Media Coverage and corporate tax burden in Spain

ABSTRACT

This research examines the relationship between media coverage and corporate tax burden in a sample of non-financial Spanish listed firms over the period 2003-2016. We show that media coverage reduces corporate tax burden. Our findings are consistent with a legitimation role for the media in continental Europe, such that firms subject to greater media attention show less need to resort to tax policy in order to legitimate corporate behaviour. Further analysis shows that companies subject to greater media coverage combined with a more negative tone of news show a higher tax burden. Thus, when the media threaten the legitimation of corporate behaviour, the firm will thus show a greater tendency to use tax policy as a way to restore corporate legitimation.

Keywords: Media coverage; Corporate tax burden; Legitimation.

JEL classification: G34; G40; M49.

Presión mediática y estrategia fiscal en España

RESUMEN

Esta investigación analiza la relación entre la presión mediática y la estrategia fiscal corporativa en una muestra de empresas no financieras cotizadas españolas en el periodo 2003-2016. Mostramos que la cobertura mediática reduce la carga fiscal de las empresas. Los resultados se encuentran en consonancia con el papel de la legitimación en Europa Continental, de manera que las empresas que están sujetas a una mayor presión mediática muestran menos necesidad de recurrir a la política fiscal para legitimar el comportamiento empresarial. Además, el estudio señala que las empresas sujetas a una mayor presión mediática combinada con un tono negativo de las noticias soportan una mayor carga fiscal. Así, cuando los medios de comunicación amenazan la legitimación de la actuación corporativa, las empresas muestran una mayor tendencia a utilizar la política fiscal como forma de restaurar su legitimación.

Palabras clave: Presión mediática; Estrategia fiscal corporativa; Legitimación.

Códigos JEL: G34; G40; M49.

1. Introduction

Recent tax scandals have revived policymaker, investor as well as public interest in the determinants of tax planning strategies adopted by large corporations such as Google, Amazon or Facebook. Research exploring the determinants of tax avoidance has therefore grown substantially (Hanlon & Heitzman, 2010). In the continental European context, an understanding of the drivers of tax planning proves to be even more significant since, in accordance with the World Economic Forum (Global Competitiveness Report 2016-2017), taxation is the main stumbling block encountered when seeking to do business in countries such as France, Germany, Italy or Spain.

Despite considerable research into tax planning, we know little about how corporate tax policies are affected by public scrutiny of corporate behaviour, particularly when increased scrutiny comes from media coverage. In the Spanish setting, prior knowledge is anecdotal and has tended to centre on scandals that have had major repercussions in the media. In 2019, the Spanish national press revealed that Google, Apple, Facebook and Amazon paid a combined total of a mere 31.7 million euros in tax for the year 2017 (El País, 24-3-2019, Los gigantes tecnológicos pagan menos en España pese a ganar más). Furthermore, the 2018 Tax Contribution and Transparency Report, published in Spain by the Commitment and Transparency Foundation, revealed that very few companies operating in Spain address fiscal transparency in a systematic and differentiated way.

The media collect, aggregate, disseminate, and amplify information (Bushee et al., 2010) and, consequently, managers and controlling shareholders are sensitive to media coverage. Previous literature has focused on media independence as a driver of corporate tax aggressiveness (Kanagaretnam et al., 2018), emphasizing the disciplinary role of the media in the presence of more aggressive corporate tax positions. Our work fills a gap in earlier research by focusing on the role of the media in the presence of any strategy aimed at reducing corporate tax burden, thereby moving away from the main concern of previous studies; namely, aggressive tax avoidance strategies. Furthermore, our work is not concerned with media independence, but focuses rather on media coverage. In order to achieve our aim, we selected a sample of Spanish nonfinancial listed companies over the period 2003-2016.

Our findings show how in the Spanish setting the level of media attention plays an important role in managers’ tax decisions. In particular, we evidence lower levels of corporate tax burden as media coverage increases. For a continental European setting, our results are thus consistent with media coverage playing an important legitimising role of corporate behaviour, such that firms which are subject to more intense media coverage show less need to use tax policy to legitimate corporate behaviour. Further analysis shows that in companies where the media threaten corporate legitimacy due to the combination of higher media coverage and a more negative tone of news, there is a greater need to resort to tax policy to legitimate corporate behaviour. Our results are robust to different measures, both of corporate tax burden and media coverage. Additionally, given that we have addressed different endogeneity sources, our results exclude the possibility that the negative relation between media coverage and corporate tax burden can be explained by greater media attention following firms with a lower tax burden.

Our study provides some important implications with regard to previous literature. First, by adopting a broader approach and by focusing on a variety of tax planning strategies, ranging from certain to more aggressive ones, our research design allows for the possibility of considering other roles which the media might play, apart from the disciplinary role, and which might affect corporate tax policies. Second, since media scrutiny forms part of a country’s informal institutions and is not conducted in a vacuum, our work provides evidence on how the European continental setting shapes the relation between media coverage and corporate tax burden. Third, we show how the tone of the coverage affects the relation between media coverage and corporate tax burden, an issue which, to the best of our knowledge, has not been addressed in earlier studies. Fourth, we focus on a single country, thereby limiting concerns that tend to plague international studies, such as a limited sample size, endogeneity in country-level variables, noisy variables, and correlated omitted variables.

The rest of the paper is split into five sections. Section 2 reviews related research, from which our hypothesis is then drawn. Section 3 explains the configuration of the sample data together with the research method. Section 4 sets out the empirical results to emerge, while section 5 provides the concluding remarks.

2. Theoretical background and hypothesis development

The media disseminate information about firms, thereby reducing information asymmetry with relevant market actors (Bushee et al., 2010). By selecting which firms and actions to cover, the media reveal certain issues that may not otherwise be widely known to stakeholders. In this sense, recent studies suggest that the media can have a significant impact on corporate behaviour, such as certain capital allocation decisions or corporate governance mechanisms (Dyck & Zingales, 2002; Miller, 2006; Core et al., 2008; Fang & Peress, 2009; Bushee et al., 2010; Engelberg & Parsons, 2011; Gurun & Butler, 2012; Bednar, 2012; Khunen & Niessen, 2012; Jansson, 2013; Liu & McConnel, 2013; Ahern & Sosyura, 2014; Drake et al., 2014; Chahine et al., 2015; Ahmad et al., 2016; Cahan et al., 2017; Lauterbach & Pajuste, 2017; Liu et al., 2017).

Tax planning might be considered a risky capital allocation decision. However, despite the existence of substantial research on the determinants of tax planning over the past decade (Hanlon and Heitzman, 2010), our understanding of the media’s potential as a key information provider that can affect corporate tax policies remains far from conclusive. Anecdotal evidence in continental Europe reveals that media exposure of aggressive tax strategies can increase firms’ pressure to pay additional taxes. Thus, although many companies in continental Europe have been successful in avoiding taxes for several years, only after exposure by the media has the issue become a political and social concern. In 2019, the Spanish national press revealed that technological giants Google, Apple, Facebook and Amazon paid a combined total of only 31.7 million euros taxes in Spain in 2017 (El País, 24-3-2019).

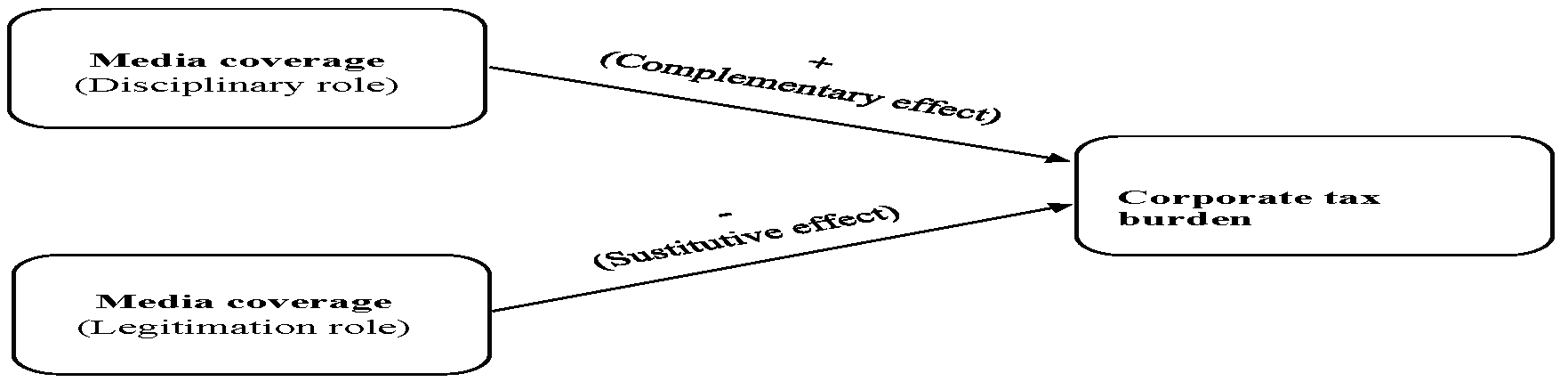

In the academic field, Kanagaretnam et al. (2018) study the effect of media independence on aggressive tax avoidance strategies in a sample of firms from 32 countries from around the world. The authors report that media independence is linked to a lower likelihood of corporate tax aggressiveness. Their findings concur with the notion of media independence playing a key monitoring role in palliating aggressive tax strategies over and above legal institutions. Subsequent studies conducted by the authors also reveal that the impact of media independence on corporate tax aggressiveness is more evident in weaker legal environments and when there is less transparency in the information environment, suggesting a substitution effect between the protection provided by the legal system and the disciplinary role of the media. To date, no study has considered how media coverage of corporate behaviour interacts with the continental European setting to shape corporate tax policy. Our study aims to fill just such a gap. Figure 1 presents our conceptual framework that is developed later.

Figure 1. The conceptual frame-work

Firms receiving higher levels of media attention find themselves coming under greater scrutiny from many stakeholder groups, thus increasing the extent to which relevant audiences might inflict a reputational penalty on company managers when the latter deviate from the “desired behaviour”, with such conduct coming into the public eye (Bednar et al., 2015). In this sense, Allen et al. (2015) found that firms under more intense analyst coverage are less likely to engage in tax avoidance. Their results are consistent with greater analyst coverage increasing the visibility of aggressive tax planning behaviour. Additionally, Lee (2015) finds that firms exposed to media coverage of tax avoidance are less likely to make tax-related disclosures. Previous results are consistent with firms avoiding discussing the most relevant tax issues when they are at the centre of media attention. Finally, Dyreng et al. (2016) evidence that public pressure associated with subsidiary disclosure can impose substantial political and reputational costs affecting tax avoidance activities and subsidiary location decisions of large, publicly traded firms. Overall, previous empirical evidence is consistent with exposure of corporate behaviour to a broader audience, increasing the likelihood of pinpointing which actions deviate from the “desired behaviour”, and which consequently imposes costs on managers.

In this sense, managers have both financial and human capital, at risk (Fama, 1980; Fama & Jensen, 1983). Dyck et al. (2008) posit that managers’ reputational capital is affected by the media since the latter might increase the extent to which participants in the managerial labour market learn about managers’ actions. In this sense, Hanlon & Slemrod (2009) documented some limited evidence consistent with reputational concern being a viable disincentive for tax aggressiveness. A recent survey in the USA suggests that executives and firms are concerned about the reputational costs associated with corporate tax planning decisions (Graham et al., 2014). Austin & Wilson (2015) find that firms with valuable consumer brands exhibit higher effective tax rates than a set of matched control firms. They attribute their results to firms with valuable consumer brands facing higher reputational costs when they adopt riskier task positions.

According to the above, firms subject to greater media coverage face closer scrutiny from the various stakeholders. Given that paying their “fair share” in taxes might be considered a relevant contribution which firms make to society, since taxes are paid to secure the financing of public goods and services, we can conclude that firms under greater media coverage will show less tendency to adopt strategies designed to decrease their corporate tax burden in order to reduce the likelihood that riskier tax positions might be known and eventually sanctioned by relevant audiences. Here, it should be remembered that reputational costs are particularly important in continental Europe where a relationship rather than a market-based economy prevails, given that reputation is key to successfully concluding contracts in such a setting (La Porta et al., 2000). Since managers care about their public image and are particularly vulnerable to reputation loss in continental Europe, firms subject to greater coverage might be expected to decrease their incentive to embrace strategies designed to reduce corporate tax burden.

Furthermore, firms which come under greater media coverage face the incremental risk of becoming the target of politically motivated actions. Thus, under the political cost theory (Watts & Zimmerman, 1978; Wong, 1988; Cahan, 1992), firms with greater visibility are more vulnerable to wealth transfers through political processes. To avoid political costs, firms subject to more severe media coverage will be less likely to implement tax strategies designed to decrease corporate tax burden. Finally, more intense media scrutiny might increase the likelihood of “non-desirable tax behaviour” being revealed and of enforcement actions, subsequently opening the door for potentially large direct costs such as litigation, interest, fines, and penalties. All things considered, as scrutiny of corporate behaviour increases, the benefits of adopting strategies aimed at decreasing corporate tax burden in continental Europe might be outweighed by the political, reputational and proprietary costs. Therefore, previous arguments support a positive association between media coverage and corporate tax burden.

From a different perspective, the stakeholder and legitimacy theories posit that companies seek to legitimize and support their relationships to survive (Lanis & Richardson, 2012). In this sense, organizational literature has mainly focused on the media’s influencing role, casting them as propagators of legitimacy (Hoffman & Ocasio, 2001; Pollock & Rindova, 2003). Many studies into the evaluative role played by the media have mainly focused on the resources and positive outcomes conferred on firms through media attention (Deephouse, 2000). Researchers have therefore conceptualized the media as a kind of social arbiter who help to define which kinds of behaviour are deemed acceptable. In their role as social arbiters, journalists are independent actors who make judgements on companies that might influence the perceptions of larger audiences (Bednar, 2012). Moreover, corporate tax policies might be used by firms to demonstrate their social commitment, that is to say, through the payment of taxes, insiders might influence stakeholders’ perceptions, decreasing any threaten to the firm’s future survival. Therefore, tax policy may be used to gain, maintain and/or repair firm legitimacy. In this sense, media coverage and tax policy could be considered alternative mechanisms for seeking the legitimation of corporate behaviour. Firms can therefore legitimate their behaviour through persistent investments in a range of relevant signals that do not all come at the same cost. As a result, if media coverage does play an important role in legitimizing corporate behaviour, then firms that come under greater media coverage will display less need to resort to other means to legitimate corporate behaviour, such as tax policy, particularly when the latter will certainly not prove to be cost free. In this sense, legitimation by reducing riskier tax positions leads to an increase in tax costs, which can damage the firm’s competitive advantage. Consequently, if media coverage plays a relevant legitimising role in continental Europe, companies that are subject to greater media coverage will be more likely to resort to strategies aimed at decreasing corporate tax burden to reduce tax costs and improve the firm’s competitive position in the market. In accordance with the presence of a legitimation role for the media, a negative relation between media coverage and corporate tax burden is therefore expected.

In light of the above, we predict an opposite impact of media coverage on corporate tax burden which needs to be addressed empirically.

3. Methodological design

3.1. Sample

Drawing on the OSIRIS database (Bureau van Dijk), the initial sample comprised the consolidated financial reports of 102 Spanish-listed firms at the close of 2016. Taking into account the sectorial classification from the Madrid stock exchange, companies from the Financial Services1 industry were removed. In line with earlier literature, firm-year observations with positive or zero income taxes were also removed. Our final sample thus comprises a non-balanced panel data with 1,130 firm-year observations for the years 2003–2016. Continuous variables were winsorized at the 1st and 99th percentiles so as to curb the impact of possible outliers. Table 1 shows the distribution of the observations, classified by year and industry.

Table 1. Sample distribution

| Panel A. Observations by year | |

|---|---|

| 2003 | 62 |

| 2004 | 62 |

| 2005 | 67 |

| 2006 | 73 |

| 2007 | 82 |

| 2008 | 81 |

| 2009 | 83 |

| 2010 | 84 |

| 2011 | 85 |

| 2012 | 84 |

| 2013 | 85 |

| 2014 | 87 |

| 2015 | 96 |

| 2016 | 99 |

| Panel B. Observations by industry | |

| Oil and energy | 104 |

| Basic materials, industry and construction | 358 |

| Consumer goods | 312 |

| Consumer services | 179 |

| Real estate | 94 |

| Technology and telecommunications | 83 |

3.2. Variables

3.2.1. Tax burden

Hanlon & Heitzman (2010) offer an extensive discussion on the diverse variables used in empirical tax avoidance studies and specify their advantages as well as drawbacks. In line with our aim, our research focuses on a varied set of tax planning strategies covering certain tax positions which are compatible with current legislation and others that are more uncertain and riskier. Following previous literature, we therefore use the supported effective tax rate (ETR) as a measure of fiscal pressure. According to the analysis carried out by Plesko (2003), this offers the best correlation with the real effective tax rate obtained from tax returns. By drawing on the OSIRIS database, which offers financial information on listed companies from around the globe, we thus calculate the ETR as the ratio between total tax expense and accounting earnings before taxes (Zimmerman, 1983; Rego, 2003; Rodríguez & Arias, 2006; Chen et al., 2010; Monterrey Mayoral & Sánchez Segura, 2015; Balakrishnan et al., 2012; Kubata et al., 2013; McGuire et al., 2014):

\[ETR_{it} = \frac{Total\ tax\ expense_{it}}{{Pre - tax\ income}_{it}}\]

According to Kubata et al. (2013), the ETR offers a number of benefits. First, because it is a variable that is derived from financial statements, investors have access to it over a long period. Second, stakeholders use the ETR to compare firms, both within a given country and across different jurisdictions. For their part, Dyreng et al. (2010) conjecture that annual ETR is frequently instable and might not predict the long-run effective corporate tax rate. Use of annual ETRs to study tax avoidance in the long term may thus give rise to biased conclusions regarding corporate tax performance. In an attempt to overcome this issue, certain authors advocate a long-run measure that has been used in most recent works (Monterrey Mayoral et al., 2010; Ayers et al., 2010; Balakrishnan et al., 2012; Kubata et al., 2013). The current study also uses a long-run tax avoidance measure as an alternative dependent variable. Our research is in the line of Balakrishnan et al. (2012), and defines a 3-year cumulative ETR as follows:

\[{3Y\_ ETR}_{it} = \frac{\sum_{t - 2}^{t}\ Total\ tax\ expense_{it}}{\sum_{t - 2}^{t}\ {Pre - tax\ income}_{it}}\]

3.2.2. Media coverage

Our variable of interest is the level of media visibility (MEDIA). In line with previous studies (Dyck & Zingales, 2002; Tetlock, 2007; Dyck et al., 2008; Core et al., 2008; Joe et al., 2009; Engelberg & Parsons, 2011; Gurun & Butler, 2012; Khunen & Niessen, 2012; Jansson, 2013; Liu & McConnell, 2013; Ahern & Sosyura, 2014; Dai et al., 2014; Lauterbach & Pajuste, 2017; Liu et al., 2017; Peña-Martel et al., 2018), Media is defined as the natural logarithm of the number of news items on a firm reported by the media in each year between 2003-2016. In order to generate our measures of media attention and tone we draw on data from Peña-Martel et al. (2018), which compiles the level of coverage from the FACTIVA database, considering the number of news items offering financial information by firm and year for 1996-2014 in the Spanish financial press (Expansión, El Economista, and Cinco Días) and international press (Dow Jones, Reuters, Financial Times, Wall Street Journal, and Business Wire). These data exclude any news which fails to provide informative content, such as alerts, announcements of dividend payments or quotes. Thus, we are not interested in tax-related media coverage but in all news about a firm and thus, we assume that any news, independently of their nature, might affect corporate tax behaviour. Since our study covers 2003-2016, we complete the previous database by adding fresh data spanning 2015 and 2016.

3.2.3. Control variables

We include a set of different variables which might have an impact on corporate tax rate. Taking into account prior research in the Spanish context (Bona-Sánchez et al., 2011; Bona-Sánchez et al., 2014; López-Iturriaga & Santana-Martín, 2015; Ruiz-Mallorquí & Santana-Marín, 2009; Sacristán-Navarro & Gómez-Ansón, 2007; Santana-Martin & Aguiar-Díaz, 2006) we therefore include the voting rights of the dominant shareholder (VOTE), and employ the control chain approach (Claessens et al., 2000; Faccio & Lang, 2002; La Porta et al., 1999). Fama & Jensen (1983) contend that ownership concentration tends to heighten risk aversion. As certain strategies designed to reduce effective tax rates could prove to be risky, we anticipate there will be a positive link between concentration of voting rights and corporate tax burden (Badertscher et al., 2013; Chen et al., 2010). Rego (2003) argues that economies of scale stemming from tax planning might account for lower ETR levels in multinational firms. They also indicate that ETRs decrease as the multinational firm grows. We thus incorporate two further variables; INTERNAT, which measures the link between international sales and total assets, and SIZE, which is defined as the natural logarithm of total assets. Nevertheless, with regard to this latter variable, it is worth pointing out that the impact of size on ETR remains unclear in earlier studies (Badertscher et al., 2013; Chen et al., 2010; McGuire et al., 2014; Minnick & Noga, 2010; Rego, 2003; Zimmerman, 1983). Also included is the variable return-on-assets (ROA), measured as income before interest and taxes divided by total assets. Again, there is no agreement with regard to what impact this variable has on ETR. Whereas some studies suggest a positive link between profitability and corporate tax burden (Plesko, 2003; Calvé Pérez et al., 2005; Chen et al., 2010), others report a negative relationship (Derashid & Zhang, 2003; Frank et al., 2009; Lisowsky, 2010). In order to control for the impact of debt on corporate tax burden, the variable LEV is included, measured as total debt divided by total assets. Whereas some studies report a negative impact of debt on corporate tax burden (Plesko, 2003; Calvé Pérez et al., 2005; Richardson & Lannis, 2007), others suggest a positive effect (Chen et al., 2010; Feeny et al., 2006). Finally, since prior research has shown that capital intensity (CI) might affect corporate tax planning, the variable CI is included, measured as the total of non-current assets divided by total assets. In this regard, earlier empirical evidence has reported inconclusive findings with regard to what impact CI has on ETR (Chen et al., 2010; Monterrey Mayoral et al., 2010; Plesko, 2003).

3.3. Estimation model

The presence of a statistically significant link between media coverage and corporate tax burden does not indicate the sense of causality. Since we focus on analysing whether media coverage affects corporate tax burden, a statistically significant association between media coverage and tax burden might also be explained by a greater propensity of media coverage towards firms with a lower corporate tax burden. Adequately addressing the different sources of endogeneity thus acquires special relevance in our analysis.

Regressions were therefore estimated using the generalised method of moments methodology (GMM) developed by Arellano & Bond (1991) and modified by Arellano & Bover (1995) and Blundell & Bond (1998). We thus control for the different sources of endogeneity 2 in our models3.

We estimate the following regressions:

\[\begin{equation*} \small \begin{split} ETR_{it} =& \ \alpha_{0} + \alpha_{1}MEDIA_{it} + \alpha_{2}VOTE_{it} + \alpha_{3}INTERNAT_{it}\\ & + \alpha_{4}SIZE_{it} + \alpha_{5}ROA_{it} + \alpha_{6}LEV_{it} + \alpha_{7}CI_{it} + \eta_{k} + \phi_{j} + \varepsilon_{it} \end{split} \end{equation*}\]

The dummy variable \(\eta_{k}\) controls for year effects (changes in tax rules), while \(\phi_{j}\) controls for industry effects, since tax planning might be affected by which industry firms operate in. Finally, \(\varepsilon_{it}\) is the error term.

4. Results

4.1. Descriptive analysis

We first study tax burden over the period 2003-2016. Thus, Table 2 shows the annual evolution of ETR and 3Y_ETR. The annual averages for the two variables are 18.1 and 10 percent, respectively. In both cases, the median value is around 23%, a value consistent with those reported in previous studies on Spanish listed companies (Monterrey Mayoral & Sánchez Segura, 2015; Bona-Sánchez et al., 2019).

Table 2. Descriptive statistics

| Mean | Standard Deviation | Median | Minimum | Maximum | |

|---|---|---|---|---|---|

| ETR | 0.181 | 0.416 | 0.238 | -2.322 | 1.751 |

| 3Y_ETR | 0.100 | 0.503 | 0.235 | -0.150 | 2.399 |

| MEDIA | 4.907 | 1.458 | 4.744 | 0 | 8.768 |

| VOTE | 29.862 | 19.685 | 24.390 | 0.040 | 97.000 |

| INTERNAT | 0.336 | 0.319 | 0.262 | 0.000 | 1.558 |

| SIZE | 13.334 | 1.990 | 13.185 | 9.453 | 17.959 |

| ROA | 0.058 | 0.100 | 0.059 | -0.003 | 0.495 |

| LEV | 0.657 | 0.216 | 0.664 | 0.187 | 0.979 |

| CIE | 0.579 | 0.208 | 0.615 | 0.053 | 0.947 |

ETR is the effective tax rate, measured as total tax income divided by pre-tax income; 3Y_ETR is the 3-year cumulative ETRs. MEDIA, is the natural logarithm of the number of news items on a firm reported by the media in each of the years between 2003-2016. VOTE is the percentage of dominant shareholder’s voting rights. INTERNAT is the relation between international sales and total assets. ROA is the return-on-assets, measured as income before interest and taxes divided by total assets. LEV is total debt divided by total assets. SIZE is the natural logarithm of total assets. CI is capital intensity, measured as non-current assets divided by total assets.

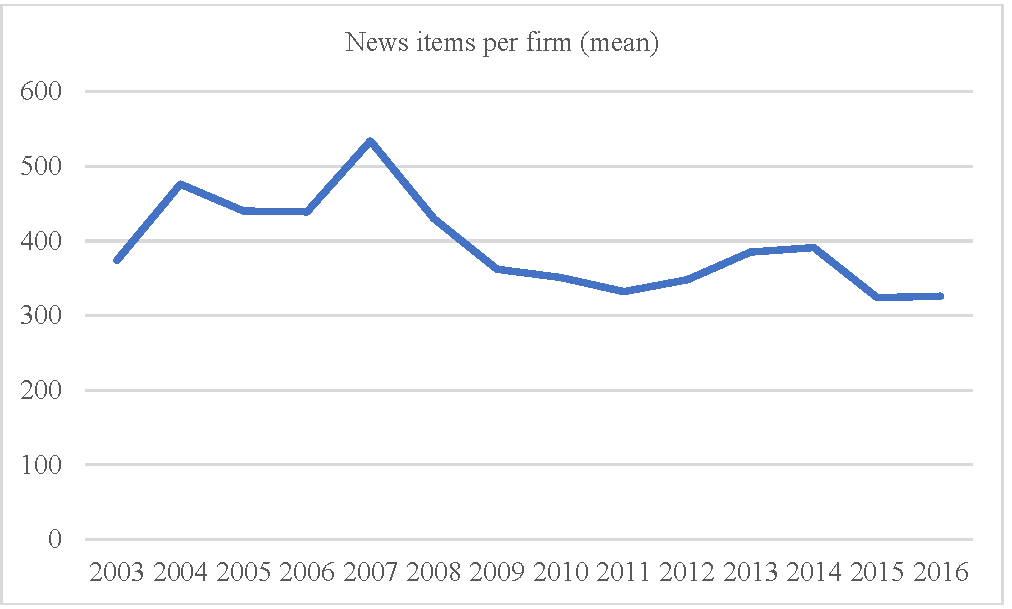

Figure 2 shows the evolution of published news items along the period. News about Spanish firms increased up to 2007, and then decreased after that year. Moreover, the average number of published news items along the whole period is 389, with a median of 114.

Figure 2. Number of published news items along the period

With regard to the correlation matrix, Table 3 shows significant correlation levels between ETR and 3Y_ETR. However, this is not relevant in our research since we never include the two variables in the same regression model at the same time. The variance inflation factor (VIF) is also calculated for each of the regression model variables. As the highest VIF is below 5 (Studenmund, 1997), multicollinearity does not emerge as a problem in our models. These results mean that multicollinearity is not a problem in our sample.

Table 3. Correlation matrix and VIF

| ETR | 3Y_ETR | MEDIA | VOTE | INTERNAT | SIZE | ROA | LEV | VIF | |

|---|---|---|---|---|---|---|---|---|---|

| 3Y_ETR | 0.283*** | ||||||||

| MEDIA | -0.087 | -0.113 | 3.35 | ||||||

| VOTE | -0.070 | -0.048 | -0.009 | 1.05 | |||||

| INTERNAT | 0.166* | 0.039 | 0.067 | -0.124** | 1.11 | ||||

| SIZE | -0.047 | 0.043 | 0.768*** | 0.049 | 0.025 | 3.19 | |||

| ROA | 0.231*** | 0.022 | 0.095 | -0.001 | 0.112* | 0.080 | 1.12 | ||

| LEV | 0.002 | -0.134 | 0.208*** | -0.003 | 0.022 | -0.027 | -0.005 | 1.18 | |

| CI | 0.145* | -0.045 | 0.136** | -0.036 | -0.112* | 0.213*** | -0.004 | -0.114 | 1.32 |

ETR is the effective tax rate, measured as total tax income divided by pre-tax income; 3Y_ETR is the 3-year cumulative ETRs. MEDIA is the natural logarithm of the number of news items on a firm reported by the media in each of the years between 2003-2016. VOTE is the percentage of dominant shareholder’s voting rights. INTERNAT is the relation between international sales and total assets. ROA is the return-on-assets, measured as income before interest and taxes divided by total assets. LEV is total debt divided by total assets. SIZE is the natural logarithm of total assets. CI is capital intensity, measured as non-current assets divided by total assets.

***p < 0.01, **p < 0.05, *p < 0.1

4.2. Media coverage and tax burden

To test our hypothesis, we estimate the regressions considering ETR and 3Y_ETR as dependent variables and the natural logarithm of the number of corporate news (MEDIA) as the independent variable. The results of Models 1 and 2 (Table 4) show a negative and significant incidence of media coverage on corporate tax burden, both when measuring this latter variable by using ETR (Model 1, α1 = -0.038) and 3Y_ETR (Model 2, α1 = -0.018). Thus, we show that media coverage of corporate behaviour shapes managerial attitude towards taxes. In this sense, we provide evidence of a lower tendency to legitimate corporate behaviour through tax policy as media coverage of corporate behaviour increases, thereby reducing corporate tax costs and promoting company competitiveness.

Table 4. Media coverage and tax burden

| Model 1 (ETR) | Model 2 (3Y_ETR) | |

|---|---|---|

| MEDIA | -0.038*** (-3.63) | -0.018*** (-2.73) |

| VOTE | 0.24*** (5.96) | 0.005*** (3.94) |

| INTERNAT | -0.125*** (-2.50) | -0.178*** (-5.65) |

| SIZE | 0.010 (1.29) | 0.09*** (2.82) |

| ROA | 0.447* (1.68) | 0.308* (1.88) |

| LEV | -0.088* (-1.76) | -0.246*** (-3.71) |

| CI | 0.103* (1.80) | 0.130*** (2.22) |

| Industry effect | Yes | Yes |

| Year effect | Yes | Yes |

| Constant | 0.253*** (2.38) | 0.09 (0.79) |

| m2 | 0.09 | 1.04 |

| Z1 | 20.05*** | 16.71*** |

| Z2 | 13.14*** | 41.37*** |

| Z3 | 19.40*** | 13.97*** |

| Hansen test | 54.99 (288) | 54.57 (318) |

| N | 1,130 | 950 |

ETR is the effective tax rate, measured as total tax income divided by pre-tax income; 3Y_ETR is the 3-year cumulative ETRs. MEDIA is the natural logarithm of the number of news items on a firm reported by the media in each of the years between 2003-2016. VOTE is the percentage of dominant shareholder’s voting rights. INTERNAT is the relation between international sales and total assets. ROA is the return-on-assets, measured as income before interest and taxes divided by total assets. LEV is total debt divided by total assets. SIZE is the natural logarithm of total assets. CI is capital intensity, measured as non-current assets divided by total assets. Hansen, test of over-identifying restrictions, under the null hypothesis that all instruments are uncorrelated with the disturbance process. m2, statistic test for lack of second-order serial correlation in the first-difference residual. Z1, Wald test of the joint significance of the reported coefficients. Z2, Wald test of the joint significance of the time dummies. Z3, Wald test of the joint significance of industry dummies.

***p < 0.01, **p < 0.05, *p < 0.1.

As for the control variables, the findings reveal a positive and significant effect of ownership concentration, firm size, profitability and capital intensity on corporate tax burden. In addition, the INTERNAT and LEV coefficients are negative and statistically significant, which shows that as external sales and debt rise, corporate tax burden falls.

4.3. Sensitivity analysis

In this section, we carry out additional analyses in order to endow our results with robustness. First, we use an alternative measure for corporate tax burden, namely cash effective tax rate (e.g., Zimmerman, 1983; McIntyre & Nguyen, 2000; Rego, 2003; Chen et al., 2010; Monterrey Mayoral & Sánchez Segura, 2015). In line with our first measure of effective cash rate we consider two variables: ETR2, defined as cash tax paid divided by pretax book income and 3Y_ETR2, defined as the 3-year cumulative cash tax paid divided by 3-year cumulative pretax book income)4. As shown in Table 5, results are consistent with those obtained in Table 4. Thus, our results are robust to a different measure of corporate tax burden.

In order to analyse the sensitivity of our results to these alternative measures to proxy for media coverage, and in line with earlier research (Ahern & Sosyura, 2014; Core et al., 2008; Hooghiemstra et al., 2015; Peña-Martel et al., 2018), we use two additional measures of media coverage; 1) we consider only news with 50 words or more (MEDIA_50); 2) we consider only news with 50 words or more and which cites the company’s name in the first 25 words (MEDIA_first25). The results obtained when using these alternative measures (see Table 6) are in line with those reported in the main specifications, allowing us to conclude that our results are robust to different measures of media coverage.

Table 5. Media coverage and tax burden. Sensitivity analysis I

| Model 3 (ETR2) | Model 4 (3Y_ETR2) | |

|---|---|---|

| MEDIA | -0.052*** (-4.88) | -0.060*** (-6.37) |

| VOTE | 0.11** (2.23) | 0.002*** (4.10) |

| INTERNAT | -0.111*** (-2.52) | -0.25*** (-6.57) |

| SIZE | 0.045*** (5.20) | 0.071*** (11.45) |

| ROA | 0.064 (0.46) | 0.254** (2.14) |

| LEV | -0.164*** (-2.72) | -0.346*** (-5.22) |

| CI | -0.373*** (-3.71) | -0.251*** (-3.31) |

| Industry effect | Yes | Yes |

| Year effect | Yes | Yes |

| Constant | 0.256* (1.74) | 0.09 (0.79) |

| m2 | 0.20 | -0.95 |

| Z1 | 22.86*** | 88.21*** |

| Z2 | 40.93*** | 19.47*** |

| Z3 | 31.30*** | 87.63*** |

| Hansen test | 68.81 (229) | 62.74 (203) |

| N | 876 | 626 |

ETR2 is our second measure of effective tax rate, measured as cash tax paid divided by pre-tax income; 3Y_ETR is the 3-year cumulative ETR2s. Media is the natural logarithm of the number of news items on a firm reported by the media in each of the years between 2007-2016. VOTE is the percentage of dominant shareholder’s voting rights. INTERNAT is the relation between international sales and total assets. ROA is the return-on-assets, measured as income before interest and taxes divided by total assets. LEV is total debt divided by total assets. SIZE is the natural logarithm of total assets. CI is capital intensity, measured as non-current assets divided by total assets. Hansen, test of over-identifying restrictions, under the null hypothesis that all instruments are uncorrelated with the disturbance process. m2, statistic test for lack of second-order serial correlation in the first-difference residual. Z1, Wald test of the joint significance of the reported coefficients. Z2, Wald test of the joint significance of the time dummies. Z3, Wald test of the joint significance of industry dummies.

***p < 0.01, **p < 0.05, *p < 0.1.

Table 6. Tax burden and media coverage. Sensitivity analysis II

| Model 5 (ETR) | Model 6 (3Y_ETR) | Model 7 (ETR) | Model 8 (3Y_ETR) | |

|---|---|---|---|---|

| MEDIA_50 | -0.041*** (-3.48) | -0.020*** (-2.65) | ||

| MEDIA_first25 | -0.044*** (-3.49) | -0.015** (-2.00) | ||

| VOTE | 0.002*** (3.63) | 0.004 (0.85) | 0.002*** (4.52) | -0.001 (-1.38) |

| INTERNAT | -0.002 (-0.50) | -0.1141*** (-4.89) | -0.043 (-0.99) | -1.159*** (-4.11) |

| SIZE | 0.020 (1.57) | 0.002 (0.30) | 0.019 (1.55) | 0.002 (0.33) |

| ROA | 0.610*** (2.67) | 0.309** (1.95) | 0.430** (2.17) | 0.422*** (3.03) |

| LEV | -0.020 (-0.22) | -0.280*** (-3.96) | 0.053 (0.66) | -0.212*** (-3.58) |

| CI | -0.071 (-1.08) | 0.152*** (2.64) | -0.173*** (-2.62) | 0.183*** (2.90) |

| Industry effect | Yes | Yes | Yes | Yes |

| Year effect | Yes | Yes | Yes | Yes |

| Constant | 0.183 (1.42) | -0.122 (1.19) | 0.076 (0.51) | 0.102 (0.94) |

| m2 | 0.22 | 1.02 | 0.25 | 1.02 |

| Z1 | 17.96*** | 16.07*** | 25.04*** | 14.86*** |

| Z2 | 13.24*** | 12.33*** | 8.06*** | 17.87*** |

| Z3 | 37.68*** | 11.94*** | 11.53*** | 7.32*** |

| Hansen test | 66.17 (307) | 59.25 (277) | 67.07 (307) | 57.38 (298) |

| N | 1,130 | 950 | 1,130 | 950 |

ETR is the effective tax rate, measured as tax income divided by pre-tax income; 3Y_ETR is the 3-year cumulative ETRs. MEDIA_50 is the natural logarithm of the number of news items on a firm reported by the media in each of the years between 2003-2016 considering only news items with 50 words or more. MEDIA_FIRST25 is the natural logarithm of the number of news items on a firm reported by the media in each of the years between 2003-2016 considering only news items with 50 words or more and that mention the company’s name in the first 25 words. VOTE is the percentage of dominant shareholder’s voting rights. INTERNAT is the relation between international sales and total assets. ROA is the return-on-assets, measured as income before interest and taxes divided by total assets. LEV is total debt divided by total assets. SIZE is the natural logarithm of total assets. CI is capital intensity, measured as non-current assets divided by total assets. Hansen, test of over-identifying restrictions, under the null hypothesis that all instruments are uncorrelated with the disturbance process. m2, statistic test for lack of second-order serial correlation in the first-difference residual. Z1, Wald test of the joint significance of the reported coefficients. Z2, Wald test of the joint significance of the time dummies. Z3, Wald test of the joint significance of industry dummies.

***p < 0.01, **p < 0.05, *p < 0.1.

In addition, although the MGM estimation limits the problems derived from endogeneity, they do not completely eliminate them. We thus make alternative specifications by using the instrumental variables approach in order to ensure greater robustness in our estimations. Specifically, we use economic uncertainty as an instrument of media coverage, since such uncertainty is likely to affect the media’s informational role (Franklin, 2014). The level of media coverage is thus first predicted using the UNCERTAINTY variable. This variable is obtained from the Index of Economic and Political Uncertainty prepared by Baker et al. (2016)5. In addition, other control variables are used, such as the presence of a family in the company’s control (FAMILY) 6, the company’s belonging to the main Spanish stock market index (IBEX35)7, or the size of the company, in line with the work by Peña-Martel et al. (2018). From the estimated values of media coverage, corporate tax pressure is then estimated. The results obtained from the first stage (models 9 to 11, Table 7) show that uncertainty is an adequate predictor of media coverage, such that the increase in uncertainty positively affects the informative role of the media. In addition, the results obtained in the second stage (Models 12 to 17, Table 7) provide support for the results of previous estimates; that is, media coverage reduces corporate tax burden.

Table 7. Tax burden and media coverage. Sensitivity analysis III

| 1st stage | 2nd stage | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Model 9 (MEDIA) | Model 10 (MEDIA_50) | Model 11 (MEDIA_25) | Model 12 (ETR) | Model 13 (3Y_ETR) | Model 14 (ETR) | Model 15 (3Y_ETR) | Model 16 (ETR) | Model 17 (3Y_ETR) | ||

| MEDIA | -0.171*** (-2.64) | -0.180*** (-3.67) | ||||||||

| MEDIA_50 | -0.270*** (-4.58) | -0.196*** (-3.38) | ||||||||

| MEDIA_first25 | -0.241*** (-2.84) | -0.327*** (-4.68) | ||||||||

| VOTE | 0.256*** (5.43) | 0.060 (1.07) | 0.501*** (9.49) | 0.397*** (6.88) | 0.540*** (-17.01) | 0.392*** (6.39) | ||||

| INTERNAT | -0.137*** (-3.88) | -0.016 (-0.56) | -0.026 (-0.81) | -0.060* (-1.95) | -0.076* (-1.71) | -0.057* (-1.82) | ||||

| SIZE | 0.155*** (2.82) | 0.175*** (2.75) | 0.173*** (2.76) | 0.031* (1.74) | -0.020 (-1.20) | 0.075*** (4.07) | 0.018 (0.83) | 0.068*** (3.53) | -0.045* (-1.76) | |

| ROA | 0.304*** (4.01) | 0.356** (2.53) | 0.886*** (11.69) | 0.075 (0.42) | 1.63*** (7.10) | 0.111*** (-6.57) | ||||

| LEV | -0.010 (-0.16) | -0.609*** (-5.84) | -0.178*** (-3.74) | -0.267*** (-3.64) | -0.09* (-1.81) | -0.328*** (-4.19) | ||||

| CI | 0.069 (1.17) | 0.135** (2.50) | 0.411*** (4.07) | 0.018 (0.83) | 0.451 (6.08) | 0.239*** (4.29) | ||||

| UNCERTAINTY | 0.002*** (3.34) | 0.007*** (4.72) | 0.001*** (3.07) | |||||||

| FAMILY | -0.364* (-1.69) | -0.268 (-1.30) | -0.296 (-1.15) | |||||||

| IBEX35 | 0.383*** (2.60) | 0.453*** (3.07) | 0.386*** (3.03) | |||||||

| Industry effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |

| Year effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | |

| Constant | 2.407*** (3.28) | 2.159** (2.56) | 1.543* (1.86) | 0.692*** (5.17) | 0.488** (2.26) | 1.218*** (8.73) | 0.519*** (2.69) | 0.964*** (5.28) | 0.613*** (5.34) | |

| Adj. R2 | 0.65 | 0.67 | 0.64 | |||||||

| F test | 10.86*** | 8.50*** | 13.55*** | 517.36*** | 833.22*** | 614.41*** | 434.53*** | 419.05*** | 371.00*** | |

| N | 1,130 | 1,130 | 1,130 | 1,130 | 950 | 1,130 | 950 | 1,150 | 950 | |

ETR is the effective tax rate, measured as tax income divided by pre-tax income; 3Y_ETR is the 3-year cumulative ETRs. MEDIA is the natural logarithm of the number of news items on a firm reported by the media in each of the years between 2003-2016. MEDIA_50 is the natural logarithm of the number of news items on a firm reported by the media in each of the years between 2003-2016 considering only news items with 50 words or more. MEDIA_FIRST25 is the natural logarithm of the number of news items on a firm reported by the media in each of the years between 2003-2016 considering only news items with 50 words or more and that mention the company’s name in the first 25 words. VOTE is the percentage of dominant shareholder’s voting rights. INTERNAT is the relation between international sales and total assets. ROA is the return-on-assets, measured as income before interest and taxes divided by total assets. LEV is total debt divided by total assets. SIZE is the natural logarithm of total assets. CI is capital intensity, measured as non-current assets divided by total assets. UNCERTAINTY, Index of Economic and Political Uncertainty prepared by Baker et al. (2016). FAMILY is a dummy variable that takes the value 1 when the company is controlled by a family, and zero otherwise. The dominant owner of a company is considered to be a family when an individual or family is the first shareholder of the company and owns at least 20% of the company. IBEX35 is a dummy variable that takes the value 1 when the company is part of the IBEX35, and zero otherwise.

***p < 0.01, **p < 0.05, *p < 0.1.

Moreover, the media might frame interpretations concerning a firm’s behaviour in positive and negative terms. In this regard, previous studies focusing on the media’s disciplinary role have evidenced that negative media coverage can induce companies to make substantive strategic changes aimed at reducing future negative coverage and at enhancing the likelihood of subsequent positive coverage, such as CEO dismissal, changes in compensation agreements, financial reporting, financial performance, and other governance-related outcomes (Joe et al., 2009; Bednar et al., 2013). To provide further robustness to our results vis-à-vis a relevant legitimation role for the media in a continental European setting, we explore whether firms show a greater need to resort to tax policy to restore legitimation of corporate behaviour in cases where the media threaten the legitimation of corporate behaviour due to a combination of wider media coverage and a more negative tone of said coverage. Should our results hold, companies subject to a greater level of media attention, combined with a more negative (positive) tone of media coverage, will show higher (lower) effective tax rates. In order to assess the negative tone of media coverage, and in line with previous studies (Gurun & Butler, 2012; Liu & McConell, 2013; Ahmad et al., 2016; Liu et al., 2017), we identify words with a negative tone in the economic and financial field as compiled by Loughran & McDonald (2011). We define the variable NEG_TONE as the total number of words with a negative tone divided by the total number of words in the media for a particular company every year. As shown in Table 8 (Models 18 and 19), the results are consistent with our prediction and evidence that companies where the media threaten corporate legitimation show a greater likelihood of resorting to tax policy to restore corporate legitimation. This explains a lower tendency to adopt tax policies aimed at decreasing corporate tax burden in companies subject to broader media coverage and where there is a more negative tone of the coverage.

Finally, we have also checked the influence of IFRS in our analysis. Firstly, we have used the Chow test to check the existence of a possible structural change along the period. The Chow test allow us to check if our regression coefficients are different for split data sets. Thus, it tests whether one regression line or two separate regression lines best fit a split set of data. We have considered two different sub-samples to check the Chow test (before and after IFRS) and the results do not evidence the presence of structural change along the period. Secondly, we have re-run our regressions including a dummy variable that takes the value of 1 for the years post IFRS, and 0 otherwise. The results of the regressions (Models 20 and 21 in Table 9) confirm the significant and negative effect of media coverage on corporate tax burden, providing consistent evidence to our previous findings.

Table 8. Tax burden and negative tone of news. Sensitivity analysis IV

| Model 18 (ETR) | Model 19 (3Y_ETR) | |

|---|---|---|

| NEG_TONE | 0.175*** (6.17) | 0.063*** (2.87) |

| VOTE | 0.006*** (7.97) | 0.006*** (7.82) |

| INTERNAT | -0.152** (-2.33) | -0.335*** (-7.13) |

| SIZE | 0.010 (1.44) | 0.053*** (5.82) |

| ROA | 0.482** (2.07) | 1.112*** (9.19) |

| LEV | -0.129** (-2.21) | -0.337*** (-3.09) |

| CI | 0.195** (2.07) | 0.786*** (7.31) |

| Industry effect | Yes | Yes |

| Year effect | Yes | Yes |

| Constant | -0.127 (-0.92) | 0.674 (0.27) |

| m2 | -0.88 | 0.19 |

| Z1 | 26.85*** | 24.44*** |

| Z2 | 13.65*** | 11.92*** |

| Z3 | 6.88*** | 13.30*** |

| Hansen test | 55.44 (71) | 69.23 (68) |

| N | 1,130 | 950 |

ETR is the effective tax rate, measured as tax income divided by pre-tax income; 3Y_ETR is the 3-year cumulative ETRs. NEG_TONE is the number of total words with a negative tone divided by the number of total words in the media of a particular company every year. VOTE is the percentage of dominant shareholder’s voting rights. INTERNAT is the relation between international sales and total assets. ROA is the return-on-assets, measured as income before interest and taxes divided by total assets. LEV is total debt divided by total assets. SIZE is the natural logarithm of total assets. CI is capital intensity, measured as non-current assets divided by total assets. Hansen, test of over-identifying restrictions, under the null hypothesis that all instruments are uncorrelated with the disturbance process. m2, statistic test for lack of second-order serial correlation in the first-difference residual. z1, Wald test of the joint significance of the reported coefficients. z2, Wald test of the joint significance of the time dummies. z3, Wald test of the joint significance of industry dummies.

***p < 0.01, **p < 0.05, *p < 0.1.

Table 9. Media coverage and tax burden. Sensitivity analysis V

| Model 20 (ETR) | Model 21 (3Y_ETR) | |

|---|---|---|

| MEDIA | -0.030*** (-3.10) | -0.019 *** (-2.72) |

| VOTE | 0.22*** (6.60) | 0.004*** (3.94) |

| INTERNAT | -0.06 (-1.61) | -0.177*** (-5.27) |

| SIZE | 0.044 (0.66) | 0.002 (0.22) |

| ROA | 0.618*** (3.11) | 0.530*** (3.79) |

| LEV | -0.065*** (-2.71) | -0.32*** (-3.93) |

| CI | 0.17*** (0.51) | 0.199*** (3.27) |

| IFRS | 0.125*** (5.83) | 0.061 (0.42) |

| Industry effect | Yes | Yes |

| Year effect | Yes | Yes |

| Constant | 0.376*** (4.11) | 0.260*** (5.64) |

| m2 | 0.05 | 0.98 |

| Z1 | 21.36*** | 23.00*** |

| Z2 | 11.98*** | 18.43*** |

| Z3 | 18.73*** | 15.52*** |

| Hansen test | 57.46 (292) | 57.98 (328) |

| N | 1,130 | 950 |

ETR is the effective tax rate, measured as total tax income divided by pre-tax income; 3Y_ETR is the 3-year cumulative ETRs. MEDIA is the natural logarithm of the number of news items on a firm reported by the media in each of the years between 2003-2016. VOTE is the percentage of dominant shareholder’s voting rights. INTERNAT is the relation between international sales and total assets. ROA is the return-on-assets, measured as income before interest and taxes divided by total assets. LEV is total debt divided by total assets. SIZE is the natural logarithm of total assets. CI is capital intensity, measured as non-current assets divided by total assets. Hansen, test of over-identifying restrictions, under the null hypothesis that all instruments are uncorrelated with the disturbance process. m2, statistic test for lack of second-order serial correlation in the first-difference residual. Z1, Wald test of the joint significance of the reported coefficients. Z2, Wald test of the joint significance of the time dummies. Z3, Wald test of the joint significance of industry dummies. ***p < 0.01, **p < 0.05, *p < 0.1.

5. Conclusions

The media collect, aggregate, disseminate and amplify information (Bushee et al., 2010). Insiders are therefore sensitive to media coverage. In this sense, some studies reveal a disciplinary role for the media through the latter’s limiting aggressive corporate tax behaviour (Kanagaretnam et al., 2018). Our results show the presence of a new actor which significantly shapes corporate tax planning and particularly the firm’s tendency to implement strategies aimed at decreasing corporate tax burden; namely, media coverage. Specifically, in a continental European setting, we show that media coverage confers legitimation on corporate behaviour, such that companies coming under greater media coverage are more likely to employ strategies designed to decrease corporate tax burden. Our findings therefore suggest that media coverage and corporate tax policy are substitution mechanisms in the search for corporate legitimation, such that companies subject to closer media scrutiny will show less need to resort to tax policy in order to legitimate corporate behaviour, thereby promoting the firm’s competitive advantage through a decrease in corporate tax burden. Our results also show that when the media threaten the legitimation of corporate behaviour due to the combination of wider media coverage coupled with a more negative tone of the coverage, firms show a greater need to resort to tax policy as a way to restore the legitimation of corporate behaviour.

We therefore offer some important contributions to previous literature. First, our results complement the literature on the determinants of corporate tax policy (Dyreng et al., 2010; Badertscher et al., 2013; McGuire et al., 2014) by showing a new driver of corporate tax strategies aimed at decreasing corporate tax burden; namely, media coverage. Second, we extend current knowledge on the real consequences of increased public scrutiny of corporate behaviour (Allen et al., 2015; Dyreng et al., 2016) and particularly on the role of the media in shaping insiders’ incentives to resort to strategies aimed at decreasing corporate tax burden. Third, since we focus on media coverage and on a variety of tax strategies that range from ordinary tax-minimizing policies to more contentious strategies that might potentially give rise to more aggressive tax positions, our results add to previous findings investigating the media’s disciplinary role in limiting aggressive corporate tax planning (Kanagaretnam et al., 2018). Fourth, our research design allows us to better capture firms’ search for legitimation in the frame of their corporate tax planning. We thus contribute to the more recent line of research on the media’s role as social arbitrator and its potential effect on corporate tax planning. Media coverage is therefore seen to play a key role in the economic system by legitimising corporate behaviour and decreasing the firm’s need to resort to alternative and more costly mechanisms to legitimise its behaviour. Finally, our findings suggest that the media play a crucial role in corporate tax planning, thereby enhancing our knowledge of the part played by certain extra-legal mechanisms in shaping corporate tax policies.

The results of the current study are conditional upon the way we measure media attention. Thus, contrary to previous studies concerned with the disciplinary role of the media in limiting aggressive tax policy, we are concern with any news about a firm, independently of their nature, and its potential effect on corporate tax burden. Thus, our results are dependent on previous assumption and provide preliminary evidence that should be complemented with similar studies accomplished in other institutional setting or that use alternative measures of media coverage. We leave this inquire for future research.