Public management reform under the dome of accruals

ABSTRACT

The main aim of this paper is to attest to the foremost role of accruals in achieving the public management reform, gathering evidence on implementation challenges and perceived outcomes.

This study covers a significant literature gap and enriches the scientific research by underpinning the questions addressed in the New Public Management and Governance paradigms that put a lot of pressure on reforming public systems towards accrual principles.

For fulfilling our goal, we performed an empirical analysis on three stages focusing on identifying the current state of budgeting and accounting bases across EU-OECD countries as a prerequisite of facilitating the wider public management reform initiatives looking for possible connections between them.

The research design undergone for achieving our aim successfully combines various statistical methods and techniques (e.g. cluster analysis, Multidimensional Scaling technique, Principal Component Analysis, correlation analysis) to assess the status of accrual reform and its power to influence the degree of public management initiatives’ achievement.

The results reveal that a majority of EU-OECD countries have completed their accrual reform programmes that bring many benefits to the public system as a whole, leading to major achievements of management initiatives, such as enhancing public transparency and accountability throughout accounting and budgeting reporting. Thus, accrual world is certainly the best way to improve public sector management and raise its efficiency, providing high-quality information for the decision-making process and allowing as well greater comparability between countries throughout reporting harmonization.

Keywords: public management, accrual accounting, budgeting, reform, European Union, OECD, public sector

JEL Classification: M48, H83, G38, C40

Reforma de la gestión pública bajo la dominación del devengo

RESUMEN

El objetivo principal de este trabajo es atestiguar el papel primordial de la contabilidad de devengo en el proceso de reforma de la gestión pública, recopilando evidencias sobre los desafíos de la implementación y los resultados percibidos.

Este estudio cubre una importante laguna de la literatura y enriquece la investigación científica al apuntalar las cuestiones abordadas en los paradigmas de la Nueva Gestión Pública y la Gobernanza, que ejercen una gran presión sobre la reforma de los sistemas públicos en favor de los principios de devengo.

El diseño de la investigación realizada para lograr nuestro objetivo combina con éxito varios métodos y técnicas estadísticas (por ejemplo, análisis de conglomerados, técnica de escalamiento multidimensional, análisis de componentes principales, análisis de correlación) para evaluar el estado de la reforma de la contabilidad de devengo y su capacidad de influir en el grado de cumplimiento de las iniciativas de la gestión pública.

Los resultados revelan que la mayoría de los países de la UE y la OCDE han completado sus programas de reforma de la contabilidad de devengo, que aportan muchos beneficios al sistema público en su conjunto, lo que ha dado lugar a importantes logros en las iniciativas de gestión, como la mejora de la transparencia pública y la rendición de cuentas a través de la presentación de informes sobre la contabilidad y la presupuestación. Por lo tanto, el mundo de la acumulación es sin duda la mejor manera de mejorar la gestión del sector público y aumentar su eficiencia, proporcionando información de alta calidad para el proceso de adopción de decisiones y permitiendo también una mayor comparabilidad entre los países a través de la armonización de la presentación de informes.

Palabras clave: gestión pública, contabilidad de devengo, presupuesto, reforma, Unión Europea, OCDE, sector público

Códigos JEL: M48, H83, G38, C40

1 Introduction

In the latest years, the public sector has gone through a tumultuous journey sprinkled with challenges and important changes like being under the dome of an achievable metamorphosis (Nistor and Stefanescu, 2018). The incentive of developments in the public system was reinforced mainly by the citizens’ need of trust in governments, as long as it funds itself through the stakeholders’ contribution (Christensen and Lægreid, 2016). Besides this, all managerial paradigms that have gradually emerged in the public sector, namely New Public Management (hereafter NPM), post-New Public Management (hereafter post-NPM) and New Public Governance (hereafter NPG) put a lot of pressure on reforming both accounting and budgeting systems towards accrual principles. Thus, the adoption of accrual accounting by public sector organisations was perceived as self-evident for long ago (Lapsley et al., 2009). However, the international regulatory bodies (IFAC, European Commission), have made impressive efforts over the years, aiming to ensure the harmonization of both financial and fiscal reporting using accruals as a linkage point.

In this tumultuous context, our paper comes to provide an up-to-date broad picture of accrual reforms across Europe, since many countries around the world gradually moved on preparing all government reports on an accrual basis instead of the cash one, aiming to enable the public management reform initiatives. “Accountability. Now.” project (IFAC, 2015) has widely encouraged governments in this respect, by promoting higher standards of public sector information able to improve the quality and transparency of their financial management. It challenged governments to recognize the importance of working toward financial and fiscal reporting that meets international standards, such as IPSAS/EPSAS and ESA 2010 that are promoting the accrual concept (EC, 2013).

Based on this background, the key objective of this paper is to attest to the foremost role of accruals in achieving the public management reform, gathering evidence on implementation challenges and perceived reform outcomes. This aim is achieved through three important stages of the study represented by the research questions addressed. Thus, the analysis is centred on identifying the current state of budgeting and accounting bases across EU-OECD countries (RQ1) as a prerequisite of facilitating the wider public management reform initiatives (RQ2), looking for possible connections between them (RQ3).

The main findings of our research reveal that the accrual reform brings many benefits to the public system as a whole, leading to major achievements of public management initiatives, while definitely enhancing public transparency and accountability throughout accounting and budgeting reporting.

The originality of the study is mainly ensured from theoretical perspective, by its topical and interdisciplinary approach offering a thorough documentation of the public accounting and budgeting system, grounded on the New Public paradigms that support the accrual reform (Brusca et al., 2016; Zafra-Gomez et al., 2012; Manes-Rossi et al., 2016a). The complexity of research is provided from empirical perspective through the statistical techniques (e.g. cluster analysis, Multidimensional Scaling technique, Principal Component Analysis, correlation analysis) used to assess the status of accrual reform and its power to influence the degree of public management initiatives’ achievement. Through all of these, our study will add high value to the scientific research on the “Gordian knot” of the public sector (Manes-Rossi et al., 2016b), filling as well the literature gap regarding the existing evidence at OECD country level.

The study addresses several users: theoreticians interested in keeping up to date with the latest developments in the accrual sphere of the public sector; practitioners willing to know about accrual implementation challenges and perceived management reform outcomes experienced by other governments; professional bodies and legislators keen on reforming the public sector towards greater transparency and public accountability.

The remainder of the paper proceeds as follows. Firstly, we provide the theoretical background focusing on the major trends in public accounting and budgeting across Europe (section 2.1), with a great emphasis on accruals as the heartbeat that links all the facets of the public management system. Then, we addressed our research questions in order to fulfil the aim of this study (section 2.3) by underpinning them on the New Public paradigms (NPM, post-NPM and NPG) (section 2.2). Afterwards, we presented in detail the research methodology applied by combining various statistical tools and the results reached (section 3). Finally, we end this paper with the discussions and conclusion revealing that most OECD countries express satisfaction that greater transparency and enhanced accountability have been achieved following the accrual reforms. However, there still are various issues and concerns about accounting and budgeting reporting, showing that some governments still have a way to go for improving the quality of their reporting practices.

2 Theoretical background

2.1 Trends in public accounting and budgeting across Europe

In the wake of two decades of public reforms, the great improvements achieved at the European Union level have accruals as the heartbeat that links all the facets of the public system – accounting, budgeting, management and taxation. Since all these developments were focused on a harmonized financial and fiscal policy able to ensure performance management and to enhance accountability through transparent reporting, accruals are definitely the cornerstone of all these.

Accrual basis has been recognized since long ago as the accounting method that introduced the value-for-money concept in the public sector, which was supported by multiple techniques of costing, budgeting and performance management (Jackson and Lapsley, 2003). However, despite many early debates regarding the accounting system’s type (cash vs. accrual) addressed in terms of theoretical issues, practical considerations and cost-benefit analyses, accruals proved to be the one that best suited to the public administration (Jaballa, et al., 2011). Thus, most jurisdictions worldwide ended up by accepting the accrual system, its adoption being nowadays regarded as self-evident (Lapsley et al., 2009). A large number of European countries either have already adhered to the accrual principles in the public sector or are still implementing these (Nistor and Stefanescu, 2016) despite its major barriers and challenges, such as the considerable investment in information systems and the development of appropriate skills for preparers and users (Land and Rocher, 2011).

Anyway, it is still important to mention not only the “lights” of the accrual accounting but its “shadows”, too. Thus, we do not have to forget that the manner in which accrual accounting developed in the public sector had the effect of privileging decisions, which advanced a controversial privatisation and trade liberalisation consistent with neo-liberal principles (Ellwood and Newberry, 2007). Besides its hidden role of acting as a tool to aid a controversial political agenda, recent evidence (Cohen et al., 2018) reveal that the accounting reforms towards accruals were adopted without informing the systems related to accountability, everyday decisions and assessment from oversight authorities.

However, due to accruals, there has been clear progress overtime in the comprehensiveness and completeness of governments’ financial reports (OECD/IFAC, 2016). In this context, the accrual principle comes to ensure an improved quality to financial and public policy, by generating an efficient and transparent reporting, with implications on public performances (Tickell, 2010), thus providing an accurate description of economic phenomena of interest to users (Garseth-Nebaskk, 2011). Moreover, the accrual concept becomes the link between national reforms and the international bodies’ vision (Mhaka, 2014), who unanimously accept its benefits. Thus, according to the European Commission accrual accounting “is the only generally accepted information system that provides a complete and reliable picture of the financial and economic position and performance of a government […]” (EC, 2013). Moreover, by adopting accruals “governments’ financial reporting is more comprehensive, with not only cash movements in and out of the government treasury reported to the public, but a range of other financial operations, as well as inventories of government’ assets and liabilities (OECD/IFAC, 2017). Finally, “accrual-based fiscal reports provide a more comprehensive view of the government’s financial performance and the cost of government activities” (IMF, 2016).

The international literature supports the benefits of applying accrual accounting by considering a transparent, clear and relevant vision of performance in public institutions increasing public accountability, improving information disclosure and the ability to faithfully represent financial information (Newberry, 2014; Brusca et al., 2016). In addition, the accrual basis results in a better financial management of public services and increasing performance comparability in different areas (Kordestani and Iranshahy, 2010). Above all these benefits lie down the ultimate desideratum of the public system – the harmonization project across EU member states from a double perspective: accounting vs. budgeting, respectively financial vs. fiscal reporting. In this context, the accrual concept became a benchmark for both financial and fiscal public policy (Nistor and Stefanescu, 2018). Moreover, it turns into a yardstick for harmonizing the two forms of governmental reporting (IPSAS and ESA 2010 references) joint-connected by the accruals, throughout EPSAS, the new set of accounting standards designed to adjust the inaccuracies between IPSAS and ESA 2010.

2.2 Theories underpinning accrual as an enabler of public management reforms

In the last decades, the worldwide public systems have been continuously marked by the waves of changes towards accruals, sustained by the economic theories that gradually aroused and continuously developed overtime.

Thus, at first, the New Public Management (NPM) took over various business-like methods and private-sector practices and behaviours that gradually headed to new accounting, budgeting and performance measurement systems designed to improve efficiency, increase interest in accountability and, finally, lead to a performance-focused public sector (Hyndman, et al., 2014). According to this theory, public accounting systems worldwide passed through a long period of continuous reforms starting from the cash method and heading to the full accruals. Moreover, by already adopting IPSAS and considering the future perspective of introducing EPSAS, most European countries have reformed their public systems in accordance with accrual principles, thus creating a political rationality and making governments more financially accountable (Brusca et al., 2016).

Similarly, according to the Post New Public Management (post-NPM), the budgeting system went through a growing demand for a strong value-based management open to transparent communication (Christensen and Lægreid, 2016). Introducing accrual basis in the budgeting process, along with the harmonization of the fiscal reporting systems by implementing the ESA 2010, bring about improvements in controlling organizations and, therefore, make the entire public sector more efficient (Zafra-Gomez, 2012).

Finally, the newest New Public Governance (NPG) emphasises the great importance of external accountability and transparency of both accounting and budgeting systems achieved through accrual reforms supported by both NPM and post-NPM. Thus, this theory supports a transparent common accounting playing field for all public sector organizations to provide reliable, comparable and accurate information (Manes-Rossi et al., 2016a).

In conclusion, New Public theories and accrual basis accounting are the best way to improve public sector management, to increase the transparency and raise the efficiency, since managers’ decisions are mainly based on accounting and budgeting reporting. Consequently, we grounded our research into these economic theories, for adding higher value to the directions outlined within this study throughout the research questions developed.

2.3 Research questions development

Modernizing public system rests on several reforms, the accounting and budgeting reporting being two of the most important whose harmonization has a great impact on the efficient use of public resources (Guarini and Pattaro, 2016).

At the European Union level, the access to reliable, accurate and comparable information useful for the decision-making process is a testimony of public accountability improvements and enhanced performance (Caba Perez et al., 2009). It is mainly the result of the latest paradigm shift (Zafra-Gomez et al., 2012) between New Public Management (hereafter NPM) and New Public Governance (hereafter NPG), that marked the public sector reform during the last decades.

In this respect, various international/European bodies involved (e.g. IPSASB, OECD, European Commission and European Council) embrace academic opinion and took measures over time to support governments in harmonizing their reporting systems. Consequently, most European Union countries have recently improved the completeness of their financial reports by moving away from pure cash accounting toward accrual accounting. Anyway, the current mixture of public sector accounting in Europe (Nistor and Stefanescu, 2016; Manes-Rossi et al., 2014), along with the tedious way towards harmonization (Brusca et al., 2015; Christiaens et al., 2015) caused multiple difficulties in getting reliable, accurate and comparable information.

Thus, both academics and standard setters have finally agreed that the interconnected economic and political approaches of the EU countries require reliable and transparent disclosure of both financial and fiscal positions (Heald and Hodges, 2015). The most feasible solution to achieve this goal was accounting standardization around accruals appreciated as the most powerful to provide complete and the only reliable image of the performance of a government, thus increasing accountability, openness and transparency (EC, 2013).

Consequently, while accruals adoption became both the current basis of a framework for standard setters when issuing IPSAS and ESA 2010 reference and the future one for the following developed EPSAS, the accrual world also turned into a focus point within this study. The motivation of concentrating our research on this topic relies on the necessity to provide an up-to-date broad look at accrual reforms by analysing both accounting and budgeting practices and discussing the current trends in moving from cash to accrual. Thus, the primary objective of this study is to attest the key-role of accruals in accomplishing the public management reform, gathering evidence on implementation challenges and perceived reform outcomes. For fulfilling this aim, the paper will follow three stages searching for an answer to the research questions arisen from the above state of the art:

RQ1: Which is the status of public reform from cash vs. accruals, the two end-points on the spectrum of both accounting and budgeting bases?

RQ2: Which is the current stage of achieving the public management reform initiatives?

RQ3: How the accrual accounting reform influenced the achievement of public management objectives?

3 Research design and results

3.1 Methodology framework

To fulfil the aim of our research, we carried out an exploratory data analysis (EDA) at the European level to identify and visualize the status of public reform from both accounting and budgeting perspectives, as well as its major initiatives’ achievements. Therefore, the analysis was performed on three interrelated stages, all of them highlighting the primary role of accruals as a target within the whole process of public sector development. The sample analysed in this research consists of all European countries that are OECD members.

Thus, firstly, wondering about the status of public reform from cash vs. accruals, the two end-points on the spectrum of both accounting and budgeting bases (RQ1), we tried to assess the EU-OECD countries’ position by the degree adoption, thus comparing the general patterns developed. Subsequently, we widened our research looking to analyse the current stage of the achievement of the public management reform initiatives (RQ2) by dividing the objectives undertaken into two categories – accounting vs. managerial. Finally, we purposed to identify whether the accrual accounting reform influenced the achievement of public management objectives (RQ3).

In this respect, we considered for our analysis four variables, expressing the current status of the public accounting, budgeting and management reform, by assigning values ranging from “1” to “3” (see Table 1), a summary of the sampled empirical data being presented in Table 2. Namely, the four variables are: the accounting basis for annual financial reports (Acc_basis), the budgeting preparation basis (Budg_basis), the accrual reform status (AR_status) and the achievement of public management reform objectives (Ref_achiev_obji).

Table 1. Variables considered for the empirical analysis

| Values assigned | Variables**) | |||

|---|---|---|---|---|

| Acc_basis | Budg_basis | AR_status | Ref_achiev_obji*) | |

| “1” | cash | cash | planned | ongoing |

| “2” | cash transition to accrual | cash and accrual | ongoing | partially |

| “3” | accrual | accrual | completed | fully |

*) this variable represents the degree of achievement the public management reform objectives (Σobji, where i=1 to 7):

Acctb - Enhancing accountability (obj1)

Transp - Increasing transparency towards the public at large (obj2)

Fin_anal - Meaningful figures/financial analysis for parliament and/or citizens (obj3)

Pub_fin - Increasing political and public awareness about the state of public finances (obj4)

Inf_costs - Better information on full costs of operations (obj5)

Decision - More informed decisions on assets/liabilities management (obj6)

Bus_proc - Efficiency of the business processes (obj7)

**) based on the survey conducted by OECD/IFAC (2017), Practices and Reform Experiences in OECD Countries, OECD Publishing, Paris.

Table 2. Summary of the sampled empirical data used within the study

| Acc_basis | Budg_basis | |

|---|---|---|

| Cash | DE, IE, IT, LU, NL | BE, CZ, FR, DE, EL, HU, IE, IT, LU, NL, PL, PT, SK, SI, ES |

| Mixed | EL, PT, SI | EE, FI, SE |

| Accrual | AT, BE, CZ, DK, EE, FI, FR, HU, PL, SK, ES, SE | AT, DK |

| AR_status | Ref_achiev_obj | |

| Planned/partially | DE, NL, EL, IE, LU, SI | EE, DE, EL, LU, SI, IE, PT |

| Ongoing | BE, CZ, IT, PT | CZ, NL, HU, BE, DK, IT, PL |

| Completed/fully | AT, DK, EE, FI, FR, HU, PL, SK, ES, SE | SK, SE, FI, FR, AT, ES |

Legend:

AT (Austria); BE (Belgium); CZ (Czech Republic); DK (Denmark); EE (Estonia); FI (Finland);

FR (France); GR (Greece); DE (Germany); HU (Hungary); IE (Ireland); IT (Italy); LU (Luxembourg);

NL (Netherlands); PL (Poland); PT (Portugal); SK (Slovakia); SL (Slovenia); SP (Spain); SE (Sweden)

For achieving our goal we combined various research methods and statistical techniques and tools, mainly the cluster and factor analysis, with the Multidimensional Scaling technique (MDS), aiming to highlight that accrual basis represents the desideratum of the public reform towards which most countries are heading for (see Table 3).

Table 3. Summary of research methods and statistical tests applied

| Research method | Statistical tests |

|---|---|

| RQ1 - Which is the current status of public reform from cash vs. accruals, the two endpoints on the spectrum of both accounting and budgeting bases? | |

|

|

|

|

| RQ2 - Which is the current stage of achieving the public management reform initiatives? | |

|

|

|

|

| RQ3: How the accrual accounting reform influenced the achievement of public management objectives? | |

Spearman's rho test to measure the strength and direction of the association between two ranked variables (e.g. accrual reform status and accounting / managerial objectives)

We appeal to these research methods since they were used before in similar studies on public sector either on a sample of local governments (Pina et al., 2009) or from the regulatory perspective at the EU level (Nistor and Ṣtefănescu, 2016; 2018). Unlike these, our research focuses on the applicability of cash vs. accruals in both accounting and budgeting reporting at the EU-OECD country level, followed by an in-depth analysis of the main public initiatives undertaken and their possible connection with the accrual reform. Thus, our paper comes to add value to the scientific literature in this field through this comprehensive research regarding the status of the public reform, as a whole, at the European level. Moreover, it provides consistent and trustworthy results reached by performing in-depth combined research methods certified through various statistical tests that increase the reliability of our findings.

3.2 Data and results

Aiming to provide an up-to-date image of the European public sector reform, as comprehensive and accurate as possible, we firstly focused on placing our sampled countries between the two end-points (cash vs. accruals) on the spectrum of both accounting and budgeting bases (RQ1).

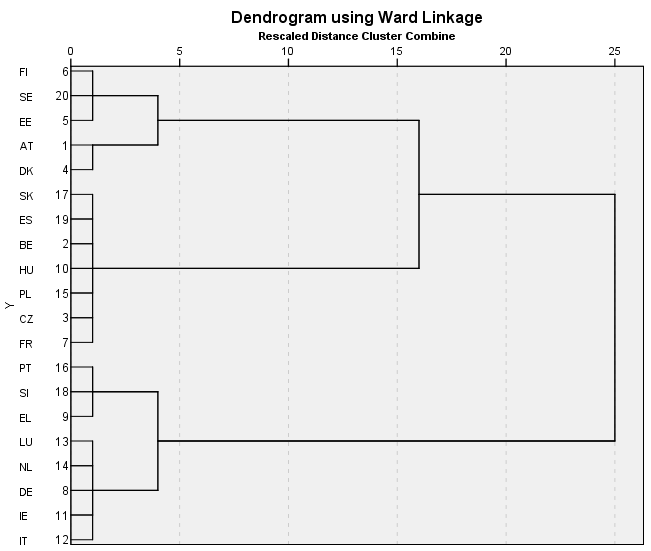

For achieving this goal, we applied the hierarchical cluster analysis to our countries’ sample to identify homogeneous groups sharing common characteristics, namely the accounting basis for annual financial reports (Acc_basis) and the budgeting preparation basis (Budg_basis). Thus, we aimed to maximize both the similarity of cases within each cluster as well as the dissimilarity between them (Burns and Burns, 2009). We choose this type of clustering as it is the best for small data sets because in this procedure a proximity matrix of the distance/similarity is computed for each pair of cases in the dataset. Moreover, we used Ward’s method as it depends upon the minimum variance concept and gives the clusters, which are more homogenous within it (Verma, 2013). In order to decide on the number of clusters, firstly, we visualized the analysis’s progress by drawing the dendrogram, which displays the distance level at which there is a merger of objects and clusters (see Figure 1). Then, we applied the Elbow method and we stopped the cluster formation when the increase for distance measures of the coefficients between two adjacent steps was large (from .000 to 2.448), thus resulting five clusters.

Figure 1. Dendrogram using Ward Linkage

Accordingly, we placed all 20 EU-OECD countries into five homogeneous groups, so that countries belonging to different clusters are dissimilar to a great extent in terms of both accounting and budgeting basis (see Table 4). Thus, we reached a balanced clustering solution, meaning not more than 50% of the sampled countries in the same cluster.

Table 4. EU-OECD country assignment to clusters

| Cluster | Countries |

|---|---|

| Cluster C1 | Austria, Denmark |

| Cluster C2 | Belgium, Czech Republic, France, Hungary, Poland, Slovakia, Spain |

| Cluster C3 | Estonia, Finland, Sweden |

| Cluster C4 | Germany, Ireland, Italy, Luxembourg, Netherlands |

| Cluster C5 | Greece, Portugal, Slovenia |

Finally, to increase the reliability of our results we performed various tests of significance for both perspectives analysed: accounting and budgeting. Firstly, we determined whether there are statistically significant differences between clusters by applying the Kruskal-Wallis test, the non-parametric equivalent of a one-way between groups ANOVA using ranked data (see Table 5).

Table 5. Significance test results for clusters’ difference

| Test Statistics,a,b | Acc_basis | Budg_basis |

| Chi-Square | 19.000 | 19.000 |

| df | 4 | 4 |

| Asymp. Sig. | .001 | .001 |

a. Kruskal Wallis Test

b. Grouping Variable: Ward Method

Since the results reached are favourable (chi-square=19.000, p=.001), pairwise comparisons among the groups need to be conducted to determine between which pairs the significant difference lies by employing the Mann-Whitney U-test (see Table 6).

Table 6. Pairwise comparisons between clusters

| Test Statistica,b | Acc_basis / Budg_basis | ||||

|---|---|---|---|---|---|

| Asymp Sig*(2-tailed) | Cluster C1 | Cluster C2 | Cluster C3 | Cluster C4 | Cluster C5 |

| Cluster C1 | - | 1.000/.005* | 1.000/.046* | .014*//014* | .046*/.046* |

| Cluster C2 | 1.000/.003* | .001*/1.000 | .003*/1.000 | ||

| Cluster C3 | .008*/.008* | .025*/.025* | |||

| Cluster C4 | .008*/1.000 | ||||

| Cluster C5 | - | ||||

a. Mann-Whitney U Test

b. Grouping Variable: Ward Method

Post hoc pairwise comparisons using the Mann-Whitney test demonstrate a significant difference between the clusters created for either accounting or budgeting perspective, with a p-value ranging between .000 and .046.

To complete the cluster analysis’ results, we applied the Multidimensional Scaling technique (MDS) to assign the perceptually interrelated objects (the sampled OECD-UE countries) into a dimensional space by mapping their locations according to the accounting (dimension 1 on the X-axis) and budgeting basis (dimension 2 on the Y-axis).

The mapping graphically illustrates the five clusters according to their statistical proximity (see Figure 2), having an excellent fit of correspondence between distances among points on the MDS map and the input matrix since the value of the Stress test (Kruskal’s type I) is less than 0.1 (0.0110).

Figure 2. EU- OECD countries’ mapping according to accounting and budgeting basis

| Dimension 1 – Accounting Dimension 2 - Budgeting | Cluster C1 Cluster C2

Cluster C3

Cluster C4

Cluster C5

| AT (Austria); DK (Denmark) SK (Slovakia); BE (Belgium); CZ (Czech Republic); FR (France); SP (Spain); HU (Hungary); PL (Poland) SE (Sweden); EE (Estonia); FI (Finland) IT (Italy); LU (Luxembourg); IE (Ireland); NL (Netherlands); DE (Germany) PT (Portugal); SL (Slovenia); GR (Greece) |

The two dimensions reflect the accounting and budgeting basis revealing their position between the cash and accrual perspectives assessed in order to answer our first research question about their status in the public sector (RQ1).

As it can be seen, the location of the cluster on the map is based on scores reached by each country on the two dimensions, justifying their place by referring to the public reform undergone. Looking at accounting and budgeting practices as a whole, there are two dominant streams followed by the vast majority of countries from the bottom side of the map - to prepare accrual financial statements but to use cash appropriations within budgeting process.

Unfortunately, from the budgeting perspective, only a quarter of EU-OECD countries prepare their annual budgets on an accrual basis or at least a mixt one, while most countries located on the right side of the map are still using cash (Cluster C2, C4 and C5). Thus, the few countries (from Cluster C1 and C3) that have adopted accrual budgeting, or a combination of accrual and cash, confessed that the key motivating factor of their decision was the consistency between ex-ante (annual budgets) and ex-post (annual financial statements) reports (OECD/IFAC, 2017). Regrettably, the vast majority of countries either are unaware of whether accrual is better than cash, their reform (e.g. Greece) being only meant to comply with demand (Cohen and Karatzimas, 2016) or do not acknowledge yet the importance of harmonizing both accounting and budgeting systems to achieve a wide comparability at the international level. Moreover, some countries still appreciate the importance of cash budgeting process (e.g. Germany), thus criticizing the use of accrual accounting due to its inconsistencies generated (Jones et al., 2014).

Such underpinnings might create barriers to public system development (Ellwood and Newberry, 2016), thus confirming that the road towards harmonization is long and winding, as recent research has demonstrated (Brusca et al., 2015; Christiaens et al., 2015). Moreover, since the budget, as the main tool for decision-making is often cash-based and unless accounting information, even if it is accrual-based, gains equal importance in the policy-making process, accrual prioritization is not self-evident (Manes-Rossi et al., 2016a).

However, through an in-depth look, the results are quite encouraging for a future harmonization of the public accounting, since around three-quarters of EU-OECD countries are situated in the left-side of the map (Cluster C1 to C3), revealing that they have already improved the completeness of their financial reports by moving away from pure cash toward accrual principles. The main reason of this change invoked by countries concerned was the purpose to gain wider accountability and to demonstrate the efficiency and effectiveness of public resources’ usage (IFAC, 2014), thus being in line with the NPM paradigm. Unfortunately, only five countries, mainly Austria and Denmark (from Clusters C1) recognized as the leaders of convergence between the two accounting systems (Hyndman, et al., 2014; Steger, 2010) and those states from Cluster C3 (Sweden, Estonia and Finland) have already taken measures for improving their budgeting process following accrual principles, too. These countries are the most aware of the demand for homogeneous forms of accounting to support fiscal transparency and ensure a strong value-based management (Heald and Hodges, 2015), thus following the Post-NPM principles.

In conclusion, the EU-OECD countries mapping of their status of public reform provides a visual answer to our first research question (RQ1). Actually, it reveals the coexistence of different reporting standards that still exists, thus supporting the great importance of accrual reform, whose principles were already widely adopted from the accounting perspective for enhancing public accountability and transparency, reinforced by the NPG paradigm. Moreover, there are promising steps ahead towards harmonization from the budgeting standpoint, too. Anyway, it does not necessarily require to entirely replace all existing tools currently in use for reporting or for the decision-making process, since a separation between a mandatory set of harmonized standards and other alternative reports embedding national features and preferences is sustained by international literature (Manes-Rossi et al., 2016b).

Grounding on these prerequisites and relying on the above results, we stepped into the second stage of our empirical research aimed to identify the stage of achieving the public management reform initiatives (RQ2), arguing about perceived outcomes and implementation challenges.

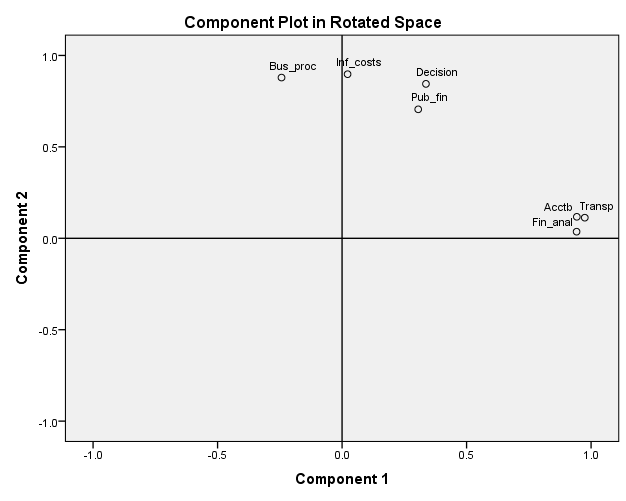

In this respect, without having any prior beliefs about which, or how many initiatives of the public management reform have been achieved, we performed an Exploratory Factor Analysis (EFA). Actually, we used the Principal Component Analysis (PCA) to demonstrate which variables clump together to create super-ordinate variables for developing a typology of the objectives achieved. Therefore, we applied this reduction technique in order to compress our variables represented by the achieved objectives into a smaller set of “artificial” ones, called principal components. Since many correlations between variables tested exceeded the 0.30 threshold, we performed a subsequent rotation using the Varimax method to enhance the interpretability of the results (see Table 7).

Table 7. Correlation matrix of the reform objectives achieved

| Correlation | Acctb | Transp | Fin_anal | Pub_fin | Inf_costs | Decision | Bus_proc |

| Acctb | 1.000 | .924 | .877 | .233 | .198 | .375 | -.061 |

| Transp | .924 | 1.000 | .888 | .388 | .102 | .428 | -.131 |

| Fin_anal | .877 | .888 | 1.000 | .238 | .112 | .286 | -.135 |

| Pub_fin | .233 | .388 | .238 | 1.000 | .473 | .763 | .346 |

| Inf_costs | .198 | .102 | .112 | .473 | 1.000 | .635 | .836 |

| Decision | .375 | .428 | .286 | .763 | .635 | 1.000 | .584 |

| Bus_proc | -.061 | -.131 | -.135 | .346 | .836 | .584 | 1.000 |

By applying the Kaiser’s rule and the scree test we identified two deemed important components, which have their eigenvalues greater than 1 and explain 82.97% of the total variance (see Table 8).

Table 8. Components analysis - model summary

Total Variance Explained | |||

| Component | Initial Eigenvalues | ||

| Total | % of Variance | Cumulative % | |

| 1 | 3.472 | 49.596 | 49.596 |

| 2 | 2.337 | 33.381 | 82.977 |

Extraction Method: Principal Component Analysis

Because all variables have a simple structure and communalities higher than 0.50 (ranging between 0.591 and 0.962), these are properly included in the best fitting component as the factor loadings of each variable on each of the factors reveal (see Table 9).

Table 9. Rotated component matrix

| Component 1 | Component 2 | |

| Acctb | .943 | |

| Transp | .975 | |

| Fin_anal | .942 | |

| Pub_fin | .306 | .705 |

| Inf_costs | .898 | |

| Decision | .337 | .845 |

| Bus_proc | .879 |

Extraction Method: Principal Component Analysis.

Rotation Method: Varimax with Kaiser Normalization

In order to ensure the validity and suitability of this approach, we tested the reliability and significance of our results. Thus, we applied the Kaiser-Meyer-Olkin measure of sampling adequacy test (KMO). The measures of sample adequacy (MSA) provided by the anti-image correlation matrix support their retention in the analysis since they lie above the threshold level of 0.50 (ranging between 0.541 and 0.865), while the overall measure of sampling adequacy (KMO) exceeds the minimum requirement of 0.5 considered to be sufficient for doing the factor analysis reliably (Verma, 2013). Finally, Bartlett’s Test of sphericity also proved to be significant (Sig<.001), thus indicating that it was worth performing the analysis as there are relationships to investigate (see Table 10).

Table 10. Adequacy and Reliability of PCA analysis

| KMO and Bartlett's Test | ||

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | .655 | |

| Bartlett's Test of Sphericity | Approx. Chi-Square | 117.594 |

| df | 21 | |

| Sig. | .000 | |

Consequently, three reform objectives (enhancing accountability; increasing transparency towards the public at large and meaningful figures/financial analysis for parliament and/or citizens) best fit into component “1” labelled “Accounting”. This labelling was mainly based on the Ministries of Finance of the sampled countries opinions, which stated that accrual accounting is responsible for all these (enhanced accountability, increased transparency, new procedures and IT systems helpful in producing information), since it has made more and better financial information available to the public at large (OECD, 2017). Component “2” was labelled “Managerial” in accordance with their expressed content closely related to it, and discriminates the rest of them (increasing political and public awareness about the state of public finances; better information on full costs of operations; more informed decisions on assets/liabilities management; efficiency of the business processes). These results are in accordance with the data visualization of the public management reform objectives provided by the component plot (see Figure 3).

Figure 3. Public management reform objectives - component plot

| Legend: | Objectives: |

|---|---|---|

| Acctb(*) | - Enhancing accountability | |

| Inf_costs(**) | - Better cost information | |

| Transp(*) | - Increasing transparency | |

| Fin_anal(*) | - Meaningful financial analysis | |

| Pub_fin(**) | - State of public finances awareness | |

| Decision(**) | - More informed decisions | |

| Bus_proc(**) | - Business processes’ efficiency |

Component 1 – Accounting objectives(*) / Component 2 – Managerial objectives(**)

To complete the Principal Component Analysis results, we finally mapped our EU-OECD countries’ dataset into the dimensional space of the reform objectives, by assigning each of them a location according to the accounting vs. managerial achievements (see Figure 4).

Figure 4. EU-OECD countries mapping according to objectives achievement

| Dimension 1 – Managerial objectives Dimension 2 – Accounting objectives | Cluster O1

Cluster O2

Cluster O3

Cluster O4

| AT (Austria); SP (Spain); FI (Finland); FR (France); SK (Slovakia) DK (Denmark); SE (Sweden); PL (Poland); IT (Italy) BE (Belgium); IE (Ireland); CZ (Czech Republic); HU (Hungary); PT (Portugal) NL (Netherlands); EE (Estonia); LU (Luxembourg); GR (Greece); DE (Germany); SL (Slovenia); |

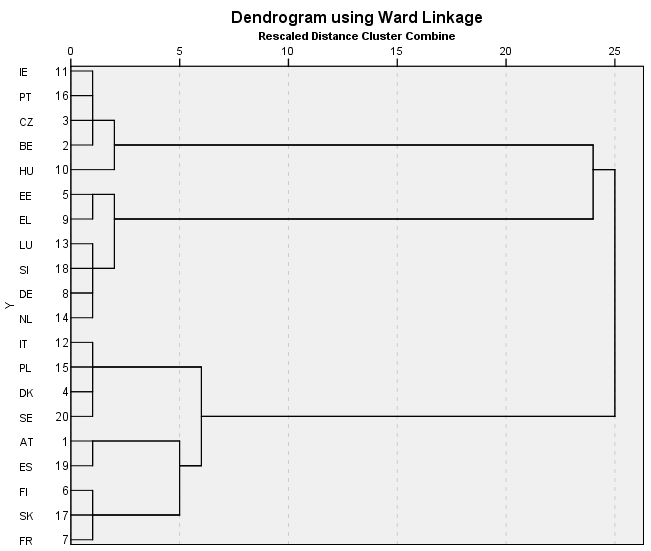

Afterwards, we run a hierarchical cluster analysis to our countries’ sample, by applying Ward’s method, thus identifying four homogeneous groups that share common characteristics regarding their reform objectives’ achievements.

Figure 5. Dendrogram using Ward Linkage

The dendrogram displaying the distance level at which there is a merger of objects and clusters enables us to visualise the analysis’s progress and to decide upon the number of clusters (see Figure 5).

We validate our clustering solution by performing the homogeneity test to assess the equality of variances. Thus, it is insignificant as the Levene test’s p-value (0.113, respectively 0.122) is a little above the 0.05 threshold, in contrast with its inadequate value for accounting objectives component in case of a three cluster solution (13.688, p-value=.000). For this reason, we also performed the robustness tests, which make adjustments if the variances are not homogeneous enough, Welch test (Sig<.001) exhibiting the greatest statistical power (see Table 11).

Table 11. Cluster analysis solution’s validation tests

| Statistica | df1 | df2 | Sig. | |

|---|---|---|---|---|

| Test of Homogeneity of Variances | ||||

| Levene*/** | 4.957 / 2.248 | 3 | 16 | .113 / .122 |

| Robust Tests of Equality of Means | ||||

| Welch */** | 178.772 / 22.326 | 3 | 7.412 / 8.505 | .000 / .000 |

| Brown-Forsythe*/** | 64.418 / 14.356 | 3 | 6.709 / 10.497 | .000 / .000 |

a. Asymptotically F distributed.

*) Accounting objectives / **) Managerial objectives

To increase the reliability of our clustering solution we performed various significance tests for both accounting and managerial objectives. Firstly, we applied the one-way analysis of variance (ANOVA) to determine whether there are major differences between clusters. As it can be seen, the ratio of the variability between clusters compared to the variability within them reached a higher value for the accounting objectives (F statistics = 64.776) compared with the managerial one (F statistics = 13.804), both being anyway significant with a p-value<0.001 (see Table 12).

Table 12. ANOVA test results

| Sum of Squares | df | Mean Square | F | Sig. | ||

|---|---|---|---|---|---|---|

| Acc_Obj | Between Groups | 17.555 | 3 | 5.852 | 64.776 | .000 |

| Within Groups | 1.445 | 16 | .090 | |||

| Total | 19.000 | 19 | ||||

| Manag_Obj | Between Groups | 13.705 | 3 | 4.568 | 13.804 | .000 |

| Within Groups | 5.295 | 16 | .331 | |||

| Total | 19.000 | 19 |

Afterwards, we applied the post-hoc tests to identify which clusters are significantly different, by using the Tukey's HSD test as it controls the overall Type 1 error rate and it is reasonably powerful. We synthesized the honestly significant differences between clusters found through multiple comparisons (see Table 13) to highlight that most clusters among our sample differ considerably (p-value<0.05) especially from accounting objectives perspective.

Table 13. Honest Significant Differences between clusters

| Tukey HSD | Multiple Comparisons | |||||

| (I) Ward Method | (J) Ward Method | Mean Diff. (I-J) | Std. Error | Sig. | 95% Confidence Interval | |

| Lower Bound | Upper Bound | |||||

| Cluster O1 | Cluster O2a | -1.85756429* | .19008945 | .000 | -2.4014140 | -1.3137146 |

| Cluster O2b | -1.65379746* | .36383880 | .002 | -2.6947475 | -.6128474 | |

| Cluster O3a | -1.19700933* | .20162031 | .000 | -1.7738490 | -.6201696 | |

| Cluster O3b | -.10728377 | .38590932 | .992 | -1.2113780 | .9968105 | |

| Cluster O4a | -2.44654220* | .18199679 | .000 | -2.9672386 | -1.9258458 | |

| Cluster O4b | .51130463 | .34834913 | .478 | -.4853291 | 1.5079384 | |

| Cluster O2 | Cluster O3a | .66055497* | .20162031 | .022 | .0837153 | 1.2373947 |

| Cluster O2 | Cluster O3b | 1.54651369* | .38590932 | .005 | .4424195 | 2.6506079 |

| Cluster O4a | -.58897791* | .18199679 | .024 | -1.1096743 | -.0682815 | |

| Cluster O4b | 2.16510209* | .34834913 | .000 | 1.1684683 | 3.1617359 | |

| Cluster O3 | Cluster O4a | -1.24953288* | .19400923 | .000 | -1.8045971 | -.6944686 |

| Cluster O4b | .61858840 | .37134142 | .373 | -.4438268 | 1.6810036 | |

*. The mean difference is significant at the 0.05 level.

a) Accounting objectives / b) Managerial objectives

The mapping of the EU-OECD countries into groups reveals the status of both accounting and managerial objectives achieved under the public management reform initiatives, thus answering our second research question (RQ2).

As it can be noticed, most sampled countries are situated on the left side of the map (Cluster O1, O2 and O4) revealing a high degree of achieving their managerial objectives, irrespective of their opposite reporting bases (cash budgeting vs. accrual accounting). From their perspective, accrual information gives limited satisfaction among external stakeholders. Thus, the meaningful financial analysis does not necessarily mean accrual financial statements, because they usually are inaccessible to their primary users such as parliamentarians. Likewise, information on the full costs of operations is not always available at operational levels. Moreover, accrual accounting adoption had a limited effect so far on improving the efficiency of administrative processes (OECD/IFAC, 2017).

On the other hand, those countries situated on the bottom of the map (Cluster O1, O2 and O3), which have completed their accrual accounting reform, have fully achieved important accounting objective, besides the managerial ones. Enhanced accountability and increased transparency seem to be the main positive outcomes of the reform, while the use of full accrual costs for evaluating the management and performance of government entities is not widespread yet (OECD/IFAC, 2017). Consequently, despite critics such as irrelevance for stakeholders or inconsistency with budgetary systems (Christiaens et al., 2015), accruals seem to be a desire in the public system due to its potential to enhance performance (Nistor and Stefanescu, 2018) and to improve the decisional process throughout qualitative and transparent information, supported by the NPG paradigm.

Relying on these results, we anticipate a positive influence on how the accrual accounting reform influenced the achievement of public management reform objectives (RQ3), which we aimed to prove empirically into the final part of our research.

For this purpose, we used the Spearman's rho coefficient to test the association between the accrual reform status and the degree of achieving accounting and managerial objectives of the public management initiatives. The accrual reform status (AR_status) was defined as a variable in Table 1, expressing the current stage (planned, ongoing or completed) of accomplishing the accrual reform. The degree of achieving accounting and managerial objectives (Acc_Obj and Manag_Obj) are two new variables representing the main factors identified after performing the Exploratory Factor Analysis using the PCA method for completing our prior goal (RQ2).

The results reached (see Table 14) reveal that there is a strong positive association between the accounting objectives and the accrual reform undergone.

Table 14. Nonparametric correlations’ test results

| Nonparametric correlations | Rank of Acc_Obj | Rank of Manag_Obj | ||

| Spearman's rho | Accrual Reform Status (AR_status) | Correlation Coefficient | .809** | -.217 |

| Sig. (2-tailed) | .000 | .359 | ||

| N | 20 | 20 |

**). Correlation is significant at the 0.01 level (2-tailed).

In conclusion, accrual reform might have a positive impact on the future developments of the public system having at their core the need for high qualitative, more relevant and transparent information useful for accountability purposes. Finally, it may lead towards providing a fair view of the public finances, assessing the full costs of government operations, introducing or enhancing a performance culture, and modernising public management.

4 Conclusions

Under the dome of the New Public paradigms that gradually upraised from management to governance level, the new trends in the public system were in a continuous improvement leading towards a more transparent and accountable public sector. They were mainly inspired by the private practices and embedded almost unanimously the accrual principles. In this dynamic context, many countries worldwide, and specifically the European ones, have recently passed through profound changes at all levels of government, having accruals as a benchmark of high-quality reporting that enjoys international acceptance (Manes-Rossi et al., 2016b).

This evolutionary environment opened us up new opportunities to enrich the scientific literature through this topical research aimed to highlight the foremost role of accruals in achieving the public management reform. Moreover, we added value through this paper by approaching an interdisciplinary research topic, grounded on NPM and NPG theory, that successfully combines accounting, budgeting and management issues on a sample made of all EU-OECD countries, thus covering a significant literature gap where evidence is scarce. Furthermore, the novelty of this study is ensured by its research design, which successfully combines clustering, Principal Component Analysis and Multidimensional Scaling Technique to fulfil the objectives assumed.

Firstly, we intended to emphasize the current status of public reform from cash vs. accruals, the two endpoints on the spectrum of both accounting and budgeting bases (RQ1), aiming to promote a harmonised accrual-based reporting system able to support public management reform initiatives.

The scenery of EU-OECD public sector provided by mapping our sample of countries according to their reporting system’s basis reinforces the latest trends of development marked by the New Public paradigms promoting public accountability and transparent communication throughout a sound reporting. Thus, our results support the demand for a common-based reporting framework grounded on accrual principles able to present a fair view of the public finances, to assess the full costs of government operations and to enhance performance, thus modernizing public management in general.

Through a deeper analysis of the accounting and budgeting reform, a great majority of EU-OECD countries have already adopted accrual accounting and more than a quarter prepare their annual budgets on an accrual basis. However, there still are countries that are still using cash appropriations, even though they are preparing accrual financial statements.

These results are in accordance with prior evidence, which established a strong positive connection between vertical harmonization and their openness towards accrual reporting reform (Christiaens et al., 2015; Caperchione and Lapsley, 2011), and found difficult to change their strong tradition even under international pressure (Manes-Rossi, et al., 2016a).

Because countries that engage in modernizing public accounting throughout accrual reform pursue a wide variety of objectives, we stepped into the second stage of our analysis aiming to assess the status of achieving the public management reform initiatives (RQ2).

Evidence from country level reveals that EU-OECD countries have completed their reform programmes to a great extent, following a wide range of objectives, either accounting (enhancing accountability, increasing transparency, producing meaningful financial analysis) or managerial (awareness about the state of public finances, better information on costs, increased efficiency of business processes, more informed decisions about asset and liability management). Moreover, our results reveal that accrual reform positively influenced the achievement of public management accounting objectives, which might create premises for potential benefits on public accountability, governmental performance and macroeconomic transparency.

Consequently, we encourage the development of a unitary accrual-based benchmark able to support accounting, budgetary and fiscal integration among European countries, since it might allow greater comparability between them. Anyway, we are entirely aware of the multiple obstacles that governments have to overcome, mainly the highly implementing costs, especially the investments in IT and educational training.

This conclusion of our study opens up further opportunities to both theoreticians by offering them a new research topic and professional bodies by providing a concrete and precise basis for future analysis regarding accounting regulation in the public sector.

Funding

This research did not receive any specific grant from funding agencies in the public, commercial or not-for-profit sectors.

Declaration of interest

The author declare no conflict of interest.