The influence that collective bargaining represents on companies listed on the Colombian Stock Exchange: An empirical analysis

ABSTRACT

Despite the conventional coverage of trade unions and the different strategies and agreements that private sector organisations have used to lessen trade union power and collective bargaining, collective bargaining has had an impact on stock markets in Colombia. The aim of this paper is analyse if the signing of a firm level collective agreement has informative content for the investors of Colombian Stock Market.The results show that the signing of an agreement is interpreted as bad news in those companies with greater union strength, on the other hand, the market reacts positively in those companies where the union loses power.

Keywords: Collective bargaining; Latin American; Stock exchange; Trade unions.

JEL classification: G14; J30; J51.

La influencia que representa la negociación colectiva en las empresas que cotizan en la Bolsa de Valores de Colombia: Un análisis empírico

RESUMEN

A pesar de la cobertura convencional de los sindicatos y de las diferentes estrategias y acuerdos que las organizaciones del sector privado han utilizado para disminuir el poder sindical y la negociación colectiva, no cabe dudad de que esta última ha tenido un impacto en los mercados de valores en Colombia. El objetivo de este trabajo es analizar si la firma de un contrato colectivo a nivel de empresa tiene contenido informativo para los inversores de la Bolsa de Valores de Colombia. Los resultados muestran que la existencia del convenio colectivo es interpretada como una mala noticia en aquellas empresas con mayor fuerza sindical; por otro lado, el mercado reacciona positivamente en aquellas empresas donde el sindicato pierde poder.

Palabras clave: Negociación colectiva; América Latina; Bolsa de valores; Sindicato.

Códigos JEL: G14; J30; J51.

1. Introduction

It is well known that the daily stock prices of firms quoted on the stock market are conditioned by a series of key dates and events, such as announcements of dividends, equity issues, mergers, earnings or profit warnings, and collective agreements1.In particular, investors having equities of firms involved in collective agreements are exposed to potential negative effects on firm’s quotation due to uncertainty on wage negotiations. Thus, investors internalize the underlying information enclosed in these events to avoid potential negative effects in market portfolios as a result of stock price fluctuations.

Collective bargaining has several effects on the performance of firms2. Labour agreements may raise wage increase labour costs and thereby reduce profits, if investors believe that a wage’s increase is not compensating with an increase in labour marginal productivity they expect abnormal negative returns because firm’s profits fall. We assume that risk-averter investors manage their market portfolio taking into account industrial relations between employers and unions at firm-level.

This is the first work in Latin America that analyses the effect that a labour event, such as the signing of a collective agreement, has on the behaviour of the share price of companies listed on the Colombian Stock Exchange 3.

Our first hypothesis is that a firm-level collective agreement is incorporated as negative information when investors exhibit risk aversion. Then, when risk averter investors have notice of a firm-level collective agreement, it is expected that they may negotiate shares of this firm by a bear performance of the price of its shares in order to avoid potential losses due to a decrease in the firm’s profits. An increase in wages not compensated by increases in productivity may reduce the present value of firm’s profits and, as a consequence, the firm’s stock price falls. If the firm-level agreement increases productivity to offset the effect of wages’ increments, firm’s profits should be at least equal or larger than those in the previous situation and, accordingly, firm’s stock price should be the same or slightly high. In this sense, the impact of collective agreement can be measured without specifying production functions or the length of time required to adjust factor inputs. Moreover, since firm’s profits include the effects of both high wages and high product prices, the net effect of the labour agreement can be measured without ambiguity.

Colombian collective bargaining is a worker’s right, in effect since 1991, recognized by Constitutional Law. This right is exercised by free election of representatives by all workers in the company, if they belong to a union. Workers’ representatives constitute work councils that are entitled to bargain wages and employment conditions at firm level only for unionised workers in a Collective Agreement.

The company may negotiate its own terms with the other non-unionised workers, in what is called the Collective Pact, whose sole purpose is to discourage trade union membership and abandon the collective agreement. To this end, Colombian companies offer better salaries in the pact than those negotiated with the unions.

This anti-union practices, allows the proliferation of collective pact in companies. These pacts, which improve the wages of the collective agreements, are offered by the employer to those non-unionized workers, which causes the number of unionized workers to decrease and reduces the power of the union in the company, given the lesser support of the workers. In this scenario, where the union has less scope for action and, therefore, less strength in the company, we propose our second hypothesis is that a firm-level collective agreement it is incorporated as positive information when the firm has collective pact.

The empirical results confirm our hypotheses and show how a firm-level collective agreement lead to changes to a firm’s share price, whilst controlling the possible effects that the country's macroeconomic situation may have such as the exchange rate of the Colombian peso with respect to the US dollar and the volatility. In this way, it checked to see if any effect or reaction that arises in the Market is due to the circumstances of the Market and not to the event itself.

The rest of the paper is structured as follows. Section 2 establishes the legal process of collective bargaining in Colombia and differentiates the forms of collective bargaining around the world. Sample and methodology are included in Section 3. Section 4 contains empirical results. Section 5 provides evidence about the influence of firm’s characteristics in cumulative abnormal returns. Section 6 gives conclusions.

2. Labour relation in Colombia

In terms of labour market events which are common across Western European countries, collective bargaining is one with a most distinctively “European flavour”. Admittedly, both the coverage rate of collective bargaining and the legal rules under which collective bargaining is conducted vary widely across countries. Nevertheless, there are some key characteristics shared by the collective bargaining system of some European countries which are not observed in the US and UK.

Collective bargaining across (Continental) Europe is mostly organized under an “open-shop” rule, so that agreements are extended to all workers within the scope of the agreement, independently of their union status, on the contrary, Anglo-Saxon countries are under the “closed-shop system”, meaning that agreements affect only to unionised workers.

Besides, collective bargaining across (Continental) Europe is frequently structured around multiple levels of negotiation (national, industry, firm…), while in other countries, as in the US, only a single level of bargaining (firm-level bargaining) is operative. In fact, in those countries individual negotiation of salaries with the workers is quite common.

One of the main differences between the “open shop system” and the “close-shop system” is that under the “close-shop system” there are just agreements negotiated by the unions. As consequence, the results of the agreements are only applicable to unionized workers. It could therefore be argued that the effect of the salary increases on the firm’s earnings after a collective agreement could be lower than in an “open shop system”. This fact could be essential if one is to understand differences between the US or UK and Continental countries. Besides, under the “closed-shop system” it is possible to bargain lower wages in the same firm. For example, Thomas & Kleiner (1992) found that two-tier wage agreement (a concession made by union and employees) resulted in small but significant increases in shareholder’s wealth because for the workers the wages became lower.

Colombia's collective bargaining system has characteristics of both negotiating systems. it is a hybrid system mentioned above. In Colombia the idea of collective bargaining is associated with certain risks such as a decrease in the price of shares and due in part to this narrative trade union coverage is decreasing and unions are losing power. Further loss in status has occurred because companies have employed strategies to decrease the chances of their workers being unionised. Although the Ministry of Labour currently regulates the area, it is difficult to find the necessary to carry out studies and thus there have not been any studies on the topic in Colombia or in the rest of Latin America over the last three decades.

In Colombia the history of labour relations comes in two stages as a general phenomenon in terms jurisprudential labour relationships, before and after 1991. At the beginning of century XX the legal labour legislation was strong especially in the form of worker association, the right to association and right to strike. These appeared in the context of the positive law (Hernandez , 2004)

Labour relations in Colombia are regulated under the constitution of 1991, the substantive labour code and other laws in concordance with the guidelines of the international labour organization ILO, and this, according with Kalmanovitz (2011), represented a big change during the XX century. Labour conflicts, social security and other benefits were regulated by collective bargaining during the liberal republic period and Frente Nacional4. However, during the 90´s there was a reduction in these rights, due to demands for flexibility within the labour market.

Collective bargaining is a key economic strategy of Colombian trade unions, however, the rate of collective bargaining is decreasing, because companies are using common agreements as collective agreements – collective pact5- that hinder the guarantee of the rights of workers, social protest freedom and integrity of the trade union movement, currently, with a coverage of 60% (Escuela nacional sindical, 2018). Things such as informal agreements, threats of violence and impunity (ITUC, 2019), make mobilization and social protest difficult. Additionally, despite the political constitution of the right, collective and social action is still criminalised in some forms. Nevertheless, despite the restrictions on collective action, union actions have increased in recent years.

According to Sarkis & Merlano (2000) developed countries have archived greater evolution, in terms of collective bargaining, than developing countries, even though, the objective in the declaration of the international labour conference was to promote programs for all nations that allow the right to collective bargaining. The labour market in Latin America has strong economics characteristics, with “major political, organizational, and legal constraints on centralized bargaining and on decentralized representation and low skill levels, high labour regulation, short job tenure, a large informal sector, and small, politicized unions that lack plant level representation” (Schneider & Karcher, 2010)

Collective bargaining in Colombia is a process that firstly requires the existence of unions and additionally an announcement of the termination of prior collective pacts or agreements 60 days before the finalisation, by the union and the employer. The complaint is made by designated negotiator with a formal list of requests in order to initiate the bargaining. The period may take 20 to 40 calendar days; finally, the company and trade union must make the results public. (Ministerio de protección social Colombia, 2011)

If there is no total or partial settlement, a mechanism called arbitration or a strike tribunal is established, within 10 days after the termination of the direct settlement. The workers, giving notice to the Ministry of Labour and Social Security of at least 5 business days, must unanimously decide the strike. This must take place within a minimum of 2 business days of the declaration or within a maximum of 10 days. If the strike is extended for more than 60 days, the legality of the strike is a decided by the labour judges and the criteria on the exercise of right to strike is decided in accordance with the agreement of the ILO6 and the intervention of the Ministry of Labour and Social Security. A decision of a court of arbitration requires employees return to work within 3 days’ maximum. (Ministerio de protección social Colombia, 2011)

The arbitration tribunal will be held when the unanimous vote of the workers cannot come to an agreement for not more than 10 days. The validity of the arbitration is a maximum of 2 years. (Ministerio de protección social Colombia, 2011)

3. Sample and methodology

Our sample covers firms quoted on the Colombian Stock Market that signed a firm-level collective agreement between January 2 2014 and December 31 2018.7 We proceeded as follows. First, we obtained the 135 firm-level collective agreements signed in firms quoted on the Colombian stock market from the Ministry of Labour. As zero momento, we consider the date on which the firm-level agreement was signed. We check that it is correct by conducting a data search in economic press and in the website of the EMI Data Base and Superintendencia Financiera de Colombia8. We found that the announcement of the agreement is published on the very day that the agreement is signed.

Second, we selected the length of the event window in order to test abnormal behaviour in the magnitudes of the sample firms. Although most information on collective agreements is usually quickly incorporated into stock prices, information may sometimes leak out before formal publication, or publication may be delayed. Then, we considered five days before and after the zero moment.

In the case of Colombia, a collective agreement requires the publishing of the text of the agreement and the date of the signing in the Ministry of Labour. Once the text as drafted by unions and firms is signed (zero moment), it is filed with the Public Registry for Agreements at the Department of Employment. The average time between signing the agreement and registration is five days, assuming that the latest time that the information is made public is when it is filed with the registry. The market may often know about the agreement days before it is signed. This is the case when there is a pre-agreement which usually gets media coverage. However, before any type of agreement is reached, both parties (the firm and unions) do not leak information to the press in order not to endanger the final agreement. Therefore, the event is analysed as non-anticipated.

Firms which happen to have more than one relevant announcement within the event window (mergers, splits, dividend announcements...) were excluded from the sample to avoid any potential confusing effects. The remaining sample after these exclusions, consisted of 89 firm-level collective agreements for 7 sectors according to the two-digit sector classification. The industries are: trade and other services, other manufacturing industries, cement, glass and construction materials, finance, transport and communications, utilities and construction. The distribution of the sample among sectors and years is illustrated in Table 1. Concerning the distribution among sectors, over 50% of firm-level collective agreements are for other manufacturing (40), cement and glass (17) and finance (14).

In addition, companies who signed a collective agreement with unionized workers, with the rest of the workers being part of collective pact, were analysed. In these cases, the unionised workers are going to have a lower salary than the rest. One the anti-union policies that companies in Colombia carry out to discourage union membership is to improve the conditions of the agreement through a pact.

We generated two subsamples, one composed of companies only with collective agreement (N = 57) and another subsample composed of companies with pact and agreement (N = 32)

In the Table 1 it can be seen that the sectors with more agreement belong to other manufacturing industries, of the 40 companies registered in this sector with an agreement, 18 of them also had a collective pact for non-union workers. Among utilities, for example, the firms only have collective agreements and finance, 10 firms have agreement and four companies have agreement and pact. The information was drawn from the Thomson Database.

Table 1. Sample distribution by Sector and Collective Agreement /Pact N=89

| Sector | Agreement and Pact | Only Agreeement |

|---|---|---|

| OMI | 18 | 22 |

| CGC | 7 | 10 |

| FINAN | 4 | 10 |

| CONS | 1 | |

| UTILITIES | 12 | |

| TOS | 1 | |

| TC | 2 | 2 |

| TOTAL | 32 | 57 |

The table shows the distribution by sector and collective agreement / collective pact, according to the two-digit sector classification. The industries are: OMI=Other Manufacturing Industries; UT=Utilities, TC=Transport and Communication; CGC=Cement, Glass and Construction Materials, TOS=Trade and Other Services, and FINAN= Financial. Source: Own construction.

As already mentioned in the introduction, the aim is to explore whether collective bargaining at firm level has an impact on a firm’s stock price. To this purpose Event Study technique is used9.

Since stock prices reflect the true value of a company and change immediately in response to any event that may potentially affect the company’s future cash-flows, the impact on the corporate value of a given event can be measured by observing stock price changes over a very short time period around the date of the event. The variable is the occurrence of abnormal returns in companies signing a collective agreement around the date of the event. In order to calculate this, the return given by the market model as normal will be used.

\[\begin{equation} \label{eq1} \small R_{it} = \alpha_{i} + \beta_{i}R_{mt} + \varepsilon_{it} \ \ \ \ (1) \end{equation}\]

Where R_{it} is the return on company i on day t; \(R_{mt}\) is the return on the market portfolio on day t; \(\alpha_{i}\) is the expected return on company; i, which is independent from the market; \(\beta_{i}\) is the sensitivity of the return on company i to changes in market return; and \(\varepsilon_{it}\) is a random perturbation. The market portfolio is represented by the COLCAP index.

As occurs in most studies on events that affect several companies on the same date, there is an overlap of events in the estimation periods, so it must be taken into account that the residuals \(\varepsilon_{it}\) are not independent, but are correlated. In addition, a frequent heteroscedasticity problem can arise in cross-sectional analyses. An appropriate regression model when considering heteroscedasticity and contemporary correlation of residuals is the Seemengly Unrelated Regressions (SUR) model10. This model proposes that the correlation of the contemporary residuals is different from zero and the non-contemporary residuals equal to zero.

Therefore, instead of estimating the classic market model for each event by OLS, we will use the system of equations (2), estimating the coefficients by GLS. This will allow us to have better estimation results taking into account temporal correlations and cross-section heteroscedasticity.

\[\begin{equation} \label{eq2} \small \begin{split} & R_{1t}=\alpha_{1}+\beta_{1}R_{mt}+\varepsilon_{1t} \\ & R_{2t}=\alpha_{2}+\beta_{2}R_{mt}+\varepsilon_{2t} \\ & R_{nt}=\alpha_{n}+\beta_{n}R_{mt}+\varepsilon_{nt} \\ \end{split} \ \ \ \ (2) \end{equation}\]

Estimating this system of equations allows calculating the daily abnormal returns (RAit) for a news item from company i:

\[\begin{equation} \label{eq3} \small AR_{it} = R_{it} - (a_{i} + b_{i} R_{mt}) \ \ \ \ (3) \end{equation}\]

Where ai and bi are the GLS estimates obtained in the regressions (2) by using a period of 145 days before the announcement. This is an appropriate period of time for estimating the parameters according to available empirical evidence on event study11 12. Abnormal returns from stocks are averaged in a cross section throughout each day of the event window or study window, producing the average daily abnormal returns ARt

Considering that the market may anticipate information regarding the event or that delays may occur in its announcement, there is an event period of 11 days around the date that the collective agreement is signed: from day T1=-5 to day T2=+5. For a more comprehensive analysis, the cumulative abnormal returns CAR(t1, t2) were calculated in order to find the cumulative effect of the event.

If the signing of a firm-level collective agreement conveys new information to investors, the expected value of the abnormal returns must be significantly different from zero. In order to test this hypothesis, the bootstrap technique was used. An analysis of the evolution of abnormal returns in the study window indicates that some of the distributions are slightly biased and present leptokurtosis. Jarque-Bera’s test does not validate the normal distribution of the sample and, therefore, the proposed hypothesis must be tested using a non-parametric test. This study likewise incorporates a non-parametric test based on the bootstrap methodology13.

Next, how a firm-level collective agreement may lead to changes to a firm’s share price was empirically investigated, controlling the possible effects that the country's macroeconomic situation may have such as the exchange rate of the Colombian peso with respect to the US dollar (TRM) and the volatility of the COLCAP calculated as the standard deviation of the COLCAP the previous 260 days by the root of 260.

The Market Representative Exchange Rate –TRM Tasa representativa del mercado– is the weighted average for the amount of the operations of buying and selling United States dollars in exchange for Colombian legal currency, agreed for compliance in both currencies on the same day of trading14.

\[\begin{equation} \label{eq4} \small R_{it} = \alpha_{i} + \beta_{1i}R_{mt} + \beta_{2i}Volatility + \beta_{3i}TRM + \varepsilon_{i} \ \ \ \ (4) \end{equation}\]

Where \(R_{it}\) is the return on company i on day t; \(R_{mt}\) is the return on the market on day t; \(\alpha_{i}\) is expected return of company i that is independent of the market; \(\beta_{1i}\) is the sensitivity of the return on company i to variations in market return; \(\beta_{2.3\ i}\) is the sensitivity of the return on company i to the volatility of the COLCAP and the exchange rate respectively, and \(\varepsilon_{it}\) is a random perturbation.

In this way it was checked whether any effect or reaction that arises in the Market is due to the macroeconomics circumstances of the Market and not to the event itself.

Different variables were used in order to test the relationship between abnormal returns on a firm and its business characteristics, a dummy variable (Agreement) that assigns 1 as a value if the firm only has Collective Agreement and 0 if the firm has Collective Pact also, has been created. The following variables are also used to characterize firms: Size, measured as the market capitalisation, Employment, number of employees, Productivity: Sales/ Employees and Labour costs in the year the agreement is signed; Labour drift as the labour cost per employee in the year of the agreement minus the labour cost per employee the previous year (the variable is a percentage). Assets and Debt, all variables in thousand Pesos. The source of the variables was obtained from Thomson Database and Ministry of Labour. Finally, with regards to the variables of the agreement itself, defining the Coverage, the workers covered by firm-level collective agreements, as derived from data retrieved from the Union Archive of Ministry of Labour. In Table 2 we can see the definition of the study variables.

Table 2. Definition of Variables

| Variable | Description |

|---|---|

| Rit | Return on company i on day t |

| Rmt | Return on the market on day t; Colpcap Index |

| ARit | Abnormal Returns ARit=Rit-(ai+biRmt) Where ai and bi are the GLS estimates obtained in the regressions by using a period of 145 days before the announcement. |

| CARit | Cumulative Abnormal Returns ∑AR |

| TRM | The Market Representative Exchange Rate the weighted average for the amount of the operations of buying and selling United States dollars in exchange for Colombian legal currency, agreed for compliance in both currencies on the same day of trading. |

| Volatility | Volatility of the COLCAP calculated as the standard deviation of the COLCAP the previous 260 days by the root of 260. |

| Industry | Dummy variable per industry |

| Agreement | Dummy variable that assigns 1 as a value if the firm only has Collective Agreement and 0 if the firm has Collective Pact |

| Size | Market capitalisation, in thousand Pesos. |

| Employment | Number of employees |

| Productivity: | Sales/ Employees |

| Labour costs | Labour cost in the year the agreement is signed, thousand Pesos |

| Labour drift | The labour cost per employee in the year of the agreement minus the labour cost per employee the previous year (the variable is a percentage) |

| Assets | Accounting Asset, thousand Pesos |

| Debt | Accounting Debt, thousand Pesos |

| Coverage | The workers covered by firm-level collective agreements, as derived from data retrieved from the Union Archive of Ministry of Labour. |

We created two subsamples based on the strength of the union. In the whole sample, all companies have an agreement, but some of them also have a collective pact, which indicates that the union is less powerful. In Table 3 we can see the main differences between these two groups of companies in averages: size, number of employees, labour costs and productivity The data is for the year the collective agreement is signed.

Table 3. Descriptive Analysis. Mean, Median and Standard Desviation. N=89

| Pact and Agreement Sample | SIZE | EMPLOYMENT | LABOR COST | LABOR DRIFT | PRODUCTIVITY | ASSETS | DEBT | COVERAGE |

|---|---|---|---|---|---|---|---|---|

| Mean | 8,97E+06 | 11.657,60 | 9,76E+08 | 0,081751 | 2,21E+07 | 1,97E+10 | 5,24E+09 | 83,80538 |

| Median | 1,11E+07 | 17.112,00 | 6,77E+08 | 0,083895 | 1,62E+07 | 1,15E+10 | 2,12E+09 | 88 |

| Std. Desviation | 3,71E+06 | 7.482,97 | 4,81E+08 | 0,029206 | 2,60E+07 | 2,90E+10 | 8,19E+09 | 21,49056 |

| Agremment Sample | ||||||||

| Mean | 1,87E+07 | 10.140,40 | 9,00E+08 | 0,080138 | 7,25E+06 | 4,49E+10 | 1,07E+10 | 32,37476 |

| Median | 1,29E+07 | 9.150,00 | 5,56E+08 | 0,069543 | 1,25E+06 | 1,89E+10 | 7,31E+09 | 28 |

| Std. Desviation | 3,33E+07 | 9.674,73 | 8,61E+08 | 0,137424 | 1,65E+07 | 5,10E+10 | 1,16E+10 | 12,71233 |

Size, measured as the market capitalisation, in thousand Pesos; Employment, number of employees in the year the agreement is signed; Labour costs in thousand pesos; Labour drift as the labour cost per employee in the year of the agreement minus the labour cost per employee the previous year (the variable is a percentage); Productivity: Sales/ Employees in thousand Pesos. Assets and Debt are in thousand Pesos. Coverage the workers covered by firm-level collective agreements, as derived from data retrieved from the Union Archive of Ministry of Labour. Source: Own construction.

Considering the Size variable as market value, the largest companies don´t have a pact and only sign a collective agreement. The average of size of these companies is around 18.000 million Colombian pesos, compared to companies with pact agreements that have a value of 9.000 million pesos. They are also bigger in terms of Assets and Debt. This result coincides with the previous empirical evidence where the largest companies are targeted by the union given their greater financial capacity15.

Labour costs are similar in both groups of companies, as are the number of employees, the increase in wages and productivity. They are companies with similar characteristics, except in what refers to the number of workers affected by the agreement, in the case of those that only have this type of agreements, around 1,400 employees, on the other hand, the workers covered by the agreement in those companies that also have a pact have around 60 employees.

As we have argued in the introduction, we hope that non-pact companies are the ones that present the most uncertainty for the investor given the power of the union. Table 3 shows that the companies without a pact are those where the number of workers covered by the agreement negotiated by the union is much higher, therefore this result already shows that possibly this profile of companies presents greater risk for the investor given the power that the union exercises in the workers.

Let us remember that in the case of Colombia, which follows a hybrid bargaining system between the closed and the shop system, collective agreements are only applicable to unionized workers, unlike what happens in Spain, for example, where the results of the agreement are applied. to all workers regardless of whether they are members of a union or not.

Regarding the percentage of women hired, it is similar in both groups of companies, on average 30%.

4. Results

Below we present the results of the event study. In the first place, in tables 4 and 5, we analyse daily and cumulative abnormal returns of the companies that sign the 89 collective agreements throughout the sample period. On the other hand, we analyse how the group of companies with a collective agreement and pact behaves. Table 4 in part 1 shows the results of the significance tests for abnormal returns for 89 collective agreements. The first panel shows the daily abnormal returns for each day during the event window (-5, +5) and the non-parametric bootstrap technique. The most significant changes in returns take place on the day prior the agreement is signed. Average daily abnormal returns on the before day are -0, 235%, and the bootstrap test give significant values of -2.10. Average abnormal returns on the event day are of -0.003%; negative and non-significant for bootstrap test. The sharpest reduction in stock prices takes place on day -1, while the rest of the days do not present significant abnormal returns

Table 4. Daily abnormal returns, AR. Bootstrap Technique. N=89

ARit=Rit-(ai+biRmt) Where ai and bi are the GLS estimates obtained in the regressions Rit=αi+β1iRmt+β2iVolatility + β3iTRM+ εI; Where Rit is the return on company i on day t; Rmt is the return on the market on day t; the volatility of the COLCAP and TRM the exchange rate. Source: Own construction.

| Day | -5 | -4 | -3 | -2 | -1 | 0 | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Results Market Model | |||||||||||

| AR | -0,00043 | -0,00143 | 0,00149 | 0,00048 | -0,00232** | -0,00003 | 0,00008 | -0,00010 | -0,00099 | -0,00096 | -0,00004 |

| t statistic | -0,27369 | -1,38533 | 1,0124 | 0,4933 | -2,10100 | -0,02825 | 0,06334 | -0,06874 | -1,02933 | -0,78158 | -0,03468 |

| P value | 0,8004 | 0,1694 | 0,2410 | 0,6068 | 0,0272 | 0,9612 | 0,9262 | 0,9036 | 0,3098 | 0,3920 | 0,9744 |

| Results Market Model with Volatility | |||||||||||

| AR | -0,00050 | -0,00151 | 0,00143 | 0,00044 | -0,00244** | -0,00009 | 0,00000 | -0,00018 | -0,00105 | -0,00104 | -0,00013 |

| t statistic | -0,30646 | -1,46117 | 1,00251 | 0,43472 | -2,15610 | -0,07526 | -0,00238 | -0,11538 | -1,10854 | -0,79467 | -0,08816 |

| P value | 0,73980 | 0,14120 | 0,23780 | 0,65080 | 0,01900 | 0,95600 | 0,98440 | 0,84620 | 0,30580 | 0,40760 | 0,91940 |

| Results Market Model with TRM | |||||||||||

| AR | -0,00059 | -0,00152 | 0,00149 | 0,00041 | -0,00237** | -0,00012 | 0,00005 | 0,00002 | -0,00106 | -0,00094 | -0,00003 |

| t statistic | -0,36753 | -1,47119 | 1,01692 | 0,40863 | -2,09710 | -0,10037 | 0,04044 | 0,00993 | -1,08211 | -0,76068 | -0,02227 |

| P value | 0,68580 | 0,13960 | 0,22520 | 0,67720 | 0,02920 | 0,92640 | 0,94060 | 0,95560 | 0,29400 | 0,41420 | 0,96140 |

*Significant at 10%. ** Significant at 5%. *** Significant at 1%.

To control the possible effect that the country's macroeconomic situation may have on the behavior of prices, we carried out the same analysis incorporating the volatility and TRM variables to the market model (See equation 4)

Observing part 2 and 3 in Table 4 the results are the same, which is, the exchange rate and volatility of the COLCAP have no effect on the behaviour of the market in the event window, so the reaction shown on the day before the agreement was signed is due to the labour event. Only on the day before the signing can abnormal returns be seen. Average daily abnormal returns on the day before of the event are -0.24% and -0.23% respectively, both significant for the bootstrap test.

Table 5. Cumulative Abnormal Returns, CAR. Bootstrap Technique. N= 89

CAR=∑ARit ; ARit=Rit-(ai+biRmt) Where ai and bi are the GLS estimates obtained in the regressions Rit=αi+β1iRmt+β2iVolatility + β3iTRM+ εI; Where Rit is the return on company i on day t; Rmt is the return on the market on day t; the volatility of the COLCAP and TRM the exchange rate. Source: Own construction.

| Window | (-5,+5) | (-3,+3) | (-2,+2) | (-1,+1) | (-5,-1) | (+1,+5) |

|---|---|---|---|---|---|---|

| Market Model | ||||||

| CAR | -0,00429 | -0,00142 | -0,00194 | -0,00233 | -0,00227 | -0,00199 |

| t statistic | -1,33215 | -0,53116 | -0,83255 | -1,33511 | -0,98444 | -0,70748 |

| P value | 0,19300 | 0,58980 | 0,39800 | 0,18780 | 0,38060 | 0,46920 |

| Market Model and Volatility | ||||||

| CAR | -0,00505 | -0,00188 | -0,00228 | -0,00254 | -0,00259 | -0,00236 |

| t statistic | -1,26091 | -0,67792 | -0,87870 | -1,37235 | -1,11461 | -0,74998 |

| P value | 0,20280 | 0,51680 | 0,36720 | 0,18880 | 0,29600 | 0,41520 |

| Market Model and TRM | ||||||

| CAR | -0,00463 | -0,00244 | -0,00202 | -0,00156 | -0,00258 | -0,00192 |

| t statistic | -1,35103 | -1,39098 | -0,84344 | -0,57371 | -1,08562 | -0,66430 |

| P value | 0,19240 | 0,16720 | 0,40140 | 0,57660 | 0,30780 | 0,49340 |

*Significant at 10%. ** Significant at 5%. *** Significant at 1%.

Table 5 summarises the cumulative abnormal market returns by means of different windows around the event. Cumulative average abnormal returns in event window (-5, +5) are -0.43%, not significant. The same result is observed for windows (-2, +2) and (-1, +1). We also observe significant negative abnormal returns in post-event windows, such as (+1, +5) non-significant for bootstrap. If we consider the value of cumulative average abnormal returns, we can see that the lowest value (i.e. the period in which stock prices suffer the sharpest falls) is the period between day -5 and day +5. Cumulative average abnormal returns for window (-5, -1) are -0.22%; -0.23% for (-1, +1) not significant for bootstrap.

The results are maintained by controlling the macroeconomic variables, so that none of the analysed windows presents significant results.

The study was extended to a wider event window – (-30, +30) days – although no significant changes were detected as regards the margin for window (-5, +5).

As we have argued in the introduction, if investors are risk-averse, their response to signing a company agreement could vary depending on the power that the union has in the company, as it could change their perception of risk. We recall that Table 3 showed important differences between companies with and without a pact, which could be decisive in the behaviour of their profitability

Table 6 shows the results for the subsample of companies with agreements and pact, and Table 7 shows the results for the subsample of companies with only agreements.

Table 6. Abnormal variables, Bootstrap Technique. Subsample with Agreement and Pact N=32

The table show the effect of a firm level collective agreement on the market variables for subsample with agreement and pact. The variables are: AR= abnormal daily returns; CAR= cumulative abnormal returns; bootstrap. CAR=∑ARit ; ARit=Rit-(ai+biRmt) where ai and bi are the GLS estimates obtained in the regressions Rit=αi+β1iRmt+ εI; Where Rit is the return on company i on day t; Rmt is the return on the market on day t; Source: Own construction.

| DAY | AR | T. Statistic | P value |

|---|---|---|---|

| -5 | -0,00188 | -0,64387 | 0,50300 |

| -4 | -0,00120 | -0,67220 | 0,51920 |

| -3 | 0,00010 | 0,07905 | 0,96040 |

| -2 | -0,00017 | -0,10744 | 0,93840 |

| -1 | 0,00158 | 1,05659 | 0,35080 |

| 0 | 0,00392** | 2,26651 | 0,01540 |

| 1 | 0,00602*** | 2,73663 | 0,00080 |

| 2 | 0,00101 | 0,64578 | 0,51420 |

| 3 | -0,00028 | -1,00000 | 0,15840 |

| 4 | -0,00061 | -0,35564 | 0,68000 |

| 5 | -0,00247 | -0,96968 | 0,32240 |

| Window | CAR | T. Statistic | P value |

| (-5,+5) | 0,00548 | 1,00000 | 0,15560 |

| (-2,+2) | 0,01171 | 1,00000 | 0,15180 |

| (-3,+3) | 0,01208*** | 4,28604 | 0,00000 |

| (-1,+1) | 0,01127*** | 6,32008 | 0,00000 |

| (-5,-1) | -0,00154 | -0,52008 | 0,59280 |

| (+1,+5) | 0,00333 | 1,00000 | 0,15440 |

*Significant at 10%. ** Significant at 5%. *** Significant at 1%.

Table 6 shows the results for those companies whose non-unionized workers have a pact agreement, so they have better working and economic conditions than their unionized colleagues who have signed an agreement. This type of practice is common in Colombia and also in the USA, where companies act with impunity in the face of the pressure they exert on workers to prevent them from forming a union.

Table 6 shows positive abnormal returns significantly different from zero, on the day of the event, and the day after signing with + 0.39% and + 0.60% respectively. Analyzing the cumulative effect of the event, the results are even more powerful, showing positive abnormal cumulative returns + 1.20% and +1.1% in the windows (-3, + 3) and (-1, + 1) respectively, both significant for bootstrap. The presence of positive abnormal returns, both daily and accumulated, show that the event has informative content for the market, but the sign of the returns indicates that for this profile of companies with a pact agreement, the market reading of the signature of an agreement is very different. In these companies, the signing of the collective agreement implies a lower salary for the workers under the agreement than the workers under the pact. The results are maintained by controlling the macroeconomic variables.

The 1991 Constitution in Colombia caused a significant loss of social and labor rights for unionized workers. The privatization of a large part of the Colombian business network meant, with this reform of the constitution, the dismantling of the strongest unions in the country. Law 50 of 1990 allowed subcontracting through temporary work agencies and self-employed cooperatives, which made the creation of unions even more difficult since these workers, the majority in many companies, are not hired by the company itself. (El congreso de Colombia, 1990)

Workers who, being hired by the company, decide to unionize, encounter all kinds of anti-union practices by the employer, one of which is the creation of the Collective Pact. In these pacts, better working and economic conditions are offered to workers to avoid unionization. According to the union census prepared by the Ministry of Labor, it shows that the unionization rate in Colombia, which is around 4%, is one of the lowest in Latin America.

On the other hand, according to previous empirical evidence, (Cuesta, 2005), unionized workers are qualified workers, since they do have a contract in the company. Therefore, this result shows that for the investors of these companies the signing of an agreement implies good news, because it represents a loss of rights and benefits, since the agreement's salary is always less than the pact.

Let us see what happens now with the investors of the companies that sign an agreement and have no collective pact. A priori, it is already telling us that unions have more strength in the company and that workers under this agreement on average will charge more than their non-union colleagues.

Table 7. Abnormal variables, Bootstrap Technique. Subsample with only agreement. N=57

The table show the effect of a firm level collective agreement on the market variables for subsample with only agreement. The variables are: AR= abnormal daily returns; CAR= cumulative abnormal returns; bootstrap. CAR=∑ARit ; ARit=Rit-(ai+biRmt) where ai and bi are the GLS estimates obtained in the regressions Rit=αi+β1iRmt+ εI; Where Rit is the return on company i on day t; Rmt is the return on the market on day t; Source: Own construction.

| DAY | AR | T. Statistic | P value |

|---|---|---|---|

| -5 | 0,00070 | 0,39689 | 0,68540 |

| -4 | -0,00174 | -1,30754 | 0,19620 |

| -3 | 0,00263 | 1,06320 | 0,20480 |

| -2 | 0,00102 | 0,79176 | 0,39960 |

| -1 | -0,00569*** | -3,62854 | 0,00000 |

| 0 | -0,00316** | -1,95002 | 0,04900 |

| 1 | -0,00452*** | -3,37011 | 0,00160 |

| 2 | -0,00102 | -0,38773 | 0,64260 |

| 3 | -0,00156 | -1,21616 | 0,28180 |

| 4 | -0,00124 | -0,70617 | 0,46040 |

| 5 | 0,00186 | 1,14634 | 0,27500 |

| Window | CAR | T. Statistic | P value |

| (-5,+5) | -0,01221*** | -2,72147 | 0,00680 |

| (-2,+2) | -0,01183*** | -3,88559 | 0,00020 |

| (-3,+3) | -0,01288*** | -4,85022 | 0,00000 |

| (-1,+1) | -0,01293*** | -8,09858 | 0,00000 |

| (-5,-1) | -0,00284 | -0,83211 | 0,49360 |

| (+1,+5) | -0,00647 | -1,20586 | 0,07420 |

*Significant at 10%. ** Significant at 5%. *** Significant at 1%.

Significant negative abnormal returns are observed for bootstrap the central days of the event window, with -0.57%, -0.31% and -0.45% on days 1-, 0 and 1 respectively. Looking at the cumulative effect of the event there are four windows, of those analyzed, with negative cumulative abnormal returns, significantly different from zero, in the windows (-5, +5), (-2, +2) (-3, +3) and (-1. +1) all significant at 1%. The results are maintained by controlling the macroeconomic variables.

These results show us that the signing of an agreement, in this profile of companies without a pact, is interpreted as bad news. This result is in line with those obtained for the Spanish Market (See Sabater y Laffarga, 2011) where the signing of a collective agreement is interpreted like a negative event due to the loss of purchasing power of the shareholder, an increase in labor costs implies less accounting benefit and lower future cash flows for the investors.

Based on the results obtained, we confirm both study hypotheses, which is, the signing of a company collective agreement has informative content for the Colombian Stock Market. The signing of a company agreement is interpreted as bad news by the investor given the increase in wages that the agreement implies and the loss of wealth for the investor, with the exception of those companies with a pact where the agreement implies lower wages, and is interpreted in a positive way.

5. Trade-off between firm`s characteristics and cumulative abnormal returns.

Next, through a regression analysis, we will try to determine what characteristics of the company in terms of the sector to which it belongs, size, salary increase, productivity, number of workers covered by the agreement and of course, if the company has collective pact for its non-unionized workers, will be some of the variables that we are going to analyse if they have any explanatory power in the abnormal returns obtained in the sample. Given that many of these variables present a high correlation between them, and given the impossibility of working with all of them together in linear regression, we applied the decision tree technique. The idea is to explain changes on cumulative abnormal returns, CAR_{i} (t1,t2), in the study window through some firm’s characteristics and market environment.

\[\begin{equation} \label{eq5} \small \begin{split} CAR_{i} (-5, +5) =& \ \sum \beta_{k} Industry_{i} + +\beta_{8}Size_{i} + \beta_{9}Agreement_{i} \\ & + \beta_{10}LabourDrift_{i} + \beta_{11}Assets_{i} \\ & + \beta_{12}Produc_{i} + \beta_{13}Coverage_{i} + \mu \end{split} \ \ \ \ (5) \end{equation}\]

Industry is included as dummy variable per industry, the criterion for the classification of firms follows the Colombian Market classification as has been shown in Table 1. A dummy variable, Agreement, that assigns 1 as a value if the firm only has Collective Agreement and 0 if the firm has Collective Pact also. Size is market value. Explanatory variables aimed at explain the most immediate consequences resulting by the agreement are included. Labour Drift is taken to be the expected change in labour costs. Productivity clauses are included as Produc, which are sales per employee. Finally, Coverage is used to measure the number of workers subject to an agreement.

If investors behave according to the terms of the agreement, firms with high wage increases, large number of employees, and high union presence (measured by Coverage) should be most penalized by the market. Contrary to this, firms that agree on productivity clauses should be less penalized because it is supposed that wage increases are compensated by a high marginal productivity.

A preliminary analysis of the correlation matrix of variables shows multicollinearity, this problem is solved using Decision Tree. Although this is a new statistical method in the accounting discipline, it has been used in other fields of scientific research (Lunetta et al., 2004; Lee et al., 2006; Amorós , 2015; Pérez Martín et al., 2018). It also has several characteristics which make it very suitable for the set of variables used in this study and the objective pursued. This method prevents the use of other models such as multiple regression models where the target variable must follow a normal distribution, residuals must be independent and variance constant, which is not met in this study. This method also presents an excellent performance in prediction and classification tasks, comparable to support vector machines. It is used to discover patterns in data; patterns are gathered and organized into models that are later used to establish relations of dependence between variables, thereby permitting a comparison between the impairment method and the amortisation method. Apart from this, it shows good predictive behaviour, even when the majority of the variables are noisy, and moreover, it does not require a pre-selection of the variable, which is to say, it shows a strong robustness with respect to the set of characteristics. It can work with a mix of categorical and continuous explanatory variables. Finally, it includes interactions between explanatory variables, and besides returning important measures of the objective variable; it establishes an order of importance between the explanatory variables.

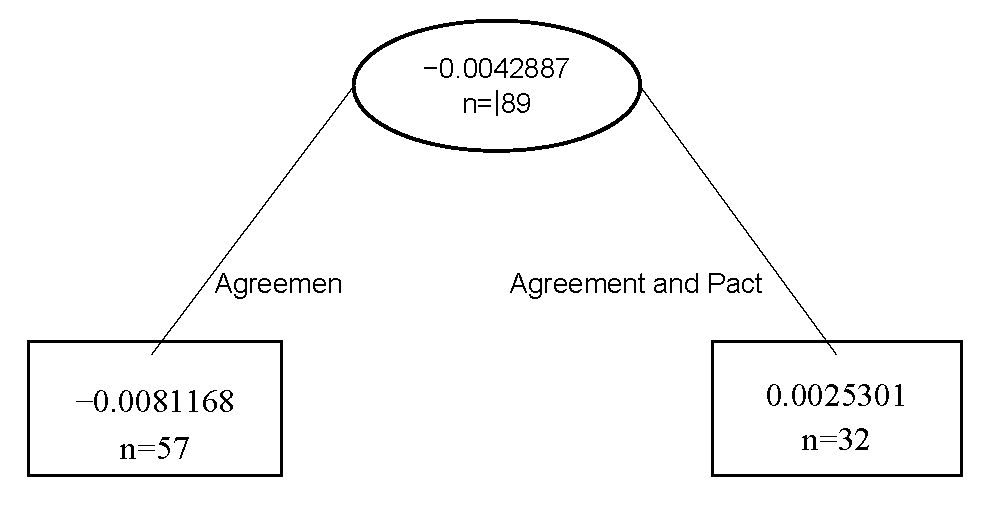

In figure 1 we can see in graphic terms, applying this technique, how the abnormal returns accumulated in the event window behave with respect to the dummy variable Agreement that we remember measures whether the company has an agreement as well as a pact.

Figure 1. Decision Tree. Dummy Agreement

Cumulative Abnormal Returns \(CAR_{i} (-5, +5) = \sum \beta_{k}Industry_{i} + \beta_{8}Agreement_{i} + \beta_{11}Assets_{i} + \beta_{13}Coverage_{i} + \mu\), Industry is included as dummy variable per industry. Agreement, that assigns 1 as a value if the firm only has Collective Agreement and 0 if the firm has Collective Pact also, Coverage used to measure the number of workers subject to an agreement.

Source: Own construction.

The results show how the abnormal returns observed on the days of the event window are conditioned by the presence of a collective pact in the company. In fact, it is observed that companies with an agreement only, which are a total of 57 events, present negative accumulated abnormal returns in the window (-5, + 5). On the other hand, companies that in addition to signing an agreement in a collective convention, have a collective pact, present positive abnormal returns for the 32 events that were considered.

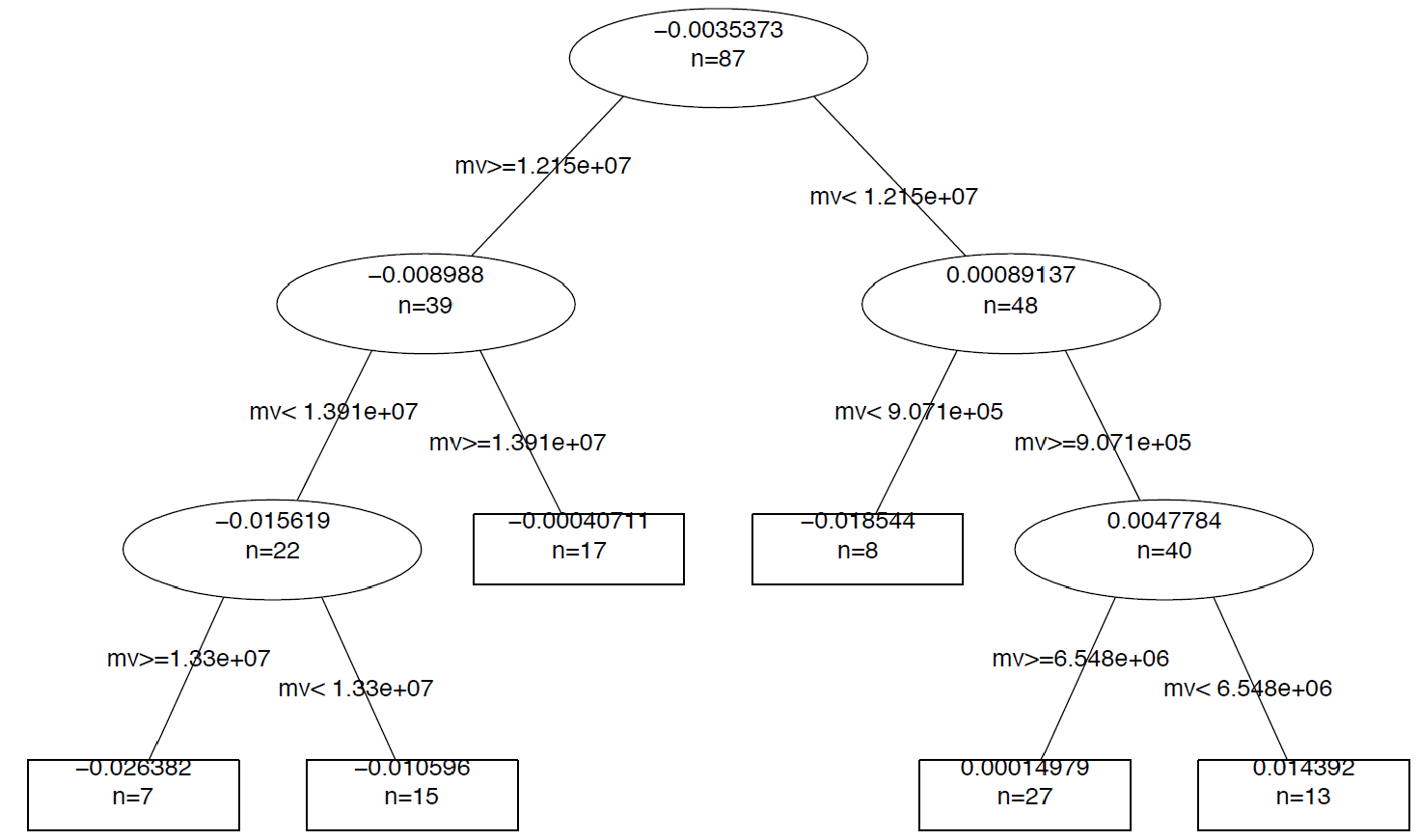

Figure 2. Decision Tree. Size (mv)

Cumulative Abnormal Returns \(CAR_{i} (-5, +5) = \sum \beta_{k}Industry_{i} + + \beta_{8}Size_{i} + \beta_{11}Assets_{i} + \beta_{13}Coverage_{i} + \mu\), Industry is included as dummy variable per industry, Size is market value, Coverage used to measure the number of workers subject to an agreement.

Source: Own construction.

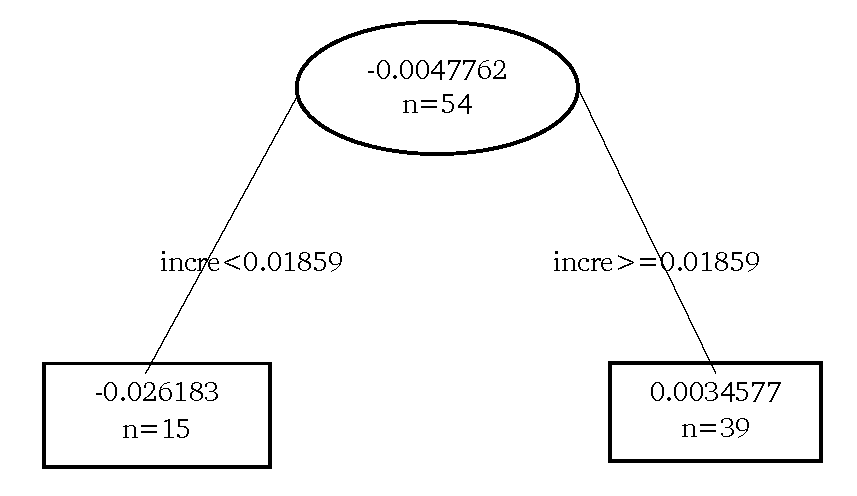

Figure 3. Decision Tree. Labor Drift (incre)

Cumulative Abnormal Returns \(CAR_{i} (-5, +5) = \sum \beta_{k}Industry_{i} + + \beta_{10}LabourDrifti_{i} + \beta_{11}Assets_{i} + \beta_{13}Coverage_{i} + \mu\), Industry is included as dummy variable per industry, Labour Drift is taken to be the expected change in labour costs, Coverage is used to measure the number of workers subject to an agreement.

Source: Own construction.

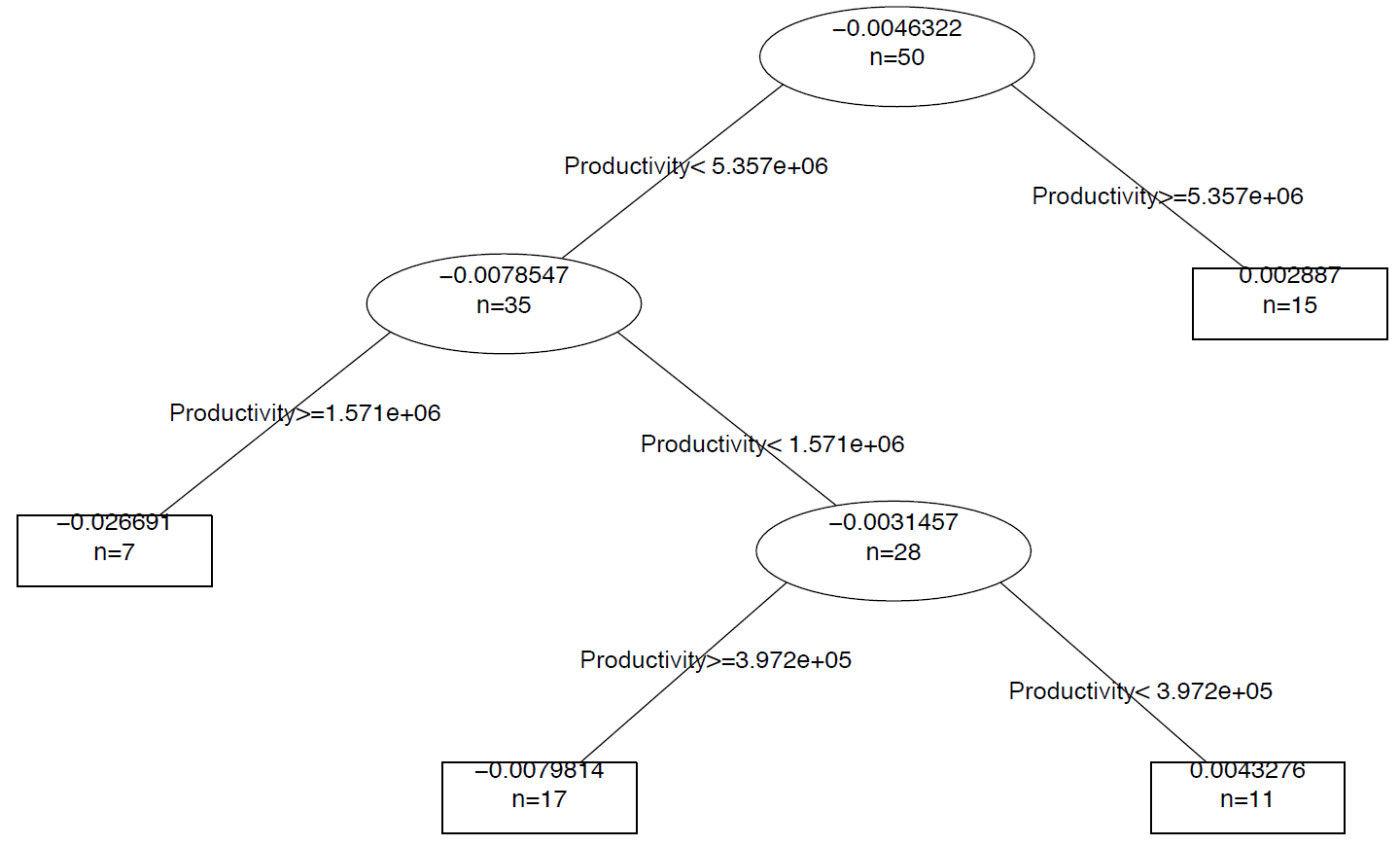

Figure 4. Decision Tree. Productivity

Cumulative Abnormal Returns \(CAR_{i} (-5, +5) = \sum \beta_{k}Industry_{i} + \beta_{11}Assets_{i} + \beta_{12}Produc_{i} + \beta_{13}Coverage_{i} + \mu\), Industry is included as dummy variable per industry, Productivity which are sales per employee, Coverage is used to measure the number of workers subject to an agreement.

Source: Own construction.

In figure 2 we can see how the largest companies are, measured by market capitalization size, they are the most penalized. This result does not coincide with other studies (Abowd, 1989) that argue that larger companies are less penalized for the greater quantity and quality of information they offer to the market. In this case, given that they are the largest companies, those without a collective pact, the presence of a strong union is more important to the investor than size. This result is maintained using Assets as a measure of size. Variable LaborDrift in figure 3 has a positive impact on abnormal returns. As Abowd (1989) argues, during the negotiation of the new collective agreement, rational investors will adjust the value of investors’ wealth to reflect all the information about future and expected labour cost.

Regarding Productivity in figure 4, one can observe that the productivity effect on abnormal returns is positive. It is argued that those firms that agree to high productivity in the collective agreement compensate for the negative effect of higher wages (Clark, 1984). Then, investors expect to recover the additional labour cost in the form of extra productivity since they expect to bear the full financial burden of any unexpected increase in labour cost.

Finally, the union coverage, the sectors to which the companies belong and the other variables analyzed do not show a significant effect on the accumulated abnormal returns.

6. Conclusions

The signing of a firm-level collective agreement is an aspect that analysts and investors take into account due to the impact it may have on future cash flows, which has given rise to a wide field of financial research. There are several works (Inurrieta, 1997; Sabater & Laffarga, 2006; Sabater & Laffarga, 2011; Gutiérrez & Sabater, 2012) that show the informative content that this type of events has for the Market, but this is the first in Latin America. Previous empirical evidence has focused on those countries with an Open Shop bargaining system, such as Spain, or Closed Shop, such as the US (Ruback & Zimmerman, 1984).

The idiosyncrasy of collective bargaining in Colombia, full of nuances and peculiarities, offers the researcher multiple scenarios under analysis. The presence of collective pact in companies is synonymous with union strength. But anti-union practices are frequent, and unpunished, which leads management to agree with the rest of non-union workers a collective pact that improves the economic and labor conditions of the agreement, and therefore, of unionized workers.

Our results show that the signing of a collective agreement has informative content for the Market, but the sign and magnitude depends on the power of the union in the company. Those larger companies, with more union presence, where unionized workers negotiate and sign their terms in an agreement, are more penalized by the Market, as evidenced by the presence of negative abnormal returns significantly different from zero. In contrast, in smaller companies, where management nullifies the effect of the agreement through pacts, the market interprets it positively, thus rewarding investors for companies with positive abnormal returns. These results are consistent when we control the effect that the country's macroeconomic situation could have, in terms of Colcap volatility and the exchange rate of the Peso against the Dollar.

When the bargaining system is closer to the Open Shop, we see that, both in the case of Spain and Colombia, the signing of an agreement is interpreted as bad news due to the increase in salaries, greater union strength, and lower future flows of cash for the investor. On the other hand, when the collective bargaining behaves like a Closed Shop, the market reacts positively, a result that is closer to those achieved in the USA and Canada.

Finally, through the Decision Trees technique, where we avoid the problem of multicollinearity between the explanatory variables, we find that the presence of a pact, the size of the company as well as the salary increase and productivity are explanatory variables of the abnormal returns observed in the study window.

The idiosyncrasy of the Colombian labor market allows two opposite reactions in the same market, making the sign of the reaction depend on the power that the union has in the company, which shows the importance that collective bargaining has, not only in wages and employment, but also, in the investor behavior.