dimension on readability is greater than corporate profitability (as measured by IDEB) in the period when Guinness was a family firm. In contrast, at the end of the period of study, when Guinness could not be defined as a family firm, the SEW dimensions were not influential. However, variables such as profitability and risk influenced readability.

Our findings also raise the interesting point of a family legacy (via the "family identity" dimension) enduring when the firm ceases to be a family firm. The "family identity" dimension is significantly (positively) related to readability only in the period 1950-1985 when the Guinness family controlled the firm, but not later. However, the "family identity" dimension remains after 1986, with a lower presence but still as the most significant (Figure 2). This is primarily due to on-going mention of the Guinness brand name. Cleary et al. (2019) identifies this association and explain why the Guinness family name should be considered as SEW, supporting the notion that family name congruence between the owning family and the firm affects the presence of SEW (Gómez-Mejía et al., 2011; Rousseau et al., 2018). In general, from 1986, there is much less mention of SEW (Table 2) as might be expected taking into account that SEW is a construct associated with family businesses (Gómez-Mejía et al., 2007). However, lower but persistent evidence of SEW might be also logical given the strong influence the family exerted on the firm over centuries and because a family member further remained on the board. This suggests the influence of a family may to some extent survive when the company ceases to be a family company. This may be more evident in firms whose products retain the family name (Drago et al., 2018).

We build on Drago et al. (2018), who studied readability in family firms, but our approach to examining SEW and readability is different. They predicted that greater family power (as measured by presence of a family CEO, percentage of family board members and ownership) and overlap between firm/family name may lead to a prioritization of "family identity". This would improve readability (Gomez-Mejia et al., 2014). Drago et al. (2018) reported mixed results, however. Readability increased when the percentage of family held shares increased, whereas decreased when firm name included the family's name. They term this latter finding as "unexpected and less robust" (p. 148) and called for further research. We focus on the most salient dimension, evidenced by the disclosure. In contrast, Drago et al. (2018) use proxies to assess the priority given only to the two dimensions argued by Gomez-Mejia et al. (2014). In addition, Drago et al. (2018) measure readability in the entire annual report, which is quite heterogeneous, long and complex. In contrast, we focus on a homogenous, highly read, section within the annual report -- the Chairman's Statement (Fanelli & Grasselli, 2006; González et al., 2021). Its content is not regulated and thus is one of the most likely places where a family firm will mention dimensions of SEW. Also, Drago et al. (2018) use the Fog index, a general readability index, while we use the Bog index, particularly developed for corporate financial disclosures and thus more likely to provide a more relevant readability indicator.

Another key differentiator of this study is that while Drago et al. (2018) use data from 48 Italian family firms over six years, we draw on data from a single large company over a much longer time period, across family generations, including the transition from family to non-family. Cleary et al. (2019) make a reasonable argument for using what they term an SEW history approach, which is using "historical research to explore SEW" (p. 120). We have followed a similar approach to explore the relationship between SEW and readability. During the period of analysis here, particularly towards the latter part, there were some changes to company laws and accounting regulations in the United Kingdom and Ireland -- the key locations of Guinness management. As noted earlier, we consider regulatory factors as being not influential. However, as per Moreno and Quinn (2020) the UK/Irish economies/business environment experienced much change during this period. Nevertheless, our findings reveal a pervasive dominance of the I dimension over time. Taking together, the extended timeframe of the study and the changing environment during this period, the fact that a family member was Chairman for most of the analysis period, and the fact that the reports analyzed do not have any particular mandated content, the evidence here provides stronger support than prior literature as to how salient SEW dimensions may affect financial reporting content.

6. Concluding comments

Our results support the notion raised by Gomez-Mejia et al. (2014), that the most salient SEW dimension drives financial reporting, here "family identity". In particular, our findings show that the emphasis on "family identity" is directly associated with reporting quality as captured by readability. This paper is, to the best of our knowledge, the first to use the Bog index in the analysis of corporate reports of a family business, being this index particularly appropriate for corporate financial disclosures. In addition, as the family lost the control of the firm in the last part of the period studied, we have offered an interesting insight with the transition of the company from being a family to a non-family firm. Overall, our results suggest that in family firms SEW may be more influential than economic determinants used by traditional perspectives. SEW was more influential on readability than profitability in the period when the family controlled the firm. Once the family lost control over the firm, SEW lost its influence in favor of the traditional economic measures. This finding reinforces the idea of the peculiarity of family firms in their accounting choices and encourage stakeholders to make out beyond the agency rationality in family firms (Gomez-Mejia et al., 2014).

Our results also contribute to the debate on the heterogeneity of family firms (Chrisman & Patel, 2012; Madden et al., 2020; Neubaum et al., 2019). While most literature has analyzed family firms as a monolithic entity, family firms are not a homogeneous group and different family firms will make different choices. In particular, depending on the emphasis on the different SEW dimensions, different corporate behavior may arise, including differences in financial reporting and accounting choices (Engel et al., 2019; Martin et al., 2016; Pazzaglia et al., 2013; Stockmans et al., 2010).

There are some limitations, some of which point to a need for future research. First, this study shares the limitations of Cleary et al. (2019). The manual identification of the SEW dimensions is inevitably subjective, although we have ensured consistency as best possible and applied methods similar to Cleary et al. (2019). Second, the documentary source of the present research, the Chairman's Statement, may contain opportunistic information. However, it is one the most read sections of the annual report and has been extensively used in prior research on corporate literature. In addition, to measure readability in a homogeneous document may be more sensible than measuring readability in the entire annual report. Third, the study is of one family firm, which although large and multinational, is a single case. Fourth, as share ownership does not convey family control in the period studied, we have not been able to conduct a robustness analysis using a different definition of family business. We established Guinness as a family firm by means of control of the board and the Chairman being a family member. However, it could be argued to consider family control through majority share ownership. Unfortunately, share registers from the 1950s, while retained by the Company Secretary of Guinness (now Diageo plc) are not accessible to the public. Cleary et al. (2019) calculated the (direct and indirect) shareholdings of Guinness family directors in 1972 as 24.6% of total shares. Similarly, with the information published in the annual reports, we have not found any evidence that the Guinness family held more than 50% of the shares during our period of study. Finally, this paper may be limited in that it utilizes the FIBER dimensions of SEW, which have been subject to some debate (see for example, Hauck et al., 2016; Jiang et al., 2018). However, in a general sense, the "family identity" dimension is less contested as an important component of the unique attributes of a family business.

There are key avenues for future research building on the work presented here. More research is needed to extend the generalizability of the findings, given the single case here. Further studies in family companies stressing different SEW dimensions may confirm the influence of the most emphasized SEW dimension. Indeed, such studies may identify different significant dimensions and reasons for such differences. These studies may also contribute to the debate on the heterogeneity of family firms (Engel et al., 2019; Stockmans et al., 2010). In addition, some firm characteristics, such as size, may affect corporate reporting (Martin et al., 2016; Paiva et al., 2019). Therefore, research on the effect of SEW on corporate reporting in smaller family firms is warranted. The role of non-family members in top posts in family firms may also offers a fertile area in financial reporting, as these members may have different interests than the SEW dimensions prioritized by family members (Waldkirch, 2020) and this can particularly affect reporting quality (Pazzaglia et al., 2013). Future studies could also focus on different textual variables, such as tone or sentiment, and on different corporate documents, including digital corporate media (Pancer et al., 2019). Given that the salience of the different SEW dimensions may change over time, there is a need to incorporate this dynamic when analyzing SEW (Cennamo et al., 2012). More historical and longitudinal research may provide meaningful insights in this respect (Basco, 2017; Ng et al., 2019). In addition, it would be interesting to conduct further research about family legacy in the case of companies ceasing to be family firms.

Appendix

Appendix. Coding scheme used by Cleary et al. (2019)

| FIBER dimension | Elements |

|---|---|

| Family Control and Influence “F” |

|

| Identification of Family Members with the Firm “I” |

|

| Binding Social Ties “B” |

|

| Emotional Attachment of Family Members “E” |

|

| Renewal of Family Bonds Through Dynastic Succession “R” |

|

* Cleary et al. (2019) coded both the Guinness and Murphy’s breweries.