Public sector financial management and democracy quality: The role of the accounting systems

ABSTRACT

Changes in accounting frameworks, such as those based on the adoption of accrual-accounting systems or the implementation of International Public Sector Accounting Standards (IPSAS), are considered to be an important feature of public-sector financial management practices and reforms. Previous studies have largely investigated the effects of these reforms on transparency and accountability, also taking into account the dimension of the participation of citizens. This study aims to examine the effects of public-sector financial management practices regarding the quality of democracy. It focuses on the role of the accounting systems in use, offering an international view and comparative analysis of IPSAS and accrual-basis system adoption. By using a sample of 33 OECD countries between 2010 and 2014, the findings which emerge from the analysis suggest that accrual-basis accounting has proven not to be sufficient for a good democracy quality; however, they indicate that IPSAS implementation improves the democracy quality, mainly due to equality and control principles.

Keywords: Public-sector financial management; Democracy; Public sector accounting; IPSAS; Transparency.

JEL classification: H83, M41, P4

Gestión financiera del sector público y calidad de la democracia: el papel de los sistemas contables

RESUMEN

Los cambios en los marcos contables, como la adopción de sistemas contables basados en el devengo (accrual accounting) o la implementación de las Normas Internacionales de Contabilidad del Sector Público (International Public Sector Financial Accounting Standards, IPSAS), se consideran importantes reformas de la gestión financiera del sector público. Estudios anteriores han investigado en gran medida los efectos de estas reformas sobre la transparencia y la rendición de cuentas, teniendo en cuenta también el nivel de participación de los ciudadanos del sector público. Este estudio tiene como objetivo examinar los efectos de estas prácticas de gestión financiera sobre la calidad de la democracia. Concretamente, se centra en estudiar el papel de los sistemas de contabilidad a nivel internacional y ofrece un análisis comparativo de la adopción de las IPSAS y del sistema basado en los accruals. Utilizando una muestra de 33 países de la OCDE entre los años 2010 y 2014, los resultados sugieren que el uso de un sistema contable basado en los accruals no ha sido suficiente para mejorar la calidad de democracia; sin embargo, los hallazgos indican que la implementación de las IPSAS sí consigue mejorar la calidad de la democracia, principalmente debido a los principios de igualdad y control.

Palabras clave: Gestión financiera del sector público; Democracia; Contabilidad del sector público; IPSAS; Transparencia.

Códigos JEL: H83, M41, P4

1 Introduction

This study aims to investigate the effects regarding the quality of democracy of public-sector financial management reforms, implemented in many countries at a central government level. Taking into account that transparency and accountability are deemed to be two key tenets of the quality of democracy (Warren, 2014), the motivation behind this research is twofold. On the one hand, it is stimulated by the growing need of increasing transparency of public-sector entities, in order to improve accountability toward citizens and stakeholders in general, enhancing also good governance and democratic participation (IMF, 2018). On the other hand, to be transparent, public-sector entities have to provide high quality information, allowing stakeholders to assess how public resources have been used.

This last aspect suggests focusing, among public-sector financial management practices and reforms, on the role of public-sector accounting, considering that key information is primarily obtained from the accounting system. Indeed, the adoption of accrual accounting is considered to be an important factor of public administration reforms globally (OECD, 2017). Scholars have frequently associated it with the New Public Management (NPM) principles (Biondi, 2014) and the implementation of the International Public Sector Accounting Standards (IPSAS). Previous studies have largely debated the impact of accrual accounting and the IPSAS implementation on transparency and accountability, even though several doubts have been raised, considering the specificities of the public sector (Blöndal, 2003; Barton, 2009). However, the possible link with the quality of democracy seems to be under-investigated. This paper tries to fill this gap by using the Democracy Barometer index to represent democracy quality (Bühlmann et al., 2012).

The core message of this study is when dealing with public-sector financial management and accounting practices/reforms means not only addressing technical issues: these practices and reforms can lead to organizational changes, technological developments, and the adoption of new managerial approaches, also affecting the economic and political life of social communities (Mussari, 2014). Furthermore, they can allow citizens and stakeholders in general to be more aware of how resources are managed to deliver public services. Accordingly, adopting a wider approach rather than focusing on technicalities could prove to be useful in assessing the effects of public-sector financial management practices and reforms on a key aspect: the democracy quality.

From a methodological perspective, a sample of 33 OECD (Organisation for Economic Co-operation and Development) countries has been selected. The OECD context is highly appropriate considering that a large number of central governments have adopted accrual accounting, and, although IPSAS adoption is low, many standard-setters use them as a primary reference for elaborating their national standards (OECD/IFAC, 2017). The analysis spans the period 2010–2014 since the relevance of IPSAS implementation and accrual accounting has increased especially in the last years.

The empirical results suggest that accrual-basis accounting has proven not be enough for good democracy quality; the increase in the degree of IPSAS implementation results in a positive effect on the democracy principles headed by equality and control. Considering that IPSAS have attracted the attention of scholars, policymakers, standard-setters and practitioners over the world, our findings offer an international view and comparative analysis of IPSAS and accrual-basis system adoption. These findings enhance the relevance of the international harmonization of accounting standards beyond the accrual-basis systems in the public sector.

The remainder of the paper is structured as follows. Section 2 describes the quality of democracy, reviews the previous literature on IPSAS and accrual accounting in the public sector, and discusses the relationship between these two concepts. Section 3 describes the sample, variables and model of analysis. Section 4 presents and discusses the results, while Section 5 concludes, also providing suggestions for future research.

2 Quality of democracy, accrual accounting and IPSAS implementation

2.1 Describing the concept of democracy quality

Traditionally the quality of democracy has been understood beyond the participation of citizens in electing their representative elites. This so-called “minimal” definition applies to the political system, leading governments to be divided into democracy vs. dictatorship. However, the quality of democracy is a more complex phenomenon that applies to a wider conception of citizen participation.

The first approach to conceptualize this phenomenon was made by Dahl (1971), who supported an ideal concept of democracy called “polyarchy”, which complies with freedom of association, expression and vote, political competition, diversity of information sources, impartial elections, and institutions that ensure governmental policies comply with voters’ wishes. From this approach, several definitions of the quality of democracy have been provided, including specific features, such as the capacity of a society to take part in a democracy (Altman & Pérez-Liñán, 2002), the control of political power (O’Donnell, 2004), and the level of welfare and equality (Diamond & Morlino, 2004).

From this heterogeneity of definitions, a wide range of measures appears (Dahl, 1971; Altman & Pérez-Liñán, 2002; Inglehart, 2003). The most popular democracy indices currently are Freedom House, Polity, and the Vanhanen Index, but they suffer from significant weaknesses in terms of conceptualization, measurement, and aggregation (Munck & Verkuilen, 2002). Accordingly, Democracy Barometer has developed a new tool to measure the quality of democracy (called DQ), which tries to overcome the shortcomings of previous indicators.

DQ is obtained after a deep theoretical discussion on the different components that represent the quality of democracy, which refers to the balance between the values of freedom and equality, and the control that is required for such a balance. It is a middle-range approach: more than minimalist, because it adds the control dimension, but lesser than maximalist, because it does not consider the results of democratic systems (Bühlmann et al., 2012).

This study adopts DQ definition, which is based on three principles: freedom, equality, and control. Freedom refers to the protection of individual rights under a good rule of law, as well as the freedom of opinion and association (Beetham, 2004). Equality refers to the equal participation in the political process for all citizens and the equal representation of the preferences of all citizens, as well as the transparency of the political process (Dahl, 1998). Control is necessary to get a balance between freedom and equality, and ensuring citizens’ representatives are accountable; coherently, it deals with the mutual constraints of constitutional powers, competitive elections, and government capability (Bühlmann et al., 2012).

Each of the three DQ principles is composed of three functions, which, in turn, consist of two components (see Table 1).

Table 1. Components of Democracy Barometer Index (DB)

| Principles | Functions | Components | Definition of components |

|---|---|---|---|

| Freedom | Individual liberties | Right to physical integrity | No cruel or degrading treatments or punishments. |

| Right to free conduct of life | Freedom of religion and movement, and protection of property rights. | ||

| Rule of law | Equality before law | Independence and impartiality of the legal framework. | |

| Quality of the legal system | Professionalism of judges and legitimacy of the justice system by the citizens' confidence. | ||

| Public sphere | Freedom of association | Density of associations with political and general public interests. | |

| Freedom of opinion | Diffusion of information by media. | ||

| Equality | Transparency | No secrecy | Corruption and bribery cases. |

| Transparency of the political process | Freedom of information legislation and freedom of media to cover political affairs. | ||

| Participation | Equality of participation in elections | Right to participate in the political decisions. | |

| Effective participation in elections | Suffrage rights. | ||

| Representation | Substantive representation | Disproportionality between votes and seats. | |

| Descriptive representation | Access to political office for ethnic and structural minorities (including women). | ||

| Control | Competition | Vulnerability (competitiveness of elections) | Uncertainty of the electoral outcome |

| Contestability (openness of elections) | Stipulations that electoral competitors have to meet in order to be allowed to enter the political race. | ||

| Mutual constraints of powers | Checks between the three powers | Efficacy of opposition and possibilities for supersession or dissolution. | |

| Vertical checks | Possibility to review the constitutionality of laws; and degree of decentralisation. | ||

| Governmental capability | Government resources | Public support and government stability (long terms of legislature). | |

| Conditions for efficient implementation of the government | Influence of non-political actors, such as military or religious powers. |

Source: The authors, based on Bühlmann et al. (2012)

2.2 The role of public financial management in enhancing democratic participation

In the last decades, several countries have introduced important reforms, with the main aim being to improve efficiency and effectiveness of public-sector entities. The origin of the NPM movement was based on severe criticisms raised against the inefficiencies of public-sector organisations. Therefore, several ideas, tools and techniques derived from the private sector (such as decentralisation, management by objectives, competition, and so on), have been gradually introduced in the public-sector context (Hood, 1991; 1995). According to OECD (1995), a number of developed countries were guided towards the same reforms, to enhance performance management, to introduce more competition into the public sector, and to improve the quality of services available to citizens. Even though this approach was criticised, as it did not take into consideration appropriately several specificities of the public sector (Tagesson, 2015), it became the fil rouge underlining this wide reform movement, based on two fundamental dimensions: (i) output legitimacy, which includes the quality, effectiveness and efficiency of task fulfilment; (ii) input legitimacy, which describes the dimension of the participation of citizens (Kuhlmann and Woolmann, 2014, p. 42).

Citizens participation can be considered as one of the main relevant public governance principles (Bovaird & Löffler, 2003) and it is heavily dependent on the information the government provides to citizens regarding how public resources are managed (Da Cruz et al., 2016). Politicians are expected to use money prudently, complying with public purposes, so accountability is necessary to ensure public officials do not abuse the power they wield on citizens’ behalf (Behn, 2001). In this respect, many public administrations are investing increasing resources in information and communication technologies (ICT) so as to bring public entities and citizens closer to each other (EC, 2016; Cohen et al., 2017). Furthermore, scholars have pointed out the positive effects of e-government initiatives on the active participation of citizens (Aversano & Manes-Rossi, 2017), documenting an improved accessibility of accounting information.

In this respect, it has been maintained that one of the key pillars of public-sector financial management practices concerns the accounting system in use, as reforms implemented under the NPM umbrella affect accounting, budgeting and reporting (Bergmann, 2009; Caperchione, 2006). Pollitt and Bouckaert (2017, p. 41) have pointed out that adopting new managerial approaches would imply, among other aspects, introducing new accounting frameworks. Therefore, in order to improve the quality of information, a widespread shift from cash-based systems to accrual-based systems has been observed, associating it with the advantages of the NPM principles (Biondi, 2014; Biondi & Soverchia, 2014). Although there is a risk of considering accrual accounting systems mainly from a mere technical perspective, it has been claimed (Caruana et al., 2019, p. 3) that accounting frameworks are not designated only for financial reporting. They also refer to the legislation of the country in which they are applied, aiming at consolidating good governance practices, also enabling management accounting, financial management, budgeting, and performance management. In a similar vein, implementing International Public Sector Accounting Standards (IPSAS) is not a mere technical decision, as these standards and the related accounting framework are expected to improve the comparability of information (Wang, 2002), playing a key role for international harmonization (Benito et al., 2007). However, it might be critically observed that accrual accounting adoption and IPSAS implementation, while guaranteeing better-quality information (Sutcliffe, 2003), do not automatically improve accountability, which requires the active participation of citizens.

Accordingly, the higher the transparency, the better the accountability can be perceived as an effort to guarantee that government processes and actions are publicly accessible and considered by citizens as representing the appearance of democracy (Harrison & Sayogo, 2014, p. 513). Therefore, it can be reasonably assumed that improving information quality fosters the participation of citizens, and hence it should enhance the quality of democracy. More specifically, it can be argued that if accrual accounting systems and IPSAS implementation, as key pillars of financial management practices, enhance transparency/accountability, they also improve the quality of democracy, because accountability plays an essential role in a “good” democracy quality (Papenfuß & Schaefer, 2010; Warren, 2014); it makes public what is done and who does it.

Accordingly, the following hypotheses are formulated:

H1, Accrual accounting adoption affects the quality of democracy.

H2, IPSAS implementation affects the quality of democracy.

3 Research methodology

3.1 Sample

To empirically test the proposed hypotheses, we need both a proxy for the quality of democracy and some public sector accounting indicators. The former has been obtained from the Democracy Barometer website, which provides data for 72 countries from 1990 to 2014. We have selected a sample of 33 OECD countries1: Australia, Austria, Belgium, Canada, Chile, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Japan, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Turkey, the UK, and the USA.

The data regarding IPSAS and accrual accounting reforms was hand-collected from: (i) the International Federation of Accountants (IFAC) website, which obtains information both from member organisations and publicly available sources listed in each jurisdiction profile; and (ii) OECD/IFAC (2017), which is based on information gathered from a survey sent to the Ministries of Finance and equivalent bodies of all OECD countries. Considering that hand-collected data is not easily obtainable, the largest period over which it was possible to attain information on public-sector accounting status (concretely 2010-2014) was selected. Furthermore, this period is appropriate because of the relevance of accrual accounting and IPSAS has increased particularly in recent years.

The data on democracy quality was obtained from the Democracy Barometer website; and the remaining data was obtained from the World Bank dataset. All variables will be described below.

3.2 Dependent variable

The proxy selected to depict democracy quality is the index DQ, obtained from the Democracy Barometer website. It is represented by three principles, namely Freedom, Equality and Control, which are proxied by three functions that, in turn, consist of two components (see Table 1). We test the effect of public sector accounting on DQ and the three principles (Freedom, Equality and Control) separately, because the impact may be different for each of them. We may expect accrual accounting and IPSAS adoption impact on Equality (i.e. transparency, participation, and representation) and Control (i.e. competition, mutual constraint of powers, and governmental capability); however, there are some doubts on their effect on Freedom (i.e. individual liberties, rule of law, and public sphere).

All these indicators take values between 0 and 100 (from the worst to the best quality) after a standardization process. Standardization is a very important process for the accuracy of the measures. To carry out this task, the Democracy Barometer project select a set of so-called “blueprint” countries that are established democracies, relying on previous indices of democracy (Polity and Freedom House). Then, the lowest and the highest values within such established democracies were rescaled to 0 and 100, respectively.

Once all indicators have the same scale, aggregation is possible. Aggregation of each level up to the 18 components are based on arithmetic means; while, the aggregation of the components to each function, functions to each principle, and the three principles to DQ is based on the optimal balance, i.e. by applying an formula that rewards high values at the lower levels and penalizes incongruences between pairs of values (Bühlmann et al., 2012).

3.3 Independent variables

Independent variables represent the status of public-sector account reforms (IPSAS and accrual-basis system implemented in order to elaborate and present the financial statements2) in each central government. As a matter of fact, there is a great diversity among countries (Benito et al., 2007; Roje et al., 2010). Several governments are piloting the implementation and leading a process to convergence towards IPSAS and accrual-basis accounting; others are in an initial stage, discussing the pros and cons of IPSAS implementation and still using cash-basis accounting, while others do not plan to adopt the international standards (Oulasvirta, 2014). Therefore, a variable that represents the diversity of implementation is required. Following previous studies (PwC, 2014; Christiaens et al., 2015; Bellanca & Vandernoot, 2014; Cuadrado-Ballesteros et al., 2019), we have created two variables: IPSAS and Accruals. The former represents different levels of IPSAS adoption:

IPSAS = 1: No actions have been undertaken to adopt IPSAS until now.

IPSAS = 2: IPSAS are being adopted, i.e. the legislative process has been undertaken and/or IPSAS are partially applied.

IPSAS = 3: IPSAS are adopted or national standards are/can be considered broadly consistent with IPSAS.

Similarly, the variable Accruals refers to the status of accruals reform(s) on the central government accounting system and it takes also three values:

Accruals = 1: Public sector accounting standards are cash-basis.

Accruals = 2: Public sector accounting standards are in transition to accrual accounting, or standards required modified accrual or modified cash systems.

Accruals = 3: Public sector accounting standards are accrual-basis.

Accordingly, the value 1 to 3 was assigned to each country, in each year, regarding the standards (IPSAS) and accounting system (Accruals) used. Therefore, a country may result in different values over the sample period (2010-2014) if its status changes during the said period. The data was hand-collected from two sources: (i) the accounting system has been codified through the report OECD/IFAC (2017), which is based on information gathered from a survey sent to Ministries of Finance and equivalent bodies of all OECD countries; and (ii) the level of IPSAS implementation has been obtained from the IFAC website, which collects the information from member organizations and publicly available sources listed in each jurisdiction profile. More specifically, the IFAC triangulates various sources within and outside the jurisdiction, such as relevant organizations (e.g. institutes of auditors and accountants, financial supervisory authorities, accountants’ regulatory boards, and so on), legislation, and publications of international organizations (e.g. Deloitte, World Bank, European Commission, and so on).

3.4 Control variables

The results are controlled by the following determinants of democracy quality (Vanhanen, 2003; Li & Reuveny, 2009; Teorell, 2010):

Economic development is represented by the GNIpc (gross national income per capita).

Socio-economic characteristics of population are represented by: Population, that is the number of inhabitants; Ethnic_frac is the probability that two randomly selected citizens from a given country will not share a certain characteristic; and Education, expressed as a percentage of adults between 25 to 64 years of age who attended (upper) secondary-schools.

Market liberalization is represented by Eco_globalization, i.e. the KOF economic globalization index that has values between 0 and 100, where higher values indicate a higher degree of globalization.

Political ideology of the government is controlled by a dummy variable that has the value 1 for the left-wing parties and 0 otherwise (namely, Ideology).

The data were collected from different official sources, namely the OECD National Accounts data, the World Bank national accounts data, and the Quality of Government Basic Dataset (Dahlberg et al., 2017).

3.5 Model and technique of analysis

To test the hypotheses of this study, we propose the following model that will be empirically estimated by using the Stata 13 software:

$$\begin{split} \textbf{Democracy}_{\textbf{it}} & = \beta_{0} + \boldsymbol{\beta}_{\textbf{1}} \textbf{Accounting}_{\textbf{it}} + \beta_{2}\text{GNIpc}_{it} \\ &\quad + \beta_{3}\text{Population}_{it}+ \beta_{4}\text{Ethnic}\ \text{frac}_{it} \\ &\quad + \beta_{5}\text{Educatio}n_{it} + \beta_{6}\text{Eco}\ \text{globalization}_{it}\\ &\quad + \beta_{7}\text{Ideology}_{it} + \sum_{j = 8}^{12}{\beta_{j}\text{Year}_{t}} + \eta_{i} + \nu_{it} \end{split} \ \ \boldsymbol{[1]}$$

Sub-indexes i and t refer to country and year, respectively; Democracy refers to democracy quality indicators, i.e. DQ, Freedom, Equality and Control; Accounting refers to IPSAS and Accruals variables; the remaining variables are those control variables previously mentioned; and Yeart are j dummy variables that have the value 1 in year t and 0 otherwise. The error term ηi refers to unobservable heterogeneity, which represents the characteristics of each country, which are different from other countries, but are invariant over time; while νit is the classical disturbance term.

For panel data, the fixed- or random-effects (FE or RE) estimators could be used to estimate parameters β of model 1. However, the two estimators require homoscedastic and no serial correlated errors, and independent/control variables should be strictly exogenous. Hence, we test firstly these conditions by using the Breusch–Pagan test and the Wooldridge test, respectively. The p-values obtained are lower than 0.05, which means that we must reject the null hypothesis of: (i) homoscedastic errors; and (ii) no serially correlated errors. Then, neither FE nor RE estimators are appropriate in this case.

Second, endogeneity problems also appear in model 1 due to three reasons (Wooldridge, 2010): (i) the use of proxy variables to represent the difficulty to quantify concepts (e.g. IPSAS/Accruals reforms, or democracy quality); (ii) results could be additionally controlled by other variables (e.g. inflation, wage gap, GINI index, foreign direct investment, economic freedom, rural population, etc.), but they have been omitted due to multicollinearity problems; and (iii) reverse causality between some control variables and the dependent variables3.

Accordingly, endogeneity should be addressed, by using instrumental variable (IV) methods. In the presence of heteroscedasticity, the conventional IV estimator is consistent but inefficient (Baum et al., 2003). Therefore, it is necessary to use another one, such as the dynamic panel estimator (Arellano & Bond, 1991) that overcomes such a limitation. More concretely, here we use the two-step system estimator of Arellano and Bover (1995), which augments the traditional estimator, called two-step difference estimator (Arellano & Bond, 1991). The difference estimator is consistent as the sample size is long, but it has poor small sample properties, and the system estimator is able to solve this problem (Arellano & Bover, 1995).

The system estimator is derived from a “system” of two equations, the “level” equation that is the model (1), and the “first-difference” equation, which is denoted as follows:

$$\begin{split} \boldsymbol{\Delta}\textbf{Democracy}_{\textbf{it}}& = \beta_{0} + \boldsymbol{\beta}_{\textbf{1}} \boldsymbol{\Delta}\textbf{Accounting}_{\textbf{it}} + \beta_{2}\Delta\text{GNIpc}_{it} \\ &\ + \beta_{3}\Delta\text{Population}_{it}+ \beta_{4}\Delta\text{Ethnic}\ \text{frac}_{it} \\ &\ + \beta_{5}\Delta\text{Educatio}n_{it} + \beta_{6}\Delta\text{Eco}\ \text{globalization}_{it}\\ &\ + \beta_{7}\Delta\text{Ideology}_{it} + \sum_{j = 8}^{12}{\beta_{j}\Delta\text{Year}_{t}} + \eta_{i} + \nu_{it} \end{split} \ \ \boldsymbol{[2]}$$

The system estimator uses the lagged values of the right-hand-side variables included in the model as instruments. For equation (2), the instruments are lagged values of endogenous and predetermined variables, and for equation (1) the instruments are the first differences of the endogenous and predetermined variables4. This estimator uses endogenous and predetermined variables as instruments to remove the endogeneity, instead of outside instruments such as the traditional IV estimators. While it is difficult to prove that outside instruments are uncorrelated with the error term and, at the same time, contain enough information on those endogenous variables, it is demonstrated that lagged values are natural instruments that contain information on the current value of the endogenous variables; additionally, they are uncorrelated with the error term (Arellano & Bond, 1991). Therefore, the system estimator uses more instruments than the traditional IV estimators, which improves efficiency.

However, the number of instruments should not be very high in relation to the number of observations because the results could be biased. The most adequate instruments are the closest lags since the furthest cannot contain information on the current value of the variables. The closest lags in the system estimator are t-1 and t for endogenous and pre-determined variables (Pindado & Requejo, 2015). Accordingly, instrument validity is tested by two tests: (i) Arellano-Bond test for AR(2) in first differences, under the null hypothesis of no serial correlation between the error terms; and (ii) Hansen test of over-identification restrictions, under the null hypothesis that the over-identifying restrictions are valid. Tables of results show the p-values of the two tests.

4 Results

4.1 Descriptive analysis

Table 2 illustrates the descriptive statistics of all variables entered into the model 1. Firstly, the mean values of the four democracy quality indicators are around 57 and 58 on a scale from 0 to 100. This means that, in general, the level of democracy quality of our sample countries is medium, and there is still work to be done to improve it. Nevertheless, there are relevant differences in the sample; Turkey and Denmark show the minimum and the maximum DQ values (29.78 and 72.73). Turkey also shows the lowest values of the three principles, Freedom (18.53), Equality (30.97) and Control (37.88); while the best value of Freedom is showed by Denmark (82.), Iceland in the case of Equality (75.34) and Switzerland stands out in the Control principle (75.07).

Table 2. Descriptive statistics

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| DQ | 165 | 57.6621 | 8.5902 | 29.7828 | 72.7310 |

| Freedom | 165 | 58.3197 | 13.4753 | 18.5297 | 82.5852 |

| Equality | 165 | 57.1023 | 8.9792 | 30.9688 | 75.3408 |

| Control | 165 | 57.6541 | 7.6735 | 37.8833 | 75.0707 |

| IPSAS | 165 | 1.6484 | 0.8021 | 1 | 3 |

| Accruals | 165 | 2.3273 | 0.8422 | 1 | 3 |

| GNIpc | 165 | 37.1489 | 12.3609 | 14.9787 | 68.0759 |

| Population | 154 | 37.4991 | 60.6685 | 0.3180 | 318.8570 |

| Ethnic_frac | 165 | 0.2473 | 0.1888 | 0.0119 | 0.7124 |

| Education | 153 | 43.5176 | 14.0058 | 16.4723 | 75.1777 |

| Eco_globalization | 132 | 77.0277 | 10.7415 | 45.2283 | 95.2746 |

| Ideology | 165 | 0.2606 | 0.4403 | 0 | 1 |

| IPSAS and Accruals variables distribution | |||||

| IPSAS | Freq. | Percent | Cum. | ||

| 1 | 92 | 55.76 | 55.76 | ||

| 2 | 39 | 23.64 | 79.39 | ||

| 3 | 34 | 20.61 | 100 | ||

| Accruals | Freq. | Percent | Cum. | ||

| 1 | 40 | 24.24 | 24.24 | ||

| 2 | 31 | 18.79 | 43.03 | ||

| 3 | 94 | 56.97 | 100 | ||

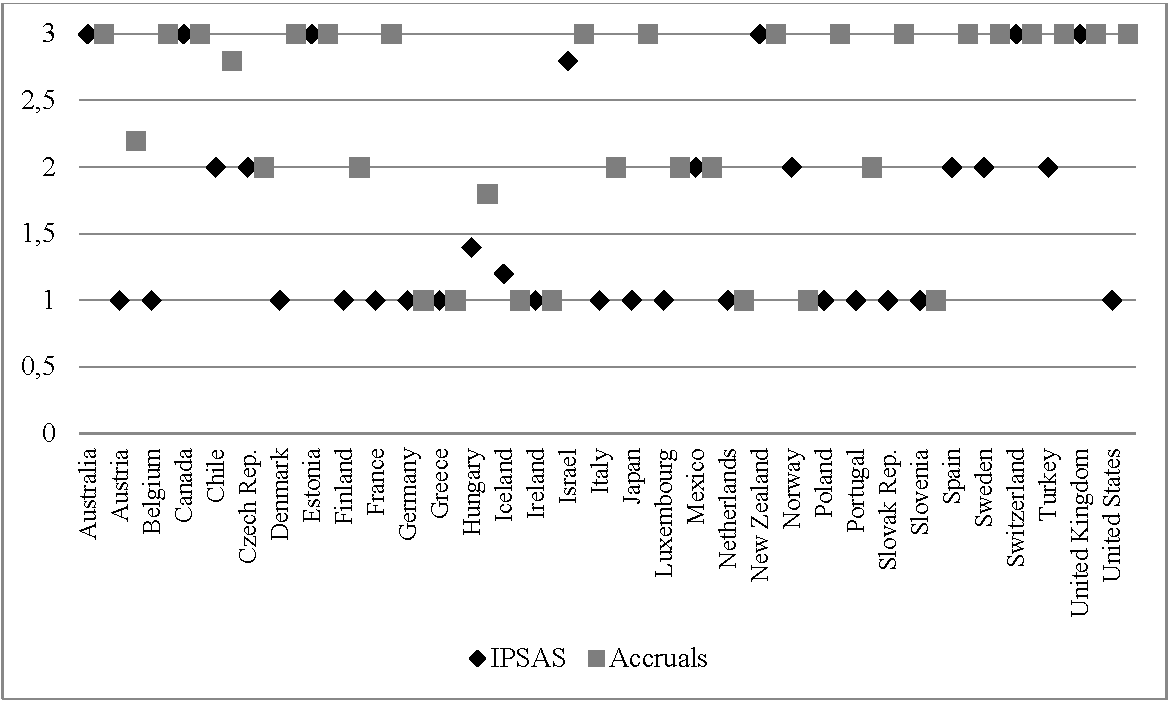

Secondly, the mean value of IPSAS is 1.65 in a range between 1 and 3, revealing that the full adoption of IPSAS in the OECD context is not very high. In our sample, Australia, Canada, Estonia, New Zealand, Switzerland, and the UK have the value IPSAS = 3, as figure 1 shows. However, the mean value of the Accruals is 2.33, in a range between 1 and 3. This may point out that, although IPSAS are not so common in the OECD countries, they tend to use accrual-basis systems in public sector accounting to a greater extent, as recently noted by OECD/IFAC (2017). Concretely, 17 countries show the value Accruals = 3, as shown in figure 1. This situation can also be seen at the bottom of table 2 (although only 20.61% of observations has the value 3 for the IPSAS variable, almost 57% use accrual-basis accounting).

Table 2 also shows the descriptive statistics of control variables. The mean value of the GNIpc is 37,148.9 US$, although there are relevant differences among countries. Regarding ethnic diversity, Canada and Japan show the most (0.7124) and the least (0.0119) fragmented population, respectively. Regarding adult literacy, 43.52% of 25-64 years- of age had attended (upper) secondary school, on average. The mean value of the KOF index (Eco_globalization) suggests a high level of globalization (77.03). Finally, the mean value of Ideology variable indicates that 26% of observations has left-wing governments in office.

Figure 1. Distribution of IPSAS and Accruals variables by country

IPSAS = 1 no actions have been undertaken to adopt IPSAS; IPSAS = 2 IPSAS are being adopted or are partially applied; IPSAS = 3 IPSAS are adopted or national standards are/can be considered broadly consistent with them; Accruals = 1 cash-basis accounting; Accruals = 2 modified accrual or modified cash accounting systems; Accruals = 3 accrual-basis accounting.

Table 3 shows the bivariate correlations between variables entered into model 1. High correlations between DQ and its three principles (Freedom, Equality, and Control) are noted. The coefficient between IPSAS and Accruals is also relevant, owing to the two variables representing the extent of the accounting maturity; so, the model 1 is estimated by introducing these variables separately. However, although they are similar, they are not totally equivalent: Accruals variable refers to accrual-basis accounting (both national standards and IPSAS); and IPSAS variable refers to IPSAS implementation (both cash- and accrual-basis). Therefore, it is interesting to test the effect of both the proxies on the democracy quality. Regarding control variables, in general, they are weakly correlated; most of the correlation coefficients are less than 0.3, which is the accepted threshold for multicollinearity problems (Wooldridge, 2010).

Table 3. Bivariate correlations

| DQ | Freedom | Equality | Control | IPSAS | Accruals | |

|---|---|---|---|---|---|---|

| DQ | 1 | |||||

| Freedom | 0.9038*** | 1 | ||||

| Equality | 0.882*** | 0.6961*** | 1 | |||

| Control | 0.7371*** | 0.462*** | 0.5676*** | 1 | ||

| IPSAS | -0.0112 | -0.1286† | 0.0127 | 0.1737* | 1 | |

| Accruals | -0.1355† | -0.1826* | -0.1165 | 0.0026 | 0.4419*** | 1 |

| GNIpc | 0.6817*** | 0.6599*** | 0.6226*** | 0.4013*** | 0.0956 | -0.1627* |

| Population | -0.3412*** | -0.2254** | -0.3436*** | -0.3359*** | 0.2716*** | 0.172* |

| Ethnic_frac | -0.0911 | -0.1554* | -0.1858* | 0.1885* | 0.3213*** | 0.1943* |

| Education | 0.162* | 0.2227** | 0.095 | 0.0374 | 0.0018 | 0.0964 |

| Eco_globalization | 0.4719*** | 0.4358*** | 0.4001*** | 0.3453*** | -0.2656** | -0.2636** |

| Ideology | 0.1616* | 0.1296 | 0.1839* | 0.0951 | -0.0683 | 0.0163 |

| GNIpc | Population | Ethnic_frac | Education | Eco_glob. | Ideology | |

| GNIpc | 1 | |||||

| Population | 0.0627 | 1 | ||||

| Ethnic_frac | 0.0247 | 0.1877* | 1 | |||

| Education | 0.0231 | -0.1453 | -0.1394 | 1 | ||

| Eco_globalization | 0.1489† | -0.2829*** | 0.0554 | 0.2242* | 1 | |

| Ideology | 0.247** | 0.0795 | -0.0489 | 0.074 | 0.1767* | 1 |

Notes: †, *, **, ***significant at 10, 5, 1, and 0.1 percent level, respectively.

4.2 Explanatory analysis

Tables 4 and 5 illustrate the empirical results obtained by estimating model 1 with the two-step system estimator. The former shows the results for the global index DQ; and the latter shows the results for each of the three democracy quality principles (Freedom, Equality, and Control).

Focusing on table 4, a positive effect of IPSAS on the global level of democracy quality (DQ) is recorded, and the coefficient is statistically relevant at 95% confidence level, suggesting that the democracy quality is positively related with IPSAS implementation. However, the link is negative in the case of Accruals, being statistically relevant also at 95%. This result calls into question the benefits of accrual-basis accounting systems per se in terms of democracy quality.

Regarding the economic development, GNIpc is positively related with DQ, being statistically relevant at 99.9% confidence level. Although the impact is very small, it suggests that the most economically developed OECD countries tend to show a higher level of democracy quality, according to the traditional thesis of Muller (1995). A negative and relevant impact of ethnic fractionalization on democracy quality is observed, being relevant at different levels. The impact of economic globalization on DQ is also relevant and positive in the two equations, indicating that globalization positively affects democracy quality. Finally, political ideology impacts negatively on DQ, suggesting that democracy quality is lower in countries governed by left-wing parties.

Table 4. Link between public sector accounting and democracy quality

| Test variable: IPSAS | Test variable: Accruals | |||

|---|---|---|---|---|

| Coef. | Std. Err. | Coef. | Std. Err. | |

| IPSAS | 3.5243* | 1.3034 | ||

| Accruals | -1.8685* | 0.6992 | ||

| GNIpc | 0.0004*** | 0.0001 | 0.0005*** | 0.0001 |

| Population | 0.0314 | 0.0335 | 0.0361* | 0.0167 |

| Ethnic_frac | -2.0960* | 1.0175 | -1.7094† | 0.8391 |

| Education | 0.0052 | 0.0695 | -0.0592 | 0.0476 |

| Eco_globalization | 0.5266** | 0.1646 | 0.5395*** | 0.0969 |

| Ideology | -1.3348** | 0.4051 | -1.1775*** | 0.2778 |

| Constant | 0.3571 | 12.3401 | 10.3242 | 6.5940 |

| Arellano-Bond test for AR(2) | Pr > z = 0.694 | Pr > z = 0.467 | ||

| Hansen test | Pr > chi2 = 0.998 | Pr > chi2 = 0.713 | ||

Notes: Dependent variable: DQ; All regressions include year fixed effects; †, *, **, *** significant at 10, 5, 1, and 0.1 percent level, respectively.

Table 5 shows the results for the three principles of democracy quality: Freedom (panel A), Equality (panel B), and Control (panel C). The results are like those obtained for DQ, although the statistical relevance of IPSAS and Accruals is lost in the case of Freedom. Observing the functions and components of Freedom described in table 1, it can be argued that public accounting harmonization is not a determinant of such democracy principle, as expected. Nevertheless, we found relevant evidence in the case of Equality and Control functions.

Table 5. Link between public sector accounting and democracy quality principles

| Panel A. Freedom principle | ||||

|---|---|---|---|---|

| Test variable: IPSAS | Test variable: Accruals | |||

| Coef. | Std. Err. | Coef. | Std. Err. | |

| IPSAS | 0.5547 | 2.2002 | ||

| Accruals | 0.2826 | 0.3953 | ||

| GNIpc | 0.0004** | 0.0001 | 0.0005*** | 0.0001 |

| Population | -0.0609 | 0.0458 | -0.1139* | 0.0477 |

| Ethnic_frac | -1.2437† | 0.6557 | 3.4275 | 8.7340 |

| Education | -0.0344 | 0.0956 | 0.1203* | 0.0514 |

| Eco_globalization | -0.2113† | 0.1210 | -0.3892* | 0.1551 |

| Ideology | -0.1251 | 0.4294 | -1.6396† | 0.8405 |

| Constant | 6.7815*** | 0.8575 | 8.4256*** | 0.9440 |

| Arellano-Bond test for AR(2) | Pr > z = 0.760 | Pr > z = 0.889 | ||

| Hansen test | Pr > chi2 = 1.000 | Pr > chi2 = 1.000 | ||

| Panel B. Equality principle | ||||

| Test variable: IPSAS | Test variable: Accruals | |||

| Coef. | Std. Err. | Coef. | Std. Err. | |

| IPSAS | 5.7929*** | 1.5429 | ||

| Accruals | -3.1688** | 0.9264 | ||

| GNIpc | 0.0006*** | 0.0001 | 0.0005*** | 0.0001 |

| Population | -0.0256 | 0.0189 | 0.0208 | 0.0309 |

| Ethnic_frac | -2.2450*** | 0.4603 | -2.0057† | 1.0792 |

| Education | -0.0370 | 0.0633 | 0.0204 | 0.0562 |

| Eco_globalization | 0.2909** | 0.0985 | 0.4509* | 0.1759 |

| Ideology | -0.3316 | 0.3616 | -0.8456*** | 0.1924 |

| Constant | 1.3861 | 0.8727 | 1.5729 | 1.1799 |

| Arellano-Bond test for AR(2) | Pr > z = 0.967 | Pr > z = 0.155 | ||

| Hansen test | Pr > chi2 = 0.976 | Pr > chi2 = 0.802 | ||

| Panel C. Control principle | ||||

| Test variable: IPSAS | Test variable: Accruals | |||

| Coef. | Std. Err. | Coef. | Std. Err. | |

| IPSAS | 2.4215*** | 0.4176 | ||

| Accruals | -2.6205** | 0.8773 | ||

| GNIpc | 0.0006*** | 0.0001 | 0.0007*** | 0.0001 |

| Population | 0.0192 | 0.0264 | -0.0526 | 0.0382 |

| Ethnic_frac | -1.4552* | 0.6003 | 6.1594 | 10.0263 |

| Education | 0.0245 | 0.0924 | -0.0660 | 0.1052 |

| Eco_globalization | 0.6678*** | 0.0928 | 0.1703 | 0.1808 |

| Ideology | -0.4805 | 0.6431 | -0.6588 | 0.5844 |

| Constant | -1.8268 | 0.8644 | 2.9702† | 1.5829 |

| Arellano-Bond test for AR(2) | Pr > z = 0.331 | Pr > z = 0.616 | ||

| Hansen test | Pr > chi2 = 0.999 | Pr > chi2 = 1.000 | ||

Notes: Dependent variables: Freedom, Equality, and Control, respectively; All regressions include year fixed effects; †, *, **, *** significant at 10, 5, 1, and 0.1 percent level, respectively.

4.3 Robustness checking

To test the robustness of previous findings, the variables IPSAS and Accruals have been changed to dIPSAS and dAccruals, which are dummy variables that take the value 1 if IPSAS and accrual-basis accounting have been implemented, respectively, and 0 otherwise. Therefore, the model (1) is estimated again, for DQ, Freedom, Equality and Control. The results are included in Table 6, which shows only the coefficients for the main variables, to facilitate the reading5. They are consistent with those obtained previously, i.e. IPSAS adoption impacts positively on the global level of democracy quality (DQ) and also on Equality and Control indicators. However, the effect is negative in the case of accrual-basis accounting systems. Furthermore, neither dIPSAS nor dAccruals are statistically relevant in explaining Freedom, such as previous findings have also suggested.

Table 6. Robustness checking for IPSAS and Accruals variables.

| Panel A. DQ variable | ||||

|---|---|---|---|---|

| Test variable: IPSAS | Test variable: Accruals | |||

| Coef. | Std. Err. | Coef. | Std. Err. | |

| dIPSAS | 2.5309* | 1.1873 | ||

| dAccruals | -1.2097* | 0.5665 | ||

| Arellano-Bond test for AR(2) | Pr > z = 0.438 | Pr > z = 0.819 | ||

| Hansen test | Pr > chi2 = 0.990 | Pr > chi2 = 0.989 | ||

| Panel B. Freedom principle | ||||

| Test variable: IPSAS | Test variable: Accruals | |||

| Coef. | Std. Err. | Coef. | Std. Err. | |

| dIPSAS | -1.2137 | 2.6510 | ||

| dAccruals | -0.8213 | 1.5184 | ||

| Arellano-Bond test for AR(2) | Pr > z = 0.505 | Pr > z = 0.552 | ||

| Hansen test | Pr > chi2 = 0.991 | Pr > chi2 = 0.992 | ||

| Panel C. Equality principle | ||||

| Test variable: IPSAS | Test variable: Accruals | |||

| Coef. | Std. Err. | Coef. | Std. Err. | |

| dIPSAS | 6.6562* | 2.7328 | ||

| dAccruals | -4.0461* | 1.6589 | ||

| Arellano-Bond test for AR(2) | Pr > z = 0.762 | Pr > z = 0.160 | ||

| Hansen test | Pr > chi2 = 0.956 | Pr > chi2 = 0.614 | ||

| Panel D. Control principle | ||||

| Test variable: IPSAS | Test variable: Accruals | |||

| Coef. | Std. Err. | Coef. | Std. Err. | |

| dIPSAS | 2.6918* | 1.3057 | ||

| dAccruals | -3.7674† | 2.1667 | ||

| Arellano-Bond test for AR(2) | Pr > z = 0.571 | Pr > z = 0.994 | ||

| Hansen test | Pr > chi2 = 0.981 | Pr > chi2 = 0.986 | ||

Notes: Dependent variables: DQ, Freedom, Equality, and Control, respectively; All regressions include year fixed effects; †, *, **, *** significant at 10, 5, 1, and 0.1 percent level, respectively.

5 Discussion and conclusions

This study has examined changes in the accounting frameworks in the wide context of reforms implemented in many countries under the umbrella of NPM, aiming to bring finance and management together (Bergmann, 2009). These reforms do not only have important financial implications; they also affect accounting, budgeting and reporting (Caperchione, 2006).

Scholars have largely studied the benefits of changes in the accounting frameworks, through IPSAS implementation and/or accrual accounting adoption, in terms of transparency and accountability. This study adds new insights, making a relevant contribution to the public-sector financial management and accounting literature, as it considers a more complex concept, namely the democracy quality. In a context where being accountable is essential for increasing the quality of democracy (Warren, 2014), it is expected that governments should disclose comparable, reliable, and timely information. Therefore, this article has investigated the relationship between IPSAS implementation and accrual accounting adoption, considered as key pillars of financial management practices, with the quality of democracy, illustrating the usefulness in modernizing public sector accounting to ensure comparability. As many countries are discussing IPSAS implementation, the experiences of previous “adopters” can serve as a learning process.

For a sample of 33 OECD countries in the period 2010–2014, empirical findings indicate that IPSAS adoption may improve democracy quality, probably due to harmonization of accounting standards which ensure internationally comparable information (Lapsley et al., 2009), enhancing accountability (Wang, 2002). Conversely, it can be argued that the empirical findings question the effect of accrual accounting per se on democracy quality, suggesting that the use of international standards may discharge accountability, stimulating democratic participation (Papenfuß & Schaefer, 2010; Warren, 2014) more than the accounting system in itself.

Considering that public sector accounting standards can be heavily influenced by private sector practices, Chan (2003) argued for a gradual symmetric approach to accruals; however, this study promotes the harmonization of public sector accounting rules, aiming at not only accountability, but also democracy quality.

This study also contributes to the recent literature on democracy quality, focused until now on developing reliable indicators (Altman & Pérez-Liñán, 2002; Bühlmann et al., 2012; O’Donnell, 2004) and studying determinant factors (Vanhanen, 2003; Li & Reuveny, 2009; Teorell, 2010). The findings which emerge from this research suggest that democracy quality is affected by other factors, such as accounting harmonization as a key aspect of public-sector financial management practices. Accordingly, dealing with financial management practices and reforms would imply considering not only the quality, effectiveness and efficiency of task fulfilment (“output legitimacy”), but also the dimension of the participation of citizens and the democratic control (“input legitimacy”) (Kuhlmann & Wollmann, 2014).

Despite these contributions, this study is not free of limitations. Firstly, IPSAS and accrual-basis reforms are difficult concepts to represent, because of the wide range of levels of implementation; the variables (IPSAS and Accruals) are proxies, so the results should be cautiously interpreted. In addition, the two public-sector accounting reforms are dynamic processes, so increasing the time period of analysis would improve the reliability of empirical findings. Here, a complete dataset with the available information has been created, but it would be interesting to improve these proxies in future research. Secondly, citizens would need to be aware of the accrual accounting and IPSAS implementation to effectively acquire an understanding of an increased comparability and standardization; however, this is not so easy to measure, and it is beyond the scope of this study.

For future research, it would be interesting to consider not only the IPSAS implementation, but also the specific case of EPSAS. In addition, it could be opportune to consider that some countries may be forced to implement IPSAS by the World Bank or the International Monetary Fund. Furthermore, enlarging the number of countries would allow control of the results by different areas (Anglo-Saxon, Latin American, Asian, etc.), due to the traditional orientations in accounting systems. Finally, it would be interesting to test the effect on the democracy quality of other variables related to different financial management practices and reforms.

Funding

This research did not receive any specific grant from funding agencies in the public, commercial or not-for-profit sectors.

Conflict of interests

The authors declare no conflict of interests.