Impact of Environmental Disclosure on Firm Performance: The Mediating Role of Green Innovation

ABSTRACT

This study focuses on the impact of environmental disclosure on financial performance. Moreover, the current study aims to explore the mediating impact of green innovation and provide novel evidence regarding this relationship using stakeholder and signalling theory. This study used a sample dataset comprising Chinese firms listed on Shanghai and Shenzhen stock exchange for the period of 2005--2016. In our measurement model, green innovation is the partial mediator between the positive relationship of environmental disclosure and firm performance. Empirical results show that environmental disclosure affects firm financial performance directly and positively influences it through green innovation in Chinese firms. The study suggests that Chinese firms have implications for improved performance by increasing environmental disclosure and green practices.

Keywords: Patents; Signalling; Stakeholder; Mediation effect; Environmental disclosure; Environmental accounting; Green innovation; Firm performance; China.

JEL classification: L25; Q51; Q56.

Impacto de la divulgación de información medioambiental en el rendimiento de las empresas: El papel mediador de la innovación verde

RESUMEN

Este estudio se centra en el impacto de la divulgación de información medioambiental en los resultados financieros. Además, el presente estudio tiene como objetivo explorar el impacto mediador de la innovación verde y proporcionar evidencia novedosa con respecto a esta relación utilizando la teoría de las partes interesadas y de la señalización. Este estudio utilizó una muestra que comprende empresas chinas que cotizan en las bolsas de Shanghái y Shenzhen durante el período 2005-2016. En nuestro modelo de medición, la innovación verde es el mediador parcial entre la relación positiva de la divulgación ambiental y el rendimiento de la empresa. Los resultados empíricos muestran que la divulgación medioambiental afecta directamente al rendimiento financiero de la empresa e influye positivamente en él a través de la innovación verde en las empresas chinas. El estudio sugiere que las empresas chinas podrían mejorar su rendimiento aumentando la divulgación medioambiental y las prácticas sostenibles.

Palabras clave: Patentes; Señalización; Partes interesadas; Efecto de mediación; Divulgación medioambiental; Contabilidad medioambiental; Innovación verde; Rendimiento de la empresa; China.

Códigos JEL: L25; Q51; Q56.

1. Introduction

Global warming arising out of industrial waste mismanagement became quite alarming around the globe for the past few decades. China became the top CO2 emitter among the six largest emitters including the U.S., European Union (EU28), India, Russia, and Japan, right after the WTO participation with a rapid increase in manufacturing accompanying a simultaneous swift spike of CO2 emissions. Thus, the sustainable development objective of the organization is hampered (Yamano & Guilhoto, 2020; Wu et al., 2018). To cope with these contemporary challenges present for corporations, pretty much equally in emerging and developed economies needed to shift their focus toward induction of sustainable practices. Therefore, researchers in academia, as well as practitioners, have an upsurge interest for studying Corporate Social Responsibility (CSR) and its different dimensions (product safety, employee rights, protection of investor rights, environment protection, creditor rights, societal well-being, etc.) over the past decade (Khan et al., 2020). However, few scholars have garnered attention to the impact of innovation on corporate disclosure and firm performance relationship (Cegarra-Navarro et al., 2016). Contrasting empirical evidence investigating environmental disclosure (ED) and financial performance (FP) relationship are available yet inconclusive (Deswanto & Siregar, 2018; Lu & Taylor, 2018; Qian & Schaltegger, 2017; Qiu et al., 2016). Therefore, the current study aims to address this research gap. Our first question is, whether environmental disclosure has an impact on firm performance?

The current study takes into consideration only the environmental dimension of disclosure due to two main reasons. First, green information disclosure has remained relatively ignored for a long due to data unavailability. However, such information disclosure has recently gained momentum due to massive growing pressure to reduce carbon emissions. Second, various stakeholders’ interest is growing in probing into a firm’s strategic orientation toward its environment, and the extent of innovation a firm is ready to incorporate. Organizations needed to induct green innovation technologies, methods, products, and processes into their operations to resolve this significant concern (Rennings, 2000). Green innovation paves the way for sustainable development by means of reducing pollution and energy resource utilization (Kemp & Pearson, 2007). According to Wei et al. (2012), CSR and innovation are distinct sources of competitive advantage for a firm, yet researchers have seldom incorporated these concepts simultaneously in this regard. Therefore, the current study addresses these constructs together and answers the question as to whether environmental CSR triggers green innovation?

Research focusing particularly on the mediating role of green innovation toward ED-FP relationship is missing in the extant literature though, a few studies have explored the effect of corporate social performance on market performance through innovation (Blanco et al., 2013), mediating role of contrasting eco-innovation strategies (Eiadat et al., 2008) and consequences of environmental regulation and eco-innovation on CSR and air pollution association (Jimenez-Parra et al., 2018). The present study aims to address the unexplored research gap studying the impact of green innovation practices on the ED-FP relationship. Green innovation likely plays an important role in shaping investor perceptions based on which they differentiate firms in terms of green or non-green products and processes including green technologies. Preference of those firms for investment that are engaged in green CSR would lead to an increase in the market value of the firm. Disclosure of environmental initiatives and practices, is a means of reducing information asymmetry among firms and stakeholders ultimately increasing the FP of the firm (Zhang et al., 2016). So, our final question is whether green innovation serves as a mediator between ED and FP relationship?

The current study contributes to the extant literature in several ways. First, this study clearly adds to the existing literature by providing novel empirical evidence that the corporate ED is one of the antecedents of green innovation. Moreover, green innovation plays the mediating role between environment disclosure and firm performance. Previous literature focused mainly on interrelationships between social and environmental disclosures, environmental performance and firm performance, therefore our study adds to the existing literature providing evidence using Chinese firms (Al-Tuwaijri et al., 2004; Li et al., 2018; Mathuva & Kiweu, 2016; Meng et al., 2014; Marco et al., 2019; Qian & Schaltegger, 2017; Qiu et al., 2016).

Secondly, the current study contributes to the existing strand of corporate finance literature consisting of reporting practices, their determinants, and consequences of ED by shedding light on the extent to which environmental disclosure influences firm green practices (Ali et al., 2017; Braam et al., 2016; Clarkson et al., 2011; Muttakin et al., 2018; Skouloudis et al., 2014; Song & Wen, 2020). Moreover, this study contributes to the environmental accounting literature dealing with green disclosure and innovation by means of providing new insights into the existing line of research highlighting the significance of green practices as a strategic tool and their impact of firm performance (Eiadat et al., 2008; Herrera, 2015; Jimenez-Parra et al., 2018; Kam‐Sing Wong, 2012; Lee et al., 2019; Marco et al., 2019; Przychodzen & Przychodzen, 2015; Wu et al., 2018; Xie et al., 2019).

Third, the current study distinguishes from that of the recent relevant literature. The present study offers empirical evidence regarding listed firms using green patents, whereas (Bouncken & Kraus, 2013; Cegarra-Navarro et al., 2016) established their mark using SME data. Besides, the present study recognized the role of green innovation (through signalling) as a mediating factor on ED-FP link contributing to the vast disclosure research focusing mainly on legitimacy and stakeholder theories (Al-Tuwaijri et al., 2004; Blacconiere & Patten, 1994; Broadstock et al., 2018; Deswanto & Siregar, 2018; Huang & Watson, 2015; Issarawornrawanich, 2019; Qiu et al., 2016). Besides, this study responds to the call for research on the consequences of social responsibility including CSR and FP link (Huang & Watson, 2015; Khan et al., 2020).

Finally, considerable studies emphasized the moderating role of green innovation exist in the corporate finance literature. By contrast, the present study responds to the call by Xie et al. (2019) and investigates whether nature of the impact of green innovation is direct or indirect on ED and FP in the particular context of an emerging economy. Besides, some studies have incorporated stakeholder and signalling theoretical perspective independently (see e.g., Delgado-Ceballos et al., 2012). However, the present study potentially serves as a means to provide a better understanding of the scenario through an integrated approach.

The rest of the paper is organized as follows. Section 2 presents the related literature and the development of hypotheses. Section 3 provides the conceptual framework of the study. Section 4 comprises the research design and variable measurement. Section 5 embodies empirical findings and their discussion. Section 6 concludes.

2. Literature Review and Development of Hypotheses

2.1. Contextual background of CSR in China

China introduced the concept of CSR in the 1990s, initially originated from the western world, to keep pace with changing trends and for the sake of globalization and enhanced development. Mere familiarization with the concept of CSR in China took longer as compared with that in the west. The Chinese government and stock exchange regulators have introduced numerous CSR initiatives in the past few years to account for social and environmental problems.

CSR disclosure is voluntary for listed companies in China except for certain specific industries. Firms disclosing social and environmental information in their reports prior to 2005 are limited. From early 2008, State-owned Assets Supervision and Administration Commission of the State Council (SASAC) of China suggested that state-owned firms (SOEs) should disclose their social and environmental activities (SASAC, 2011). Shanghai stock exchange (SSE) and Shenzhen stock exchange (SZSE) took the initiative taken by SASAC one-step ahead by promulgating the directions for listed firms about social and ED. Accordingly, the number of Chinese significantly increased. These firms disclosed their social and environmental activities in their annual or CSR reports as a piece of supplementary information, for example, disclosure of social and environmental activities accrued in response to the continued efforts of the Chinese government and regulatory bodies.

2.2. Environmental Disclosure and Financial Performance

An organization’s disclosure may have different dimensions. Nevertheless, the literature has focused widely on environmental, social, and governance aspects (Cegarra-Navarro et al., 2016; Clarkson et al., 2008; Grougiou et al., 2016; Huang et al., 2018; Husted & Allen, 2006; Malik et al., 2020; Meng et al., 2014; Nekhili et al., 2017; Orlitzky & Benjamin, 2001; Orlitzky et al., 2011). Certain scholars take social and environmental dimensions of disclosure together into an account while analyzing their impact on FP (Mathuva & Kiweu, 2016; Qiu et al., 2016). The current study takes into consideration only the environmental dimension of disclosure due to two main reasons. First, green information disclosure has remained relatively ignored for long due to data unavailability. However, such information disclosure has recently gained momentum due to massive growing pressure to reduce carbon emissions. Second, various stakeholders’ interest is growing in probing into a firm’s strategic orientation toward its environment, and the extent of innovation a firm is ready to incorporate.

Previously, the stream of literature related to disclosure contained a remarkable contribution toward CSR and its distinct dimensions. In the last decade, numerous studies have tried to contribute to the body of literature encompassing the impact of environmental and social disclosure on firm performance to fill the missing gap in corporate finance literature (Al-Tuwaijri et al., 2004; Broadstock et al., 2018; Lioui & Sharma, 2012; Lu & Taylor, 2018; Mathuva & Kiweu, 2016; Qian & Schaltegger, 2017; Qiu et al., 2016). The existing literature entails a number of studies regarding corporate social disclosure and firm FP. However, a dearth of literature with a particular emphasis on ED and firm performance exists, except for a few studies such as (Lioui & Sharma, 2012; Lu & Taylor, 2018). In addition, Mathuva & Kiweu (2016) reported a negative association between corporate social and ED and FP in Kenyan saving and credit cooperatives. They argued that the regulatory framework could be a reason for these findings or because of the transitioning of corporations to profit orientation. Lu & Taylor (2018) reported that the relationships among environmental performance (EP), ED, and FP maintained a negative relationship between EP and FP and a positive relationship between EP and ED. Results suggested that financially successful firms pay less attention to be environment-oriented. In addition, green firms’ good environmental performers are likely to disclose their environmental activities.

Huang et al. (2018) demonstrated that appropriate environmental initiatives and precautionary measures may result in improved business efficiency, ultimately leading to a higher FP, that is, a win-win situation for business. The level of green information disclosure can promote the level of the FP of the firm in addition to gain visibility, transparency, and legitimacy incentives. Recently, Song and Wen (2020) studied CSR communication strategies of Fortune 500 controversial versus noncontroversial companies and stakeholders’ responses to these strategies. They argued that environmental management and economic benefits should be in harmony to achieve long-term contribution toward the protection of the environment.

Qiu et al. (2016) found no sign of the relationship between ED and profitability; however, they found the relationship of social disclosure and past profitability significant, thereby confirming previous literature in this regard. This contradictory evidence provides the ground for further investigation of the problem as described and, thus, modeling the impact of ED on firm performance along with factors that mediate this relationship. Recently, numerous studies have discussed the relationship between ED and firm performance (Al-Tuwaijri et al., 2004; Lu & Taylor, 2018; Mathuva & Kiweu, 2016; Qian & Schaltegger, 2017; Qiu et al., 2016; Song et al., 2017). The current study aims to enhance the development of evidence regarding emerging markets specifically the world’s largest emergent economy, China.

Considering the above argument, we propose two hypotheses:

H1a: Environmental disclosure has a significant positive impact on the firm’s current financial performance.

H1b: Environmental disclosure has a significant positive impact on the firm’s future financial performance.

2.3. Environmental Disclosure and Green Innovation

One of the key drivers for the success of an organization is having a competitive advantage that comes from innovation activities a firm carries out (Bruni & Verona, 2009; García-Morales et al., 2008; Lee et al., 2019). Another way to gain a competitive advantage is the adoption and implementation of environmental CSR policies in the long run through which companies may be benefiting by enhancing their image and reputation (Knox & Maklan, 2004).

The strategic management literature highlights the significance of the strategic orientation of the firm toward the environment. Firms choose to be either proactive or reactive to deal with environmental issues (Menguc et al., 2010). Studies demonstrated that proactive firms likely outperform as compared with their counterparts in terms of EP and FP (Torugsa et al., 2012, 2013). Firms that perform in terms of environmental practices tend to disclose about their green practices and innovative activities (Clarkson et al., 2008; Meng et al., 2014). Stakeholders gauge a firm’s strategic orientation through its disclosure practices. In other words, firms outperforming environmentally likely disclose about their green practices, thus, signalling their stakeholders about its proactive approach toward the environment (Spence, 2002). Hence, stakeholders’ expectations for transparency, accountability, and an increase in green innovation in forthcoming years are enhanced.

Recently, Wu et al. (2018) found a positive association between ED and green innovation. They argue that firms that adopt green policies and practices always gain greater visibility and legitimacy resulting in a competitive advantage over non-green firms. Authors further demonstrate that if green CSR is great, then the innovation performance in the case of Chinese firms is good.

Considering the above discussion, our second hypothesis is as follows:

H2: Environmental disclosure has a positive impact on green innovation.

2.4. Green Innovation and Firm Financial Performance

Two facets of the green innovation literature that researchers have focused in recent years are worth mentioning. The first one concentrates on the drivers of green innovation, such as external pressures by stakeholders, regulatory requirements, resource abundance, potential economic outcomes, and awareness of environmental activities and significance of internal management (Delgado-Ceballos et al., 2012; Hojnik & Ruzzier, 2016; Horbach, 2008; Murilloluna et al., 2008). The second strand of literature focuses on the repercussions of green innovation, for example, green innovation and corporate performance relationships (Eiadat et al., 2008; Herrera, 2015). Multiple interchangeable terms have been used to describe eco-innovation, such as green, environmental, and sustainable innovations in the relevant works (Jimenez-Parra et al., 2018; Lee & Min, 2015; Pavelin & Porter, 2008; Rennings, 2000; Wagner, 2010; Xie et al., 2019). Although researchers have not reached any unanimous direction, we have examples of certain studies that empirically prove the positive impact of green innovation on business performance (Horváthová, 2012; Sarkis & Cordeiro, 2001). They demonstrate that environmental innovation intention and eco-innovation behavior has a stronger effect on the EP of the firm as compared with its economic performance. In addition, increased investment in eco-innovation implies an increase in the sustainable existence of the organization. Therefore, education and training of organization personnel about the significance of innovation behavior can be helpful to reduce environmental pollution and to attain the objective of clean production processes.

Certain authors have studied the inter-relationship of different types of eco-innovation, such as product and process innovation using content analysis techniques (Xie et al., 2019). Authors study the impact of different kinds of eco-innovation on business performance. Moreover, green research and development have a positive relationship with FP, establishing the fact that proactive environmental strategy leads to superior EP and FP.

Blanco et al. (2013) explain the positive mediating effect of corporate social performance over FP through innovation. For measurement purposes, they used the KLD index of community, corporate governance, diversity, environment, product, employee relations, human rights, and as controversial issues (alcohol, gambling, military, nuclear power, and tobacco).

Taking into account the theoretical arguments and empirical findings above, we hypothesize that:

H3: Green innovation mediates the relationship between environmental disclosure and firm performance.

3. Conceptual Framework of the Study

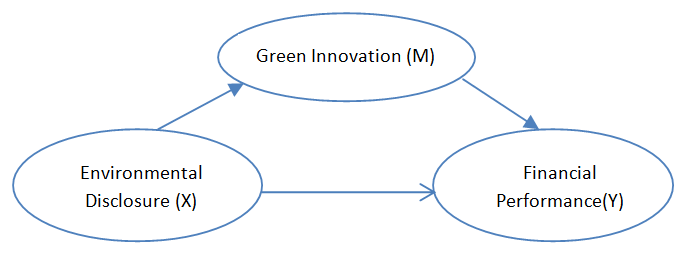

Several researchers have discussed ED and EP (Qian & Schaltegger, 2017). Huang & Kung (2010) have discussed the determinants of ED and Al-Tuwaijri et al. (2004) and Broadstock et al. (2018) have discussed ED and firm FP. However, no previous literature focused on the mediating role of green innovation toward this relationship. Although the previous literature found mixed evidence, still the direction of this relationship is ambiguous. This notion is the main motivation behind our study, based on which we attempt to fill this original research gap. We extend previous research by studying the direct relationship of ED and firm performance and along with the mediating role of green innovation on this link that attempts to fill the gap in the corporate finance literature. In addition, this link contributes to the existing strand of literature consisting of determinants and consequences of ED.

This study presents an integrated approach based on stakeholder and signalling theories. As the popular “stakeholder approach” propagates the idea of the right material and timely information about the organization and its activities to its stakeholders, different dimensions of disclosure fulfill this objective (Freeman, 1984). Disclosure would reduce the information asymmetry problem between managers and the users of information. This way, reduced agency costs would improve FP. In addition, proponents of the “signalling approach” suggest that nonfinancial communication including ED reduces information asymmetry (Connelly et al., 2011; Spence, 2002). ED triggers green innovation by signalling investors and interested parties about a company’s green innovation activities. Thus, they tend to build a positive perception of companies that disclose their environmental activities, thus having additional expectations and accountability on the part of the organization. Firms likely become active in environment-friendly practices through investing in terms of green innovation to cope up with this pressure.

The population for this study comprises Chinese-listed companies because of China’s distinguished cultural setting apart from being an emerging and transitioning economy. China, from the last few decades, is actively focusing on the implementation of the environmentally sustainable roadmap to deal with environmental issues arising from heavy carbon emissions from the industrial ventures. Consequently, ED and green innovation are commendable for academics and businesses due to the intensity and materiality of their detrimental consequences to the interested parties.

Figure 1. The Relationship between Environmental Disclosure, Green Innovation, and Financial Performance

4. Methodology and Measurement

4.1. Measurement of variables

We use patent data to measure green innovation despite its certain limitations following Griliches (1990) and among recent studies, Kesidou & Wu (2020). Although such data cover only patentable and patented innovations, such patent data provide the advantage of detailed information about the innovated product/technology that helps in the measurement and classification of industries and over time. Green innovation throws light in two distinct dimensions, generally, that is, green product and green process innovations (Rennings, 2000). As far as product innovation is concerned, various measures have been used by previous studies, such as green patents used by Brunnermeier & Cohen (2003), Berrone et al. (2013) and green R&D as suggested by Lee & Min (2015). The green patent is the indicator of green product innovation that is comparatively convenient than the other two indicators as discussed above. Therefore, we have undertaken patent activity data for the measurement of green product innovation, which is also used by (Brunnermeier & Cohen, 2003).

An important matter of drawing our attention is the selection of our dependent variable, that is, financial performance, because green practices are related to the company’s future market value and profitability. Return on assets (ROA) is the measure of the short-term FP/profitability of the firm widely used in the literature. Ideally, ROA is used to capture the accounting performance of the firm as ED is a cost and directly affects the profitability of the firm. We have opted for the subsequent measurement of performance, that is, market value widely used in the corporate finance literature, to take into account the long-term (future) performance.

Table 1. Variables Definition and their Measurement

| Variable | Definition and Measurement |

|---|---|

| Dependent variable | |

| Firm Performance: | |

| 1. Accounting measure: | |

| Return on Assets (ROA) | The ratio of Net income to Total Assets |

| 2. Market Measure: | |

| Market Value future (MVt+1) | Log of market value on April 30 in the next year. |

| Market Value current (MVt) | Log of current market value on December 31st. |

| Independent variable | |

| Environmental Disclosure (EDISC) | A dummy variable equals 1 if firm discloses environmental CSR otherwise 0. |

| Mediating variable | |

| Green Innovation (GINN) | Number of green patents |

| Control Variables | |

| Firm Age (AGE) | Natural log of firm operating years |

| Environment Sensitive Industry (ESI) | According to the Ministry of Environmental Protection of China, Assign “1” to environmentally sensitive industries, otherwise “0”. |

| CEO Duality (CEOD) | A dummy variable equals 1 if the CEO has also the chair role otherwise 0. |

| Board Independence Ratio (BIR) | The ratio of independent Directors to Board size |

| Leverage (LEV) | The ratio of Total Liabilities to Total Assets |

| YEAR | Year dummies coded 1 if the event takes place in year i, otherwise 0. |

| INDUSTRY | Industry dummies coded 1 if the firm belongs to the industry i, otherwise 0. |

For measuring FP, we have used three performance indicators, that is, ROA, to measure current accounting performance, the market value of the firm at year-end (MVt) to measure current market performance, and market value of the firm in the following year (MVt+1) to measure future firm performance. In this research, ED is the binary dependent variable by using “1” if the firm discloses its environmental activities and “0” if otherwise. Aside from this, eco-innovation is the mediating variable that has an assumed positive impact on the relationship between ED and FP. One of the main objectives of the current study is to investigate the mediation effect of eco-innovation on the link between ED and firm performance.

In line with previous studies of Lu & Taylor (2018) and Mathuva & Kiweu (2016), we employed firm age, environmentally sensitive industry, CEO duality, board independence ratio, and leverage as control variables to measure the effect of control variables as these variables have an impact on firm FP. In addition, we control for time and industry-specific effects by adding industry and year dummies to our model. Table 1 provides an explanation of all variables along with their measurements in detail.

4.2. Sample

The population of this study consists of A-share-listed companies at the two independent stock markets of the People’s Republic of China, that is, SSE and SZSE. Data are extracted from the CSMAR database for a period of 12 years, that is, 2005–2016. Initially, 26,445 observations are obtained in total. However, after dropping observations with incomplete information and scrutinizing data on the basis of the disclosure of environmental activities and other control variables, our final sample consists of 8,619 unique observations. Winsorization of all the variables was carried out at the first and 99th percentile to overcome outliers in data. Table 2 represents the sample selection information.

Table 2. Sample Selection

| No. of samples | |

|---|---|

| Initial sample consisting of A-share listed firms disclosing patent information | 26445 |

| Less: Firms with insufficient data of disclosure and other control variables | (17826) |

| Final Sample | 8619 |

The population of this study comprises of Chinese-listed companies because of China’s emerging and transitioning economy. China, from the last few decades, is actively focusing on the implementation of the environmentally sustainable roadmap. Moreover, studying Chinese firms in distinct contexts is understandably interesting due to their unique setting. Consequently, ED and green innovation are the topics of hot interest nowadays because awareness about sustainable practices is growing among Chinese firms.

4.3. Econometric Model

The econometric model is the basic model suggested by Baron & Kenny (1986), wherein firm performance is the dependent variable, and ED is the independent variable along with control variables. The green innovation serves as the mediating factor influencing the relationship between firm performance and ED. According to them, if at least one step showed significant result then partial mediation exists and to further explore the significance of that mediation, Sobel test is performed. The objective of first three steps is to found that zero-order association between the variables exist or not. If insignificant results are obtained in at least one of the step then generally conclude that mediation is not likely, however this is not a principle (MacKinnon et al., 2007). If explanatory variable and mediator appear to be both significant then the data supports partial mediation.

Equation 1: \(\text{Firm Performance}_{it} = \alpha_{it} + \beta_{it} \text{Environmental Disclosure}_{it}\\ + \sum \text{Control variables}_{it} + \textit{Year dummies} + \text{Industry dummies} + \varepsilon_{it}\)

Equation 2: \(\text{Green Innovation}_{it} = \alpha_{it} + \beta_{it} \text{Environmental Disclosure}_{it}\\ + \sum \text{Control variables}_{it} + \textit{Year dummies} + \text{Industry dummies} + \varepsilon_{it}\)

Equation 3: \(\text{Firm Performance}_{it} = \alpha_{it} + \beta_{it} \text{Environmental Disclosure}_{it} + \text{Green Innovation}_{it}\\ + \sum \text{Control variables}_{it} + \textit{Year dummies} + \text{Industry dummies} + \varepsilon_{it}\)

where \(\alpha_{i}\) represents intercept coefficients. Firm performance is the dependent variable, whereas ED is the independent variable. Green innovation represents the mediating variable. \(\beta_{it}\) represents coefficients of independent and mediating variables in the model. \(\varepsilon_{it}\) accounts for the error terms for unobserved effects. \(\sum\text{Control variables}_{it}\) represent control variables that control for the firm-specific characteristics.

5. Empirical Results

5.1. Descriptive Statistics

Table 3 shows the descriptive statistics of variables. ROA, our dependent variable, has a mean value of 0.05 billion with a maximum of 108.36 billion and a minimum of −6.77 billion. ROA refers to the notion that our sample represents a range of highly profitable companies to the firms facing negative returns. The MVt+1 representing future performance reveals an average of 2.50 billion with a maximum of 2.17 billion. Moreover, MVt depicts an average of 2.42 billion with a maximum value of 2.24 billion. The mean value of firm age is 20.54 indicating that an average number of firms in our sample are mature in terms of the life cycle of a firm. The average Green Innovation (GINN) value is 2.732 with a standard deviation of 18.608 which implies the average firms’ low inclination toward green innovation. Our sample contains firms that have zero patents, whereas other firms that have a high number of green patents indicating firms’ passive orientation toward green innovation also exist. Seven hundred eighty-two is the maximum number of green patents a firm holds. Almost 50% of our sample firms belong to the environment-sensitive industries. Our results reveal that 16% of the CEOs hold the position of the chairperson. This notion implies that 84% of the firms have separate persons as CEO and chairperson. The mean BIR value denotes the independent directors’ ratio, that is, 36.7% of directors are independent. Furthermore, our sample Chinese companies use 51% of debt in their capital structure.

Table 3. Descriptive Statistics

| Variable | Obs. (n) | Mean | S.D. | Min. | Max. |

|---|---|---|---|---|---|

| ROA | 8619 | 0.03 | 0.10 | (6.77) | 108.36 |

| MVt+1 | 7865 | 2.50 | 9.09 | 12.11 | 21.49 |

| MVt | 8619 | 2.42 | 9.30 | 11.88 | 21.53 |

| GINN | 8619 | 2.73 | 18.61 | 0 | 782 |

| EDISC | 8619 | 0.54 | 0.49 | 0 | 1 |

| AGE | 8619 | 20.54 | 4.89 | 7 | 39 |

| ESI | 8619 | 0.47 | 0.50 | 0 | 1 |

| CEOD | 8619 | 0.16 | 0.37 | 0 | 1 |

| BIR | 8619 | 0.36 | 0.06 | 0.09 | 0.80 |

| LEV | 8619 | 0.51 | 0.29 | (0.194) | 14.473 |

5.2. Correlation Matrix

Table 4 depicts the correlation matrix for major variables. No multicollinearity exists among the variables that could affect the findings, as the correlation coefficient is extremely low for the explanatory variables. In addition, a positive association is observed between green innovation and ED at the 0.10 level, confirming our primary supposition.

Table 4. Correlation Matrix

| GINN | EDISC | AGE | ESI | BIR | CEOD | LEV | |

|---|---|---|---|---|---|---|---|

| GINN | 1 | ||||||

| EDISC | 0.09* | 1 | |||||

| AGE | -0.09* | -0.05* | 1 | ||||

| ESI | 0.18 | 0.00*** | -0.08* | 1 | |||

| BIR | 0.07* | 0.09* | -0.08* | -0.05* | 1 | ||

| CEOD | 0.04** | -0.01** | -0.06* | 0.03** | 0.09* | 1 | |

| LEV | 0.03*** | 0.00*** | 0.19*** | -0.11*** | 0.00*** | -0.08* | 1 |

Note: *** p < 0.01, ** p < 0.05, * p < 0.10, two-tailed test.

5.3. Mediation Analysis

Our model must meet three requirements according to Baron & Kenny (1986). First, environmental disclosure (EDISC) must have an impact on ROA. Second, EDISC must have a significant impact on GINN. Last, when ROA is regressed on EDISC and GINN together, GINN must affect ROA. We have applied three models, namely, Models 1, 2, and 3, employing the same methodology because we have three different measures of our dependent variable. Each model contains three regression equations following the above-mentioned technique. We will discuss each model’s results in the following paragraphs.

Table 5 shows the mediation results of performing Baron & Kenny steps while having ROA as a dependent variable representing FP. First, Column 1 represents the coefficient of ROA regressed on EDISC, that is, b = 0.007 significant at a 1% level. Thus, our first hypothesis is supported. Column 2 shows the regression output of the second equation explaining the impact of EDISC on GINN. B coefficient in Equation 2 is also positive and highly significant at a 1% level (; p < 0.01). This finding confirms our second hypothesis, which is in line with (Wu et al., 2018). This finding implies that if the policies of the firm are green, then such policies gain visibility and legitimacy, thus confirming the legitimacy viewpoint (Deegan, 2002). Last, Column 3 demonstrates the impact of EDISC and GINN together on ROA, and the impact turns out to be highly significant (b3 = 0.007, ; b4 = 0.002, p < 0.1) supporting the third hypothesis. This finding is in line with (Blanco et al., 2013).

The direct mediation effect for model 1 is 0.007 significant at 1% level, whereas the indirect effect is calculated as 0.004 (a = 2.432*b = 0.002). The total mediation effect is calculated as (0.007 + 0.004 = 0.011) by adding direct and indirect effects.

Taken together, these results indicate that green innovation partially mediates the relationship between FP and ED. Thus, partial mediation holds in this situation confirming our third hypothesis.

Table 5. Model1: Mediation Effect of Green Innovation on Firm Performance (ROA) and Environmental Disclosure

| Panel A-OLS | Panel B-GMM | |||||

|---|---|---|---|---|---|---|

| Variables | Eq.1(ROA) | Eq.2(GINN) | Eq.3(ROA) | Eq.1(ROA) | Eq.2(GINN) | Eq.3(ROA) |

| Coef. (SE) | Coef. (SE) | Coef. (SE) | Coef. (SE) | Coef. (SE) | Coef. (SE) | |

| Constant | 0.106*** (0.017) | 7.442** (6.272) | 0.104*** (0.017) | 0.108*** (0.009) | -11.939*** (3.117) | 0.104*** (0.025) |

| EDISC | 0.007*** (0.003) | 2.432*** (0.383) | 0.007*** (0.003) | 0.007*** (0.002) | 35.796*** (8.741) | 0.007*** (0.002) |

| GINN | 0.002* (0.001) | 0.001 (0.000) | ||||

| AGE | 0.007 (0.013) | -4.837*** (2.238) | 0.008 (0.014) | |||

| ESI | -0.004 (0.004) | 2.166* (1.171) | -0.005) (0.004) | -0.002** (0.001) | 1.566** (0.577) | |

| BIR | -0.034 (0.028) | 15.776* (9.382) | -0.037 (0.028) | -0.037* (0.013) | -9.061 (8.157) | -0.032* (0.017) |

| CEOD | -0.004 (0.008) | -0.206 (1.087) | -0.004 (0.008) | |||

| LEV | -0.158** (0.077) | 3.427** (1.372) | -0.159** (0.078) | -0.123*** (0.014) | -4.515* (2.548) | -0.123* (0.058) |

| YEAR | Yes | Yes | Yes | |||

| INDUSTRY | Yes | Yes | Yes | |||

| n | 8619 | 8619 | 8619 | 8404 | 8404 | 8404 |

| Adj-R2 | 0.196 | 0.016 | 0.196 | |||

| Test of overidentification | ||||||

| Chi-Sq. (Sig.) | 0.232 (0.63) | 0.590 (0.442) | 1.445 (0.229) | |||

Note: ***, **, * represents p<0.01, p<0.05 and p<0.10 respectively. Robust standard errors in parentheses.

Table 6 depicts model 2 mediation results considering MVt+1 as the dependent variable as a measure of future performance of the firm. All other constructs are the same as in Model 1, including explanatory, mediating, and control variables. Column 1 portrays a significant positive coefficient of EDISC and MVt+1, that is, 0.728 significant at a 1% level. This finding confirms our first hypothesis and coincides with the previous literature in this regard (Huang et al., 2018). Column 2 indicates that EDISC and GINN are significantly positively associated confirming our second hypothesis. In addition, Chinese firms likely adopt a proactive strategic orientation toward the environment rather than a reactive approach (Menguc et al., 2010). We can derive that EDISC and GINN are significant at less than a 1% level and have a positive impact on firm performance from Eq. 3. The direct mediation effect for Model 2 is 0.728 significant at a 1% level, whereas indirect effect is calculated as 0.132 (a = 0.351*b = 0.377). The total mediation effect is calculated as (0.728 + 0.132 = 0.860) by adding direct and indirect effects. Thus, from the above results, we deduce that ED not only directly affects FP but also has an indirect impact mediated through green innovation.

Table 6. Model 2: Mediation Effect of Green Innovation on Firm Performance (MVt+1) and Environmental Disclosure

| Panel A-OLS | Panel B-GMM | |||||

|---|---|---|---|---|---|---|

| Variables | Eq.1(MVt+1) | Eq.2(GINN) | Eq.3(MVt+1) | Eq.1(MVt+1) | Eq.2(GINN) | Eq.3(MVt+1) |

| Coef. (SE) | Coef. (SE) | Coef. (SE) | Coef. (SE) | Coef. (SE) | Coef. (SE) | |

| Constant | 15.344*** (31.42) | 0.387 (1.26) | 15.159*** (31.65) | 21.153*** (0.195) | -11.939*** (3.117) | 21.706*** (0.098) |

| EDISC | 0.728*** (19.45) | 0.351*** (12.10) | 0.594*** (14.96) | 3.581*** (0.599) | 35.796*** (8.741) | 0.455*** (0.026) |

| GINN | 0.377*** (8.46) | 0.013*** (0.002) | ||||

| AGE | -0.189 (-1.25) | -0.323*** (-3.10) | -0.049 (-0.34) | |||

| ESI | -0.150** (-2.25) | 0.265*** (5.65) | -0.252*** (-4.15) | -0.145** (0.044) | 1.566** (0.577) | |

| BIR | 1.729*** (3.55) | 1.607*** (3.20) | 1.094** (2.53) | -0.795 (0.618) | -9.061 (8.157) | 1.605*** (0.249) |

| CEOD | -0.144** (-2.33) | 0.039 (0.72) | -0.159*** (-2.83) | |||

| LEV | 0.475* (1.74) | 0.285*** (2.89) | 0.354 (1.48) | -0.105 (0.159) | -4.515* (2.548) | 0.229* (0.080) |

| YEAR | Yes | Yes | Yes | |||

| INDUSTRY | Yes | Yes | Yes | |||

| n | 8619 | 8619 | 8619 | 8404 | 8404 | 8404 |

| Adj-R2 | 0.118 | 0.089 | 0.187 | |||

| Test of overidentification | ||||||

| Chi-Sq. (Sig.) | 1.410 (0.234) | 0.590 (0.442) | 2.454 (0.117) | |||

Note: ***, **, * represents p<0.01, p<0.05 and p<0.10 respectively. Robust standard errors in parentheses.

Table 7 presents MVt as the current year’s performance measure, and all three equations have significant positive results. These results confirm the findings in Table 6 as MVt also substitutes for a market measure of FP. The direct mediation effect for Model 3 is 0.823 significant at 1% level, whereas an indirect effect is calculated as 0.133 (a = 0.351*b = 0.380). The total mediation effect is calculated as (0.823 + 0.133 = 0.956) by adding direct and indirect effects. To sum up, Table 7 shows that partial mediation still holds in the case of the current market measure of current performance in Chinese firms.

Table 7. Model 3: Mediation Effect of Green Innovation on Firm Performance (MVt) and Environmental Disclosure

| Panel A-OLS | Panel B-OLS | |||||

|---|---|---|---|---|---|---|

| Variables | Eq.1(MVt) | Eq.2(GINN) | Eq.3(MVt) | Eq.1(MVt) | Eq.2(GINN) | Eq.3(MVt) |

| Coef. (SE) | Coef. (SE) | Coef. (SE) | Coef. (SE) | Coef. (SE) | Coef. (SE) | |

| Constant | 15.383*** (31.66) | 0.387 (1.26) | 15.237*** (31.90) | 20.869*** (0.169) | -11.939*** (3.117) | 21.646*** (0.128) |

| EDISC | 0.823*** (22.67) | 0.351*** (12.10) | 0.689*** (17.82) | 3.377*** (0.530) | 35.796*** (8.741) | 0.745*** (0.050) |

| GINN | 0.380*** (8.62) | 0.049*** (0.013) | ||||

| AGE | -0.256* (-1.71) | -0.323*** (-3.10) | -0.131 (-0.91) | |||

| ESI | -0.185*** (-2.75) | 0.265*** (5.65) | -0.284*** (-4.66) | -0.114** (0.038) | 1.566** (0.577) | |

| BIR | 1.817*** (3.65) | 1.607*** (3.20) | 1.194*** (2.70) | 0.069 (0.548) | -9.061 (8.157) | 1.125*** (0.350) |

| CEOD | -0.150** (-2.43) | 0.039 (0.72) | -0.166*** (-2.97) | |||

| LEV | 0.467** (1.99) | 0.285*** (2.89) | 0.353* (1.72) | -0.019 (0.137) | -4.515* (2.548) | 0.273** (0.129) |

| YEAR | Yes | Yes | Yes | |||

| INDUSTRY | Yes | Yes | Yes | |||

| n | 8442 | 8619 | 8442 | 8404 | 8404 | 8404 |

| Adj-R2 | 0.134 | 0.089 | 0.198 | |||

| Test of overidentification | ||||||

| Chi-Sq. (Sig.) | 1.442 (0.229) | 0.590 (0.442) | 2.939 (0.230) | |||

Note: ***, **, * represents p<0.01, p<0.05 and p<0.10 respectively. Robust standard errors in parentheses.

5.4. Robustness Checks

In order to ensure robustness of our results, the current study applies alternative techniques such as Generalized Method of Moments approach and Hayes PROCESS to our main model. First, heteroscedasticity is a serious problem potentially present in data. It means standard errors associated with each regression coefficients will not be correct (Gujarati & Porter, 2009). To control the problem of heteroscedasticity in our estimates, we have employed robust standard errors. Second, we have applied Generalized Method of Moments (GMM) to control for potential endogeneity in the model as panel data suffers from this problem commonly leading to biased and unreliable results (Arellano & Bond, 1991). In a regression model, a variable faces endogeneity problem when there is a correlation among error terms. Also, these problems can arise as an outcome of auto-regression with omitted variables, measurement errors, and auto-correlated errors. The coefficients of dependent variables reported the significant positive outcomes. The coefficients of the main independent variables and those of mediating variable demonstrated the similar results in accord with the reported results. Hence, GMM results exhibited that dynamic effects may impact the significance of corporate financial performance models, yet, relationships hypothesized in our model do not affect by endogeneity.

Third, we used ROA and two different market value measures for firm performance to establish that our baseline results are not sensitive to the proxies of our dependent variable i.e. firm performance. Panel B of Table 5, Table 6 and Table 7 constitute the results of GMM analysis.

Table 8. Robustness test (Hayes PROCESS results)

| Model 1 | Model 2 | Model 3 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Variables | Eq.1 (ROA) | Eq.2 (GINN) | Eq.3 (ROA) | Eq.1 (MVt+1) | Eq.2 (GINN) | Eq.3 (MVt+1) | Eq.1 (MVt) | Eq.2 (GINN) | Eq.3 (MVt) |

| Coef (S.E.) | Coef (S.E.) | Coef (S.E.) | Coef (S.E.) | Coef (S.E.) | Coef (S.E.) | Coef (S.E.) | Coef (S.E.) | Coef (S.E.) | |

| Constant | 0.123*** (0.008) | -2.329 (1.819) | 0.123*** (0.01) | 14.842*** (0.114) | -1.846 (1.951) | 14.867*** (0.110) | 14.774*** (0.112) | -2.329 (1.819) | 14.806*** (0.110) |

| EDISC | 0.007*** (0.002) | 2.465*** (0.429) | 0.007*** (0.002) | 0.735*** (0.027) | 2.454*** (0.455) | 0.702*** (0.026) | 0.828*** (0.027) | 2.465*** (0.429) | 0.795*** (0.026) |

| GINN | 0.002*** (0.001) | 0.013*** (0.006) | 0.014*** (0.007) | ||||||

| AGE | 0.004* (0.001) | -0.247*** (0.044) | 0.001** (0.002) | -0.005* (0.003) | -0.282*** (0.047) | -0.001 (0.003) | -0.008** (0.003) | -0.247*** (0.044) | -0.005* (0.003) |

| ESI | -0.005** (0.002) | 2.113*** (0.429) | -0.005** (0.002) | -0.151*** (0.027) | 2.091*** (0.455) | -0.179*** (0.025) | -0.188** (0.027) | 2.113*** (0.429) | -0.216*** (0.026) |

| BIR | -0.040** (0.018) | 16.618*** (3.916) | -0.043** (0.018) | 1.739*** (0.244) | 17.148*** (4.178) | 1.509*** (0.237) | 1.787*** (0.242) | 16.618*** (3.916) | 1.559*** (0.236) |

| LEV | -0.165** (0.003) | 3.563*** (0.754) | -0.165** (0.003) | 0.503*** (0.048) | 4.178*** (0.833) | 0.452*** (0.047) | 0.466 (0.046) | 3.563*** (0.754) | 0.417*** (0.046) |

| YEAR | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| INDUSTRY | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| n | 8442 | 8442 | 8442 | 7865 | 7865 | 7865 | 8442 | 8442 | 8442 |

| Adj-R2 | 0.204 | 0.015 | 0.20 | 0.117 | 0.016 | 0.163 | 0.131 | 0.015 | 0.173 |

| F-Stat (Sig.) | 431.09 (0.00) | 26.148 (0.00) | 361.158 (0.00) | 207.591 (0.00) | 25.352 (0.00) | 256.171 (0.00) | 254.692 (0.00) | 380.087 (0.00) | 295.801 (0.00) |

Note: ***, **, * represents p<0.01, p<0.05 and p<0.10 respectively. Robust standard errors in parentheses.

Moreover, significance of our mediation analysis results have further been established by using Hayes Process ‘Macro 4’ in SPSS (Hayes, 2009, 2013; Nitzl et al., 2016). Though, Baron & Kenny (1986) steps provide a seminal approach to test the full, partial or no mediation effect and widely in use by the researchers in academia, yet, we find improved methods available to test the mediating effect of a variable on our dependent and independent variables to cover the limitations of the underlying approach used in this study.

Table 8 presents the results for all the three models. In the present study, the indirect effect has been tested using bootstrapped confidence intervals to test the significance of the indirect effect as suggested by (Hayes, 2013). The sampling technique generated 5000 samples with a confidence interval of 95%. Hence, robust analysis from the alternative technique confirmed our main results and the existence of partial mediation effect in our model.

6. Discussion of Results

Our initial evidence suggests that firms that disclose more environmental information to reduce information asymmetry perform better both, in terms of present and future prospects in China. Hence, the spirit of stakeholder theory that ED mitigates information asymmetry among the stakeholders and makes them able to make well-informed decisions that lead to improved FP is reinforced (Freeman, 1984). This finding may point to the notion that firms may have found out about the hidden costs that were previously associated with overhead costs. As Huang et al. (2018) noted, our findings reinforce that the realization of waste resources management would account for the hidden costs and would take steps to reduce such costs, thus promoting the efficiency of resources and overall effectiveness. In addition, firms can effectively convey the corporate strategy internally and externally utilizing increased ED. Moreover, as Qiu et al. (2016), we report that Chinese firms with good FP can cover the expenses caused by ED in the future.

The second problem was whether ED triggers green innovation or not in the particular context of Chinese firms. To address this issue, we developed and tested our second hypothesis. As Potrich et al. (2019), Ryszko (2016), Torugsa et al. (2012), Torugsa et al. (2013), we document that environmental disclosure promotes green innovation practices. Like these authors, we emphasize that proactive Chinese firms outperform their counterparts in terms of environmental and financial terms. Moreover, Wu et al. (2018) stated that green firms always gain greater visibility and legitimacy along with competitive edge as compared with non-green firms. Hence, firms disclose additional information, signalling its stakeholders about the firm’s proactive strategic orientation, hence, coinciding with the signalling hypothesis (Spence, 2002). Since Chinese firms do not follow a mandatory mechanism to disclose their environmental practices except few industries therefore, being proactive in this regard may provide firms with the competitive edge over their counterparts.

Our third and most significant concern was to investigate whether green innovation plays a mediating role between the FP and ED relationship. We addressed this concern theoretically and empirically, and accordingly, all the three models’ results indicate that partial mediation impact exists between ED and FP. Previous studies such as Blanco et al. (2013) studied the behavior of non-socially responsible firms to gain legitimacy through innovation practices while Jimenez-Parra et al. (2018) focused on influence of CSR on air pollution through eco-innovation, yet, leave the gap behind. Therefore, our finding adds to the novel evidence to the previous literature suggesting that implementation of green innovation in a firm strategy results in an improved disclosure-performance relationship. Moreover, all three models demonstrate that eco-innovation partially mediates the ED and FP link confirming signalling theory assumptions (Spence, 2002). This finding can be interpreted as “if the ED exists, a firm’s image and reputation will be good.” Hence, customers and other external stakeholders expect increased green innovation in the future. Greener firms have superior FP than non-green firms due to various reasons. Other reasons include a competitive edge in the form of resources, improved efficiency, and reputation pressure from various stakeholders.

To assess the long-term impact of ED on green innovation and in turn, on financial performance, future market performance is utilized. The positive impact of green innovation practices is pronounced in this scenario too. This finding suggests that environmental footprint can go a long way for firms as they incorporate green innovation practices into their strategy. Sellitto et al. (2019) studying green supply chain management practices and Zhang et al. (2016) investigating Chinese environmental governance structure have also reported the similar results. Since innovation environment is not yet mature in case of Chinese corporate system, our study undoubtedly can stimulate firms to adopt green practices and initiatives to improve their overall sustainability.

7. Conclusion

The current study investigates the direct link between ED and FP of a firm and the unexplored mediating factor, that is, green innovation impact on this relationship using the Chinese dataset. This study employs a sample composed of 8619 listed firms from 2005 to 2016.

The empirical analysis reveals a positive link between ED and FP suggesting that firms disclosing environmental information tend to be successful in terms of FP. Moreover, the current study contributes to the previous literature by offering novel empirical evidence regarding the mediation effect of green innovation on the relationship between ED and FP. ED stimulates green innovation in response to the greater expectations and better image perceived by its investors as more ED signals a proactive approach towards the environmental strategy of the firm. In turn, the adoption of green practices provides a firm with greater visibility, better image, improved efficiency in operations, and a competitive edge over its counterparts. All of these factors result in the improved financial performance of the firm and ultimately result in stakeholder satisfaction.

Furthermore, this research adds to the corporate finance and environmental accounting literature by providing theoretical and empirical evidence from the unique setting of an emerging economy, China. Since Chinese firms are prone to face challenging environmental hazards particularly from the past few decades, this study attempts to enhance the understanding of the link between the constructs like environmental disclosure, green innovation, and financial performance. These interrelationships may enable the top management of Chinese firms to formulate a better innovation strategy and improved decision making. Theoretically, the current study contributes to the literature encompassing stakeholder and signalling theories using an integrated approach.

These results have important implications for managers, academics, regulators, and practitioners. In particular, the results of the current study can be useful for regulators and practitioners for policy-making regarding the extent of disclosure and green practices to be adopted by the firms. Academics may apply the results of the current study for the development and extension of the relevant body of knowledge particularly in the Chinese context by using more appropriate measures, other theoretical approaches, and dimensions missing in the current study. The results of the current research may be fruitful for managers in the selection, prioritization, and implementation of the strategic objectives, for example, employing environmental CSR and green innovation as a competitive advantage for the firm in addition to attracting prospective investors. The study suggests that Chinese firms have implications for improved performance by increasing environmental disclosure and green initiatives. These findings provide signals to potential investors regarding the firm current and prospective performance and might be helpful for them to assess the potential returns and make investment decisions in the firm.

Despite the contribution the current study offers to the extant literature, this study is not free from limitations. First, due to the unique institutional context of the Chinese setting, it is not recommended to generalize the findings of the current study to other emerging economies. Second, measurement of green innovation using Chen et al (2006)’s methodology through eight items might be possible but, no adequate information in this regard has been disclosed in the annual reports. Moreover, we measured environmental disclosure only as a dummy variable and did not attempt to measure it using a content analysis based on the GRI environmental indicators. These limitations present opportunities for future research.

Qualitative research design might consider this aspect while measuring this variable in future studies. Moreover, other aspects affecting this relationship have not been focused in this study, for example, the absorptive capacity of the firm, affecting green innovation and performance, the impact of environmental performance on environmental disclosure and firm performance relationships. Another shortcoming of the current study could be used as an opportunity for future research that is, the current study takes a single forthcoming year to assess the future financial performance of the firm. Future research may incorporate successive three or more years to ensure whether this impact sustains or hampers in the coming years.

Future researchers should consider the qualitative aspect of ED as this study concentrated on the quantitative aspect of disclosure due to the availability of data. Moreover, future studies may choose other countries’ setting as a research object and verify whether the stated hypothesis can be generalized or not for the rest of the world. We only focused on the Chinese economy where firms’ innovation environment is not yet mature. Hence, results cannot be generalized to other countries. Therefore, future researchers may consider conducting a comparative study between Chinese and western contexts. The current study may serve as a reference to future research in this arena.